Industrial Ethernet Market Size, Share, Trends and Forecast by Offering, Protocol, End User, and Region, 2025-2033

Industrial Ethernet Market Size and Share:

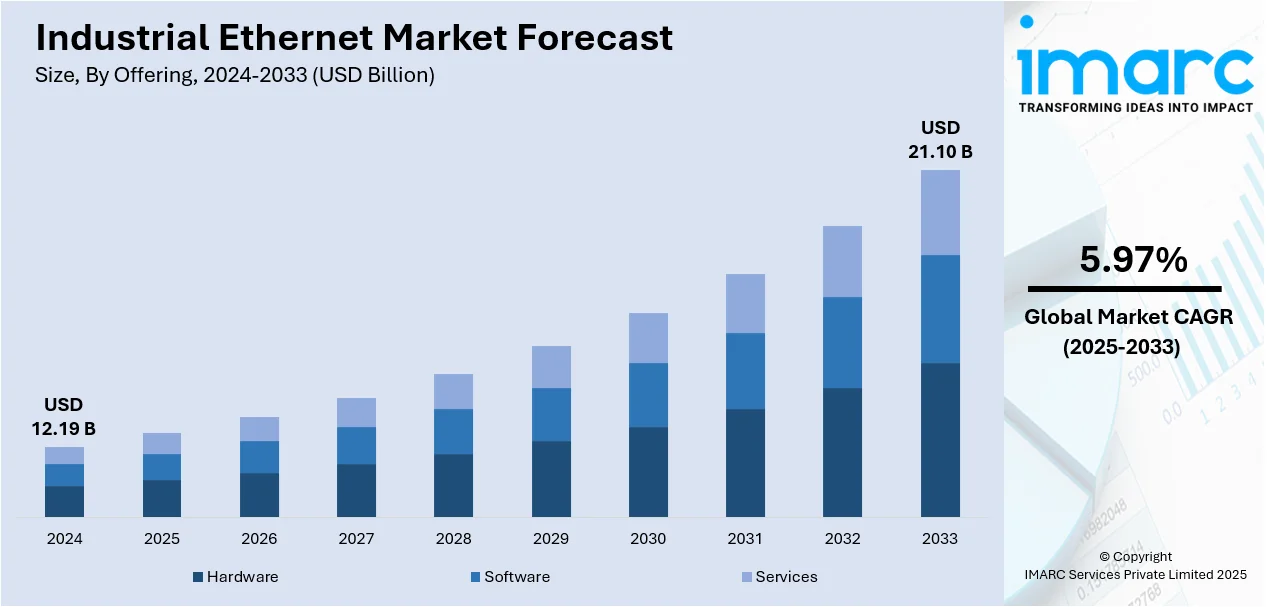

The global industrial ethernet market size was valued at USD 12.19 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 21.10 Billion by 2033, exhibiting a CAGR of 5.97% during 2025-2033. Europe currently dominates the market, holding a significant market share of over 33.8% in 2024. The market is experiencing robust growth, driven by the expanding adoption of industrial automation, the rise of the Industrial Internet of Things (IIoT) technology, an enhanced focus on cybersecurity, the increasing demand for high-speed and reliable connectivity, and the increasing integration of edge computing.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 12.19 Billion |

|

Market Forecast in 2033

|

USD 21.10 Billion |

| Market Growth Rate 2025-2033 | 5.97% |

The global industrial ethernet market is primarily driven by the rising demand for automation across various industries, including manufacturing, automotive, and energy. Companies increasingly rely on robust, real-time communication networks to support advanced technologies such as IoT and AI, enhance operational efficiency, reduce downtime. On February 28, 2024, AVIVA Links, Inc. announced the industry's first family of multi-Gigabit asymmetrical Ethernet devices based on the Automotive SerDes Alliance Motion Link Ethernet (ASA-MLE) draft specification. These devices, including Ethernet PHYs, switches, CSI-2 bridge ICs, and zonal aggregators, are optimized for ultra-high bandwidth asymmetric video and control links, aiming to enhance infrastructure for next-generation Software Defined Vehicles (SDVs). Besides this, the shift toward Industry 4.0 and smart factory initiatives is further propelling the adoption of ethernet-based solutions for seamless data transfer and improved connectivity. Additionally, growing investments in digital infrastructure and the need for high-speed, reliable networks to handle complex industrial applications fuel industrial ethernet market growth. Moreover, increasing awareness of the benefits of industrial ethernet, such as scalability, reliability, and cost-effectiveness, continues to encourage its deployment across diverse industrial sectors.

