Industrial Catalyst Market Size, Share, Trends and Forecast by Type, Raw Material, Application, and Region, 2025-2033

Industrial Catalyst Market Size and Share:

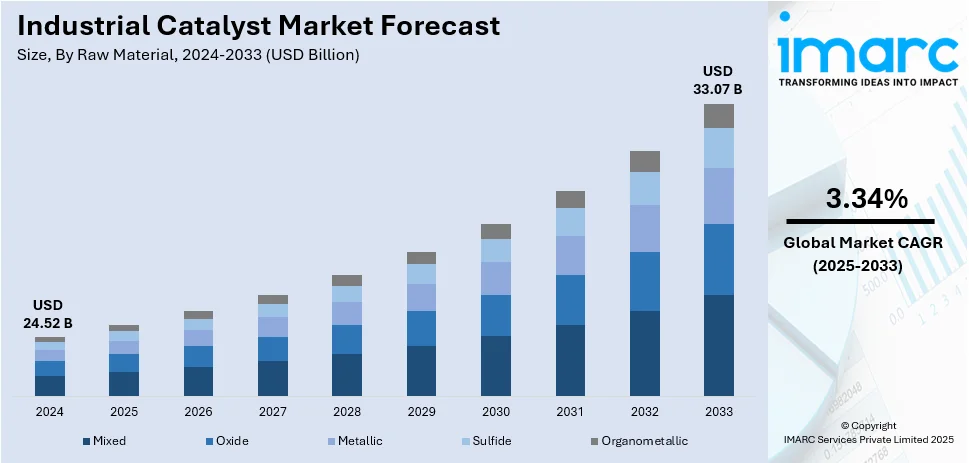

The global industrial catalyst market size reached USD 24.52 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 33.07 Billion by 2033, exhibiting a growth rate (CAGR) of 3.34% during 2025-2033. Asia Pacific currently dominates the market with a significant market share of 36.3% in 2024. The expanding petrochemical industries, ongoing technological advancements, and the shift towards renewable energy are primarily driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 24.52 Billion |

|

Market Forecast in 2033

|

USD 33.07 Billion |

| Market Growth Rate (2025-2033) | 3.34% |

The global market is majorly driven by the increasing demand within the petrochemical sector due to the rising production of polymers and synthetic materials used in industrial applications. For instance, as per an article by Zero Carbon Analytics, the global petrochemical industry is growing rapidly through increasing demand for plastics, fertilizers, and other petrochemical products especially in Asia. This sector happens to form a significant fraction of greenhouse gas emissions; plastics have dominated the global output. Reducing such impacts demands a reduction of single-use plastics and improvement strategies in recycling. Additionally, the increase in the usage of catalysts in the refining processes, such as hydrocracking and catalytic reforming, is allowing the market to expand further. Moreover, increasing activity to improve fuel efficiency and meet strict environmental regulations are encouraging the adoption of environment-friendly catalysts, which will further propel the growth in the market. Furthermore, growth in industrial activities, mainly in developing nations, which is increasing catalyst consumption in the chemical industry, is propelling the market. Besides, increasing investments in clean energy projects such as hydrogen production and carbon capture technologies are presenting huge business opportunities for the market.

The U.S. industrial catalyst market is driven by the nation's advanced manufacturing sector and strong focus on innovation in catalyst technologies. Significant investment in research and development (R&D) activities by private industries and federal agencies promotes breakthroughs in catalyst efficiency and longevity. The United States' leadership in high-value chemical production, such as pharmaceuticals and specialty chemicals, generates consistent demand for cutting-edge catalysts. Additionally, the country's well-established infrastructure for clean energy and decarbonization projects, such as biofuel production and emissions control, enhances the adoption of novel catalytic solutions. Collaboration between universities, research institutions, and industries further bolsters the market’s growth course.

Industrial Catalyst Market Trends:

Growing Petrochemical Industry

The growing petrochemical industry is a major driving force behind the expansion of the market. For instance, according to IMARC, the global petrochemicals market size reached USD 616.0 Billion in 2023. Looking forward, IMARC Group expects the market to reach USD 949.9 Billion by 2032, exhibiting a growth rate (CAGR) of 4.8% during 2024-2032. Industrial catalysts are crucial in petrochemical processes as they accelerate chemical reactions, improve efficiency, and ensure higher yields of desired products. This is escalating the industrial catalyst market demand.

