Industrial Computed Tomography Market Size, Share, Trends, and Forecast by Offering, Application, End Use Industry, and Region, 2025-2033

Industrial Computed Tomography Market Size and Share:

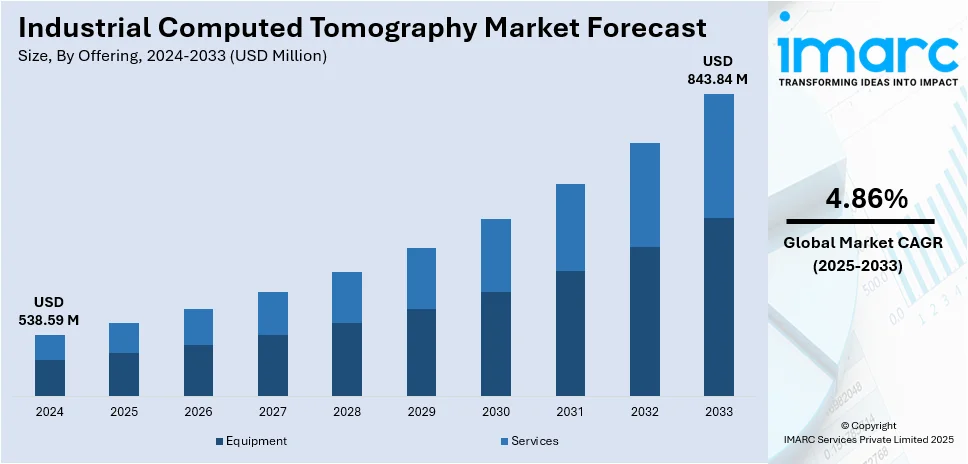

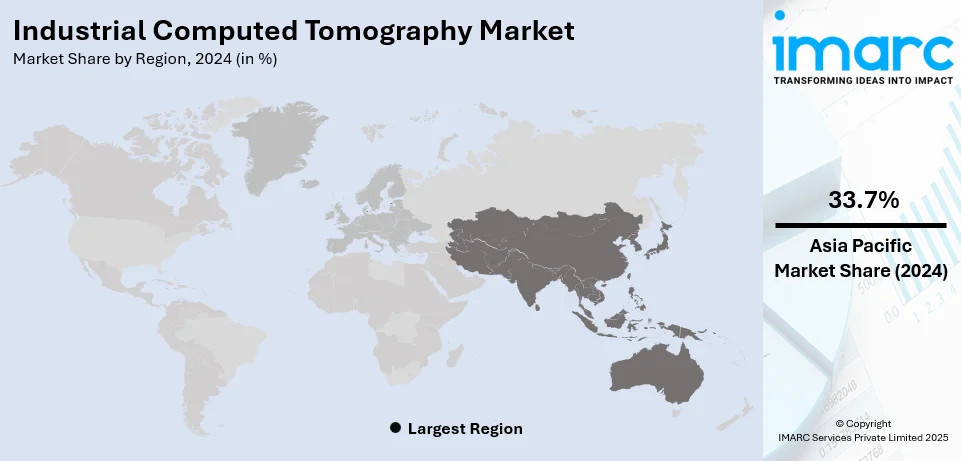

The global industrial computed tomography market size was valued at USD 538.59 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 843.84 Million by 2033, exhibiting a CAGR of 4.86% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 33.7% in 2024. The market is experiencing growth due to the rising demand for non-destructive testing (NDT) in manufacturing. Advancements in CT technology including enhanced resolution and 3D imaging capabilities are further increasing the overall industrial computed tomography market share across the globe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 538.59 Million |

| Market Forecast in 2033 | USD 843.84 Million |

| Market Growth Rate (2025-2033) | 4.86% |

Industrial Computed Tomography (CT) is driven by an increasing demand for accurate and non-destructive testing solutions in aerospace, automotive and electronics. Improvements in CT technology in terms of resolution imaging and speed of scanning improve the accuracy and efficiency of inspections. The growing focus on quality control, product innovation and compliance with stringent regulatory standards is further boosting adoption. For instance, in April 2023, Nikon Corporation launched the "VOXLS 40 C 450" a large-volume X-ray and CT system for non-destructive inspection of various components including automotive and aerospace parts. Developed collaboratively with Avonix Imaging it features the industry's largest imaging area and aims to enhance manufacturing innovation for diverse applications. Expanding application of industrial CT in additive manufacturing and reverse engineering is further supporting the growth of the market.

