Indonesia Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Indonesia Duty-Free and Travel Retail Market Overview:

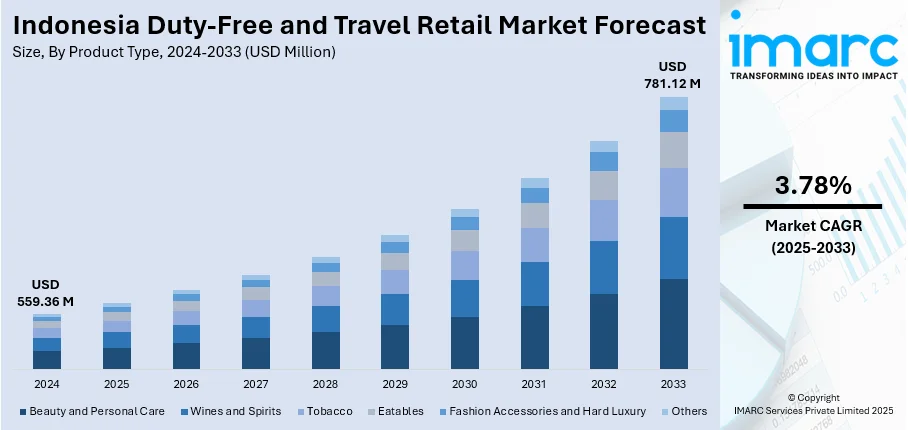

The Indonesia duty-free and travel retail market size reached USD 559.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 781.12 Million by 2033, exhibiting a growth rate (CAGR) of 3.78% during 2025-2033. Rising tourist arrivals, government support for airport expansion, and increasing disposable incomes are some of the factors contributing to the Indonesia duty-free and travel retail market share. International brands entering airports and seaports attract affluent shoppers. Growing middle class, regional connectivity, and modern retail formats strengthen sales in premium alcohol, cosmetics, and luxury goods.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 559.36 Million |

| Market Forecast in 2033 | USD 781.12 Million |

| Market Growth Rate 2025-2033 | 3.78% |

Indonesia Duty-Free and Travel Retail Market Trends:

Luxury Fragrance Labels Elevating Airport Shopping

Airports in Indonesia are becoming more than transit points; they’re turning into gateways for luxury purchases. A recent expansion by a well-known British perfume house into Jakarta’s duty-free zone shows how brands are reshaping what travelers expect before takeoff. Now, Indonesian passengers can pick up signature scents like Halfeti and Luna, plus bath products, discovery sets, travel sizes, and custom gift services. The goal is to tempt shoppers with an experience that feels tailored and indulgent, even during a short wait. This approach taps into the growing appetite among Indonesian flyers for premium items that add a touch of refinement to their journeys. By blending exclusive goods with perks like personalization and elegant wrapping, high-end labels are turning airports into convenient spots for treating oneself or finding a thoughtful last-minute gift. Expect more luxury names to follow, recognizing that travelers crave special touches along the way. These factors are intensifying the Indonesia duty-free and travel retail market growth. For example, in March 2025, British fragrance house Penhaligon’s, owned by Puig, strengthened its presence in Asia Pacific travel retail with new stores, including one at Jakarta Duty Free in Indonesia. Indonesian travelers now have access to Penhaligon’s bestsellers like Halfeti and Luna, along with bath and body products, discovery sets, travel sizes, personalization services, and gift wrapping, enhancing the premium shopping experience at Indonesian airports.

To get more information on this market, Request Sample

Duty-Free Expansions Shaping Passenger Spending

Travelers passing through Indonesia’s airports are encountering more shopping options than ever. A new foothold at Kualanamu International Airport in Medan signals how major players keep broadening their reach to tap into rising demand from domestic and international passengers. With dozens of stores across the country, duty-free operators are focusing on serving high-traffic hubs that connect Indonesia with the wider region. Medan, as one of Southeast Asia’s busiest gateways, now offers travelers a wider mix of products, from spirits and fragrances to gifts and local specialties. More retail space means more chances for travelers to pick up premium goods and souvenirs without leaving the airport. This growth also hints at bigger plans to strengthen Indonesia’s position as a key stop for duty-free shopping in Southeast Asia. As passenger numbers climb, expect more new openings in cities beyond Jakarta and Bali to keep pace with travelers’ appetite to shop. For instance, in April 2024, Avolta won a new duty-free concession for two stores at Kualanamu International Airport in Medan, North Sumatra, marking its first venture in Medan and third in Indonesia. With nearly 50 outlets nationwide, Avolta continues to expand its presence in Indonesia’s growing duty-free and travel retail market, serving one of Southeast Asia’s busiest passenger hubs.

Indonesia Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

Distribution Channel Insights:

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Region Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Duty-Free and Travel Retail Market News:

- In May 2025, Lagardère Travel Retail secured a major long-term concession at Singapore’s HarbourFront Passenger Terminal and Tanah Merah Ferry Terminal. This move is set to reshape duty-free shopping for passengers traveling to and from Indonesia. The upgraded stores would blend local Indonesian culture with premium products and more grab-and-go options, boosting appeal for Indonesian travelers. This expansion strengthens retail links on busy ferry routes, promising better shopping choices and convenience for the growing Indonesia duty-free market.

Indonesia Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia duty-free and travel retail market on the basis of product type?

- What is the breakup of the Indonesia duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the Indonesia duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the Indonesia duty-free and travel retail market?

- What are the key driving factors and challenges in the Indonesia duty-free and travel retail market?

- What is the structure of the Indonesia duty-free and travel retail market and who are the key players?

- What is the degree of competition in the Indonesia duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia duty-free and travel retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)