Indonesia Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Indonesia Diaper Market Overview:

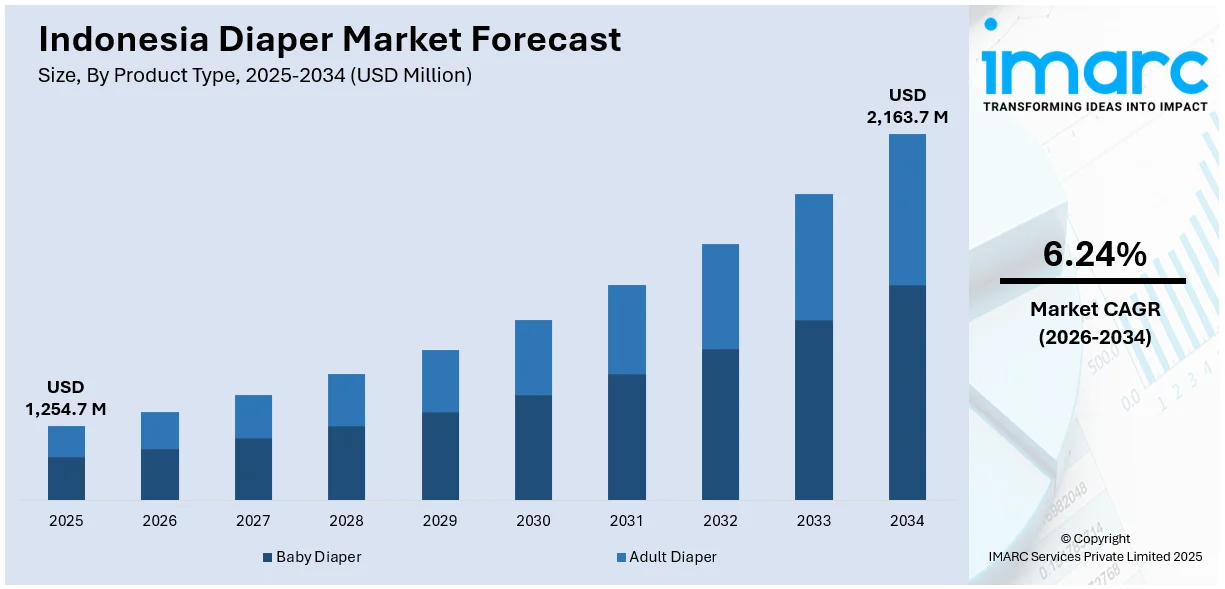

The Indonesia diaper market size reached USD 1,254.7 Million in 2025. The market is projected to reach USD 2,163.7 Million by 2034, exhibiting a growth rate (CAGR) of 6.24% during 2026-2034. The market is expanding steadily, driven by the rising birth rate, growing awareness about hygiene, and an aging population. Rising demand for premium, eco-friendly, and ultra-absorbent diapers, and introduction of innovative features like breathable materials and skin-sensitive designs by manufacturers are also accelerating product sales. Evolving distribution channels, with modern retail outlets and e-commerce platforms are further gaining significant traction, highlighting the dynamic Indonesia diaper market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,254.7 Million |

| Market Forecast in 2034 | USD 2,163.7 Million |

| Market Growth Rate 2026-2034 | 6.24% |

Indonesia Diaper Market Trends:

Innovation in Product Design

A surge of creativity is reshaping the Indonesia diaper market, placing user comfort and performance front and center. Manufacturers are engineering diapers that are remarkably thinner while maintaining ultra‑high absorbency allowing for a sleek fit without compromising leakage protection. New materials and layering techniques, such as advanced superabsorbent polymers and breathable cotton-like fabrics, enhance airflow to prevent rashes and irritation, making them ideal for prolonged wear. Skin-sensitive designs integrate wetness indicators, adaptive size fittings, and hypoallergenic components, catering to a wide range of users from newborns to seniors. These design breakthroughs not only satisfy evolving consumer expectations but also help brands differentiate in a competitive space. This wave of development strongly supports ongoing Indonesia diaper market growth.

To get more information on this market Request Sample

Growing Demand for Eco-Friendly Diapers

The growing environmental awareness among Indonesian consumers is also having a profound impact on diaper-buying habits. Caregivers and parents are now more inclined to use biodegradable, plant-based, and chemical-free diaper options that are kind to skin and the environment as well. These green diapers not only cut down on landfill waste but tend to steer clear of toxic chemicals like chlorine, latex, and scents, rendering them safer for babies and individuals with sensitive skin. Domestic and foreign producers are reacting by launching eco-friendly product lines that utilize renewable resources and recyclable packaging. The movement not only assists the environment but also resonates with health-conscious consumers who value natural products. For instance, in May 2023, Five ITB chemical engineering students won first place at the 2023 UI Chemical Product Design Competition with their innovative biodegradable diaper, BAYPER, made from chitosan and bagasse. The product boasts superior absorption and eco-friendly materials, overcoming challenges through teamwork and determination. The move toward greener options is proving to be pivotal in propelling the growth of the market.

