Industrial Motors Market Report by Type of Motor (Alternating Current (AC) Motor, Direct Current (DC) Motor, and Others), Voltage (Low Voltage, Medium Voltage, High Voltage), End User (Oil and Gas, Power Generation, Mining and Metals, Water and Wastewater Management, Chemicals and Petrochemicals, Discrete Manufacturing, and Others), and Region 2025-2033

Market Overview:

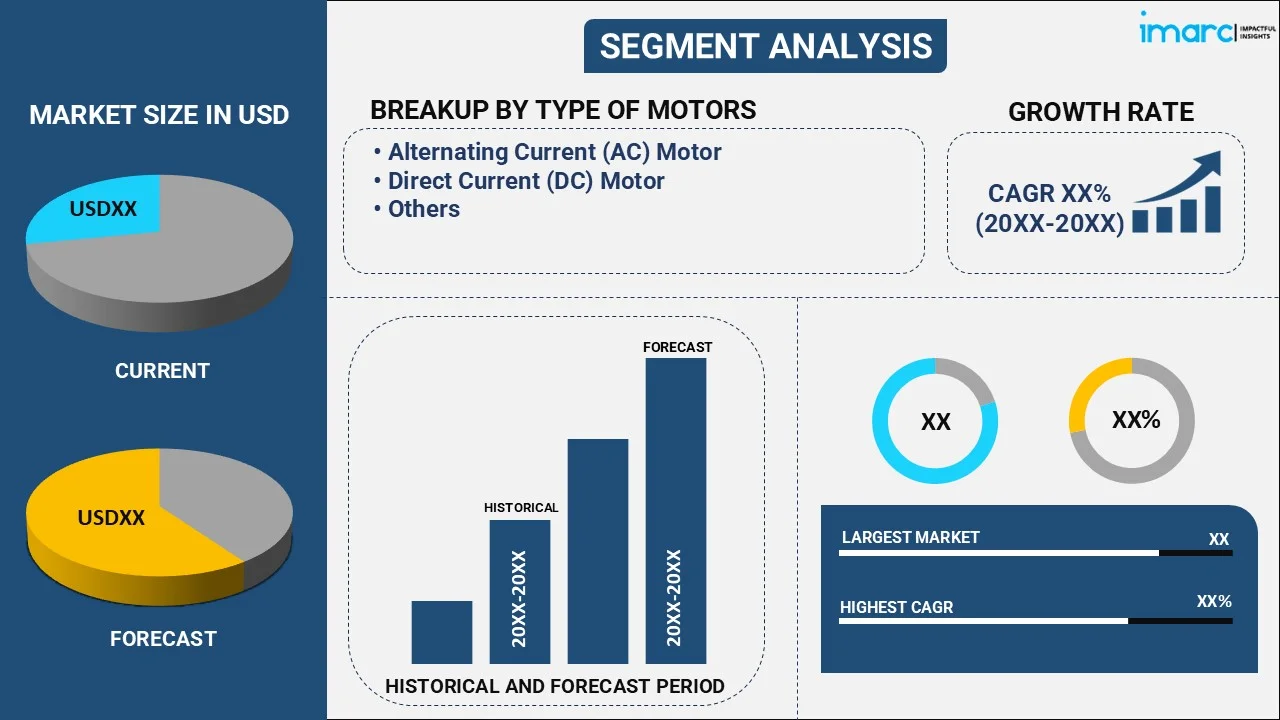

The global industrial motors market size reached USD 24.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 33.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.28% during 2025-2033. Asia-Pacific dominates the market driven by increasing investments in infrastructure and the growing demand for customized motors. The rapid technological advancements, imposition of stringent energy regulations, and increasing emphasis on sustainability are some of the major factors propelling the industrial motors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 24.6 Billion |

| Market Forecast in 2033 | USD 33.3 Billion |

| Market Growth Rate 2025-2033 | 3.28% |

Industrial motors refer to electrical devices used to convert electrical energy into mechanical energy. They are comprised of several components, such as rotors, bearings, stators, windings, and frames. Industrial motors are widely used in manufacturing machinery, mining equipment, water treatment plants, pumping stations, conveyor systems, elevators, marine vessels, renewable energy plants, and heating, ventilation, and air conditioning (HVAC) systems. They enhance operational efficiency, reduce energy consumption, extend equipment lifespan, provide precise control, increase reliability, facilitate automation, minimize maintenance requirements, and comply with environmental standards.