The United States stands out as a key regional market, primarily driven by the growing adoption of advanced manufacturing technologies and the increasing integration of digital systems in industries such as aerospace, defense, and healthcare. Along with this, rising investments in modernization projects, including smart grids and connected utilities, drive demand for reliable and high-speed networking solutions. The expansion of cloud-based platforms and edge computing in industrial settings further accelerates the need for ethernet connectivity to enable seamless data exchange and monitoring. Concurrently, government initiatives to enhance domestic manufacturing capabilities and bolster infrastructure resilience contribute to the market. Furthermore, the focus on reducing operational costs and improving supply chain efficiency is encouraging industries to adopt ethernet solutions tailored to U.S. industrial requirements.

Industrial Ethernet Market Trends:

Expanding Industrial Automation and Smart Manufacturing

The rise of industrial automation and smart manufacturing is a major driver of the market, as firms use modern technology to improve production processes. As per industry reports, the global industrial automation market size is valued at USD 224 Billion. Along with this, the size of India's industrial automation market was valued at USD 15 Billion in 2024 and is expected to grow further to a value of about USD 29 Billion by 2029. This ongoing shift towards automation is creating the need for robust and reliable communication networks. Industrial ethernet plays an important role in this context as it provides high-speed data transfer capabilities and minimal latency. It is well-suited to meet the stringent demands of modern automated environments.

Growing Adoption of the Industrial Internet of Things (IIoT)

The widespread adoption of the Industrial Internet of Things (IIoT) is increasing the industrial ethernet demand as enterprises discover the benefits of connected equipment and systems for enhancing operations. IIoT comprises the integration of sensors, actuators, and devices into industrial processes, allowing for real-time monitoring, data collection, and analysis. This interconnected ecosystem requires a robust and reliable communication network to facilitate seamless data exchange. In line with this, industrial ethernet's ability to enable high-speed data transfer and low-latency communication makes it an excellent choice for IIoT applications in industries such as manufacturing, energy, and transportation. For instance, the manufacturing industry will account for the largest amount of potential economic value from IoT, growing to an estimated 26% in 2030.

Increasing Focus on Cybersecurity in Industrial Networks

The growing concern over cybersecurity in industrial networks is a significant driver of the industrial ethernet market share. In the United States, the amount of cyberattacks on manufacturing had risen by more than 300 percent, accounting for 22% of the total attacks across all industries in 2020. As industrial processes become more interconnected and reliant on digital technologies, the risk of cyberattacks on critical infrastructure increases. In this context, industrial ethernet presents complex security protocols and capabilities, making it the preferred choice for organizations who are looking to protect their communication networks. Additionally, the ability to include robust cybersecurity measures, such as encryption, access control, and network segmentation within industrial ethernet networks, is enhancing the expansion of this industry.

Industrial Ethernet Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial ethernet market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on offering, protocol, and end user.

Analysis by Offering:

- Hardware

- Software

- Services

Hardware stands as the largest component in 2024, holding around 46.7% of the market. The hardware segment is driven by the widespread need for robust and reliable physical infrastructure to support high-speed data transmission and seamless connectivity in industrial environments. This segment includes essential components such as switches, routers, connectors, and cables, which are crucial for establishing and maintaining stable network connections. Moreover, the rising demand for hardware components, fuelled by the increasing adoption of automation and smart manufacturing, is positively impacting the industrial ethernet market growth.

Analysis by Protocol:

- EtherNet/IP

- EtherCAT

- PROFINET

- POWERLINK

- SERCOS III

- Others

PROFINET leads the market in 2024 due to its high performance, scalability, and versatility. This protocol enables real-time communication, which is essential for automation and control systems, ensuring precise and synchronized operations across diverse industrial environments. Moreover, PROFINET's ability to integrate seamlessly with existing information technology (IT) and automation systems, thereby providing industries with the flexibility to expand and upgrade their networks without significant disruptions is fueling the market growth. Additionally, its support for discrete and process automation, along with advanced features such as redundancy, diagnostics, and safety integration, is propelling the industrial ethernet market revenue.

