Indonesia Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2025-2033

Indonesia Online Travel Market Overview:

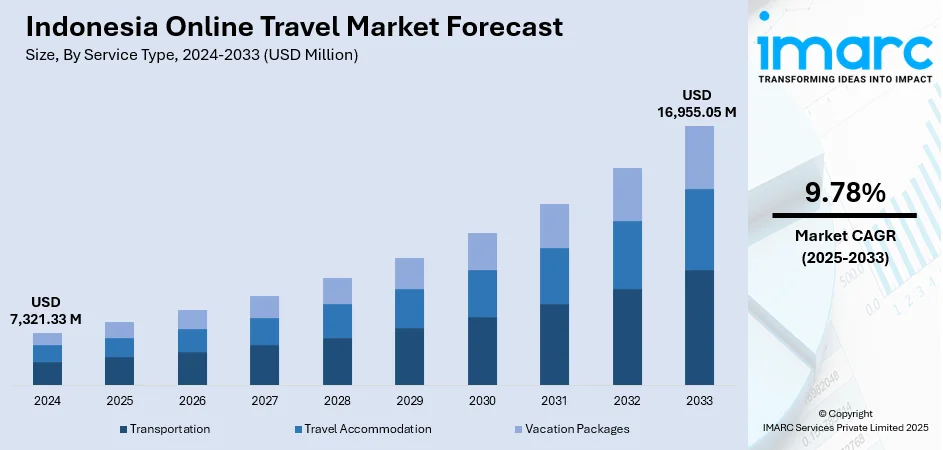

The Indonesia online travel market size reached USD 7,321.33 Million in 2024. The market is projected to reach USD 16,955.05 Million by 2033, exhibiting a growth rate (CAGR) of 9.78% during 2025-2033. The market is experiencing strong growth, fueled by rising digital adoption, a mobile-first consumer base, and growing demand for frictionless travel experiences. Major services including flight tickets, hotels, and holiday packages are becoming more popular through online media. Urban dwellers and young tourists are driving this online growth, which is being supported by better payments infrastructure and advertising campaigns. These trends pinpoint the increasing opportunities and competitive environment that are defining the Indonesia online travel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7,321.33 Million |

| Market Forecast in 2033 | USD 16,955.05 Million |

| Market Growth Rate 2025-2033 | 9.78% |

Indonesia Online Travel Market Trends:

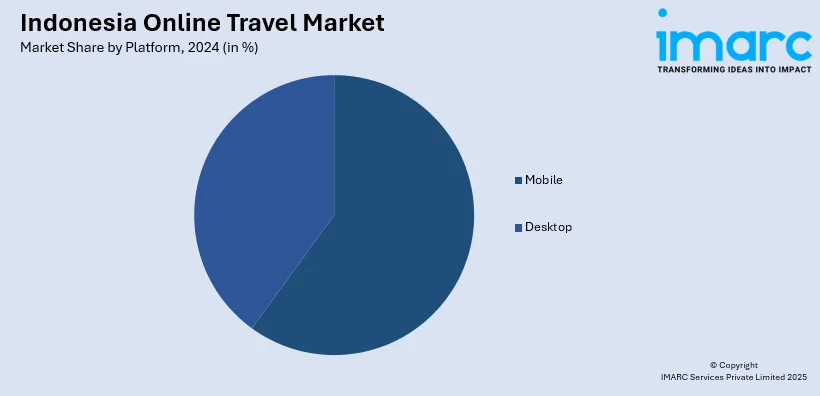

Mobile Adoption Reshaping Travel Bookings

A dramatic shift toward mobile-first travel booking is underway in Indonesia. In 2025, a YouGov study revealed that over half of Indonesian travelers find the booking process stressful, highlighting the growing need for seamless mobile experiences. In response, travel platforms are upgrading their mobile interfaces with AI-powered assistants, voice search, and one-click payment features to boost user satisfaction and loyalty. These digital solutions address key pain points, providing instant confirmation and proactive updates to ease consumer anxiety. This shift is supported by Indonesia’s growing digital infrastructure and increased smartphone penetration, enabling more users across urban and rural regions to book travel through mobile apps. Mobile convenience has also enabled spontaneous travel planning and encouraged last-minute getaways, which are becoming more popular among younger demographics. Platforms that adapt quickly are now prioritizing a streamlined interface, minimal input steps, and instant verification features. As Indonesia seeks to outperform in a competitive regional context by 2025, mobile-first evolution is no longer a nice-to-have, it defines service quality. Mobile innovation will shape future success in the Indonesia online travel market trends.

