Indonesia Fertilizer Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Indonesia Fertilizer Market Size and Share:

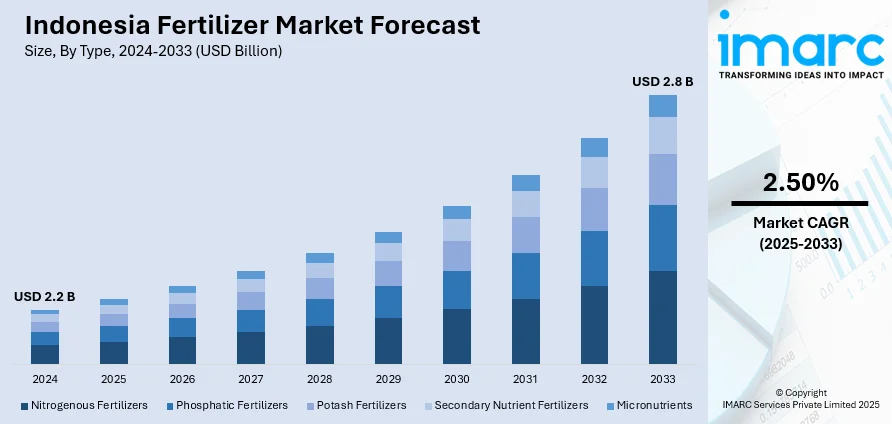

The Indonesia fertilizer market size reached USD 2.2 Billion in 2024. The market is expected to reach USD 2.8 Billion by 2033, exhibiting a growth rate (CAGR) of 2.50% during 2025-2033. The market growth is attributed to the diversification of crops in Indonesia, the climate variability, the increasing adoption of modern agricultural technologies, the rising government and non-governmental initiatives focused on educating farmers about the benefits of fertilizers, the country's integration into the global agricultural market, and the rapid infrastructure development, particularly in rural areas.

Market Insights:

- On the basis of region, the market is divided into Java, Sumatra, Kalimantan, Sulawesi, and Others

- Based on type, the market is segmented into nitrogenous fertilizers, phosphatic fertilizers, potash fertilizers, secondary nutrient fertilizers, and micronutrients.

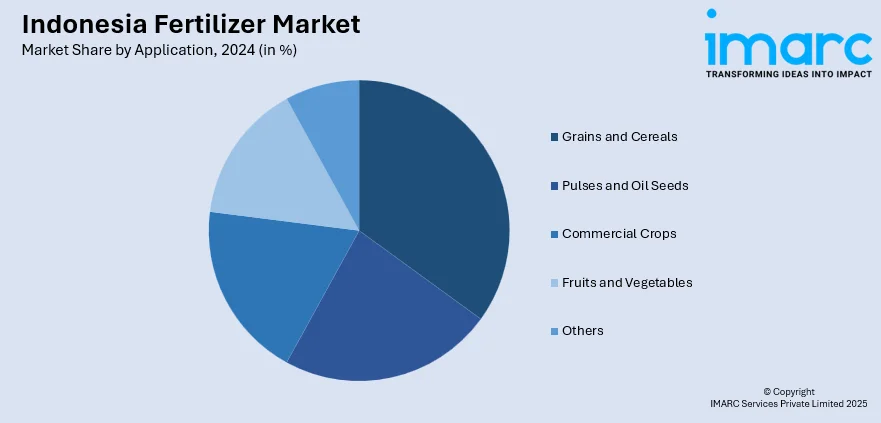

- On the basis of application, grains and cereals, pulses and oil seeds, commercial crops, fruits and vegetables, and others

Market Size and Forecast:

- 2024 Market Size: USD 2.2 Billion

- 2033 Projected Market Forecast: USD 2.8 Billion

- CAGR (2025-2033): 2.50%

Fertilizer, a cornerstone of modern agriculture, is a boon for global food production. This essential agricultural input, typically rich in vital nutrients like nitrogen, phosphorus, and potassium, actively enhances soil fertility, promoting robust plant growth and maximizing crop yields. Fertilizers are pivotal in ensuring food security by providing crops with the nutrients necessary for optimal development. By bolstering nutrient levels in the soil, fertilizers contribute to healthier plants, increased resistance to pests and diseases, and accelerated maturation. This heightened agricultural productivity meets the demands of a growing global population and aids in economic prosperity by supporting farmers' livelihoods and fostering rural development. Moreover, fertilizers contribute to sustainable farming practices, allowing for efficient land use and reducing the need for extensive cultivation areas. Their positive impact extends beyond immediate crop cycles, enabling farmers to adopt precision agriculture techniques, minimizing resource wastage and environmental impact. In essence, fertilizers catalyze agricultural success, ensuring bountiful harvests, food sufficiency, and the sustainable advancement of farming communities worldwide.