To get more information on this market, Request Sample

The increasing investment in infrastructures, such as transportation systems, water treatment facilities, and renewable energy projects, which require industrial motors to function efficiently, is propelling the market growth. Additionally, the escalating energy prices across the globe are facilitating product demand to promote energy efficiency and reduce operational costs. Furthermore, the growing demand for customized motors to meet clients’ unique requirements is boosting the market growth. Apart from this, the rising product adoption across various industries to replace aging motors to comply with modern standards and reduce energy consumption is strengthening the market growth. Moreover, the increasing emphasis on sustainability is prompting companies to adopt eco-friendly, including energy-efficient industrial motors. Other factors, including rapid industrialization activities, extensive research and development (R&D) work, and the growing collaboration between manufacturers and suppliers, are anticipated to drive the market growth.

Industrial Motors Market Trends:

Rising infrastructure development

Increasing infrastructure development is significantly fueling the growth of the market, as construction, transportation, and utilities demand robust and efficient motor-driven systems. Expanding urbanization and government-led infrastructure projects, such as smart cities, metro rail networks, highways, and commercial complexes, are creating a surge in the requirement for industrial motors used in elevators, pumps, and material handling equipment. In May 2025, Narendra Modi, the Prime Minister of India, announced infrastructure initiatives totaling INR 48,520 Crore in Bihar prior to the assembly elections. Important projects encompassed the Nabinagar Super Thermal Power Project and improvements to significant highways. Moreover, advancements in railway and airport facilities in Patna and Bihta were launched to enhance connectivity and capabilities. Power generation and water management infrastructure also heavily rely on motors to ensure uninterrupted operations. Additionally, large-scale industrial parks require advanced motor solutions to support automation and production efficiency.

Increasing electric vehicle (EV) production

Rising production of EVs is positively influencing the market, as motors serve as critical components in EV powertrains, battery systems, and auxiliary applications. As per the IBEF, the Indian EV market is projected to grow to USD 113.99 Billion by 2029, achieving a CAGR of 66.52%. With automakers scaling up EV manufacturing to meet global sustainability goals and regulatory requirements, the demand for high-performance motors is surging. Industrial motors enable efficient propulsion, regenerative braking, and thermal management, making them vital for the reliability of EVs. Beyond vehicle assembly, motors are widely used in EV production facilities, powering robotics, conveyor systems, and automated tools. Additionally, the expansion of EV charging infrastructure, which relies on advanced motor-driven systems for cooling and operation, is further strengthening the market.

Growing integration of Internet of Things (IoT)

Increasing integration of the IoT is transforming the market by enabling smarter, more efficient, and predictive motor operations. As per the IMARC Group, the global IoT market size reached USD 1,022.6 Billion in 2024. IoT-based motors are equipped with sensors and connectivity features that provide real-time monitoring of performance parameters, such as temperature, vibration, and energy utilization. This data allows predictive maintenance, reducing downtime and extending motor lifespan, which is highly valuable in industries like oil and gas and utilities. IoT integration also supports energy optimization, helping companies align with sustainability targets and cut operational costs. Moreover, connected motors enable remote diagnostics and control, making them essential in modern automated and digitally connected industries.

Key Growth Drivers of Industrial Motors Market:

Rising renewable energy projects

Industrial motors play an indispensable role in wind, solar, and hydropower systems. In wind energy, motors are used for yaw control, blade adjustment, and auxiliary operations, while solar power plants employ them in tracking systems and cooling mechanisms. Hydropower facilities also rely on motors for pumping, gates, and turbine support. With governments and private players investing heavily in clean energy to reduce carbon emissions, the demand for durable, energy-efficient, and reliable motors is increasing. Moreover, renewable projects often require motors that can operate in harsh conditions and deliver consistent performance. The rising focus on sustainability and energy transition is ensuring steady demand for innovative motor technologies, firmly positioning renewable energy development as a strong growth catalyst.

Thriving manufacturing industry

The expansion of the manufacturing industry is offering a favorable market outlook, as motors are indispensable for powering machinery, automation systems, and production equipment across diverse sectors. With rising demand for consumer goods, electronics, automotive components, and heavy machinery, manufacturers are scaling up production capacities, requiring efficient and reliable motor systems to support continuous operations. Motors are essential for robotics, conveyors, pumps, and compressors, which are widely utilized in modern factories. Additionally, the shift towards smart manufacturing and Industry 4.0 is creating the need for advanced, energy-optimized, and digitally connected motors to ensure productivity and reduce operational costs. As global and domestic manufacturing activities are broadening, the reliance on industrial motors is increasing, making this sector a critical contributor to the market growth.

