Indonesia Oil and Gas Market Size, Share, Trends and Forecast by Sector and Region, 2026-2034

Indonesia Oil and Gas Market Overview:

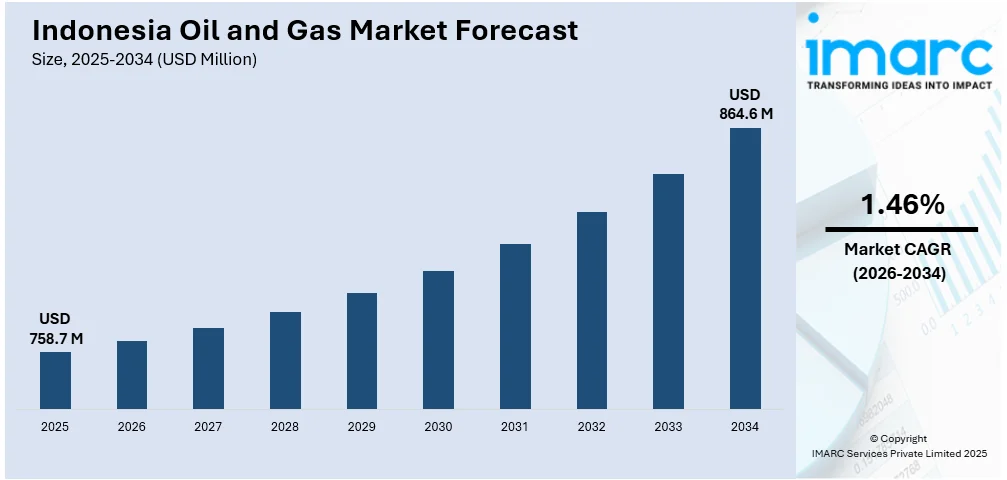

The Indonesia oil and gas market size was valued at USD 758.7 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 864.6 Million by 2034, exhibiting a CAGR of 1.46% from 2026-2034. Kalimantan currently dominates the market, holding the largest share. The market is driven by the growing domestic demand, aging production fields, and increased focus on natural gas development. Government incentives, improved contract terms, and exploration in frontier areas are attracting new investment. Infrastructure upgrades and downstream expansion are also underway to boost energy security. The shift toward cleaner fuels and regulatory reforms are shaping the competitive landscape, thereby directly influencing Indonesia oil and gas market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 758.7 Million |

| Market Forecast in 2034 | USD 864.6 Million |

| Market Growth Rate 2026-2034 | 1.46% |

Indonesia’s oil and gas market is primarily driven by rising domestic energy demand, fueled by population growth and expanding industrial activities. The government’s commitment to reducing energy imports has led to increased focus on upstream exploration and production. Efforts to develop untapped reserves, including offshore resources, are supported by regulatory reforms and incentives aimed at attracting foreign investments. Additionally, infrastructure development, such as refineries and pipelines, is being prioritized to improve supply efficiency. For instance, in March 2025, Indonesia government announced its plans to construct a new oil refinery with a capacity of 500,000 b/d, aiming to enhance energy security and reduce import reliance. The USD 12.5 billion project, details pending, aligns with efforts to boost oil production and further develop dimethyl ether as an LPG substitute.

To get more information on this market Request Sample

The growing need for energy security is encouraging diversification within the oil and gas sector. Investments in LNG infrastructure and gas-fired power generation are accelerating to meet cleaner energy goals. The government's strategic push for improved self-sufficiency, coupled with policy support for enhanced oil recovery (EOR) and marginal field development, also play a crucial role. For instance, in February 2025, in an effort to improve national energy security, the Indonesian government declared its intention to build a petroleum storage facility on Nipa Island, increasing its energy buffer stocks from 21 to 51 days. The initiative includes boosting domestic oil production through foreign investment and offering flexible contracts to oil and gas companies. These factors collectively drive exploration, production, and technological advancement across Indonesia’s oil and gas value chain.

Indonesia Oil and Gas Market Trends:

Shift Toward Natural Gas

Indonesia is prioritizing natural gas development as part of its long-term energy strategy. With coal and oil facing pressure from both environmental policies and market dynamics, gas offers a cleaner-burning alternative for power generation and industrial use. Several large-scale LNG and pipeline infrastructure projects are underway to support this transition. For instance, in May 2025, Indonesian coal miner Bukit Asam announced its plans to invest USD 3.1 billion in a plant to convert coal into synthetic natural gas, aiming for 240 billion British thermal units per day. The project, in collaboration with state gas distributor PGN, seeks to boost domestic gas supply following the withdrawal of Air Products. Domestic consumption is rising, particularly in Java and Sumatra, while export volumes are being recalibrated to ensure local supply security. The government’s support through incentives and regulatory easing is also attracting interest in offshore and unconventional gas blocks. This shift is central to the Indonesia oil and gas market outlook.