Expanding Renewable Energy Sector

The growing consumption of renewable energy is a significant driver of growth in the market. For instance, according to the International Energy Agency (IEA), as part of the Net Zero Emissions Scenario 2021-2050, hydrogen and hydrogen-based fuels could avoid up to 60 gigatonnes of CO2 emissions, equivalent to 6% of total cumulative emissions reductions. As per the industrial catalyst market analysis report, this is acting as a significant growth-inducing factor. As per the industrial catalyst market analysis report, this is acting as a significant growth-inducing factor.

Environmental Regulations

Governments across various regions are setting goals to reduce greenhouse gas emissions, particularly in industries such as power generation, refining, and manufacturing. For instance, the regulatory authority of Japan has implemented energy policies aiming at achieving carbon neutrality, or net-zero greenhouse gas (GHG) emissions, by 2050 through emissions reductions in the electric generation, industrial, and transportation sectors. Industrial catalysts are essential in processes like catalytic combustion and selective catalytic reduction (SCR), which help in reducing harmful emissions, including nitrogen oxides (NOx) and carbon dioxide (CO₂).

Industrial Catalyst Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the industrial catalyst market forecast at the global and regional levels from 2025-2033. Our report has categorized the market based on type, raw material, and application.

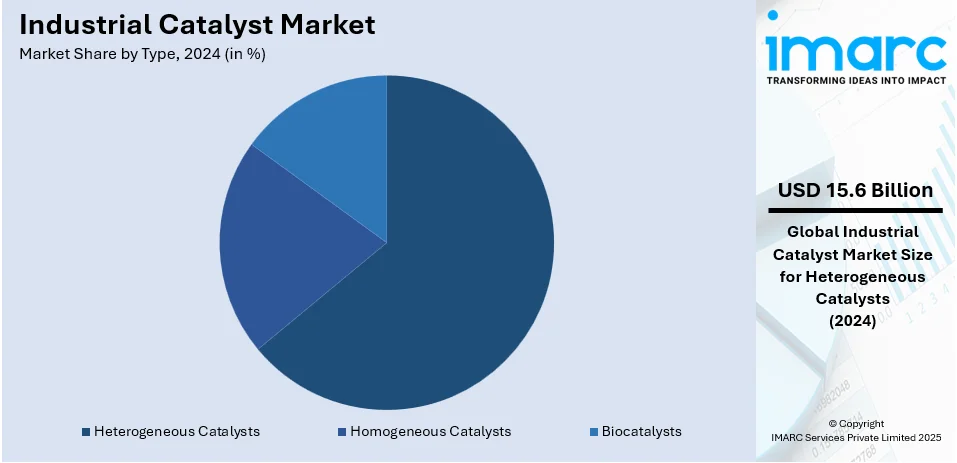

Analysis by Type:

- Heterogeneous Catalysts

- Homogeneous Catalysts

- Biocatalysts

Heterogeneous catalysts lead the market with around 63.8% of market share in 2024. According to the industrial catalyst market outlook, heterogeneous industrial catalysts are vital in numerous industrial processes because of their ability to speed up reactions while remaining in a different phase than the reactants (typically solids interacting with gases or liquids). Moreover, they are extensively used in the petrochemical and refining sectors, particularly in processes, such as cracking, reforming, hydrodesulfurization, and hydrotreating.

Analysis by Raw Material:

- Mixed

- Oxide

- Metallic

- Sulfide

- Organometallic

Mixed leads the market in 2024. According to the industrial catalyst market forecast report, mixed catalysts can involve combinations of metallic, oxide, or other types tailored for specific industrial reactions. The demand for chemicals, such as ammonia (for fertilizers) and methanol, is a major driver, particularly in agricultural and petrochemical industries. Moreover, mixed catalysts are also used in renewable energy processes, such as biomass conversion and green ammonia production, contributing to demand growth. Besides this, as industries seek to optimize gas processing and reduce carbon emissions, mixed catalysts find applications in syngas production, carbon capture, and gas purification.

