Infrared Thermometer Market Report by Type (Contact Thermometers, Non-Contact Thermometers), Component (Optical Components, Electronics, Display & Control Unit, and Others), Application (Medical, Non-Medical), End Use Industry (Food & Beverage, Healthcare, Electronics, and Others), Region and Competitive Landscape (Market Share, Business Overview, Products Offered, Business Strategies, SWOT Analysis and Major News and Events) 2025-2033

Infrared Thermometer Market Size:

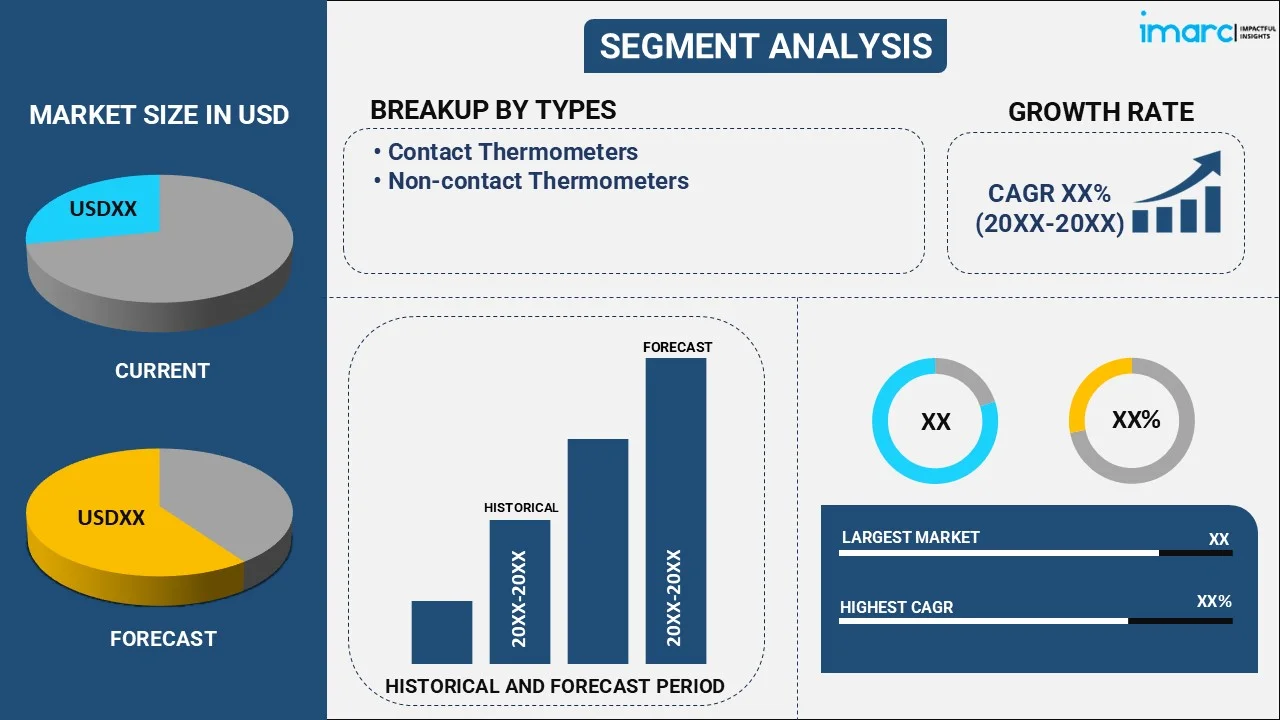

The global infrared thermometer market size reached USD 3.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.1 Billion by 2033, exhibiting a growth rate (CAGR) of 8.3% during 2025-2033. North America dominates the market, driven by rising awareness about hygiene and safety in healthcare settings and technological advancements. The increasing demand for non-contact temperature measurement and the growing product adoption in consumer electronics for home use are some of the factors propelling the market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.0 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Market Growth Rate (2025-2033) | 8.3% |

Infrared Thermometer Market Analysis:

- Major Market Drivers: The market is majorly driven by the increasing number of regulatory requirements and the rising integration of these thermometers into smart devices.