To get more information on this market, Request Sample

The United States industrial computed tomography (CT) market is driven by the growing emphasis on advanced non-destructive testing (NDT) solutions for quality control across sectors like aerospace, automotive and healthcare. Increasing adoption of CT technology for detailed internal inspection, reverse engineering and additive manufacturing enhances its market appeal. Stringent regulatory standards and the need for precise defect detection further propel industrial computed tomography market demand. Advancements in CT imaging technology and government investments in industrial innovation are also key contributors to the growth of the market in the United States. For instance, in December 2024, Philips launched its CT 5300 system in the US at RSNA 2024 featuring innovative AI-driven workflows that enhance diagnostic confidence and efficiency. Collaborating with Annalise.ai Philips aims to improve triage support for time-sensitive cases optimizing emergency department operations and addressing the shortage of skilled radiologists.

Industrial Computed Tomography Market Trends

Growing Demand for Non-Destructive Testing

The increasing demand for non-destructive testing (NDT) is highly driving the adoption of industrial CT scanning. NDT techniques allow industries to inspect internal structures, components, and assemblies without causing damage ensuring that the integrity of the product remains intact. Industrial CT scanning is particularly valuable in sectors like aerospace, automotive and electronics where precision and safety are critical. It is used to detect defects, porosities, and material inconsistencies in complex parts such as turbine blades, battery packs or microchips. The capability of delivering detailed 3D imaging and cross-sectional views helps in quality control and supports the requirement of high standards in the industry. Failures are reduced and reliability is ensured. This trend is further underscored by strategic acquisitions in the industry to strengthen NDT capabilities and expand market reach. For instance, in February 2024, Pinnacle X-Ray Solutions announced the acquisition of Willick Engineering, a market leader dealing with NDT X-ray equipment serving military, aerospace and medical sectors. The deal enhances Pinnacle's product offerings and customer service capabilities on the West Coast supporting future growth and strategic initiatives as stated by executives from both companies.

Advancements in Imaging Technologies

High-resolution detectors and faster scanning techniques are revolutionizing the industrial CT market with advancements in imaging technology, thereby contributing to the industrial computed tomography market growth. For instance, in October 2024, Lumafield announced the launch of Ultra-Fast CT technology reducing scan times by 99% enabling scans in a tenth of a second. This advancement could enhance quality control in industries like additive manufacturing. Their subscription model and accompanying software Voyager aim to streamline inspections although data security concerns may hinder adoption for critical parts. This allows for precise visualization of complex internal structures with exceptional clarity and accuracy even in highly dense or intricate materials. High-resolution detectors improve image quality to the extent that micro-defects, voids, and structural anomalies are detected that previously were not visible. Faster scanning techniques reduce inspection time thereby improving operational efficiency and throughput. Aerospace, automotive and electronics industries are increasingly adopting these advancements for applications like material analysis, quality assurance and reverse engineering ensuring better product performance and compliance with stringent standards. These industrial computed tomography market trends are contributing significantly to create positive industrial computed tomography market outlook.

Growing Adoption of AI and ML

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing industrial CT imaging systems. AI algorithms are capable of high-precision automated defect detection thereby reducing manual analysis and minimizing the possibility of errors. ML models learn and improve continuously from vast datasets thereby optimizing imaging processes and increasing accuracy in the identification of anomalies. For instance, in January 2025, Heitec announced the integration of in-line CT scanning with robotics at BMW's Landshut facility to ensure quality checks for electric vehicle engine housings. This system allows real-time inspection generating digital models for analysis and detecting defects quickly. BMW's commitment to quality aims to prevent expensive errors before assembly. These technologies streamline workflow automation by accelerating data processing and generating actionable insights in real time. Improved productivity, faster decision-making and consistent quality control are benefits to industries such as aerospace, automotive and electronics ensuring efficiency and competitiveness in production processes. These industrial computed tomography market trends are contributing significantly to create positive outlook for the market.

Industrial Computed Tomography Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial computed tomography market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on offering, application, and end use industry.

Analysis by Offering:

- Equipment

- Line Beam Scanners

- Cone Beam Scanners

- Services

Equipment stands as the largest offering in 2024, holding around 52.7% of the market. Equipment leads the industrial computed tomography (CT) market by offering advanced solutions that enable precise and non-destructive inspection of complex components. These systems provide high-resolution imaging allowing industries to detect internal defects, porosities, and material inconsistencies with exceptional accuracy. The latest CT equipment incorporates features like automated scanning, faster processing speeds and 3D imaging enhancing efficiency and reducing operational costs. With the rising demand in sectors, such as aerospace, automotive, and electronics, CT equipment is essential for quality control, reverse engineering, and material analysis. The continuous innovation in equipment design and functionality ensures its dominant position in the market. These advancements in equipment technology create a positive industrial computed tomography market outlook driving greater adoption across various industries.

