Mining Equipment Market Size, Share, Trends and Forecast by Type, Equipment, Application, and Region, 2025-2033

Mining Equipment Market Size and Share:

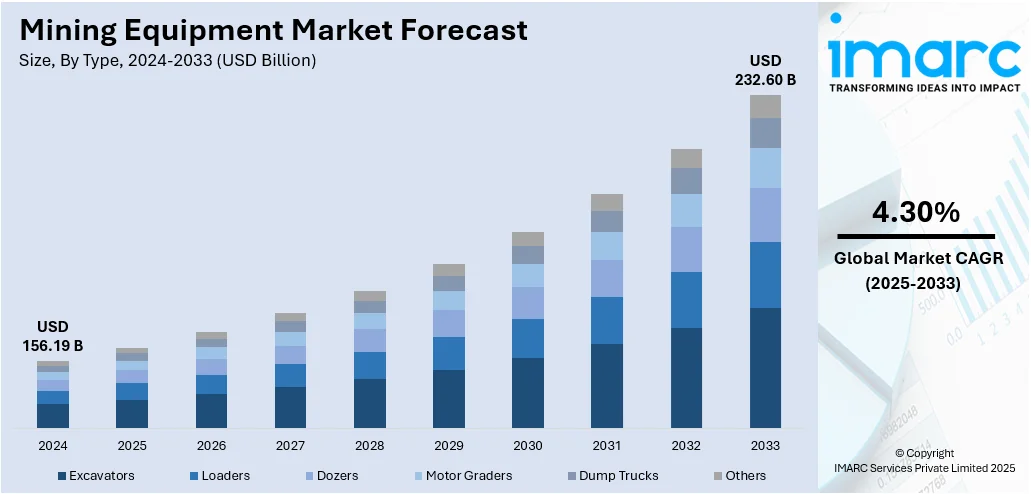

The global mining equipment market size was valued at USD 156.19 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 232.60 Billion by 2033, exhibiting a CAGR of 4.30% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 61.9% in 2024. There is a rising focus on environmental sustainability across the globe. This, along with innovations to facilitate cost savings, improved safety, and high operational efficiency, is contributing to the market growth. Besides this, the continuous supply of minerals and metals, essential for industries such as construction, manufacturing, electronics, and energy, is expanding the mining equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 156.19 Billion |

|

Market Forecast in 2033

|

USD 232.60 Billion |

| Market Growth Rate 2025-2033 | 4.30% |

The mining machinery industry is undergoing various change as organizations are adopting latest technologies for improving overall productivity and safety. Companies are incorporating artificial intelligence (AI), automation, and Internet of Things (IoT)-based solutions into their machines and equipment to maximize operational efficiency and minimize downtime. The sector is addressing expanding environmental issues by creating power-efficient equipment and machinery that reduce carbon footprints and meet tougher sustainability requirements. Firms are also putting money into electrifying mining fleets to reduce reliance on fossil fuels and keep pace with changing regulatory needs. Emerging economies are catalyzing the demand for advanced mining equipment as they develop their infrastructure and industrial base. The industry is seeing a shift towards underground mining activities, leading equipment suppliers to design robust and compact equipment that can withstand challenging conditions, thereby offering a favorable mining equipment market outlook.

To get more information on this market, Request Sample

The United States mining equipment market is experiencing significant evolution as operators are adopting advanced technologies to boost productivity and sustainability. Companies are increasingly investing in automation and digital solutions to streamline operations and reduce human intervention in hazardous environments. Leading manufacturers are developing electric and hybrid mining equipment to address stringent environmental regulations and growing pressure to cut greenhouse gas emissions. The sector is also witnessing a rise in the integration of real-time data analytics and IoT-enabled systems, enhancing equipment monitoring and maintenance efficiency. The demand for critical minerals such as lithium, cobalt, and rare earth elements is driving exploration and extraction activities, motivating mining firms to upgrade their equipment fleets with more specialized and efficient machinery. Mining companies are focusing on underground mining due to declining surface deposits, creating a need for compact, durable equipment capable of operating in confined spaces. For instance, in 2025, Hitachi Construction Machinery Co., Ltd. revealed the creation of the LANDCROS Connect Insight solution, designed to evaluate the operational data of mining equipment gathered in near-real time to assist customers in enhancing their operational efficiency. The firm intends to implement this solution via its dealers to mining locations globally, including Australia, Zambia, Chile, and the United States, beginning in FY2025.