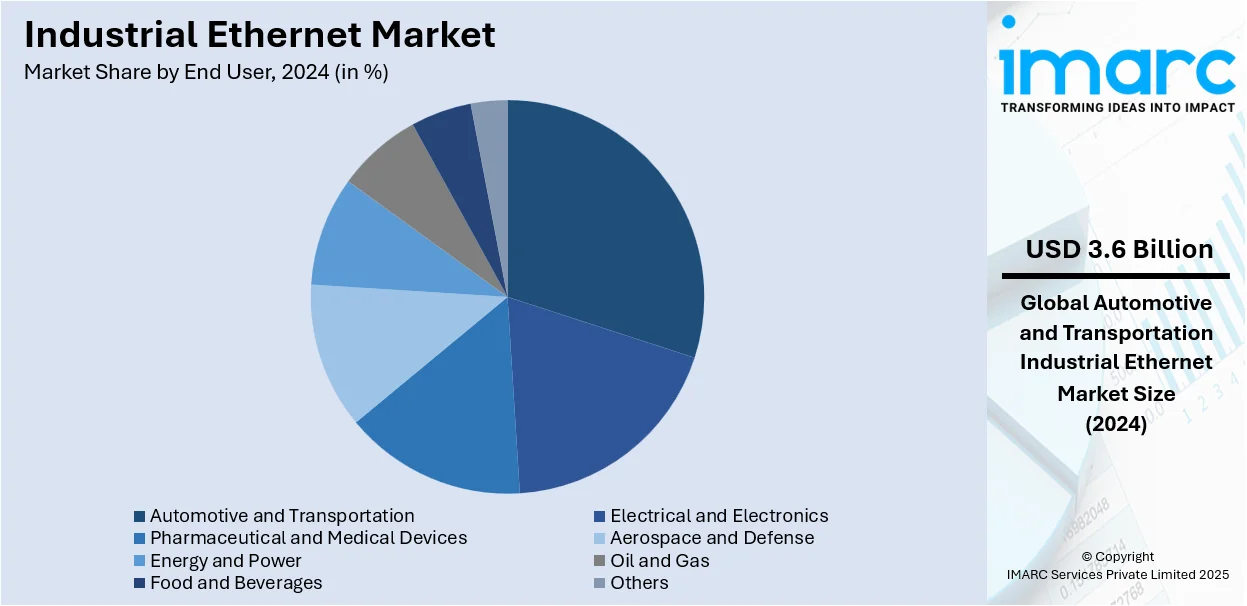

Analysis by End User:

- Automotive and Transportation

- Electrical and Electronics

- Pharmaceutical and Medical Devices

- Aerospace and Defense

- Energy and Power

- Oil and Gas

- Food and Beverages

- Others

Automotive and transportation lead the market with around 29.8% of market share in 2024. The automotive and transportation sector is driven by the industry's increasing reliance on automation, robotics, and smart manufacturing processes to product quality and enhance production efficiency. Moreover, the rising adoption of advanced technologies by automotive manufacturers, including autonomous vehicles, electric cars, and connected infrastructure, creating the need for reliable, high-speed communication networks is fostering market growth. Industrial ethernet provides the robust connectivity required to support these complex operations, enabling real-time data exchange between machines, sensors, and control systems.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of over 33.8%. Europe is driven by the region's strong industrial base, advanced manufacturing practices, and early adoption of automation technologies. Moreover, the presence of key industries such as automotive, aerospace, and energy, which rely on sophisticated communication networks, is fueling the market growth. Besides this, the rising implementation of Industry 4.0 initiatives, emphasizing the integration of digital technologies into manufacturing processes, is enhancing the market growth. Additionally, the region's stringent regulations regarding industrial safety and efficiency, along with significant investments in upgrading industrial infrastructure, are fostering market growth.

Key Regional Takeaways:

United States Industrial Ethernet Market Analysis

In 2024, the US accounted for around 87.80% of the total North America industrial ethernet market. The expansion of aerospace and defense operations and increasing investments have significantly influenced the increased adoption of industrial ethernet across facilities and processes. According to reports, the U.S. Department of Defense proposes a 2.6% budget increase for 2024, aiming for USD 842 Billion compared to USD 820.3 Billion spent in 2023. Enhanced communication networks are critical to managing complex systems in aircraft manufacturing and defense production lines, where real-time data exchange ensures precision. With growing investments in automated assembly lines for fighter jets and spacecraft, the need for seamless connectivity to coordinate robotics and control systems has driven the implementation of robust ethernet protocols. Moreover, secure and scalable networks address the confidentiality and operational demands of sensitive projects. Ethernet’s ability to manage large-scale data analytics has further enhanced maintenance schedules for aerospace components, optimizing uptime. The system's adaptability supports intricate supply chains, providing centralized control across dispersed production hubs.