Analysis by Application:

- Flaw Detection and Inspection

- Failure Analysis

- Assembly Analysis

- Others

Flaw detection and inspection leads the market with around 25.7% of market share in 2024. Flaw detection and inspection are the most important drivers in the industrial computed tomography (CT) market as they enable highly accurate identification of defects and irregularities in materials and components. CT scanning helps detect internal flaws such as cracks, voids, porosities and inclusions without damaging the product by providing detailed 3D imaging. This capability is very important in industries like aerospace, automotive and electronics where safety, reliability and precision are paramount. The ability to perform non-destructive testing (NDT) ensures that products meet strict quality standards reducing the risk of failures and improving overall product performance which is why flaw detection remains a leading application.

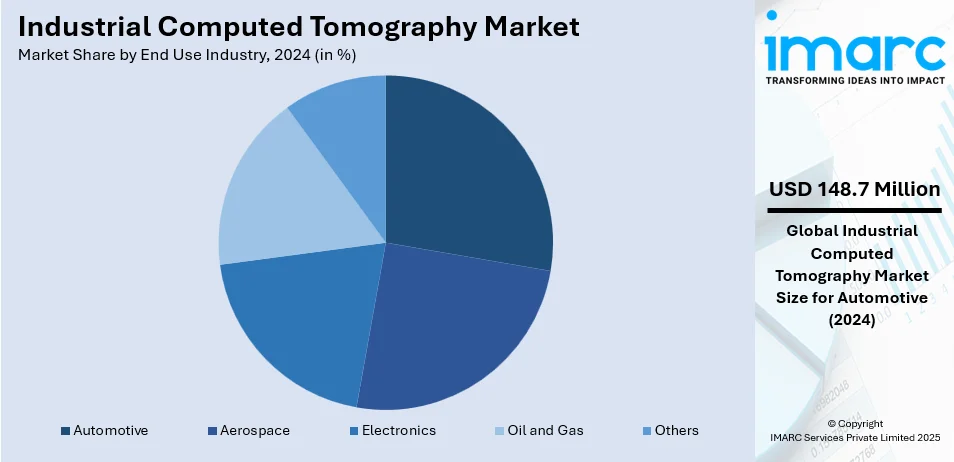

Analysis by End Use Industry:

- Aerospace

- Automotive

- Electronics

- Oil and Gas

- Others

Automotive leads the market with around 27.6% of the total industrial computed tomography market share in 2024. The automotive sector dominates the Industrial Computed Tomography (CT) market due to its growing demand for high-precision inspection and quality control. Automotive manufacturers apply CT scanning to analyze complex components such as engine parts, transmission systems and lightweight structures for internal defects, material integrity and assembly quality. With the trend toward electric vehicles and advanced materials CT technology helps validate complex designs and ensures parts meet the strict safety and performance standards. Its non-destructive testing capabilities allow for fast, accurate inspections reducing downtime and ensuring reliable production making CT an indispensable tool in the automotive industry.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 33.7%. Asia Pacific accounts for the largest share of the Industrial Computed Tomography (CT) market due to the region’s strong industrial base particularly in manufacturing, electronics, and automotive sectors. Countries like China, Japan and South Korea are key drivers with extensive use of CT technology in quality control, defect detection and process optimization. The region's growing adoption of advanced materials, electric vehicles, and precision engineering further boosts demand for high-resolution imaging systems. Asia-Pacific's focus on enhancing manufacturing efficiency and meeting global standards accelerates the need for advanced and non-destructive testing solutions positioning the region as a market leader.

Key Regional Takeaways:

North America Industrial Computed Tomography Market Analysis

The North American industrial computed tomography (CT) market is driven by the widespread adoption of advanced imaging technologies across key industries including aerospace, automotive and electronics. Industrial CT plays a crucial role in non-destructive testing (NDT), dimensional measurement and defect analysis ensuring high precision and reliability in manufacturing processes. As industries increasingly face the burden of strict regulations CT helps to maintain quality and safety products. With greater integration of automation and AI it makes the system more efficient and accurate. Investments in research and development promote innovation and help the region to stay ahead in the global markets.