Mining Equipment Market Trends:

Growing Demand for Mining Commodities

Increased worldwide demand for necessary mining commodities, such as metals and minerals, is fueling the mining equipment market growth. With industries like construction, electronics, and energy focusing on innovations, there is a growing demand for raw materials like copper, iron ore, and lithium. This rising demand is encouraging mining organizations to expand their operations, which in turn necessitates more modern and more efficient equipment to increase productivity and lower operational costs. Mining companies are always updating their fleets to address both the growing demand and technological innovations within the industry. Moreover, governments across the world are promoting mining to support local economies, further increasing demand for up-to-date mining equipment. As such, equipment manufacturers are concentrating on creating innovative solutions to meet the growing need for raw materials, as well as improve the sustainability of mining activities. In 2024, CR Powered by Epiroc claimed to strengthen its position in the fast-expanding mining industry of the Middle East by establishing a dealership partnership with Rasi Investment Co., a well-known investment company in Saudi Arabia. This strategic collaboration, enabled by Austrade, marked a notable progress for CR Powered by Epiroc in addressing the growing needs of Saudi Arabia’s mining sector.

Technological Advancements in Mining Equipment

Ongoing technology advancements are offering a favorable mining equipment market outlook by enhancing efficiency and safety. Firms in the industry continue to incorporate automation, artificial intelligence (AI), and machine learning (ML) in mining activities, thus streamlining the entire mining process. The implementation of autonomous vehicles, drones, and robotic systems is enhancing the efficiency of exploration, extraction, and transportation activities. In addition, advances in smart sensors and predictive maintenance technologies are enabling mining operators to track equipment performance in real-time, minimizing downtime and improving productivity. The mining equipment sector is also looking to develop energy-efficient and environment friendly machinery to achieve sustainability targets. These technological advancements are also minimizing safety risks since automated systems lower human presence in dangerous areas, reducing accident risks. In total, these innovations are redefining the future of mining, propelling the market toward safer, more efficient, and sustainable operations. In 2025, AIM raised $50 million to transform the construction and mining sectors by developing the world’s first AI platform for heavy machinery. The platform also supports various applications, from extracting vital resources to constructing infrastructure on a planetary scale.

Government Regulations and Sustainability Goals

The primary mining equipment market trends include the adoption stricter environmental compliance and sustainability targets by governments, catalyzing the demand for cutting-edge mining equipment. Such regulations tend to call for mining operations to minimize their carbon footprint, enhance energy efficiency, and practice environmentally sustainable measures. Mining corporations are, therefore, investing in the latest, eco-friendly equipment that complies with these regulatory requirements while seeking to maximize operations. In 2025, Saudi Arabia introduced a fresh incentive program to draw foreign direct investments to the country's mining industry as the Kingdom persistently advances its economic diversification initiatives. The pressure to cut emissions and boost the use of renewable energy in mining is generating tremendous demand for advanced machinery that facilitates these efforts. With governments increasingly focusing on environmental sustainability, mining operators are also being encouraged to use equipment that helps reduce waste and conserve water. As such, the market for mining equipment is adapting to address these regulatory requirements, with industries continually producing increasingly energy-efficient solutions and technologies aligned with international sustainability goals.

Mining Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global mining equipment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, equipment, and application.

Analysis by Type:

- Excavators

- Loaders

- Dozers

- Motor Graders

- Dump Trucks

- Others

Excavators stand as the largest component in 2024, holding 38.0% of the market. They offer substantial advantages in construction, mining, and infrastructure projects by improving efficiency and decreasing manual labor. Businesses are progressively utilizing excavators to carry out activities like digging, lifting, and demolition with enhanced speed and accuracy. Contemporary excavators feature sophisticated hydraulic systems, enabling operators to manage substantial loads while ensuring fuel efficiency. Contractors are reaping advantages from adaptable attachments that allow one excavator to perform various tasks, reducing the necessity for extra equipment on location. Manufacturers are creating excavators with enhanced safety features, guaranteeing that operators are functioning in safe and comfortable conditions. Companies are utilizing the global positioning system (GPS) and telematics systems in excavators to assess performance, oversee maintenance requirements, and enhance fuel efficiency.

Analysis by Equipment:

- Underground Mining

- Surface Mining

- Crushing, Pulverizing and Screening

- Drills and Breakers

- Others

Surface mining leads the market with 28.8% of market share in 2024. It is progressively depending on a variety of machinery to enhance efficiency and satisfy the growing need for minerals and metals. Firms utilize draglines, electric rope shovels, hydraulic shovels, and large haul trucks to efficiently extract and move significant amounts of overburden and ore. Producers are consistently creating bigger and more robust machinery to manage challenging tasks while achieving reduced fuel use and increased productivity. Operators are incorporating sophisticated automation and remote-control technologies into surface mining machinery, improving safety and lessening the reliance on manual labor in dangerous areas. Producers are utilizing predictive maintenance tools to track equipment condition in real time, reducing unexpected downtime and maximizing fleet readiness.