- Key Trends: The development of infrared thermometers with multi-functionality, offering additional features is one of the key trends in the market.

- Geographical Trends: The market is witnessing some major activity in various regions across the globe due to the rapid expansion of industrial applications such as manufacturing and food processing.

- Competitive Landscape: Some of the major market players are AMETEK land, Fluke, HORIBA, Ltd., and Microlife, among others.

- Challenges and Opportunities: A major challenge in the industry is to ensure consistent accuracy across various environmental conditions and surfaces. Conversely, several opportunities lie in the expansion into emerging markets with growing industrial and healthcare sectors.

To get more information on this market, Request Sample

Infrared Thermometer Market Trends:

Rising Healthcare Infrastructure and Hospital Adoption

The expansion of healthcare infrastructure worldwide is driving strong demand for infrared thermometers. Hospitals, diagnostic centers, and clinics require reliable, fast, and hygienic temperature measurement devices for patient monitoring and infection control. Unlike conventional thermometers, infrared thermometers are easy to sterilize and can be used repeatedly without direct skin contact, saving time and resources in busy healthcare environments. With more healthcare facilities being established in emerging economies and developed regions upgrading to modern equipment, the adoption of infrared thermometers is rising rapidly. In September 2025, Rainbow Children opened a new 100-bed greenfield hospital, with approximately INR 60 crore investment, in Rajahmundry, Andhra Pradesh, making it their third facility in the state following Vijayawada and Visakhapatnam. As hospitals continue to prioritize efficiency and safety, infrared thermometers are increasingly considered essential medical equipment.

Increasing Incidence of Infectious Diseases

The growing incidence of infectious ailments, such as influenza, dengue, and respiratory illnesses, is boosting the importance of early temperature monitoring. As per the CDC, in 2024, over 13 Million instances of dengue were documented in North, Central, and South America as well as the Caribbean. Fever is a common symptom of many infections, making infrared thermometers a crucial tool for timely detection. During outbreaks and seasonal epidemics, quick screening of large populations becomes necessary, and infrared thermometers provide the ideal solution. With rising awareness about public health and government initiatives emphasizing early detection and prevention, the role of infrared thermometers in monitoring body temperatures is expanding. This link between disease management and quick, accurate temperature monitoring is a major market growth driver.

Growing Adoption in Household Healthcare

Infrared thermometers are becoming a common household device due to their ease of use, safety, and convenience. Parents, in particular, value them for monitoring infants and children without discomfort. Home healthcare has grown substantially as people prefer self-monitoring solutions to reduce hospital visits, especially for minor illnesses. With greater awareness about preventive healthcare, families are investing in reliable tools to quickly track body temperature and make informed decisions. The affordability and availability of consumer-grade infrared thermometers through pharmacies, supermarkets, and online platforms have further boosted adoption. As home healthcare continues to expand globally, the role of infrared thermometers as an essential household item is increasing, contributing significantly to the overall market growth. As per the IMARC Group, the global home healthcare market is set to attain USD 816.4 Billion by 2033, exhibiting a CAGR of 7.48% during 2025-2033.

Key Growth Drivers of Infrared Thermometer Market:

High Demand for Non-Contact Temperature Measurement

Non-contact thermometers have become increasingly important for safe and hygienic temperature monitoring. Infrared thermometers allow readings from a distance, eliminating the need for physical contact and reducing cross-contamination risks. This makes them particularly valuable in hospitals, clinics, airports, and public places where mass screening is required. They are also convenient for use in households, especially for infants and children, since they provide quick and painless temperature checks. The simplicity of use and fast results make infrared thermometers preferable to traditional devices. With rising global focus on hygiene and infection prevention, the demand for safe, contactless measurement methods has surged, fueling the growth of the infrared thermometer market across healthcare, consumer, and industrial applications.

