Indonesia Ecotourism Market Size, Share, Trends and Forecast by Traveler Type, Age Group, Sales Channel, and Region, 2025-2033

Indonesia Ecotourism Market Overview:

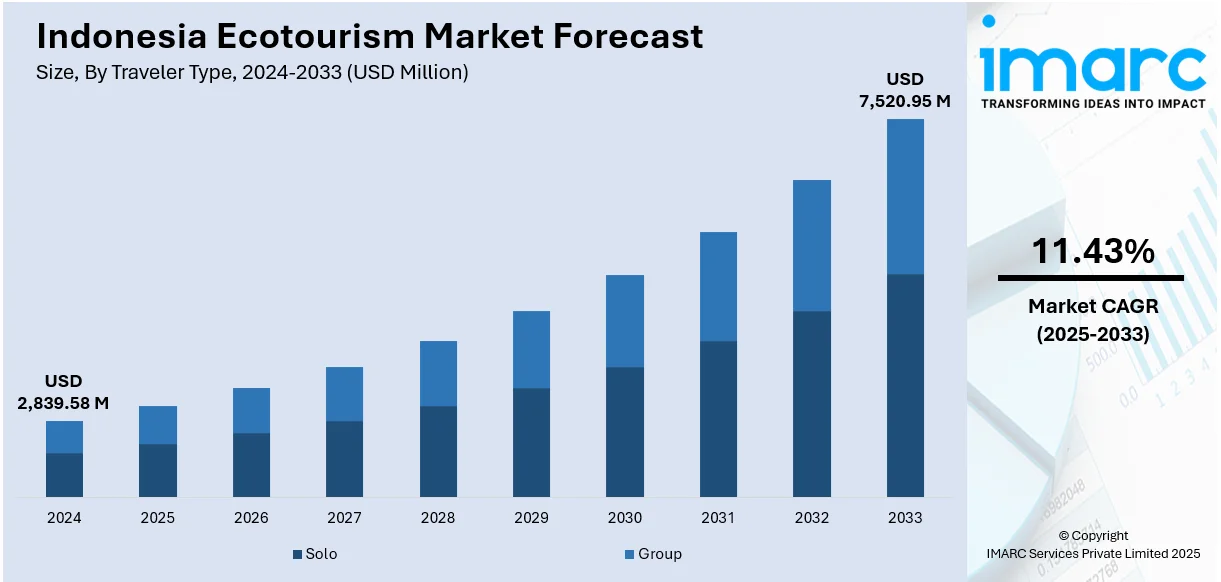

The Indonesia ecotourism market size reached USD 2,839.58 Million in 2024. The market is projected to reach USD 7,520.95 Million by 2033, exhibiting a growth rate (CAGR) of 11.43% during 2025-2033. The market is driven by the country's immense biodiversity and cultural heritage, which are appealing to environmentally friendly tourists in search of unique experiences. Increasing awareness of eco-friendly travel practices and support for community-based tourism are influencing both local and international visitors to venture into lesser-tapped, sustainable destinations within the nation. In addition, government efforts and greater investments in sustainable facilities are further augmenting the Indonesia ecotourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,839.58 Million |

| Market Forecast in 2033 | USD 7,520.95 Million |

| Market Growth Rate 2025-2033 | 11.43% |

Indonesia Ecotourism Market Trends:

Expansion of Sustainable Tourism Infrastructure

Indonesia is experiencing a marked increase in the development of sustainable tourism infrastructure, especially in environmentally sensitive regions such as Bali, Lombok, and Labuan Bajo. In response to growing demand for ecologically responsible travel, both the government and private sector are investing in eco-lodges, off-grid accommodations, and renewable energy integration within tourist facilities. Notably, on 11 March 2025, Cross Hotels & Resorts announced a strategic expansion of its Indonesian portfolio through a Hotel Management Agreement with PT Bali Penida Jaya to launch CROSS CELESTA NUSA PENIDA, a luxury eco-resort overlooking Kelingking Beach. Scheduled to open in 2027, the resort will comprise 61 tented villas and offer high-end amenities such as infinity pools, wellness facilities, fine dining, and event spaces. Designed with a strong emphasis on sustainability and low environmental impact, the project underscores the brand’s commitment to eco-conscious luxury and responsible tourism development in the region. Apart from this, efforts are also underway to upgrade transport systems using low-emission vehicles and to implement waste management protocols that align with global sustainability standards. This infrastructure push is not limited to high-profile destinations but extends to secondary and rural areas, reflecting a broader national commitment to decarbonize tourism. As a result, destinations once threatened by over-tourism are now transitioning to regulated, eco-sensitive models that balance visitor inflow with conservation.