To get more information on this market, Request Sample

Personalization Driving User Engagement

In Indonesia, personalization is rapidly becoming a cornerstone of online travel experiences. Travel platforms are now analyzing browsing behaviors, past bookings, and traveler preferences to offer tailored itineraries, dynamic packaging, and localized recommendations. Machine learning tools are being applied to detect user intent and match it with curated activities, such as culinary tours or wellness retreats. These personalized experiences help users feel understood and supported during the booking process, while also improving the likelihood of successful conversions. By 2025, the adoption of AI-supported digital infrastructure by tourism operators is expected to increase substantially, reflecting government and industry priorities. As digital literacy rises and consumer expectations evolve, travelers are demanding more relevant suggestions, less time-consuming searches, and more flexibility. Personalized content also supports upselling opportunities through well-timed offers based on user behavior. From suggesting off-the-beaten-path stays to recognizing dietary preferences, platforms that leverage personalization will lead in customer engagement. This growing focus on tailored service, backed by data-driven technology, significantly bolsters Indonesia online travel market growth.

Sustainable Travel Influencing Consumer Demand

Indonesian travelers increasingly seek authentic, immersive, and sustainable travel experiences. Domestic destinations such as Bali, Yogyakarta, and emerging regions across Sulawesi, Kalimantan, and Papua are gaining popularity as providers offer cultural, adventure-based, and eco-sensitive packages. Travelers are gravitating toward unique interactions with nature, heritage, and local communities. The government’s promotion of “tourism villages” and special economic zones further emphasizes responsible regional development, with notable recognition in 2024 and expanded focus in 2025. These efforts support not only environmental preservation but also inclusive growth by empowering small businesses and local artisans. In line with this shift, travel platforms are integrating sustainability filters, carbon-offset options, and virtual tour previews to guide travelers toward informed choices. They are also promoting low-impact travel styles and transparency in sustainability practices. As global travel norms change, Indonesian consumers are aligning their leisure choices with environmental and social responsibility. These experiential packages support equitable growth, uplift local communities, and align with long-term environmental priorities.

Indonesia Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, platform, mode of booking, and age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs) and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-31 years, 32-43 years, 44-56 years, and above 56 years.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Online Travel Market News:

- May 2025: Indonesia has renewed its strategic partnership with Agoda to promote international and domestic tourism. The partnership targets the promotion of sustainable travel practices, the promotion of digital growth in Indonesia's tourism industry, and using Agoda's advanced technology to make travel better. The partnership also involves empowering local tourism professionals through training in digital skills and the rollout of innovative marketing campaigns. Through ongoing promotion of the "Wonderful Indonesia" campaign, the partnership seeks to establish Indonesia as a prime eco-tourism destination while exploring new markets around the globe.

- August 2024: Tiket.com, one of Indonesia's leading online travel agencies, has deepened its relationship with Amadeus to further leverage its travel technology. The agreement brings forward-looking airline content, such as NDC products, onto Amadeus' Travel Platform. Tiket.com will gain from AI-enhanced capabilities, powerful APIs, and biometric solutions to deliver more personalized and streamlined travel experiences. This strategic partnership further consolidates Tiket.com as the online travel market leader in Indonesia's highly competitive online travel scene.

Indonesia Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia online travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia online travel market on the basis of service type?

- What is the breakup of the Indonesia online travel market on the basis of platform?

- What is the breakup of the Indonesia online travel market on the basis of mode of booking?

- What is the breakup of the Indonesia online travel market on the basis of age group?

- What is the breakup of the Indonesia online travel market on the basis of the region?

- What are the various stages in the value chain of the Indonesia online travel market?

- What are the key driving factors and challenges in the Indonesia online travel market?

- What is the structure of the Indonesia online travel market and who are the key players?

- What is the degree of competition in the Indonesia online travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia online travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia online travel market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)