Indonesia Hair Care Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2026-2034

Indonesia Hair Care Market Overview:

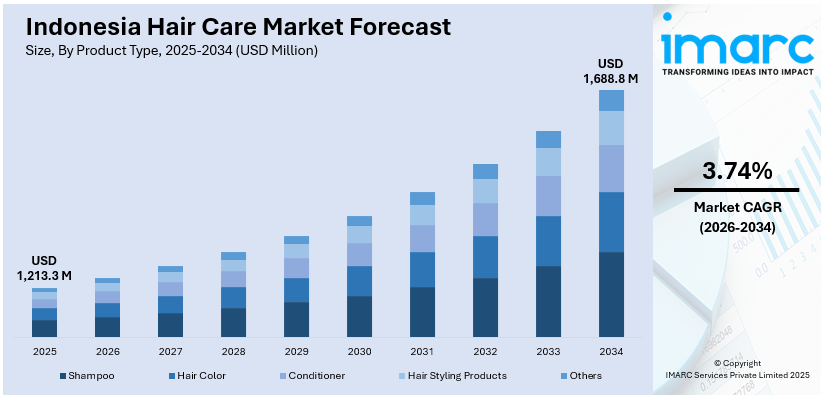

The Indonesia hair care market size reached USD 1,213.3 Million in 2025. Looking forward, the market is expected to reach USD 1,688.8 Million by 2034, exhibiting a growth rate (CAGR) of 3.74% during 2026-2034. The market is fueled by an increasing youth population, heightened awareness regarding personal hygiene, and growing demand for natural and halal-certified products. Urbanization and enhanced internet penetration have created a surge in the popularity of online beauty tutorials, prompting consumers to look for personalized hair solutions. Local and global brands are drawing on heritage ingredients such as coconut oil and candlenut to appeal to environmentally conscious consumers, which further increases the Indonesia hair care market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,213.3 Million |

| Market Forecast in 2034 | USD 1,688.8 Million |

| Market Growth Rate 2026-2034 | 3.74% |

Indonesia Hair Care Market Trends:

Natural & Traditional Ingredient Revival

Indonesia's hair care industry is going through a renaissance of indigenous and traditional ingredients that mirror the wider cultural renaissance. Companies are tapping centuries of indigenous knowledge, using tropical staples such as coconut oil, aloe vera, candlenut, and herbal extracts indigenous to Indonesia's archipelago. This convergence of folk remedy with contemporary beauty science speaks deep to Indonesian consumers, who welcome products that resonate with their local culture and environmental situation. For example, products with candlenut and ginseng have been favored, which are being marketed for hair nourishment and root strengthening, particularly being sought after in a humid climate that tends to destroy hair integrity. The trend is also eco-friendly in line with a movement that honors sustainability values in packaging and sourcing approaches. By combining locally endemic botanical ingredients with clean-label communications, Indonesian hair care companies have established a distinctive presence, one that balances cultural authenticity with modern wellness patterns and further contributes to the Indonesia hair care market growth.

To get more information on this market Request Sample

Halal Certification & Hijab-Friendly Innovation

With global Islam's largest population living in Indonesia, halal certification has become a must-have rather than a nice-to-have in the global hair care business. Following compulsory halal labeling, global and local companies have made a shift to offering products that align with Islamic ethical and compositional requirements. This regulatory and cultural context has prompted focused innovation to serve the hair needs of hijab-covering women. These customers generally experience issues like scalp dryness, breakage, and excessive humidity under extended hair cover. Consequently, firms have come up with dedicated shampoo and scalp-care products tailored to provide moisture while lessening dandruff under hijab wear. This transition has driven the market past universal solutions, and there has been an explosion of products that enable women to have healthy hair within cultural parameters—driving ethical and functional innovation within a conventionally underserved segment.

Digital Influence & Salon-Driven Personalization

Indonesia's active youth population and speedy digital adoption have transformed hair care consumption habits. YouTube, TikTok, and Instagram influencers lead consumers towards more personalized and experiential hair regimens. Tutorials that target specific problems such as dry hair and dandruff have experienced significant spikes, prompting consumers to look for targeted cream baths, scalp serums, and keratin treatments at salons. Consequently, salon treatments have become ubiquitous, providing sophisticated treatments linked to specific hair types—straightening, coloring, or moisture treatment—fueled by social content that fosters believability in these rituals. Concurrently, digital shopping platforms like Tokopedia and Shopee have made niche and curated products more accessible, facilitating consumers in urban and distant areas to avail themselves of expert hair care. This online synergy between online learning, salon visits, and product availability has established a feedback loop that drives ongoing innovation and consumer interaction throughout Indonesia's hair care economy.

Indonesia Hair Care Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Shampoo

- Hair Color

- Conditioner

- Hair Styling Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes shampoo, hair color, conditioner, hair styling products, and others.

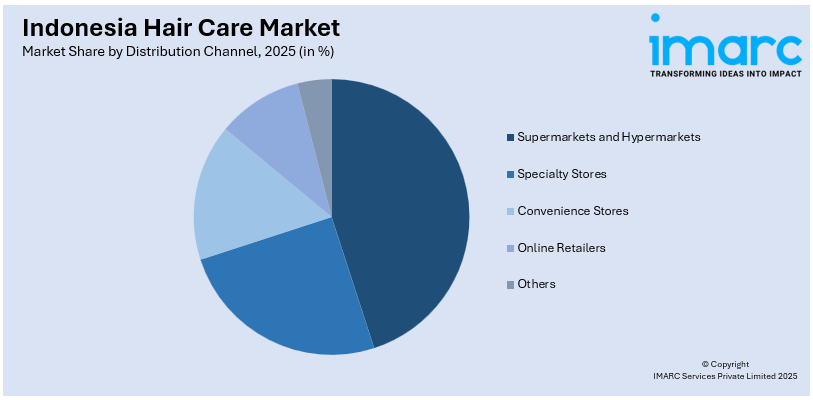

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Retailers

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, convenience stores, online retailers, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Hair Care Market News:

- In November 2023, at the FMCG Asia Awards PT Kino Indonesia Tbk celebrated the successful launch of its Ellips Hair Vitamin Mist by winning the prestigious Consumer Good of the Year (Hair Care)-Indonesia award. This innovative product has produced outstanding results in addition to solidifying PT Kino Indonesia Tbk's position as a market leader in the hair vitamin industry. These include a remarkable more than 200% increase in return on advertising spending (ROAS) on online shopping sites, a 2% increase in market share, and a 4% and 24% improvement in brand image and customer happiness, respectively.

Indonesia Hair Care Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Shampoo, Hair Color, Conditioner, Hair Styling Products, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Retailers, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia hair care market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia hair care market on the basis of product type?

- What is the breakup of the Indonesia hair care market on the basis of distribution channel?

- What is the breakup of the Indonesia hair care market on the basis of region?

- What are the various stages in the value chain of the Indonesia hair care market?

- What are the key driving factors and challenges in the Indonesia hair care market?

- What is the structure of the Indonesia hair care market and who are the key players?

- What is the degree of competition in the Indonesia hair care market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia hair care market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia hair care market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia hair care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)