Technological innovations

Technological innovations are enhancing performance, energy optimization, and adaptability to modern industrial requirements. The development of high-efficiency motors, such as permanent magnet synchronous motors and variable frequency drive (VFD)-integrated systems, is helping industries reduce power usage and operational costs. Advancements in materials, cooling techniques, and motor design have improved durability and reduced maintenance needs, making motors more reliable in critical applications. Smart motors embedded with artificial intelligence (AI) enable predictive maintenance and real-time optimization, aligning with Industry 4.0 goals. Additionally, lightweight and compact designs are being developed for emerging sectors like robotics and electric mobility. These technological strides ensure that motors remain indispensable in evolving industries, further accelerating the market expansion.

Industrial Motors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global industrial motors market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on type of motor, voltage and end user.

Breakup by Type of Motor:

- Alternating Current (AC) Motor

- Direct Current (DC) Motor

- Others

Alternating current (AC) motor dominates the market

The report has provided a detailed breakup and analysis of the market based on the type of motor. This includes alternating current (AC) motor, direct current (DC) motor, and others. According to the report, alternating current (AC) motor represented the largest segment.

Alternating current (AC) motors are dominating the market as they are more energy-efficient compared to DC motors, especially in continuous operation scenarios. This alignment with energy conservation goals makes them more attractive to industries aiming to reduce operational costs. Furthermore, they are known for their simple construction and fewer components, making them less prone to wear and tear. This contributes to their reliability and lower maintenance needs, both of which are vital in industrial settings. Besides this, the production and maintenance of AC motors are less expensive compared to their DC counterparts. Moreover, the direct compatibility of AC motors with industrial and commercial power systems, which simplifies integration and eliminates the need for additional conversion equipment, is favoring the market growth.

Breakup by Voltage:

- Low Voltage

- Medium Voltage

- High Voltage

Low voltage dominates the market

The report has provided a detailed breakup and analysis of the market based on the voltage. This includes low, medium, and high voltage. According to the report, low voltage represented the largest segment.

Low voltage motors operate at a higher efficiency compared to their high voltage counterparts, which translates into energy savings, aligning with global energy conservation goals. Apart from this, they are suitable for a wide range of industrial applications, from simple conveyance systems to complex manufacturing machinery, which is contributing to the market growth. Additionally, low voltage motors can be more readily integrated into existing systems without the need for substantial infrastructure modifications. Furthermore, they allow the use of less expensive protection and control equipment, making them a more economical option. Besides this, the growing demand for low voltage motors to meet energy-efficiency standards and comply with electrical codes is contributing to the market growth.

Breakup by End User:

- Oil and Gas

- Power Generation

- Mining and Metals

- Water and Wastewater Management

- Chemicals and Petrochemicals

- Discrete Manufacturing

- Others

Oil and gas dominate the market

The report has provided a detailed breakup and analysis of the market based on the end user. This includes oil and gas, power generation, mining and metals, water and wastewater management, chemicals and petrochemicals, discrete manufacturing, and others. According to the report, oil and gas represented the largest market segment.

The oil and gas sector is dominating the market as it requires industrial motors to drive its various processes, such as drilling, extraction, refining, and transportation. Furthermore, the industry's operations are multifaceted and require a range of specialized equipment. In line with this, industrial motors play a vital role, offering precise control and consistent performance, thus making them indispensable to the industry. Besides this, the oil and gas industry is spread across the globe and operates in diverse and often remote locations. The extensive utilization of industrial motors within these various locations contributes to the market expansion. Moreover, the industry's emphasis on efficiency, safety, and environmental compliance, which has led to significant investments in technological advancements, including state-of-the-art industrial motors, is positively influencing the market growth.

Breakup by Region:

.webp)

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance in the market, accounting for the largest industrial motors market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represented the largest market segment.