Rising Use in Industrial and Manufacturing Settings

Beyond healthcare, infrared thermometers are widely used in industrial and manufacturing environments to monitor equipment, detect overheating, and ensure worker safety. Industries such as food processing, automotive, and electronics rely on accurate non-contact temperature measurements to maintain quality and efficiency. In the food industry, infrared thermometers help ensure compliance with safety standards by monitoring cooking and storage temperatures. In manufacturing, they are utilized for preventive maintenance, detecting heat irregularities in machinery before failures occur. This industrial versatility is broadening their market beyond medical use. As industries focus on automation, safety, and quality control, the demand for reliable, non-contact thermometers is steadily increasing, driving strong growth of the industrial application segment of the infrared thermometer market.

Technological Advancements and Smart Features

Innovations are a major growth driver of the infrared thermometer market. Modern devices feature digital displays, Bluetooth connectivity, memory storage, multi-mode settings, and integration with mobile health apps. These advancements make thermometers more user-friendly, accurate, and connected, appealing to both healthcare professionals and tech-savvy consumers. Smart features allow continuous monitoring, record-keeping, and data sharing, which are valuable for patient management and remote healthcare. Compact designs and improved sensors also enhance portability and precision. As people increasingly prefer smart healthcare devices that complement digital health ecosystems, the demand for advanced infrared thermometers continues to rise. The integration of technology is transforming these devices from simple tools into intelligent health-monitoring solutions, significantly fueling the market expansion.

Global Infrared Thermometer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on type, component, application, and end use industry.

Breakup by Type:

- Contact Thermometers

- Non-contact Thermometers

Non-contact thermometers account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the type. This includes contact thermometers and non-contact thermometers. According to the report, non-contact thermometers represented the largest segment.

Non-contact thermometers segment is dominating the market. The growth of the healthcare industry, combined with the frequent outbreaks of infectious diseases, has entirely shifted the market in favor of non-contact infrared thermometers, which have the ability to monitor temperatures from a distance without contacting objects. The increasing demand for these thermometers is also due to the rise in the number of infectious diseases across the globe. The growing demand for safety, speed, and convenience is driving the introduction of non-contact infrared thermometers. Non-contact infrared thermometers are in high demand as they are easy to use and allow users to perform customized training. These thermometers are user-friendly and suitable for a wide range of applications, thereby driving market expansion.

Breakup by Component:

- Optical Components

- Electronics

- Display & Control Unit

- Others

Display & control unit holds the largest share of the industry

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes optical components, electronics, display & control unit, and others. According to the report, the display & control unit accounted for the largest market share.

The display & control unit dominates the infrared thermometer sector due to its pivotal role in user interface and data management. This unit seamlessly integrates advanced technologies, offering precise temperature readings with user-friendly controls. Its intuitive displays enhance readability, crucial for various applications from medical diagnostics to industrial processes. Furthermore, ergonomic designs ensure effortless handling, boosting operational efficiency. With customizable settings and comprehensive data storage, it caters to diverse user needs. Moreover, continuous innovation in this segment drives market growth, solidifying its position as the cornerstone of the industry.

Breakup by Application:

- Medical

- Non-Medical

Medical holds the largest share of the industry

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes medical and non-medical. According to the report, medical accounted for the largest market share.

The medical segment is dominating the market growth. This is due to population growth and an increase in the number of various diseases causing fever. The infrared sensor incorporated with the infrared thermometer accurately detects temperature, as an increase in temperature is one of the symptoms of COVID-19. Portable infrared thermometers are widely favored due to their low cost, high quality, and ability to perform rapid non-contact screening for body temperature measurement. All of these reasons contribute to increased demand for infrared thermometers in the medical segment.