United States Industrial Computed Tomography Market Analysis

In 2024, the United States captured 83.80% of revenue in the North American market. One key driver is the rapid adoption of advanced imaging technologies in industries such as aerospace, automotive, and electronics. These sectors leverage industrial CT for non-destructive testing (NDT), dimensional measurement, and defect analysis, ensuring high precision and reliability in manufacturing processes. In the automotive industry, CT is employed for analyzing parts such as engine components, batteries for electric vehicles (EVs), and crash test dummies. It supports dimensional analysis, material testing, and defect identification. There is a rise in the demand for vehicles among individuals in the country because of changing lifestyles. According to reports, 15,608,386 vehicle units were sold out in 2023 in United States. In line with this, stringent regulatory frameworks in the U.S. further boost the market. Industries are required to adhere to rigorous quality standards, such as those outlined by the Federal Aviation Administration (FAA) and the Food and Drug Administration (FDA). Another driver is the increasing integration of industrial CT with automation and artificial intelligence (AI). Automated workflows and AI-driven analysis enhance efficiency and accuracy, making CT systems more appealing to manufacturers. This trend aligns with the broader shift toward Industry 4.0, which emphasizes smart and interconnected production environments. Additionally, federal and state-level investments in research and development encourage innovation. Government initiatives aimed at fostering advanced manufacturing capabilities is spurring the adoption of cutting-edge industrial CT systems, enabling domestic companies to maintain a competitive edge in global markets.

Europe Industrial Computed Tomography Market Analysis

Europe’s industrial computed tomography (CT) market is influenced by the region’s focus on innovation, stringent regulatory standards, and a well-established industrial base. Key industries such as automotive, aerospace, and medical devices rely heavily on industrial CT for precise inspection and quality assurance, driving consistent demand. Moreover, CT is crucial in the development and maintenance of medical devices, where precision and safety are paramount. It also facilitates the inspection of intricate designs for devices, such as implants, surgical instruments, and prosthetics. The thriving medical sector in the region is catalyzing the demand for industrial computed tomography. According to reports, the European medical device market has been growing on average by 5.7% per year over the past ten years. A major driver is Europe’s strong emphasis on sustainability and resource efficiency. Industrial CT systems enable companies to optimize material usage, reduce waste, and achieve higher accuracy in manufacturing processes. This aligns with the European Union’s Green Deal objectives, which encourage industries to adopt eco-friendly practices. Furthermore, the region’s commitment to research and development (R&D) also supports industrial computed tomography market growth. Collaborative projects and funding from organizations foster innovation in CT technology. Advanced imaging techniques, such as high-resolution micro-CT, are increasingly being developed and adopted across European industries. Additionally, the rise of digital transformation and Industry 4.0 initiatives enhances the market.

Latin America Industrial Computed Tomography Market Analysis

In Latin America, the industrial computed tomography (CT) market is primarily driven by the growing adoption of non-destructive testing (NDT) technologies and the expansion of the automotive and aerospace sectors. The automotive industry increasingly uses 3D printing for parts and CT ensures the dimensional accuracy and structural integrity of these parts. People are increasingly purchasing vehicles because of rapid urbanization. According to the CEIC, Brazil motor vehicle production was reported at 2,324,838 units in December 2023. Countries such as Brazil and Mexico are key contributors, with increasing investments in advanced manufacturing. Besides this, the region’s focus on improving product quality and adhering to international standards is another driver. Industrial CT systems are widely used for defect analysis and material inspection, particularly in industries exporting to global markets.

Middle East and Africa Industrial Computed Tomography Market Analysis

The rising need for reliable inspection technologies in various industries like medical, automotive, aerospace, and electronics, is driving the adoption of industrial CT systems. These systems inspect printed circuit boards (PCBs) for soldering defects, misaligned components, and hidden faults without damaging the board. Integrated circuits (ICs), sensors, and microchips are evaluated for internal flaws and voids. Saudi Arabia automotive sensors market is projected to exhibit a CAGR of 5.94% during 2024-2032, as per reports. Additionally, government-led infrastructure development projects and economic diversification initiatives, particularly in the Gulf Cooperation Council (GCC) countries, are significant drivers. These programs prioritize technological advancement and quality assurance, creating demand for sophisticated imaging solutions like industrial CT. Emerging applications in the mining sector further bolster market potential, as industrial CT is leveraged for precise internal imaging and material analysis.

