Indonesia Glamping Market Size, Share, Trends and Forecast by Age Group, Accommodation Type, Booking Mode, and Region, 2025-2033

Indonesia Glamping Market Overview:

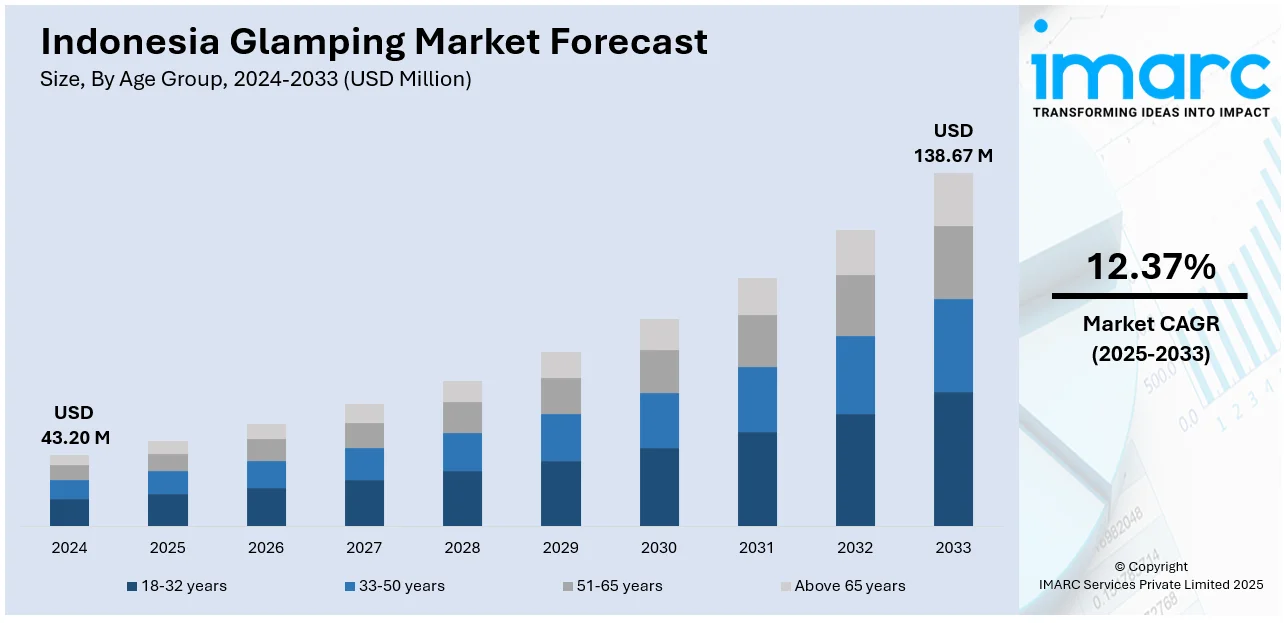

The Indonesia glamping market size reached USD 43.20 Million in 2024. The market is projected to reach USD 138.67 Million by 2033, exhibiting a growth rate (CAGR) of 12.37% during 2025-2033. The market is driven by the rising domestic tourism among millennials and families seeking unique outdoor experiences with modern comforts. Apart from this, strong government support for sustainable tourism and eco-friendly accommodation also fuels demand for well-managed glamping sites. Moreover, the growing disposable incomes and social media influence further encourage travelers to choose glamping as an alternative to conventional resorts and hotels, which is significantly augmenting the Indonesia glamping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 43.20 Million |

| Market Forecast in 2033 | USD 138.67 Million |

| Market Growth Rate 2025-2033 | 12.37% |

Indonesia Glamping Market Trends:

Strong Growth of Domestic and Inbound Tourism

The steady expansion of the country's tourism sector plays a critical role in driving the market growth. With government initiatives like the "10 New Balis" program and improved infrastructure in secondary destinations, more domestic and international visitors are exploring regions beyond Bali. In addition to this, families, young couples, and groups of friends are actively looking for short getaways that combine nature with comfort. Moreover, domestic tourists, in particular, are rediscovering destinations closer to major cities such as Jakarta, Bandung, and Yogyakarta, creating demand for weekend stays in scenic, secluded areas. Besides, rising disposable income, an expanding middle class, and greater awareness of leisure travel have strengthened this trend. According to industry reports, international visitor arrivals have rebounded strongly in Indonesia, with 13.9 million international tourists recorded in 2024. The influx of visitors fuels demand for novel accommodation concepts, and glamping stands out as an attractive choice for those seeking nature-based stays with comfort and privacy. Many international tourists are now looking beyond traditional hotels and resorts, drawn instead to immersive outdoor experiences that highlight Indonesia's diverse landscapes. Apart from this, local governments often support glamping ventures with permits and promotion, seeing them as a low-impact way to boost visitor numbers without excessive construction. This steady flow of visitors encourages operators to expand sites and upgrade amenities to match evolving expectations, which further supports the Indonesia glamping market growth.

