Indonesia Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

Indonesia Meat Market Overview:

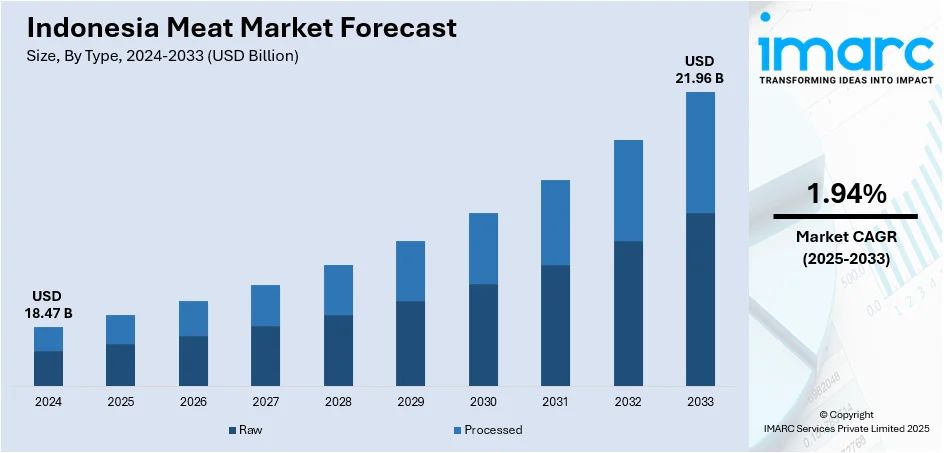

The Indonesia meat market size reached USD 18.47 Billion in 2024. The market is projected to reach USD 21.96 Billion by 2033, exhibiting a growth rate (CAGR) of 1.94% during 2025-2033. The market is fueled by growing population expansion, urbanization, and expanding middle-class incomes, which enhance demand for meat products, particularly chicken and beef. Halal certification and cultural and religious tastes highly impact consumer demand. Also, government efforts to enhance food security and livestock productivity promote market growth. The growth of modern retail and online shopping also enables access to a wider range of meat products, thus increasing the Indonesia meat market share in urban and semi-urban regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.47 Billion |

| Market Forecast in 2033 | USD 21.96 Billion |

| Market Growth Rate 2025-2033 | 1.94% |

Indonesia Meat Market Trends:

Growing Middle-Class Population and Income Levels

Indonesia's growing middle class is the key driver of the Indonesia meat market trends. With rising incomes, eating habits are shifting away from conventional vegetable-based staples towards protein-based diets, where demand for meat products, especially poultry and beef, picks up. Affluence also contributes to increased concerns about nutrition, health, and food safety, prompting consumers to look for higher quality, hygienically processed, and conveniently packed meat. Urbanization adds to this trend because city residents tend to eat more meat as they have better exposure to new retail channels and diversified food options. Also, increased incomes allow consumers to dine out more, use fast-food chains, and order food delivery services sectors that heavily depend on meat-based products. The middle class's purchasing power is transforming the pattern of meat consumption in favor of premium segments and stimulating domestic as well as international meat producers to invest in fulfilling the Indonesia meat market growth.

To get more information on this market, Request Sample

Religious and Cultural Influence on Meat Consumption

Religious and cultural factors are central to Indonesia’s meat market. As the world’s largest Muslim-majority nation, halal certification shapes consumer behavior, representing not just religious compliance but also hygiene and safety. This fuels demand for halal-certified meat, both local and imported. Cultural events like Eid al-Adha and Eid al-Fitr significantly increase meat consumption, especially beef and goat. In 2024, the Qurban economy reached IDR 24.5 trillion, with 2.08 million participants and 103,000 tonnes of qurban meat distributed nationwide highlighting the scale of religious-driven demand. Such celebrations lead to a surge in livestock slaughtering, affecting supply chains and prices. Communal feasts and traditional meals further sustain year-round demand. As a result, meat producers, distributors, and retailers align offerings with religious and cultural practices, reinforcing halal standards and seasonal responsiveness, which shape the unique and resilient dynamics of Indonesia’s meat industry.

Government Initiatives and Agricultural Development

The Indonesian government has a central role to play in shaping the country's national meat market by introducing policies to enhance food security and curb reliance on imports. Several programs are in place to support livestock breeding, feed manufacturing, animal disease control, and education for farmers to improve meat production locally as well as product quality. Initiatives such as the "Beef Self-Sufficiency Program" facilitate domestic cattle farming through subsidies, capacity building, and infrastructural investment. Concurrently, the government supervises meat imports and implements halal standards for consumer protection and religious purposes. Further, attempts to establish modern slaughterhouses and supply chain infrastructure enhance cold storage and transport facilities, minimizing spoilage and improving the distribution of meat between islands. Through private-public collaboration, authorities are attempting to stabilize meat prices and maintain sufficient supply, particularly during holidays. These strategic interventions are helping to build a more robust and resilient meat market, to the advantage of both producers and consumers in Indonesia's vast archipelago.

Indonesia Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

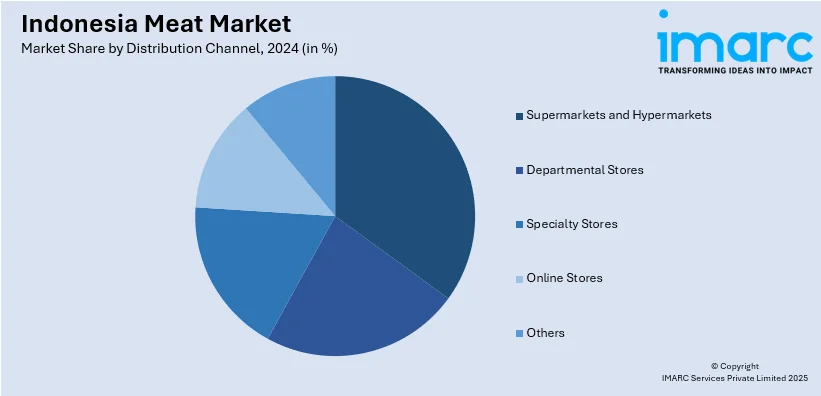

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Meat Market News:

- In March 2025, The Indonesian government plans to merge three SOEs—Virama Karya, Yodya Karya, and Indra Karya—into a new agriculture and fisheries holding company named Agrinas, backed by the sovereign wealth fund Danantara. Led by the Agriculture and Marine Affairs Ministries, Agrinas aims to boost food security through projects like developing 20,000 hectares of fishponds and 1 million hectares of palm plantations, as discussed with President Prabowo.

- In February 2025, The Indonesian government will launch a nationwide Cheap Food Movement (GPM) from February 24 to March 31, 2025, to ensure affordable food ahead of Ramadan. Coordinated by multiple agencies and supported by SOEs and private firms, the program will distribute 189,000 tons of sugar, rice, garlic, frozen buffalo meat, and 70,000 kiloliters of cooking oil below retail prices across 514 districts and 38 provinces.

Indonesia Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia meat market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia meat market on the basis of type?

- What is the breakup of the Indonesia meat market on the basis of product?

- What is the breakup of the Indonesia meat market on the basis of distribution channel?

- What is the breakup of the Indonesia meat market on the basis of region?

- What are the various stages in the value chain of the Indonesia meat market?

- What are the key driving factors and challenges in the Indonesia meat market?

- What is the structure of the Indonesia meat market and who are the key players?

- What is the degree of competition in the Indonesia meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)