Indonesia Online Education Market Size, Share, Trends and Forecast by Type, Provider, Technology, End-User, and Region, 2026-2034

Indonesia Online Education Market Overview:

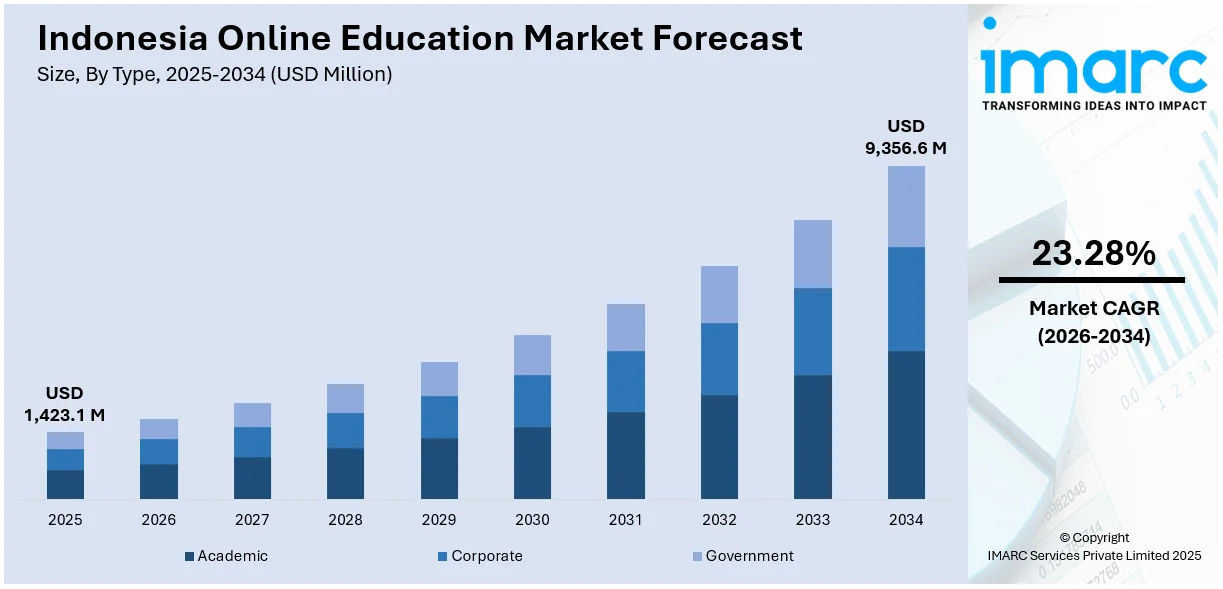

The Indonesia online education market size reached USD 1,423.1 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 9,356.6 Million by 2034, exhibiting a growth rate (CAGR) of 23.28% during 2026-2034. The market is driven by government-backed digital education programs fostering ICT integration in schools, supported by private sector partnerships. Rising demand for job-oriented online courses among professionals, coupled with the growing popularity of recognized certifications, is fueling platform engagement. Increasing adoption of mobile-based learning solutions is further augmenting the Indonesia online education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,423.1 Million |

| Market Forecast in 2034 | USD 9,356.6 Million |

| Market Growth Rate 2026-2034 | 23.28% |

Indonesia Online Education Market Trends:

Government Support for Digital Learning Ecosystems

The Indonesian online education sector is witnessing accelerated growth supported by proactive government initiatives aimed at integrating digital tools into the national education framework. Programs such as Merdeka Belajar and Digital School focus on reshaping traditional classroom environments into tech-enabled ecosystems, enhancing both infrastructure and digital content delivery. Efforts to bridge the digital divide across urban and rural regions have led to collaborations between the Ministry of Education and private technology providers, emphasizing affordable internet access and digital literacy for students and teachers. These initiatives target not just primary and secondary schools, but also vocational institutions, empowering learners with access to a diverse range of educational resources. As a result, a strong foundation has been laid for blended and fully online learning methodologies to flourish in Indonesia’s academic system. The synergy between public sector policies and private sector innovation continues to shape a digitally inclusive education landscape, directly influencing Indonesia online education market growth in the long term

To get more information on this market Request Sample

Increasing Demand for Workforce-Oriented Online Courses

Indonesia’s dynamic workforce is generating substantial demand for online education platforms offering practical, employment-driven learning programs. The country’s evolving job market emphasizes skill sets in areas such as IT, entrepreneurship, finance, and language proficiency, particularly English. As a result, young professionals and jobseekers increasingly utilize e-learning platforms offering certifications, short courses, and vocational training tailored to industry demands. Companies across sectors have also adopted corporate e-learning solutions to upskill employees while optimizing training costs. Platforms offering recognized micro-credentials in partnership with universities or global educational providers have gained strong traction, creating new pathways for professional development. Additionally, digital learning formats offer flexibility to those balancing employment with continued education, further driving enrollments. These professional courses support Indonesia’s broader employment and productivity goals, contributing significantly to the country’s long-term economic strategies. This alignment between market demand and academic supply has firmly positioned online education as a mainstream mode of acquiring workforce-ready qualifications across Indonesia.