Exploration in Frontier Areas

Exploration is expanding into less developed regions, especially eastern Indonesia and deepwater basins like the Arafura Sea and Papua. These areas hold untapped potential but require high capital and technical capability. To attract investors, the government has introduced improved gross split terms, streamlined licensing, and offered access to newly acquired seismic data. Partnerships with international firms are increasing as Indonesia seeks to boost reserves and reverse production declines. Infrastructure gaps remain a challenge, but planned incentives and support for early-stage projects aim to mitigate risks. For instance, in May 2025, Inpex Corp. gained exploration rights for the Serpang Working Area offshore East Java, Indonesia, following the 2024 Petroleum Bidding Round. The company signed a Production Sharing Contract with SKK Migas and partners, aiming to enhance its natural gas and LNG sector, aligning with its Vision 2035 strategy. According to the Indonesia oil and gas market forecast, frontier exploration will be a key driver of long-term supply growth.

Stronger Domestic Supply Mandate

The Indonesian government is tightening its focus on meeting domestic energy demand, particularly for natural gas. Industries, power plants, and households are being prioritized over exports, with policies like the Domestic Market Obligation (DMO) reinforcing this shift. According to regulatory updates, new production-sharing contracts increasingly include terms that guarantee domestic allocation. This has led to a recalibration of LNG export volumes and renegotiation of long-term contracts. The policy aims to reduce import reliance and ensure energy security for critical sectors. This demand-driven approach is expected to play a major role in Indonesia oil and gas market growth.

Indonesia Oil and Gas Industry Segmentation:

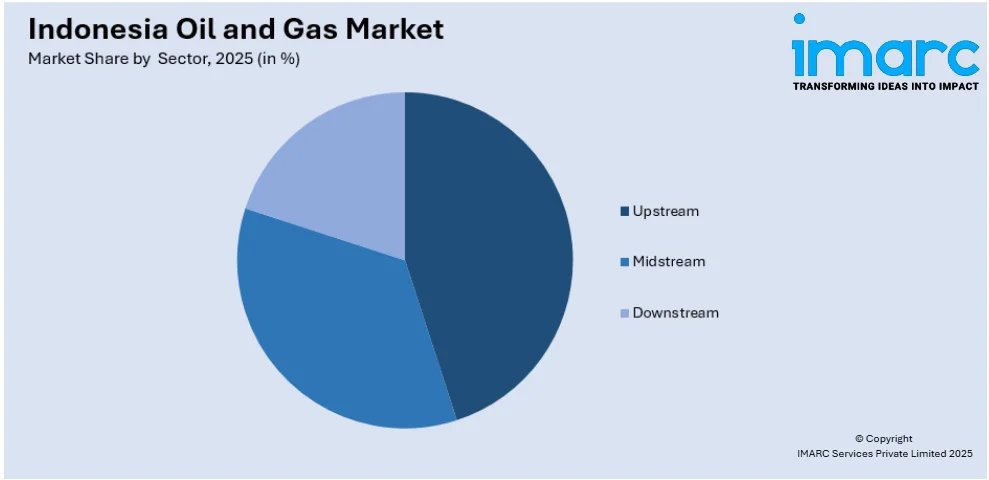

IMARC Group provides an analysis of the key trends in each segment of the Indonesia oil and gas market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on sector.

Analysis by Sector:

Access the comprehensive market breakdown Request Sample

- Upstream

- Midstream

- Downstream

Indonesia’s oil and gas sector continues to be driven by upstream activities, which include exploration, drilling, and production. According to industry data, upstream accounts for the largest share of investment and project focus, especially as the country pushes to boost declining output. Government initiatives like gross split PSCs, reduced bureaucracy, and seismic data access have encouraged both local and international operators to invest in untapped and marginal fields. National oil company Pertamina and global players such as Eni and BP are expanding upstream commitments, targeting both conventional and unconventional resources. Deepwater blocks and frontier regions are attracting attention due to their long-term potential. As a result, upstream performance provides a positive impact on the Indonesia oil and gas market trends.

