Indonesia Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2026-2034

Indonesia Steel Market Overview:

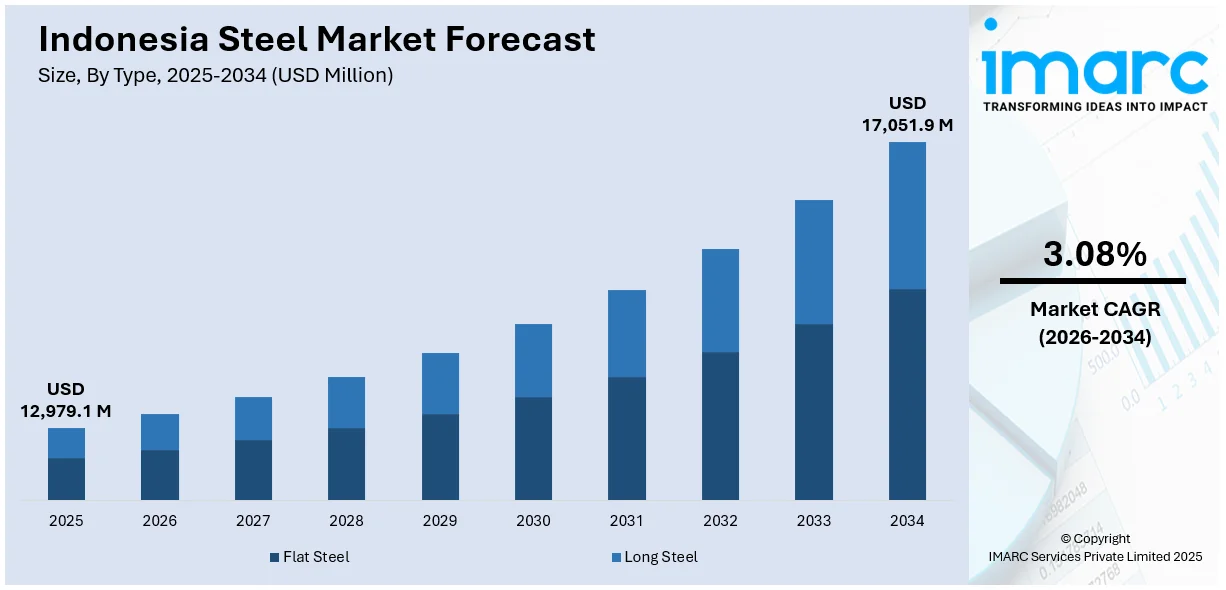

The Indonesia steel market size reached USD 12,979.1 Million in 2025. The market is projected to reach USD 17,051.9 Million by 2034, exhibiting a growth rate (CAGR) of 3.08% during 2026-2034. The market is driven by rapid infrastructure development, fueled by government projects like Nusantara and ongoing urbanization. The growing automotive and manufacturing industries increase demand for quality steel in vehicles, machinery, and construction. Additionally, government policies promoting import substitution, local content requirements, and investment incentives support domestic steel production. Moreover, strong construction demand, industrial growth, and favorable regulations are transforming Indonesia into a key regional steel hub, enhancing self-sufficiency and attracting both local and foreign investment is aiding the Indonesia steel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 12,979.1 Million |

| Market Forecast in 2034 | USD 17,051.9 Million |

| Market Growth Rate 2026-2034 | 3.08% |

Indonesia Steel Market Trends:

Infrastructure Development and Urbanization

Indonesia's fast urbanization and large infrastructure drive are among the primary drivers of steel consumption. The government's "National Strategic Projects" and construction of the new capital, Nusantara, necessitate huge amounts of steel for bridges, roads, ports, railways, and skyscrapers. Importantly, Nusantara's initial construction phase alone would use 0.5–0.7 million tonnes of steel, with approximately 1 million tonnes for every following phase. Expanding urbanization also fuels demand for residential and commercial building, fueling long and flat steel product consumption. Public expenditure, private investment, and large doses of foreign direct investment by countries such as China and Japan finance the infrastructure outlays. Such projects guarantee consistent, long-term demand for steel, bolstering local production as well as imports. Moreover, the growth of the middle class puts pressure on housing and transport markets, hence infrastructure and urban development sustaining Indonesia's steel market growth.

To get more information of this market Request Sample

Automotive and Manufacturing Industry Growth

Indonesia’s automotive and manufacturing sectors are pivotal in driving steel consumption. As the largest car market in Southeast Asia, Indonesia’s demand for automotive-grade steel has surged alongside rising vehicle ownership. The government's focus on becoming a regional automotive manufacturing hub, supported by incentives for electric vehicle (EV) production and local content requirements, has prompted increased investment in domestic manufacturing. Steel is essential for car bodies, engines, and components, driving demand for high-quality flat products. Additionally, the broader manufacturing sector, including machinery, electronics, and consumer goods, requires various steel forms for production and packaging. Growth in these sectors also boosts demand for value-added and specialty steels, stimulating technological upgrades in domestic steel production. As supply chains localize and industrialization expands beyond Java, regional steel demand is becoming more diversified and robust, ensuring sustained consumption within the manufacturing ecosystem.