Asia Pacific is witnessing fast-paced industrial growth in manufacturing, automotive, and construction, leading to the increased demand for industrial motors. Furthermore, the introduction of supportive policies by the regional governments promoting manufacturing and industrial development through incentives, subsidies, and favorable regulations is acting as another growth-inducing factor. Apart from this, the significant investments in infrastructure projects, such as railways, power plants, and water treatment facilities, which require the use of industrial motors, are supporting the market growth. Additionally, the increasing push towards energy conservation in the Asia Pacific, leading to the implementation of strict energy regulations and the adoption of energy-efficient motors, is strengthening the market growth. Moreover, the abundant supply of raw materials and labor force, which makes it a cost-effective hub for the manufacturing of industrial motors, attracting both local and foreign companies, is propelling the market growth.

Competitive Landscape:

The top industrial motor companies are creating advanced, energy-efficient, and intelligent motor solutions to provide a competitive edge and cater to diverse industrial applications. Furthermore, many companies are expanding their global footprint through strategic acquisitions, mergers, and partnerships to access new markets, share technological expertise, and optimize resources. Additionally, they are offering tailored solutions to meet specific customer requirements and enhance their product portfolios. Moreover, several key players are developing eco-friendly products that align with global sustainability goals and regulations. Along with this, they are emphasizing quality control and adherence to international standards to ensure that the motors meet stringent quality benchmarks. In addition, companies are providing comprehensive after-sales support, including maintenance, repair, and technical guidance, which aids in maintaining long-term relationships with customers and ensuring product longevity.

The report has provided a comprehensive analysis of the competitive landscape in the global industrial motors market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- ABB Ltd.

- Brook Crompton

- Hitachi Ltd.

- Johnson Electric Holdings Limited

- Menzel Elektromotoren GmbH

- Nidec Corporation

- Regal Rexnord Corporation

- Rockwell Automation Inc.

- Siemens AG

- Toshiba Corporation

Industrial Motors Market News:

- March 2025: ITT Inc. unveiled VIDAR, an innovative compact smart motor featuring integrated variable speed intelligence that could decrease energy usage and CO2 emissions, cut expenses, and extend the lifespan of industrial pumps and fans used in demanding conditions. The industrial motor utilized advanced variable frequency technology in a form that was 60% more compact than existing market products.

- February 2025: ABB India launched its newest collection of flameproof motors as the most secure option in potentially explosive settings. Built for speed, these engines were tailored for industries like oil and gas, pharma, and chemicals, where hazardous gases necessitated a strong focus on safety and reliability. Produced at ABB’s advanced facility in Bengaluru, these motors aimed to provide safety, reliability, longevity, and energy efficiency.

Industrial Motors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Type of Motors Covered | Alternating Current (AC) Motor, Direct Current (DC) Motor, Others |

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| End Users Covered | Oil and Gas, Power Generation, Mining and Metals, Water and Wastewater Management, Chemicals and Petrochemicals, Discrete manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Brook Crompton, Hitachi Ltd., Johnson Electric Holdings Limited, Menzel Elektromotoren GmbH, Nidec Corporation, Regal Rexnord Corporation, Rockwell Automation Inc., Siemens AG, Toshiba Corporation etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the industrial motors market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global industrial motors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the industrial motors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global industrial motors market was valued at USD 24.6 Billion in 2024.

We expect the global industrial motors market to exhibit a CAGR of 3.28% during 2025-2033.

The rising demand for industrial motors in commercial processes and auxiliary systems, such as ventilation, compressed air generation, water pumping, etc., is primarily driving the global industrial motors market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations, resulting in the temporary closure of numerous end-use industries for industrial motors.

Based on the type of motor, the global industrial motors market can be segmented into Alternating Current (AC) motor, Direct Current (DC) motor, and others. Currently, Alternating Current (AC) motor holds the majority of the total market share.

Based on the voltage, the global industrial motors market has been divided into low voltage, medium voltage, and high voltage. Among these, low voltage currently exhibits a clear dominance in the market.

Based on the end user, the global industrial motors market can be categorized into oil and gas, power generation, mining and metals, water and wastewater management, chemicals and petrochemicals, discrete manufacturing, and others. Currently, oil and gas accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia-Pacific, Europe, Latin America, and Middle East and Africa, where Asia-Pacific currently dominates the global market.

Some of the major players in the global industrial motors market include ABB Ltd., Brook Crompton, Hitachi Ltd., Johnson Electric Holdings Limited, Menzel Elektromotoren GmbH, Nidec Corporation, Regal Rexnord Corporation, Rockwell Automation Inc., Siemens AG, and Toshiba Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)