To get more information on this market, Request Sample

Growing Preference for Hassle-Free Booking and Digital Access

The widespread adoption of online booking platforms has made glamping in Indonesia far more accessible to a broader customer base. Consumers now expect clear, convenient booking options, and digital travel agencies, along with dedicated glamping platforms, make this simple. As per industry reports, as of 2024, about 26% of the country's population had access to 5G network coverage, which supports faster and more reliable browsing and transactions. Stronger high-speed connectivity helps travelers easily compare prices, browse detailed photos, check real-time availability, and read reviews before confirming reservations within minutes. This ease encourages more spontaneous trips and helps operators maintain high occupancy. Several operators now list their tents and cabins on mainstream travel sites and also invest in mobile-friendly websites with direct booking engines, allowing them to control pricing and upsell additional services. Furthermore, the integration of online payment gateways, instant confirmation, and flexible cancellation policies further reassure travelers who value convenience. Also, social media advertisements and influencer promotions funnel potential guests directly to booking pages, accelerating impulse travel decisions. This ease of booking boosts occupancy rates year-round, helping operators capture demand from spontaneous weekend travelers and tourists who plan getaways in a short time.

Indonesia Glamping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on age group, accommodation type, and booking mode.

Age Group Insights:

- 18-32 years

- 33-50 years

- 51-65 years

- Above 65 years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 18-32 years, 33-50 years, 51-65 years, and above 65 years.

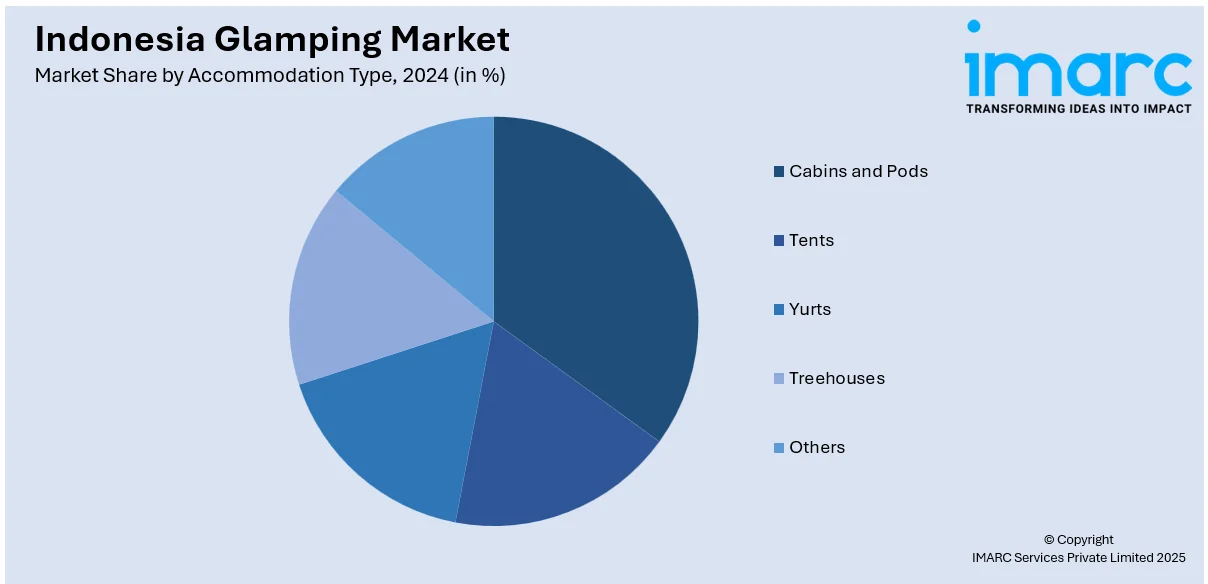

Accommodation Type Insights:

- Cabins and Pods

- Tents

- Yurts

- Treehouses

- Others

A detailed breakup and analysis of the market based on the accommodation type have also been provided in the report. This includes cabins and pods, tents, yurts, treehouses, and others.

Booking Mode Insights:

- Direct Booking

- Travel Agents

- Online Travel Agencies

The report has provided a detailed breakup and analysis of the market based on the booking mode. This includes direct booking, travel agents, and online travel agencies.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Glamping Market News:

- On January 26, 2024, Radisson Hotel Group announced the launch of a new beachfront resort in Anyer, Indonesia, featuring 150 keys, including 120 guest rooms and 30 upscale tented villas designed with Scandinavian-inspired architecture in a tropical setting. The development will introduce a glamping concept, offering luxurious outdoor accommodations alongside amenities such as private beach access, a beach club, diverse dining options, a wellness spa, a gym, and meeting facilities. Scheduled to open in 2027, the resort aims to elevate the coastal hospitality experience by combining natural beauty with contemporary comfort.

Indonesia Glamping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Age Groups Covered | 18-32 years, 33-50 years, 51-65 years, Above 65 years |

| Accommodation Types Covered | Cabins and Pods, Tents, Yurts, Treehouses, Others |

| Booking Modes Covered | Direct Booking, Travel Agents, Online Travel Agencies |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia glamping market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia glamping market on the basis of age group?

- What is the breakup of the Indonesia glamping market on the basis of accommodation type?

- What is the breakup of the Indonesia glamping market on the basis of booking mode?

- What is the breakup of the Indonesia glamping market on the basis of region?

- What are the various stages in the value chain of the Indonesia glamping market?

- What are the key driving factors and challenges in the Indonesia glamping market?

- What is the structure of the Indonesia glamping market and who are the key players?

- What is the degree of competition in the Indonesia glamping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia glamping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia glamping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia glamping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)