Rising Preference for Premium Products

In Indonesia, customers are increasingly shifting towards premium diaper products that have higher features and greater comfort. This is based on a growing number of middle-class consumers who are ready to pay more for quality items for enhanced care and hygiene. Premium diapers generally have high absorbency, with longer dryness and fewer changes required. They are also constructed with breathable fabrics that permit improved airflow, reducing the possibility of skin irritation or rashes. Wetness indicators, stretchy waistbands, and ergonomic fits are also contributing to the popularity. As parents become increasingly educated about the benefits of a product and focus on the well-being of their child, the market for comfort-boosted and performance-oriented diapers keeps expanding.

Indonesia Diaper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Baby Diaper

- Disposable Diaper

- Training Diaper

- Cloth Diaper

- Swim Pants

- Biodegradable Diaper

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby diaper (disposable diaper, training diaper, cloth diaper, swim pants, and biodegradable diaper) and adult diaper (pad type, flat type, and pant type)

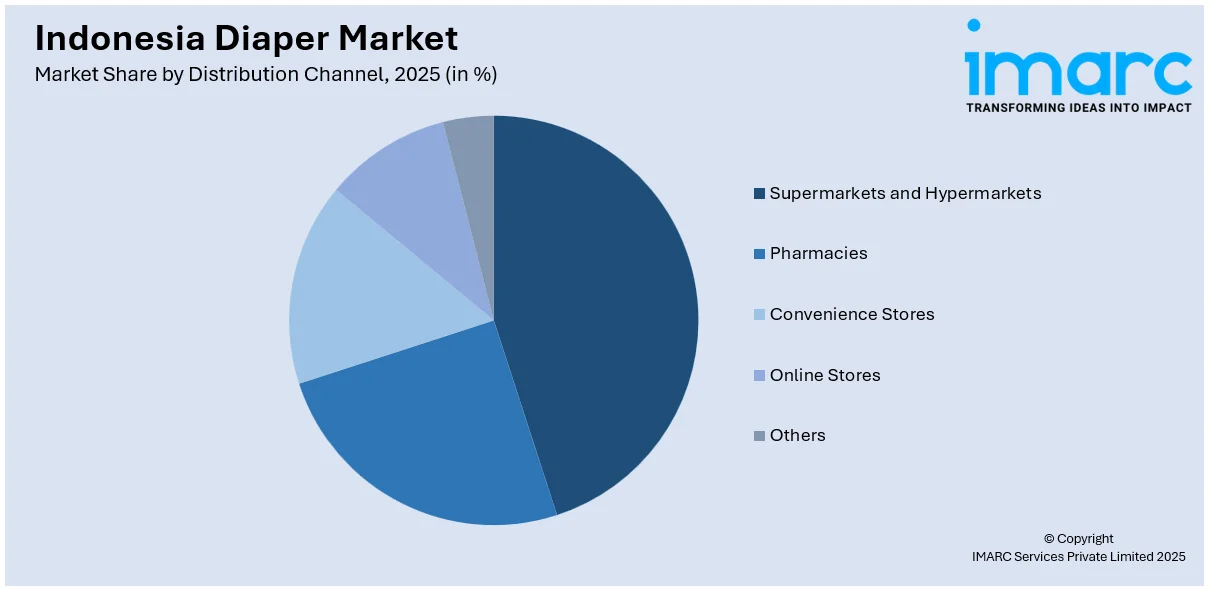

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, pharmacies, convenience stores, online stores, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Diaper Market News:

- In August 2024, Nippon Shokubai Co., Ltd. announced its plans to invest USD 110 Million to expand its Indonesian operations by building a new superabsorbent polymer (SAP) plant capable of producing 50,000 Metric Tons annually. This decision aims to meet rising global SAP demand, particularly for diaper manufacturing in growing markets.

- In June 2024, Unicharm Indonesia launched three limited-edition products using biomaterials: MamyPoko baby diapers, Charm sanitary pads, and Kirey antibacterial wet wipes. This initiative, marking a first for the company, responds to rising consumer demand for eco-friendly products, with all items integrating sustainable materials.

- In October 2023, Unicharm's "MamyPoko Royal Soft Organic Cotton" was certified by the National Museum of Indonesia as the country's first baby diaper pants made with organic cotton. Launched in July 2022, the product emphasizes skin-friendliness and environmental responsibility, aligning with consumer demand and sustainable practices.

Indonesia Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia diaper market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia diaper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The diaper market in Indonesia was valued at USD 1,254.7 Million in 2025.

The Indonesia diaper market is projected to exhibit a CAGR of 6.24% during 2026-2034, reaching a value of USD 2,163.7 Million by 2034.

The market is driven by a growing infant population and increasing hygiene awareness among parents. Improvements in living standards and affordability of disposable diapers support daily use. Changing lifestyles, such as more working mothers and preference for convenience, further contribute. Additionally, the adult diaper segment is gaining traction due to increased focus on elderly care.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)