To get more information on this market, Request Sample

The market in Indonesia is majorly driven by the country's commitment to achieving food security and sustaining its agrarian economy. Fertilizers are pivotal in enhancing soil fertility, ensuring that crops receive essential nutrients for optimal growth. With a rapidly growing population, there is an increasing demand for higher agricultural productivity, and fertilizers become indispensable tools in meeting this demand. The Indonesia fertilizer market share continues to expand as government support and initiatives are instrumental in propelling the market forward. Indonesia has implemented various policies and programs to encourage farmers to adopt modern agricultural practices, including fertilizers. Also, subsidies, education campaigns, and extension services are geared towards enhancing farmers' awareness of the benefits of fertilizers and promoting their judicious use. Besides, expanding the palm oil industry offers numerous opportunities for the market. As one of the world's largest palm oil producers, the country's agribusiness sector heavily relies on fertilizers to ensure the health and productivity of oil palm plantations. The robust demand from this sector is contributing substantially to the overall growth of the fertilizer market. Moreover, rapid advancements in agricultural technology and farming practices drive the market. Concurrently, the rising adoption of precision farming techniques and customized fertilizer blends is gaining traction, thereby enabling farmers to optimize nutrient management and improve crop yields. Additionally, the escalating awareness of sustainable agriculture practices is creating a positive Indonesia fertilizer market outlook. Apart from this, there is a growing emphasis on environmentally friendly and nutrient-efficient fertilizers, aligning with global concerns about environmental impact and resource conservation.

Indonesia Fertilizer Market Trends:

Digital Agriculture Integration and Smart Farming Technologies

Indonesia’s fertilizer market is undergoing a major shift as digital agriculture and smart farming tools become more widely adopted. Farmers are increasingly turning to precision technologies such as soil sensors, GPS-enabled application systems, and drones to improve fertilizer use. These tools make nutrient management far more efficient by tailoring application rates to real-time soil and crop conditions, cutting down on waste while boosting productivity. IoT devices are also playing a big role, giving farmers constant updates on soil health and nutrient levels, which helps them make smarter, data-backed decisions. Beyond hardware, mobile apps and digital platforms are becoming everyday resources for accessing fertilizer recommendations, weather insights, and advisory services. Importantly, these solutions are no longer limited to large-scale operations—smallholder farmers are gaining access to, due to rising smartphone use and government-backed digital agriculture programs. Together, these trends are making smart farming more practical and accessible across the country’s diverse agricultural landscape.

Sustainable and Organic Fertilizer Adoption

Sustainability is becoming a central theme in Indonesia’s agricultural sector, with more farmers shifting toward organic and eco-friendly fertilizer options. Besides this, as the consumer demand for organic produce increases, farmers are also recognizing benefits such as healthier soils, better water retention, and reduced long-term dependency on chemicals. Bio-fertilizers with beneficial microbes are seeing strong uptake, as they improve nutrient absorption and plant resilience while lowering reliance on synthetic inputs. As per Indonesia fertilizer market research report, compost-based fertilizers made from crop residues and animal waste are another growing segment, creating opportunities for a circular economy within agriculture. This transition is supported by government initiatives, organic certification schemes, and rising export demand for organically grown products. At the same time, research centers and agribusinesses are developing advanced organic formulations that blend traditional practices with modern processing to improve nutrient content and ease of use. The result is a fast-maturing market that is aligning farmer practices with both environmental goals and international demand.

Growth, Opportunities, and Challenges in the Indonesia Fertilizer Market:

- Growth Drivers: The Indonesia fertilizer market is primarily driven by the country's commitment to achieving food security amid a rapidly growing population. Government initiatives including subsidies, education campaigns, and extension services are instrumental in promoting fertilizer adoption among farmers. This, in turn, is augmenting Indonesia fertilizer market growth. The expansion of the palm oil industry, where Indonesia ranks as one of the world's largest producers, creates substantial demand for fertilizers to maintain plantation productivity.

- Market Opportunities: The integration of digital agriculture and precision farming technologies presents significant opportunities for fertilizer manufacturers to develop smart application systems and data-driven solutions. Growing emphasis on sustainable agriculture practices creates demand for environmentally friendly and nutrient-efficient fertilizer formulations. Crop diversification trends across different regions offer opportunities for developing specialized fertilizer blends tailored to specific crops and growing conditions.

