Indonesia Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2025-2033

Indonesia Medical Tourism Market Overview:

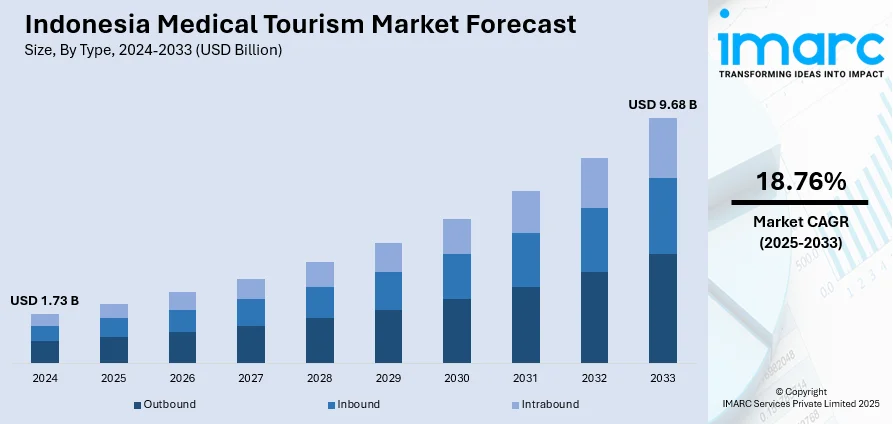

The Indonesia medical tourism market size reached USD 1.73 Billion in 2024. Looking forward, the market is projected to reach USD 9.68 Billion by 2033, exhibiting a growth rate (CAGR) of 18.76% during 2025-2033. The market is driven by government-backed healthcare modernization efforts designed to retain outbound patients and build inbound demand. Traditional wellness integration in destinations like Bali and Yogyakarta attracts international clients seeking holistic recovery. Additionally, the affordability and improved capabilities of private hospitals are further augmenting the Indonesia medical tourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.73 Billion |

| Market Forecast in 2033 | USD 9.68 Billion |

| Market Growth Rate 2025-2033 | 18.76% |

Indonesia Medical Tourism Market Trends:

Wellness and Traditional Healing Integration in Tourist Destinations

Indonesia’s rich tradition of holistic wellness, combined with its global appeal as a tourist destination, forms a unique foundation for its medical tourism expansion. Wellness resorts in Bali, Yogyakarta, and Lombok are blending modern treatments with traditional Indonesian therapies, such as jamu herbal medicine, reflexology, and energy-based healing. International tourists are increasingly drawn to packages that combine yoga, detox, physical therapy, and cosmetic procedures in a resort-like setting. Healthcare providers in these regions partner with hospitality groups to offer pre- and post-treatment recovery in serene environments, supported by nutritious diets and personalized care. On June 25, 2025, Indonesia inaugurated its first medical tourism special economic zone in Sanur, Bali, integrating international hospitals, specialist clinics, and research facilities. The initiative aims to curb the estimated USD 9.2 Billion Indonesians spend annually on overseas healthcare by offering comparable world-class services domestically. With Bali already attracting 6.3 Million international tourists in 2024, the project is expected to elevate the country’s position in global health and wellness tourism. Spa-medical hybrid facilities, especially in Bali, are offering dermatology, anti-aging treatments, and minor aesthetic procedures alongside traditional wellness practices. The Ministry of Tourism promotes medical and wellness tourism together under its Wonderful Indonesia Health Tourism campaign, emphasizing Indonesia’s unique healing heritage. As global travelers become more health-conscious and seek integrated wellness solutions, Indonesia’s natural positioning as a spiritual and therapeutic retreat is gaining traction. This convergence of healthcare and cultural wellness is reshaping the regional healthcare map and driving Indonesia medical tourism market growth by elevating domestic competitiveness.