Government Policy and Import Substitution

Government policy plays a central role in shaping Indonesia’s steel market trends. Through measures like import restrictions, anti-dumping duties, and local content mandates, the government aims to promote domestic production and reduce reliance on imported steel. Initiatives under “Making Indonesia 4.0” support industrial self-sufficiency and encourage technological advancements in steel manufacturing. The development of domestic steel giants, such as Krakatau Steel, is backed by state investment and restructuring efforts to enhance competitiveness. Policies encouraging foreign partnerships and investment in smelters and processing plants (especially for nickel and stainless steel) have created a stronger upstream supply chain. These strategies aim to support local production, stabilize prices, and ensure supply security. By fostering a favorable regulatory environment and protecting the local industry, government policy acts as a key driver for market growth, import substitution, and the development of an integrated, resilient steel sector.

Indonesia Steel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, product, and application.

Type Insights:

- Flat Steel

- Long Steel

The report has provided a detailed breakup and analysis of the market based on the type. This includes flat steel and long steel.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes structural steel, prestressing steel, bright steel, welding wire and rod, iron steel wire, ropes, and braids.

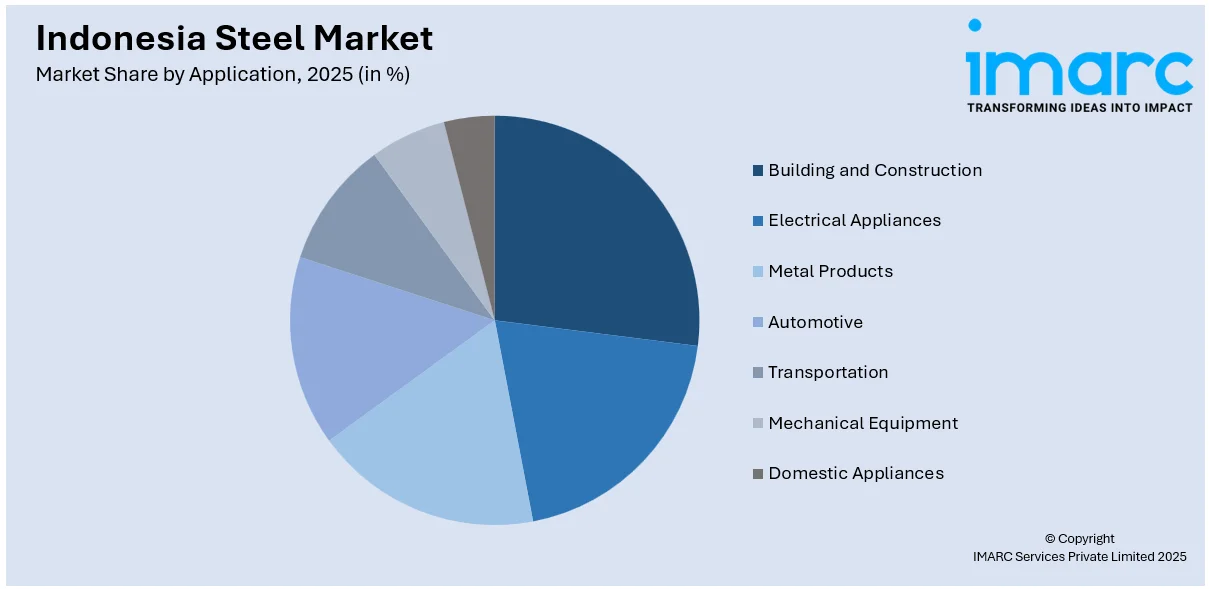

Application Insights:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The report has provided a detailed breakup and analysis of the market based on the application. This includes building and construction, electrical appliances, metal products, automotive, transportation, mechanical equipment, and domestic appliances.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Steel Market News:

- In August 2024, Jindal Stainless commissioned its Nickel Pig Iron (NPI) smelter in Indonesia’s Halmahera Islands, eight months ahead of schedule. Developed through a joint venture with New Yaking Pte. Ltd., the project secures a long-term nickel supply for stainless steel production. With a 49% equity stake worth USD 157 million, Jindal aims to reduce exposure to volatile global nickel prices and ensure raw material stability outside India, which lacks domestic nickel resources.

- In August 2024, Indonesia plans to launch its own Metal Exchange for nickel trading in 2025 to strengthen price control and reduce reliance on China. The initiative, led by the Indonesian Nickel Miners Association (APNI), aims to establish Indonesia as a price-setting authority in the global nickel market. APNI’s General Secretary, Meidy Katrin Lengkey, stated that controlling domestic nickel prices is essential, as the country holds one of the world’s largest nickel reserves, vital for battery and EV industries.

- In July 2024, Indonesia launched an online tracking system, SIMBARA, to monitor the movement of nickel and tin from mines to local processing plants, aiming to boost transparency and government revenue. Initially introduced in 2022 for coal, SIMBARA is now expanded to cover other key minerals. Authorities expect this system to improve resource accountability, curb illegal mining activities, and strengthen control over the country’s critical mineral supply chain, essential for industries like stainless steel and electric vehicles.

Indonesia Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia steel market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia steel market on the basis of type?

- What is the breakup of the Indonesia steel market on the basis of product?

- What is the breakup of the Indonesia steel market on the basis of application?

- What is the breakup of the Indonesia steel market on the basis of region?

- What are the various stages in the value chain of the Indonesia steel market?

- What are the key driving factors and challenges in the Indonesia steel market?

- What is the structure of the Indonesia steel market and who are the key players?

- What is the degree of competition in the Indonesia steel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia steel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia steel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia steel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)