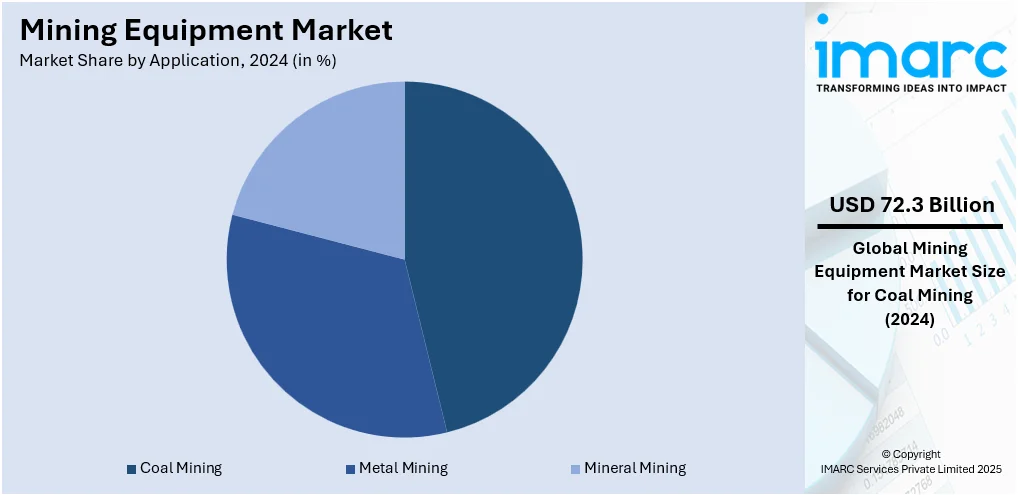

Analysis by Application:

- Metal Mining

- Mineral Mining

- Coal Mining

Coal mining leads the market with 46.3% of market share in 2024. Coal mining operations are constantly advancing as companies integrate modern machinery and eco-friendly practices to satisfy shifting energy needs and environmental regulations. Operators utilize cutting-edge longwall and continuous mining technology to enhance extraction efficiency and minimize manual labor in underground mines. Companies are putting money into high-capacity conveyors and transport systems to simplify the movement of coal from mines to processing plants, reducing handling time and operational expenses. Businesses are adopting dust control technologies and airflow systems to improve employee safety and comply with strict health standards. Producers are utilizing digital monitoring tools to assess equipment performance and enhance maintenance schedules, guaranteeing increased uptime and productivity. The sector is progressively moving towards cleaner coal innovations and carbon capture methods to tackle environmental issues and meet emission goals.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of 61.9%. The industry is experiencing tremendous change as regional countries widen infrastructure and energy projects to meet accelerated industrialization and urbanization. Mining firms are increasingly using sophisticated equipment to improve productivity and increase demand for minerals like coal, iron ore, bauxite, and strategic rare earth elements. The manufacturers are bringing automation, remote monitoring, and intelligent control systems into the picture to make mining processes safer and more efficient in surface as well as underground mines. Governing agencies are enacting tougher environmental controls, and thus companies are spending money on cleaner, fuel-efficient, and hybrid mining vehicles to cut down emissions and their impact on the environment. Companies are also paying attention to replacing their fleets with new-generation equipment that can withstand difficult terrain and remote areas of operation. Increased spending on renewable energy technology is generating demand for minerals such as lithium and nickel, which is urging miners to increase exploration efforts using specialized equipment.

Key Regional Takeaways:

United States Mining Equipment Market Analysis

The United States holds 73.30% share in North America. Growing investment in the extraction of essential minerals for renewable energy is the main factor propelling the market. To improve supply chain resilience, job creation, and national energy security, DOE financed USD 32.75 million in 12 projects in January 2025 to co-manufacture value-added goods from waste and increase U.S. essential mineral output. Accordingly, the market is expanding because to the growth of local copper and nickel refining, which is raising demand for sophisticated handling and crushing systems. The market is expanding due to the increasing use of underground mining methods, which makes small, highly accurate equipment necessary. In addition, mining companies are moving toward electric and hybrid equipment due to stricter pollution requirements. The rising demand for construction aggregates, driven by infrastructure and renewable energy projects, is also stimulating market demand as the use of surface mining equipment increases. Additionally, the rapid integration of telematics and automation for equipment optimization is gaining traction in the market. Moreover, favorable government incentives for mine modernization and worker safety are reinforcing equipment upgrades and impacting market trends.