To get more information on this market, Request Sample

Cost-Effectiveness and Growing Private Healthcare Sector

Affordability remains a central factor in attracting both domestic and international medical tourists to Indonesia. Treatments in private Indonesian hospitals are significantly lower in cost compared to those in neighboring countries, especially for cosmetic surgery, fertility treatments, dentistry, and minor elective surgeries. Despite competitive pricing, the private sector is delivering increasing quality and comfort, with hospitals now meeting international standards and hiring foreign-trained specialists. Accredited institutions in Jakarta, Surabaya, and Batam are offering bundled pricing, multi-lingual care, and concierge services tailored to middle- and upper-class patients from Malaysia, Australia, Papua New Guinea, and the Middle East. Indonesia’s private healthcare providers are also leveraging telemedicine for international consultations, pre-arrival diagnostics, and post-discharge follow-ups, improving continuity of care. Investment in infrastructure and technology, like robotic-assisted surgery and advanced imaging, is positioning select institutions as destination hospitals for regional patients. According to a 2024 NLM report, it was reported that nearly 2 Million Indonesians sought medical treatment abroad in 2022, resulting in an estimated economic loss of USD 11.5 Billion (IDR 170 Trillion). Around 1 Million traveled to Malaysia and 750,000 to Singapore, making Indonesia the top patient source, contributing over 75% of Malaysia’s and 60% of Singapore’s medical tourism revenues. Additionally, 60% of outbound patients were from Jakarta, prompting Indonesia’s government to invest in domestic medical infrastructure to curb outbound medical travel. With rising investor interest in health-tech and hospital networks, Indonesia’s private healthcare sector is gaining the capacity and confidence to scale medical tourism in targeted specialties. This balance of affordability and improving service delivery enhances Indonesia’s competitiveness in the regional healthcare travel landscape.

Indonesia Medical Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and treatment type.

Type Insights:

- Outbound

- Inbound

- Intrabound

The report has provided a detailed breakup and analysis of the market based on the type. This includes outbound, inbound, and intrabound.

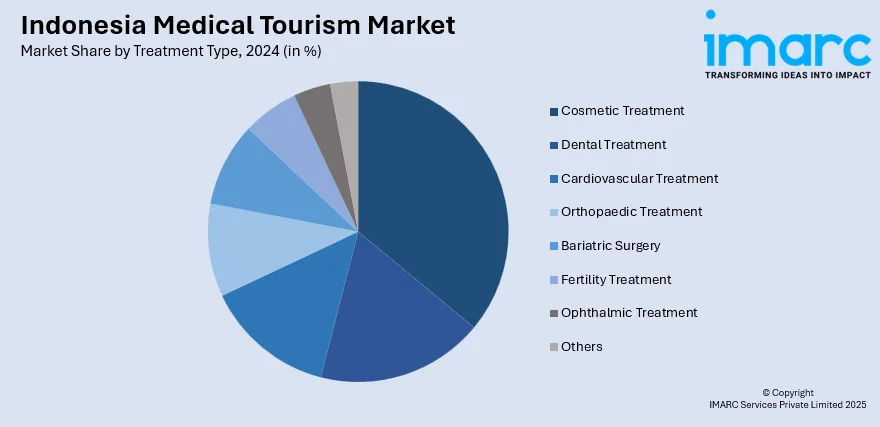

Treatment Type Insights:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment type. This includes cosmetic treatment, dental treatment, cardiovascular treatment, orthopaedic treatment, bariatric surgery, fertility treatment, ophthalmic treatment, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Medical Tourism Market News:

- On April 26, 2025, Bali International Hospital (BIH) announced global partnerships in the Sanur Health Special Economic Zone, including the launch of the Icon Cancer Center, which began operations in May. For the first time, foreign doctors are permitted to practice in Indonesia under SEZ regulations. This marks a major development for Indonesia’s medical tourism sector, reinforcing BIH’s role as a regional hub for international healthcare services.

- On May 27, 2025, JCB International and Noage International expanded Japan’s advanced medical tourism program for affluent Indonesians through a new partnership. The initiative provides complimentary health checkups at premium Tokyo clinics for JCB Indonesia cardholders, with multilingual support and coordinated travel services. This development strengthens outbound medical tourism opportunities for Indonesians, amid growing regional competition.

Indonesia Medical Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Outbound, Inbound, Intrabound |

| Treatment Types Covered | Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia medical tourism market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia medical tourism market on the basis of type?

- What is the breakup of the Indonesia medical tourism market on the basis of treatment type?

- What is the breakup of the Indonesia medical tourism market on the basis of region?

- What are the various stages in the value chain of the Indonesia medical tourism market?

- What are the key driving factors and challenges in the Indonesia medical tourism market?

- What is the structure of the Indonesia medical tourism market and who are the key players?

- What is the degree of competition in the Indonesia medical tourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia medical tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia medical tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia medical tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)