Regional Analysis:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

Kalimantan has become a focal point for Indonesia’s oil and gas production. With mature fields, ongoing exploration, and expanding infrastructure, it plays a central role in both upstream and midstream segments. The presence of large gas reserves and established processing facilities gives it a logistical advantage over more remote regions. Local governments have also supported sector growth through permitting coordination and land access facilitation. Several national and international operators have concentrated operations there due to relatively stable output and access to export routes. Kalimantan’s contribution to national energy supply makes it one of the most active and strategically important regions in the Indonesia oil and gas market.

Competitive Landscape:

The Indonesia oil and gas market is highly competitive, with a mix of state-backed and private players operating across upstream, midstream, and downstream segments. Companies are vying for exploration rights in both mature and frontier areas, with fiscal terms and geological prospects influencing investment decisions. Domestic demand growth has pushed participants to secure long-term supply contracts, especially for natural gas. Regulatory changes and environmental targets are also shaping strategies, as firms adapt to stricter emissions standards and local content rules. Competition is further intensified by shifting global energy trends, requiring operators to balance cost efficiency with energy transition goals.

The report provides a comprehensive analysis of the competitive landscape in the Indonesia oil and gas market with detailed profiles of all major companies, including:

- BP p.l.c.

- Chevron Corporation

- China National Offshore Oil Corporation

- ExxonMobil Corporation

- Petroliam Nasional Berhad (PETRONAS)

- PT Pertamina (Persero)

- PT. Connusa Energindo

- PT. Perusahaan Gas Negara Tbk

- Shell plc

Latest News and Developments:

- May 2025: Eni began gas production from the Merakes East field offshore Indonesia, contributing up to 100 MMSCFD or 18,000 boepd. The field is connected to the Jangkrik Floating Production Unit and supports both domestic supply and LNG exports. This development enhances Eni's gas strategy in the Kutei Basin.

- May 2025: Indonesia inaugurated two offshore oil and gas projects worth USD 600 Million in the South Natuna Sea. Operated by Medco E&P Natuna, the projects aim to produce 20,000 barrels of oil per day, supporting the country’s energy self-sufficiency and net-zero goals by 2050.

- May 2025: JAPEX acquired a 50% stake in EMP Gebang, focusing on the PSC Gebang block in North Sumatra for future gas exploration. JAPEX will lead the development of the Secanggang field, shifting away from its mature Kangean project.

- May 2025: TotalEnergies planned to acquire a 25% stake in Indonesia's Bobara oil and gas block, alongside Pertamina Hulu Energi. This potential return to Indonesia's upstream sector reflects growing investor confidence, following Total's previous involvement in the Mahakam Block until 2018.

- March 2025: Pertamina East Natuna commenced oil and gas exploration in the North Natuna Sea to boost Indonesia’s hydrocarbon reserves. The project involves a 3D seismic data acquisition and aims to begin exploration drilling in 2026, supporting national energy security and economic growth.

- December 2024: Indonesia's Ministry of Energy launched auctions for six new oil and gas blocks with a combined 48 Gboe of reserves, marking the second auction of the year. The government also signed a contract with Harbour Energy and Mubadala Energy for developing the Central Andaman block.

Indonesia Oil and Gas Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Upstream, Midstream, Downstream |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Companies Covered | BP p.l.c., Chevron Corporation, China National Offshore Oil Corporation, ExxonMobil Corporation, Petroliam Nasional Berhad (PETRONAS), PT Pertamina (Persero), PT. Connusa Energindo, PT. Perusahaan Gas Negara Tbk, Shell plc, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia oil and gas market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indonesia oil and gas market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia oil and gas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oil and gas market in the Indonesia was valued at USD 758.7 Million in 2025

The Indonesia oil and gas market is projected to exhibit a CAGR of 1.46% during 2026-2034, reaching a value of USD 864.6 Million by 2034

Rising domestic energy demand, favorable government policies, and increased investment in upstream activities are major drivers. Efforts to boost exploration, develop infrastructure, and prioritize natural gas for power and industry also contribute to the market’s steady growth

Kalimantan holds the largest share of Indonesia’s oil and gas market due to its established production facilities, active upstream operations, and strategic export access. The region’s mature fields and continued exploration activity make it a central hub for national output.

Some of the major players in the Indonesia oil and gas market include BP p.l.c., Chevron Corporation, China National Offshore Oil Corporation, ExxonMobil Corporation, Petroliam Nasional Berhad (PETRONAS), PT Pertamina (Persero), PT. Connusa Energindo, PT. Perusahaan Gas Negara Tbk, Shell plc, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)