Competitive Landscape:

The Industrial Computed Tomography (CT) Market is highly competitive with numerous players offering advanced solutions to meet the growing demand across industries like aerospace, automotive, electronics and medical. Companies are increasingly focusing on innovation developing high-resolution CT systems that enable more precise inspection, faster scanning, and improved defect detection capabilities. In order to stay ahead, market players are integrating artificial intelligence (AI) and automation into their systems enhancing productivity and accuracy while reducing human error. Strategic partnerships, acquisitions and investments in research and development (R&D) are also key strategies employed by companies to expand their market share and offer cutting-edge solutions. As industries continue to prioritize non-destructive testing (NDT) and quality assurance competition is expected to intensify with an emphasis on offering reliable, efficient, and cost-effective CT solutions.

The report provides a comprehensive analysis of the competitive landscape in the industrial computed tomography market with detailed profiles of all major companies, including:

- Baker Hughes Company

- Bruker

- Comet Yxlon

- Nikon Corporation

- North Star Imaging Inc. (Illinois Tool Works Inc.)

- OMRON Corporation

- Rigaku Holdings Corporation

- RX Solutions

- Shimadzu Corporation

- VJ Technologies, Inc.

- WENZEL Group

- Werth Messtechnik GmbH

- ZEISS Group

Latest News and Developments:

- October 2024: VCB2, a cutting-edge computed tomography (CT) scanner developed by VisiConsult and Glimpse, was launched as the world’s highest throughput CT scanner. This system was specifically tailored for the cylindrical battery cell market, catering to industries involved in battery development and quality assurance.

- July 2024: Hyundai announced the acquisition and installation of Nikon's X-ray computed tomography (CT) system. This marks a substantial investment in Hyundai's newly inaugurated USD 51.4 million Safety Test and Investigation Laboratory (STIL) located in Superior Township, MI. Nikon's X-ray CT system features a large scanning volume, multi-source versatility, dual-detector capability, and a wide array of enhancements, collectively offering unparalleled inspection capabilities to its users.

- June 2024: Fujifilm introduced its 128-slice computed tomography (CT) system, the FCT iStream, which incorporates Vision Modeling Iterative Reconstruction (VMIR) technology. This new system is designed to provide high-resolution imaging with reduced radiation exposure for patients. The 128-slice capability offers faster and more accurate scans, while the advanced VMIR technology enhances image quality by reducing noise and improving contrast, particularly in challenging clinical conditions.

- January 2023: GE HealthCare entered into an agreement to acquire IMACTIS, an innovator in the rapidly growing field of computed tomography (CT) interventional guidance across an array of care areas. IMACTIS is a company located in France, established in 2009 by Stephane Lavallee and Lionel Carrat. They developed CT-Navigation™, an ergonomic and versatile system designed for stereotactic needle guidance. This solution allows for intuitive pre-planning and ongoing control during various procedures, spanning from diagnosis to treatment.

Industrial Computed Tomography Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered |

|

| Applications Covered | Flaw Detection and Inspection, Failure Analysis, Assembly Analysis, Others |

| End Use Industries Covered | Aerospace, Automotive, Electronics, Oil and Gas and Others |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Baker Hughes Company, Bruker, Comet Yxlon, Nikon Corporation, North Star Imaging Inc. (Illinois Tool Works Inc.), OMRON Corporation, Rigaku Holdings Corporation, RX Solutions, Shimadzu Corporation, VJ Technologies, Inc., WENZEL Group, Werth Messtechnik GmbH, ZEISS Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial computed tomography market from 2019-2033.

- The industrial computed tomography market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial computed tomography industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The industrial computed tomography market was valued at USD 538.59 Million in 2024.

IMARC estimates the industrial computed tomography market to reach USD 843.84 Million by 2033 exhibiting a CAGR of 4.86% during 2025-2033.

Key factors driving the industrial computed tomography (CT) market include the increasing demand for non-destructive testing in quality control and manufacturing processes. Advancements in CT technology, offering higher resolution and faster scanning, enhance inspection capabilities. Additionally, growing automation and the need for precise 3D imaging in sectors like aerospace and automotive fuel market growth.

Asia Pacific holds the largest share of the industrial computed tomography (CT) market, accounting for over 33.7%. The region's dominance is driven by the rapid growth in manufacturing industries, particularly in China, Japan, and South Korea, which are adopting advanced inspection technologies for quality control and product development.

Some of the major players in the industrial computed tomography market include Baker Hughes Company, Bruker, Comet Yxlon, Nikon Corporation, North Star Imaging Inc. (Illinois Tool Works Inc.), OMRON Corporation, Rigaku Holdings Corporation, RX Solutions, Shimadzu Corporation, VJ Technologies, Inc., WENZEL Group, Werth Messtechnik GmbH, ZEISS Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)