Breakup by End Use Industry:

- Food & Beverage

- Healthcare

- Electronics

- Others

Healthcare holds the largest share of the industry

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes food & beverage, healthcare, electronics, and others. According to the report, healthcare accounted for the largest market share.

The healthcare industry is dominating the market. In the healthcare industry, infrared sensors are used to detect the skin temperature of patients. The temperature distribution over the surface of the human skin reveals information on a variety of physiological issues related to thermoregulation and metabolism. Portable infrared thermometers are often suggested due to their low cost, superior quality, and non-contact rapid screening for detecting body temperature. Furthermore, the market is expected to rise as healthcare professionals rely on these thermometers to analyze patients' health.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

North America leads the market, accounting for the largest market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); the Middle East; and Africa. According to the report, North America accounted for the largest market share.

In terms of market share, North America is dominating the market. Compared to Canada, the United States plays a major role in increasing regional demand. Due to its developed infrastructure, which can house cutting-edge solutions from numerous sectors, the country is expected to dominate the global market over the projection period. Contactless temperature monitoring techniques, such as infrared thermometers, have become increasingly important as infectious diseases spread in countries such as the United States and Canada. Customers spend significantly on home care products such as infrared thermometers.

Analysis Covered Across Each Country:

- Historical, current, and future market performance

- Historical, current, and future performance of the market based on type, component, application, and end use industry.

- Competitive Landscape

- Government Regulations

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape covering market structure, market share by key players, market player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, among others. Detailed profiles of all major companies have also been provided. This includes business overview, product offerings, business strategies, SWOT analysis, financials, and major news and events. Some of the key players in the global infrared thermometer industry include AMETEK Land, Fluke, HORIBA, Ltd., Microlife, Omega Engineering Inc., Omron, PCE, SKF, Testo, etc.

The infrared thermometer market is highly competitive. Many reputed companies produce infrared thermometers. The global supply of modern infrared thermometers is the main focus of the market players. Companies are continuously reducing the costs of these infrared thermometers. Globally accessible thermometers are also a goal of major manufacturers. For instance, in November 2022, TriMedika, a medical technology manufacturer supplying clinical devices for hospitals, displayed their non-contact thermometer product at Medica. TRITEMP is a precision-engineered thermometer that has a favorable impact on patient care and infection prevention in healthcare around the world. The market players are also investing in research and development activities to gain a competitive edge in the market.

Analysis Covered for Each Player:

- Market Share

- Business Overview

- Products Offered

- Business Strategies

- SWOT Analysis

- Major News and Events

Infrared Thermometer Market News:

- August 2025: AMETEK LAND created a novel non-contact infrared thermometer for accurate measurement and regulation during deposition processes in the production of optical fiber. The VDT+ was an independent thermometer designed for application in the burner zone where deposition occurred.

- December 2024: Orka developed a new meat thermometer that incorporated the features of multiple devices in one. It was a quick-read meat thermometer, featured a wireless probe for tracking cooking, and included an infrared thermometer.

Infrared Thermometer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Contact Thermometers, Non-contact Thermometers |

| Components Covered | Optical Components, Electronics, Display & Control Unit, Others |

| Applications Covered | Medical, Non-Medical |

| End Use Industries Covered | Food & Beverage, Healthcare, Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AMETEK Land, Fluke, HORIBA, Ltd., Microlife, Omega Engineering Inc., Omron, PCE, SKF, Testo, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global infrared thermometer market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global infrared thermometer market?

- What is the impact of each driver, restraint, and opportunity on the global infrared thermometer market?

- What are the key regional markets?

- Which countries represent the most attractive infrared thermometer market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the infrared thermometer market?

- What is the breakup of the market based on the component?

- Which is the most attractive component in the infrared thermometer market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the infrared thermometer market?

- What is the breakup of the market based on the end use industry?

- Which is the most attractive end use industry in the infrared thermometer market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global infrared thermometer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the infrared thermometer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global infrared thermometer market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the infrared thermometer industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)