Asia Pacific Industrial Ethernet Market Analysis

The rapid advancement of automotive production facilities and modern transportation networks has led to a notable increase in industrial ethernet deployment. According to the India Brand Equity Foundation, the automotive sector in India witnessed a rise in cumulative equity FDI inflow from USD 35.65 Billion (April 2000 - December 2023) to USD 36.268 Billion (April 2000 - March 2024), underscoring robust growth. Automated production lines in vehicle manufacturing plants rely on precise synchronization, which ethernet facilitates through low-latency communication. Smart factories integrating electric vehicle assembly lines and autonomous transportation systems leverage the technology for consistent performance monitoring. In addition, ethernet enhances rail and urban transit systems, enabling predictive maintenance for signaling equipment. By connecting diverse devices such as sensors and actuators, the technology supports advanced traffic management and logistics centers, ensuring efficiency. This adaptability in manufacturing and infrastructure fosters operational excellence, driving broader adoption across industries.

Europe Industrial Ethernet Market Analysis

The transformation of energy production and distribution systems has created a substantial demand for industrial ethernet in managing renewable power installations. According to the International Energy Agency, EU electricity demand is projected to grow at an average rate of 2.3% annually from 2024 to 2026, driven by increasing energy needs. Modern wind and solar farms rely on ethernet-enabled connections to monitor turbines, photovoltaic systems, and energy storage devices remotely. Substations utilize the technology for fault detection, ensuring swift responses and minimal downtime. Additionally, energy-intensive sectors, including heavy manufacturing, benefit from seamless data transmission to optimize power utilization and reduce waste. The deployment of ethernet supports the integration of microgrids, enhancing scalability and sustainability across the grid. Its compatibility with advanced metering systems and grid analytics has reinforced energy efficiency across the region.

Latin America Industrial Ethernet Market Analysis

The increasing automation of pharmaceutical production lines and medical device assembly processes has propelled the adoption of industrial ethernet for enhanced precision. According to the International Trade Administration, Brazil's pharmaceutical market, ranked sixth globally, saw a 26.2% sales increase in 2022 to USD 20.67 Billion. Ethernet supports data integration in drug manufacturing, ensuring compliance with stringent standards while maintaining production speed. The seamless communication between the interconnected machinery benefits real-time quality assurance in medical device factories. The technology also helps monitor supply chain logistics efficiently, especially in temperature-sensitive products such as vaccines. Its scalability addresses changing needs in laboratories and production sites to foster innovation in healthcare equipment manufacturing.

Middle East and Africa Industrial Ethernet Market Analysis

Industrial Ethernet has become indispensable in oil and gas facilities for improving operational efficiencies and maintaining safety standards. According to International Energy Agency, Saudi Arabia, UAE, and Iraq drive a 1.4 mb/d OPEC+ oil capacity rise, as UAE and Iraq increase their crude output, and Saudi expands NGL and condensate supply. Offshore platforms and refineries leverage the technology to monitor critical processes, including pipeline pressure and temperature levels. By connecting diverse equipment across remote locations, ethernet ensures uninterrupted communication, vital for controlling extraction and distribution systems. Its deployment supports predictive maintenance, reducing downtime, and optimizing resource utilization. Furthermore, the technology enhances environmental compliance by integrating monitoring systems that track emissions and hazardous materials handling, aligning with industry standards.

Competitive Landscape:

The major industrial ethernet companies are focusing on strategic initiatives to strengthen their market positions and expand their global footprint. These initiatives include continuous innovation in product offerings, such as developing more advanced and reliable hardware components, as well as software solutions that enhance network performance and security. Moreover, according to the industrial ethernet market's recent opportunities and developments, several companies are investing in research to support the integration of emerging technologies such as IIoT and edge computing into their industrial ethernet solutions. Apart from this, they are also collaborating and allying with other industry leaders to improve their product offerings and gain entry into new geographies. Additionally, prime players are focusing on making customized solutions based on some specific requirements of the various industries, such as those in the automotive, manufacturing, and energy sectors.