Europe Mining Equipment Market Analysis

The European market is experiencing growth due to the region’s increased emphasis on resource independence, which is driving a rise in the mining of strategic raw materials. In accordance with this, the EU Critical Raw Materials Act, encouraging exploration and production investments, is fostering market expansion. Similarly, the growing focus on circular economy practices is promoting the adoption of equipment tailored for material recovery and recycling. The rising demand for battery metals to support electric vehicle manufacturing, driving the expansion of underground mining operations, is strengthening market demand. Furthermore, the ongoing integration of smart technologies, including predictive maintenance and autonomous systems, is enhancing productivity and uptime in the market. Additionally, cross-border infrastructure initiatives that increase the extraction of construction materials are propelling market growth. Besides this, enhanced research collaborations that foster innovation in durable and sustainable mining equipment are creating lucrative opportunities in the market. As such, Hitachi Construction Machinery and TU Delft began a two-year research project using sensor data from ultra-large mining equipment to predict component failures, aiming to reduce downtime, cut life-cycle costs, and enhance maintenance accuracy.

Asia Pacific Mining Equipment Market Analysis

The market in Asia Pacific is primarily driven by large-scale mineral exploration in China, India, and Australia, which supports the expansion of the industrial and energy sectors. The Chinese government, in 2024, opened over 1,400 areas for strategic mineral exploration, the highest in a decade. During the 14th Five-Year Plan, investments totaled 400 billion yuan, with 92% coming from the private sector. Additionally, numerous public-private mining collaborations, which streamline project execution and expedite the deployment of machinery, are driving the market growth. Similarly, the establishment of various manufacturing bases by global original equipment manufacturers (OEMs) is improving market access to cost-effective, region-specific equipment. Moreover, government-backed digitization and smart mining programs are encouraging the adoption of automated and remotely operated machinery. The rising demand for operator-friendly equipment, driven by workforce training initiatives across the region, is enhancing the market appeal. Apart from this, flexible financing and leasing models, which enable small and mid-size operators to invest in modern mining equipment, are expanding the market scope.

Latin America Mining Equipment Market Analysis

In Latin America, the market is progressing, driven by the growing exploration of copper and lithium reserves in Chile, Peru, and Argentina, which aim to meet global clean energy demands. Accordingly, in April 2025, Antofagasta planned a USD 220 Million, seven-year exploration at Chile's Cachorro copper project, drilling 700+ holes and a 300m tunnel. The 255Mt deposit at 1.26% Cu includes environmental, archaeological, and community engagement efforts. Similarly, increased foreign direct investment is accelerating the adoption of technologically advanced equipment across key mining operations, thereby stimulating market appeal. Furthermore, rising environmental regulations, encouraging the deployment of water-efficient and low-emission machinery, is bolstering market development. Besides this, supportive government incentives that enhance regional access to next-generation mining technologies are providing an impetus.

Middle East and Africa Mining Equipment Market Analysis

The market in the Middle East and Africa is significantly influenced by the expansion of mineral exploration programs across Saudi Arabia, South Africa, and Namibia, which aligns with national resource development goals. As such, in January 2025, Saudi Arabia selected six firms for its Exploration Enablement Program, allocating USD 182.6 Million to accelerate mining, cover 4,000 sq. km, and support the discovery of USD 2.5 Trillion in mineral potential. Furthermore, rising investment in mining infrastructure, including haul roads, processing plants, and logistics networks, is promoting equipment procurement. Additionally, increasing emphasis on environmental compliance, encouraging the adoption of low-emission, energy-efficient machinery in both surface and underground operations, is fueling market expansion. Moreover, the growing implementation of digital mine planning tools and intelligent fleet management systems is enhancing productivity and operational visibility, thereby strengthening market prospects.

Competitive Landscape:

Global market participants in the mining equipment industry are progressively prioritizing technological advancement, sustainability, and strategic growth to enhance their market standing. Businesses are significantly investing in automation, AI, and IoT technologies to improve operational efficiency and safety. They are prioritizing the creation of energy-efficient and environmentally friendly equipment to meet stricter environmental regulations. In response to the increasing demand, major companies are enhancing their production capacities and service networks, particularly in developing regions. Moreover, they are establishing strategic alliances and purchasing local companies to reinforce their presence and provide tailored solutions. According to mining equipment market forecasts, companies are anticipated to enhance equipment efficiency and lower operational expenses by incorporating digital solutions such as predictive maintenance and remote monitoring.