To get more information on this market, Request Sample

Rising Environmental Awareness Among Younger Domestic Travelers

The heightened environmental consciousness among younger domestic travelers is a significant factor contributing to the Indonesia ecotourism market growth. Millennials and Gen Z, in particular, are showing a strong preference for experiences that align with sustainability values, such as wildlife preservation, waste-free travel, and engagement in conservation volunteering. Their travel choices are increasingly guided by ethical considerations, including support for local economies and low-carbon transport options. This demographic shift is encouraging tourism operators to redesign packages that are more immersive, educational, and environmentally sound. Moreover, according to industry reports, social media posts from influencers play a significant role in destination choices for 49% of Indonesian travelers, with around 92% of them following influencers on Instagram. In addition to this, younger tourists are more receptive to digital innovations that support eco-friendly travel, such as mobile apps for tracking carbon footprints or finding certified green accommodations. As this segment gains economic strength and social influence, its preferences are shaping broader industry practices, compelling both public and private stakeholders to adapt their offerings to meet evolving expectations around ecological responsibility.

Indonesia Ecotourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on traveler type, age group, and sales channel.

Traveler Type Insights:

- Solo

- Group

The report has provided a detailed breakup and analysis of the market based on the traveler type. This includes solo and group.

Age Group Insights:

- Generation X

- Generation Y

- Generation Z

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes generation X, generation Y, and generation Z.

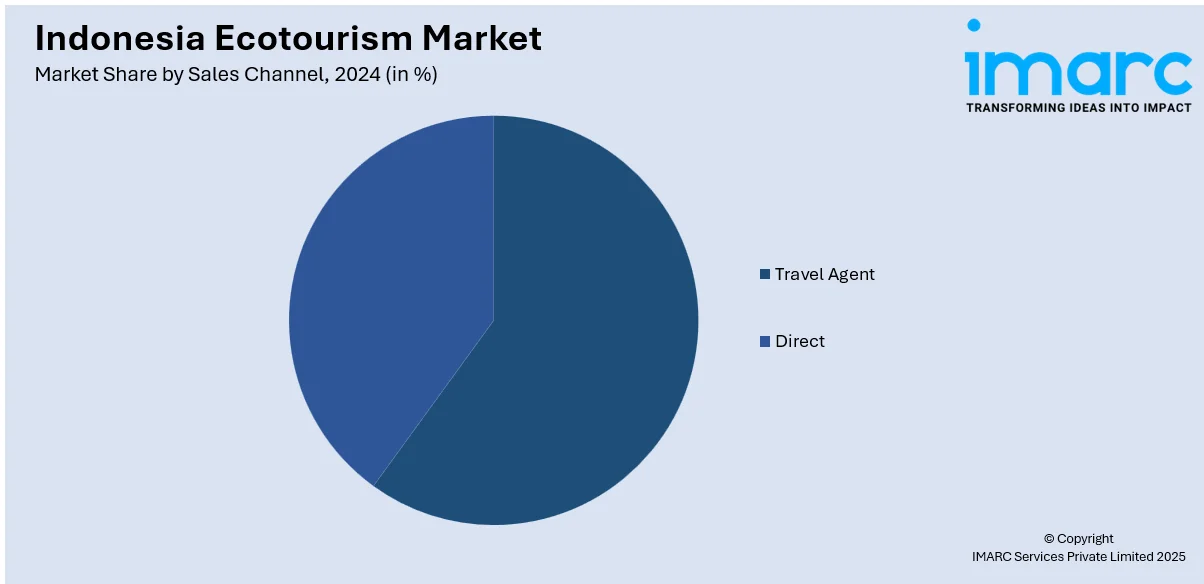

Sales Channel Insights:

- Travel Agent

- Direct

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes travel agent and direct.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, and Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Ecotourism Market News:

- On June 30, 2025, Indonesia’s Morowali Industrial Park (IMIP) initiated its first green tourism partnership by signing agreements with four surrounding villages in Labota village, Central Sulawesi. The collaboration, backed by major companies including PT Indonesia Tsingshan Stainless Steel and PT Dexin Steel Indonesia, focuses on joint development of tourism infrastructure, promotional platforms, and ecological education and training programs. This move signals IMIP’s strategic shift toward a greener, community-inclusive development model that integrates environmental stewardship with industrial growth and local economic empowerment.

Indonesia Ecotourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Traveler Types Covered | Solo, Group |

| Age Groups Covered | Generation X, Generation Y, Generation Z |

| Sales Channels Covered | Travel Agent, Direct |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia ecotourism market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia ecotourism market on the basis of traveler type?

- What is the breakup of the Indonesia ecotourism market on the basis of age group?

- What is the breakup of the Indonesia ecotourism market on the basis of sales channel?

- What is the breakup of the Indonesia ecotourism market on the basis of region?

- What are the various stages in the value chain of the Indonesia ecotourism market?

- What are the key driving factors and challenges in the Indonesia ecotourism market?

- What is the structure of the Indonesia ecotourism market and who are the key players?

- What is the degree of competition in the Indonesia ecotourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia ecotourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia ecotourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia ecotourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)