Analysis by Application:

- Petroleum Refinery

- Chemical Synthesis

- Petrochemicals

- Others

Petroleum refinery leads the market in 2024. According to the industrial catalyst market outlook report, the extensive use of catalysts in refining processes, combined with the global dependence on petroleum products, has made refineries a key driver of catalyst demand. Moreover, catalysts are essential in transforming crude oil into valuable products like gasoline, diesel, jet fuel, and other petrochemical feedstocks. Furthermore, increasingly stringent environmental regulations on fuel emissions have driven demand for advanced catalysts that enable refineries to produce low-sulfur fuels and reduce harmful emissions.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

Asia Pacific is the leading region in 2024 with a share of around 36.3%. According to the industrial catalyst market share, Asia Pacific countries are undergoing rapid industrialization, which is fueling demand for energy, chemicals, and manufactured goods. Moreover, the region is home to several of the world's largest and most modern refineries, particularly in China, India, South Korea, and Japan. The region's refining capacity is expanding to meet rising fuel demand both domestically and for export. This growth drives the demand for catalysts used in refining processes like fluid catalytic cracking (FCC), hydrotreating, and hydrocracking. Countries in Asia Pacific are increasingly adopting environmental regulations to combat air pollution. For instance, in September 2024, the government of the Jakarta, Indonesia, planned to deliver low-sulfur fuel without raising fuel prices, giving the public access to better quality and cleaner fuel.

Key Regional Takeaways:

United States Industrial Catalyst Market Analysis

In 2024, the United States accounted for 83.70% of North America industrial catalyst market. The market for industrial catalysts in the US is driven by advancements in energy production, chemical production, and stringent environmental regulations. As per the data by American Fuel and Petrochemical Manufacturers, the nation is a leader among the world's producers of chemicals, and the industry adds more than USD 820 Billion annually to the economy. Industrial catalysts are used in refineries and petrochemical plants to run cracking, polymerisation, and reforming.

The U.S. refining industry relies on catalysts basically to raise efficiency and supply the stringently required level of fuels. With crude oil processed at more than 18 Million barrels daily by the data of the Energy Information Administration of the U.S. To offer relatively cleaner fuels, hydrocracking as well as fluid catalytic cracking (FCC) catalysts are in extreme demand by virtue of policies such as Tier 3 fuel standards, limiting the sulphur levels in fuel.

Moreover, demand for catalysts in the production of biofuel is on a rise as the focus on sustainability and renewable energy is at a peak. For instance, over 1.8 Billion gallons of biodiesel are produced annually, and such biodiesel requires specific catalysts, according to the data by USDA Economic Research Service. Catalysts play a vital role in the manufacture of hydrogen through steam methane reforming, and the U.S. hydrogen market is on the rise owing to clean energy programs.

Europe Industrial Catalyst Market Analysis

Strict environmental laws, a strong emphasis on sustainability, and advancements in the creation of green energy are driving the industrial catalyst market in Europe. The European Union's Green Deal, which aims for carbon neutrality by 2050, is expected to significantly boost the demand for catalysts in emission control applications. For instance, car catalytic converters, that need to meet Euro 6 and Euro 7 pollution standards, rely heavily on catalysts.

Catalytic processes like polymerization and refining are significant to the region's chemical industry. According to the European Committee for Standardisation, around 13.5% of the world's chemical manufacturing comes from Europe. Chemicals represent about 7.5% of all EU manufacturing in terms of turnover. This investment has seen Germany, France, and the UK make huge commitments to hydrogen production, leading Europe to become a continent of first choice in terms of renewable energy use. Europe aims at producing 10 Million tonnes of renewable hydrogen annually by 2030, a task that demands catalysts in processes like electrolysis of water and in production of fuel cells.

Asia Pacific Industrial Catalyst Market Analysis

Asia-Pacific has become the world's largest consumer of industrial catalysts due to rapid industrialization, a booming chemical industry, and energy demands. According to Oil and Gas Journal data, more than 40% of the world's petrochemical production occurs in this region, led by the refinery expansions of China and India. Refining capacity for China stands at over 18 million barrels per day, and FCC units and catalysts are indispensable for hydro processing, according to industry reports. The increasing demand for polymers and plastics in building and industrial propels the utilization of polymerisation catalysts.

Green catalysts also increasingly gain popularity because of renewable energy projects by Asia-Pacific, especially on hydrogen and biofuels. In this regard, Japan, for instance, aims to up the production of hydrogen under the Green Growth Strategy that focuses on high technology catalytic processes. Environmental regulations in countries such as Singapore and South Korea are also promoting the use of catalysts in reducing emissions and cleaner fuel production.

Latin America Industrial Catalyst Market Analysis

The growth of the Latin American industrial catalyst market is mainly driven by the developing oil and gas industry and the expanding chemical manufacturing sector. Brazil and Mexico have the largest economies and the most refining capacity in the region; the Brazilian National Agency of Petroleum, Natural Gas and Biofuels (ANP) reports that average oil and gas production in Brazil hit record highs in 2023. Crude oil production increased by almost 13% to over 3.4 Million Bareels/Day, and natural gas production increased by 8.7%. Catalysts play an important role in hydrocracking and desulfurization in these refineries. The region's agrochemical industry also plays a big role, given that Brazil is the biggest fertiliser exporter. The synthesis of methanol and ammonia, which are building blocks for fertilisers, depends heavily on catalysts. The increased interest in biofuels in Latin America, especially Brazil's ethanol production, further fuels the need for certain catalysts.