The report provides a comprehensive analysis of the competitive landscape in the mining equipment market with detailed profiles of all major companies, including:

- Atlas Copco AB

- Astec Industries Inc.

- Caterpillar Inc.

- Epiroc AB

- HD Hyundai Heavy Industries Co., Ltd

- J.C. Bamford Excavators Ltd.

- Komatsu Ltd.

- Liebherr Group

- Metso

- Sandvik AB

- SANY Group

- Tata Hitachi Construction Machinery Company Private Limited

- XCMG Group

Latest News and Developments:

- June 2025: Komatsu acquired six Core Machinery dealerships in Arizona and California to expand its U.S. dealer network. The transition enhances Komatsu’s ability to serve mining customers in the southwest, aligns with its growth strategy, and integrates the Core team into Komatsu-owned operations for improved equipment, parts, and service delivery.

- May 2025: Epiroc launched the Diamec Automated Rod Magazine (ARM), enhancing safety and automation in core drilling. Compatible with Diamec Smart rigs, ARM reduces operator fatigue, enables remote control, automates rod handling, and boosts productivity by allowing 252 meters of drilling without manual input, supporting Epiroc’s Live Work Elimination initiative.

- April 2025: SANY India launched the SKT130S, the country’s first locally made 100-ton hybrid mining dump truck in Pune. It offers 20–25% fuel savings and supports India's self-reliance push. That same month, Audi India reported 17% Q1 sales growth and 23% growth in its pre-owned segment.

- April 2025: BEML Ltd. launched the indigenously developed Motor Grader BG 1205 at its Mysuru complex. Designed for high-intensity mining operations, the 24-foot blade grader supports SECL and NCL sites. The launch aligns with India’s Atmanirbhar Bharat vision, emphasizing self-reliance and innovation in mining equipment manufacturing.

- April 2025: Hitachi Construction Machinery launched LANDCROS Connect Insight, a near-real-time data analytics solution for mining machinery. It enhances operational efficiency, predictive maintenance, and asset health monitoring. The platform supports global deployment, builds on ConSite Mine, and will receive functional upgrades starting June 2025 based on customer needs.

- March 2025: Metso launched three next-generation Nordberg HPe Series cone crushers, HP600e, HP800e, and HP900e, offering up to 15% more capacity and 35% more crushing force. Equipped with advanced automation and safety features, the crushers target high-demand mining and aggregate applications, enhancing performance, uptime, and operational efficiency.

- January 2025: Gainwell Engineering (GEPL) launched India’s first domestically manufactured room and pillar mining equipment package, including the GCM345 continuous miner and GFB110 feeder breaker. Delivered to Eastern Coalfields, this move supports the 'Make in India' push, strengthens underground coal mining, and enhances India’s self-reliance in high-end capital goods.

Mining Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Excavators, Loaders, Dozers, Motor Graders, Dump Trucks, Others |

| Equipments Covered | Underground Mining, Surface Mining, Crushing, Pulverizing and Screening, Drills and Breakers, Others |

| Applications Covered | Metal Mining, Mineral Mining, Coal Mining |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atlas Copco AB, Astec Industries Inc., Caterpillar Inc., Epiroc AB, HD Hyundai Heavy Industries Co., Ltd, J.C. Bamford Excavators Ltd., Komatsu Ltd., Liebherr Group, Metso, Sandvik AB, SANY Group, Tata Hitachi Construction Machinery Company Private Limited, XCMG Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the mining equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global mining equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the mining equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mining equipment market was valued at USD 156.19 Billion in 2024.

The mining equipment market is projected to exhibit a CAGR of 4.30% during 2025-2033, reaching a value of USD 232.60 Billion by 2033.

Key factors driving the market include increasing environmental sustainability concerns, technological advancements, such as automation and AI, growing demand for minerals and metals across various industries, and the shift towards cleaner and more efficient mining equipment to meet stricter environmental regulations.

Asia Pacific currently dominates the mining equipment market, accounting for a share of 61.9% in 2024. This growth is driven by rapid industrialization, mineral exploration, and infrastructure development across the region.

Some of the major players in the mining equipment market include Atlas Copco AB, Astec Industries Inc., Caterpillar Inc., Epiroc AB, HD Hyundai Heavy Industries Co., Ltd, J.C. Bamford Excavators Ltd., Komatsu Ltd., Liebherr Group, Metso, Sandvik AB, SANY Group, Tata Hitachi Construction Machinery Company Private Limited, XCMG Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)