Growing Use of Mobile-Based Learning Platforms

The proliferation of affordable smartphones and improved internet connectivity across Indonesia is significantly shaping the expansion of mobile-based online learning platforms. With a young, tech-savvy population increasingly reliant on mobile devices for information access, education providers have tailored offerings specifically for mobile delivery. Language learning apps, test preparation platforms, and skill-based micro-courses are widely accessed through smartphones, offering convenience and immediacy for learners nationwide. Key players in the edtech sector have designed gamified content, bite-sized lessons, and adaptive quizzes optimized for mobile interfaces, increasing user engagement rates. Furthermore, strategic collaborations between telecom operators and educational institutions have resulted in subsidized data packages dedicated to accessing learning resources. This democratization of mobile-based education is instrumental in expanding learning access beyond major urban centers to remote and underserved regions. By combining technological accessibility with relevant educational content, mobile-first approaches have established themselves as pivotal drivers of the digital education transformation in Indonesia’s academic and vocational sectors.

Indonesia Online Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, provider, technology, and end-user.

Type Insights:

- Academic

- Higher Education

- Vocational Training

- K-12 Education

- Corporate

- Large Enterprises

- SMBs

- Government

The report has provided a detailed breakup and analysis of the market based on the type. This includes academic (higher education, vocational training, and K-12 education), corporate (large enterprises and SMBs), and government.

Provider Insights:

- Content

- Services

The report has provided a detailed breakup and analysis of the market based on the provider. This includes content and services.

Technology Insights:

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes mobile e-learning, rapid e-learning, virtual classroom, and others.

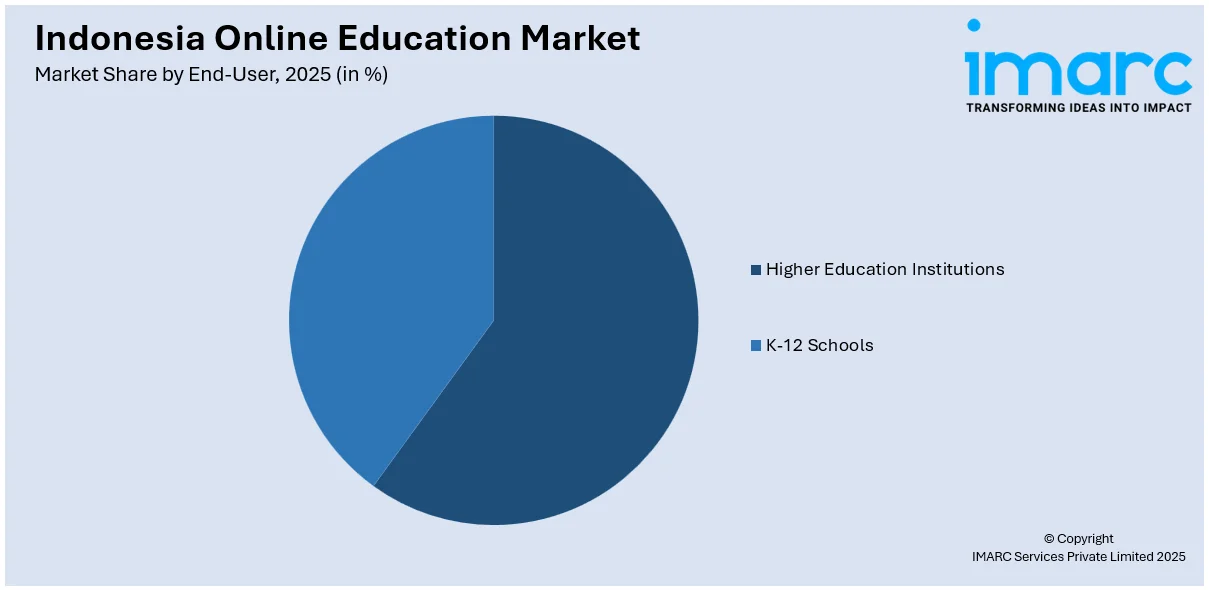

End-User Insights:

Access the comprehensive market breakdown Request Sample

- Higher Education Institutions

- K-12 Schools

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes higher education institutions and K-12 schools.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Online Education Market News:

-

On August 5, 2024, Pearson announced a landmark partnership with Indonesia’s Ministry of Education to advance English language proficiency across all schools by 2027. The initiative will provide fully online and AI-assisted training and assessment for more than 180,000 English teachers nationwide, improving accessibility for educators across Indonesia’s 17,000+ islands. This project significantly accelerates the Indonesia online education market.

Indonesia Online Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Providers Covered | Content, Services |

| Technologies Covered | Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| End-Users Covered | Higher Education Institutions, K-12 Schools |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia online education market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia online education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia online education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Indonesia online education market was valued at USD 1,423.1 Million in 2025.

The Indonesia online education market is projected to exhibit a CAGR of 23.28% during 2026-2034, reaching a value of USD 9,356.6 Million by 2034.

The Indonesia online education market is driven by rising internet and smartphone penetration, government digital learning initiatives, and increasing demand for flexible, skill-based courses. Growing awareness of lifelong learning and professional development, especially among youth and working professionals, further fuels adoption, expanding access to quality education across urban and rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)