Middle East and Africa Industrial Catalyst Market Analysis

The dominance of the oil and gas industry along with downstream operations is boosting the industrial catalyst market in the Middle East and Africa. According to an industrial report, nearly 24% of crude oil worldwide is produced in the GCC region, and countries such as Saudi Arabia and the United Arab Emirates have invested in sophisticated refining facilities. Catalysts are important for the improvement of fuel quality and the efficiency of refining. The region's petrochemical sector is expanding as well, particularly in Saudi Arabia, which produced 9.5 million barrels of crude oil per day in 2023—a 9% drop from 10.4 million barrels per day in 2022, as per an industry report. The need for catalysts in cleaner fuel production and emission control technologies is also being driven by rising environmental consciousness.

Competitive Landscape:

The global industrial catalyst market exhibits a highly competitive landscape characterized by numerous players focusing on innovation and sustainability. Key trends include rising investments in advanced catalytic technologies and the development of eco-friendly solutions to meet stringent environmental regulations. Companies are leveraging strategic partnerships, expanding production capacities, and exploring niche applications to strengthen their market presence. The growing emphasis on efficient energy utilization and performance optimization is driving the development of specialized catalysts tailored to diverse industrial processes, fostering intense competition and innovation in the market.

The report provides a comprehensive analysis of the competitive landscape in the industrial catalyst market with detailed profiles of all major companies, including:

- Albemarle Corporation

- Arkema S.A.

- BASF Corporation

- Clariant Ag

- Evonik Industries Ag

- Exxon Mobil Chemical Co

- Akzo Nobel N.V.

- Chevron Phillips Chemical Company

- The DOW Chemical Company

Recent Developments:

- August 2024: Catalyst Power Holdings LLC, an independent provider specializing in retail electricity and cleaner energy solutions for commercial and industrial markets, launched retail electricity services in Maryland.

- August 2024: BASF Catalysts India (BCIL), the Indian subsidiary of BASF Environmental Catalyst and Metal Solutions (BASF ECMS), established a new Research, Development, and Application (RD&A) laboratory at Mahindra World City, Chennai, Tamil Nadu.

- March 2024: Evonik introduced Octamax, a catalyst that improves sulfur removal in refinery fuels and promotes industry sustainability.

Industrial Catalyst Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Heterogeneous Catalysts, Homogeneous Catalysts, Biocatalysts |

| Raw Materials Covered | Mixed, Oxide, Metallic, Sulfide, Organometallic |

| Applications Covered | Petroleum Refinery, Chemical Synthesis, Petrochemicals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Albemarle Corporation, Arkema S.A., BASF Corporation, Clariant AG, Evonik Industries AG, Exxon Mobil Chemical Corporation, Akzo Nobel N.V., Chevron Phillips Chemical Company, The DOW Chemical Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, industrial catalyst market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global industrial catalyst market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial catalyst industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Industrial catalyst is a substance that speed up chemical reactions without undergoing permanent changes themselves. It is extensively used in various sectors such as petrochemical, chemical synthesis, and refining, helping industries improve efficiency, reduce emissions, and meet environmental standards.

The industrial catalyst market was valued at USD 24.52 Billion in 2024.

IMARC estimates the global industrial catalyst market to exhibit a CAGR of 3.34% during 2025-2033.

The market is majorly driven by rapid industrialization, stringent environmental regulations for reducing emissions, and technological advancements leading to more efficient and durable catalysts. The expanding manufacturing and petrochemical sectors further provide a boost to the market demand.

In 2024, heterogeneous catalysts represented the largest segment by type, driven by their widespread application in refining and chemical processes.

Mixed segment is leading the market by material due to their extensive use in various chemical manufacturing processes.

The petroleum refinery segment is the leading segment by application, driven by the high demand for catalysts in chemical production processes.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the global industrial catalyst market include Albemarle Corporation, Arkema S.A., BASF SE, Clariant AG, Evonik Industries AG, Exxon Mobil Chemical Co, Akzo Nobel N.V., Chevron Phillips Chemical Company, and The DOW Chemical Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)