- Market Challenges: According to Indonesia fertilizer market forecast, price volatility of raw materials and energy costs are expected to significantly impacts fertilizer production and pricing, thus affecting farmer affordability and market demand. Limited awareness among smallholder farmers about proper fertilizer application techniques and optimal nutrient management practices constrains market growth potential. Infrastructure challenges in remote areas, including poor transportation networks and limited storage facilities, hinder efficient fertilizer distribution.

Indonesia Fertilizer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Nitrogenous Fertilizers

- Urea

- Calcium Ammonium Nitrate (CAN)

- Ammonia

- Ammonium Nitrate

- Ammonium Sulfate

- Others

- Phosphatic Fertilizers

- Mono-ammonium Phosphate (MAP)

- Di-ammonium Phosphate (DAP)

- Triple Superphosphate (TSP)

- Others

- Potash Fertilizers

- Muriate of Potash (MOP)

- Others

- Secondary Nutrient Fertilizers

- Micronutrients

The report has provided a detailed breakup and analysis of the market based on the type. This includes nitrogenous fertilizers (urea, calcium ammonium nitrate (CAN), ammonia, ammonium nitrate, ammonium sulfate, and others), phosphatic fertilizers (mono-ammonium phosphate (MAP), di-ammonium phosphate (DAP), triple superphosphate (TSP), and others), potash fertilizers (muriate of potash (MOP) and others), secondary nutrient fertilizers, and micronutrients.

Application Insights:

- Grains and Cereals

- Pulses and Oil Seeds

- Commercial Crops

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes grains and cereals, pulses and oil seeds, commercial crops, fruits and vegetables, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- PT Pupuk Indonesia (Persero)

- PT Pupuk Sriwidjaja Palembang (Pusri)

- PT. Dupan Anugerah Lestari (Saraswanti Group)

- PT. Jadi Mas

- Wilmar International Limited

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- September 2025: Universitas Gadjah Mada (UGM), in collaboration with PT Bukit Asam (PTBA) and MIND ID, launched a pilot project for Potassium Humate, an innovative soil conditioner derived from low-calorie coal, at the Faculty of Engineering. Branded as BA Grow in both solid and liquid forms, the product is designed to improve soil structure, enhance nutrient and water absorption, and reduce reliance on conventional fertilizers, while supporting Indonesia’s food sovereignty and industrial downstreaming strategies.

- May 2025: Indonesia and Jordan are exploring strategic collaboration in fertilizer production and agricultural technology to enhance food security and improve farming efficiency in both countries, with Indonesia proposing a joint fertilizer company to serve Southeast Asian and broader Asian markets. The cooperation also encompasses irrigation and water management systems inspired by Jordan’s successful practices, as well as the use of drone technology for precise application of fertilizers, pesticides, and herbicides—especially in swampy areas—with pilot programs planned for modern agricultural clusters.

- February 2025: PT Pupuk Kaltim (PKT), a subsidiary of PT Pupuk Indonesia (Persero), announced progress on its planned fertilizer plant in West Papua, with permits and land acquisition underway and completion targeted for 2028. To secure feedstock, PKT signed a gas sales agreement with Genting Oil Kasuri Pte. Ltd., operator of the Kasuri Block in Teluk Bintuni, for a supply of 101 MMscfd of natural gas to support ammonia and urea production.

Indonesia Fertilizer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Applications Covered | Grains and Cereals, Pulses and Oil Seeds, Commercial Crops, Fruits and Vegetables, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Companies Covered | PT Pupuk Indonesia (Persero), PT Pupuk Sriwidjaja Palembang (Pusri), PT. Dupan Anugerah Lestari (Saraswanti Group), PT. Jadi Mas, Wilmar International Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia fertilizer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia fertilizer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia fertilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fertilizer market in Indonesia was valued at USD 2.2 Billion in 2024.

The Indonesia fertilizer market is projected to exhibit a CAGR of 2.50% during 2025-2033, reaching a value of USD 2.8 Billion by 2033.

The expansion of cash crops, such as palm oil, rice, and rubber, is contributing to higher fertilizer utilization. In addition, the growing awareness among farmers about the benefits of balanced nutrient application is encouraging the adoption of both organic and chemical fertilizers. Government initiatives, including subsidies and training programs, are further promoting fertilizer use, especially in rural areas.

Some of the major players in the Indonesia fertilizer market include PT Pupuk Indonesia (Persero), PT Pupuk Sriwidjaja Palembang (Pusri), PT. Dupan Anugerah Lestari (Saraswanti Group), PT. Jadi Mas, Wilmar International Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)