The report provides a comprehensive analysis of the competitive landscape in the industrial ethernet market with detailed profiles of all major companies, including:

- ABB Ltd.

- Advantech Co. Ltd.

- Beckhoff Automation

- Belden Inc.

- Cisco Systems Inc.

- Honeywell International Inc.

- Moxa Inc.

- OMRON Corporation

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Weidmüller GmbH & Co KG

Latest News and Developments:

- December 2024: Synopsys has announced Ultra Ethernet and UALink IP solutions, delivering up to 1.6 Tbps bandwidth and 200 Gbps per lane, respectively, to support massive AI accelerator clusters. The solutions connect up to one Million endpoints and 1,024 accelerators, built on industry-leading Ethernet and PCIe IP. Key collaborators include AMD, Juniper Networks, and Astera Labs.

- December 2024: L-com has launched IX Industrial cables with angled connectors, supporting 10-gigabit Ethernet and PoE compatibility. Designed for harsh, compact spaces, the cables come in outdoor, high-flex, and economy variants, offering multiple configurations. Length options include one and three meters, catering to diverse industrial applications.

- November 2024: Renesas Electronics has launched the RZ/T2H microprocessor, tailored for industrial robots, PLCs, and motion controllers. The MPU delivers high-speed, high-precision motor control for up to 9 axes, integrating Industrial Ethernet on a single chip. It targets advanced industrial equipment, enhancing performance in automation and control systems.

- July 2024: ABB Ltd. launched FSS400 Swirl and FSV400 Vortex flowmeters with Ethernet-APL connectivity, allowing for high-speed transmission of field data. This Ethernet-APL technology is opening new possibilities for digital collection and analysis of data in processes in the chemical, oil & gas, and hydrogen industries.

- July 2024: Moxa launched its new MRX Series Layer 3 rackmount ethernet switches that is capable of supporting 64 ports, including up to 16 ports with 10GbE speeds, to enhance data aggregation efficiency for industrial applications. This series helps users build high-bandwidth network infrastructure to realize IT/OT convergence with the EDS-4000/G4000 Series Layer 2 DIN-rail Ethernet switches which supports 2.5GbE uplink options.

Industrial Ethernet Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offerings Covered | Hardware, Software, Services |

| Protocols Covered | EtherNet/IP, EtherCAT, PROFINET, POWERLINK, SERCOS III, Others |

| End Users Covered | Automotive and Transportation, Electrical and Electronics, Pharmaceutical and Medical Devices, Aerospace and Defense, Energy and Power, Oil and Gas, Food and Beverages, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Advantech Co. Ltd., Beckhoff Automation, Belden Inc., Cisco Systems Inc., Honeywell International Inc., Moxa Inc., OMRON Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, Weidmüller GmbH & Co KG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial ethernet market from 2019-2033.

- The industrial ethernet market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial ethernet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Industrial ethernet is a network communication standard designed specifically for industrial environments. It facilitates high-speed, reliable, and real-time data transfer for automation, process control, and machine-to-machine communication. It ensures seamless integration of connected devices, enabling enhanced efficiency and scalability in industries such as manufacturing, energy, and transportation.

The global industrial ethernet market was valued at USD 12.19 Billion in 2024.

IMARC estimates the global industrial ethernet market to exhibit a CAGR of 5.97% during 2025-2033.

The market is driven by rising industrial automation, widespread adoption of Industrial Internet of Things (IIoT), increasing demand for high-speed, reliable connectivity, growing focus on cybersecurity, and investments in digital infrastructure supporting advanced technologies like edge computing and AI.

Hardware represented the largest segment by offering, driven by its role in supporting robust and reliable physical infrastructure for industrial connectivity.

PROFINET leads the market by protocol due to its high performance, scalability, and seamless integration with IT and automation systems.

The automotive and transportation sector is the leading segment by end user, driven by its increasing reliance on automation, robotics, and smart manufacturing processes.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Europe currently dominates the market.

Some of the major players in the global industrial ethernet market include ABB Ltd., Advantech Co. Ltd., Beckhoff Automation, Belden Inc., Cisco Systems Inc., Honeywell International Inc., Moxa Inc., OMRON Corporation, Rockwell Automation Inc., Schneider Electric SE, Siemens AG, and Weidmüller GmbH & Co KG, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)