Infrastructure-as-a-Service (IaaS) Market Report by Deployment Type (Public Cloud, Private Cloud, Hybrid Cloud), Solution (Managed Hosting, Disaster Recovery as a Service, Storage as a Service, Colocation, Network Management, Content Delivery, High Performance Computing as a Service, and Others), End-User (SMBs, Large Enterprises), Vertical (IT and Telecom, Banking, Financial Services, and Insurance (BFSI), Healthcare, Retail and E-commerce, Government and Defense, Energy and Utilities, Manufacturing, and Others), and Region 2025-2033

Market Overview:

The global infrastructure-as-a-service (IaaS) market size reached USD 127.9 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 706.8 billion by 2033, exhibiting a growth rate (CAGR) of 20.64% during 2025-2033. The growing demand for cost-effective infrastructure solutions, rising focus on scalability and agility in a business to seize new opportunities quickly, and increasing adoption of flexible solutions are some of the major factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 127.9 billion |

| Market Forecast in 2033 | USD 706.8 billion |

| Market Growth Rate 2025-2033 | 20.64% |

Infrastructure-as-a-service (IaaS) is a cloud computing model that offers businesses access to fundamental computing resources over the internet. It allows cloud providers to manage and deliver a range of infrastructure components, such as virtualized computing resources, including servers, storage, and networking. It provides organizations with the flexibility to scale the information technology (IT) infrastructure up or down according to their requirement and eliminates the need for extensive on-premises hardware investments. As it aids in streamlining IT operations and reducing capital expenditures, the demand for IaaS is rising across the globe.

At present, the increasing need for infrastructure that can support operations in multiple locations is bolstering the growth of the market. Besides this, the growing demand for convenient business solutions among various enterprises is offering a positive market outlook. In line with this, the rising adoption of IaaS, as it assists in optimizing the IT resources of a business, is propelling the growth of the market. Apart from this, the increasing awareness about the importance of data security and compliance requirements is contributing to the growth of the market. Furthermore, the rising demand for IaaS, as it ensures that data and applications are protected and can be quickly restored in case of disruptions, is strengthening the growth of the market. Moreover, the increasing adoption of IaaS due to the rising popularity of remote work culture worldwide is supporting the growth of the market.

Infrastructure-as-a-Service (IaaS) Market Trends/Drivers:

Rising demand for cost-effective infrastructure solution

The rising adoption of IaaS due to the increasing demand for cost-effective infrastructure solutions in a business is contributing to the growth of the market. In addition, traditional IT infrastructure investments often involve substantial upfront capital expenses for hardware, maintenance, and physical space. On the other hand, IaaS allows businesses to shift to a pay-as-you-go model that reduces capital expenditures. They pay only for the computing resources they use and assist in optimizing cost management. Furthermore, it eliminates the need for over-provisioning, where businesses invest in excess infrastructure to accommodate future growth. This scalability ensures that organizations maintain cost efficiency as they can easily scale resources up or down based on demand.

Increasing focus on scalability in businesses

The rising focus on scalability and agility in businesses is supporting the growth of the market. In line with this, businesses operate in dynamic environments with fluctuating resource demands. Besides this, IaaS assists in scaling infrastructure resources in real-time to meet these changing needs. Moreover, it ensures resource availability without the constraints of physical hardware, such as handling traffic spikes during product launches. This scalability supports business growth strategies and allows organizations to seize new opportunities quickly. It also fosters innovation and enables companies to experiment with new services and technologies without the burden of procuring additional hardware. Furthermore, scalability is critical for businesses seeking operational agility and competitiveness.

Growing adoption of flexible solutions

There is an increase in the adoption of flexible solutions in a business across various sectors. Additionally, IaaS liberates businesses from the limitations of on-premises infrastructure and offers a virtualized environment where resources can be provisioned and configured rapidly. This agility accelerates development and deployment cycles and reduces time-to-market for products and services. Apart from this, IaaS allows for the use of modern development practices like development and operations (DevOps) and continuous integration or continuous deployment (CI/CD). These practices further enhance flexibility by automating software delivery and infrastructure management and facilitating iterative development and faster innovation cycles. Furthermore, it empowers businesses to select the best-fit technologies for their specific needs.

Infrastructure-as-a-Service (IaaS) Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global infrastructure-as-a-service (IaaS) market report, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on deployment type, solution, end-user, and vertical.

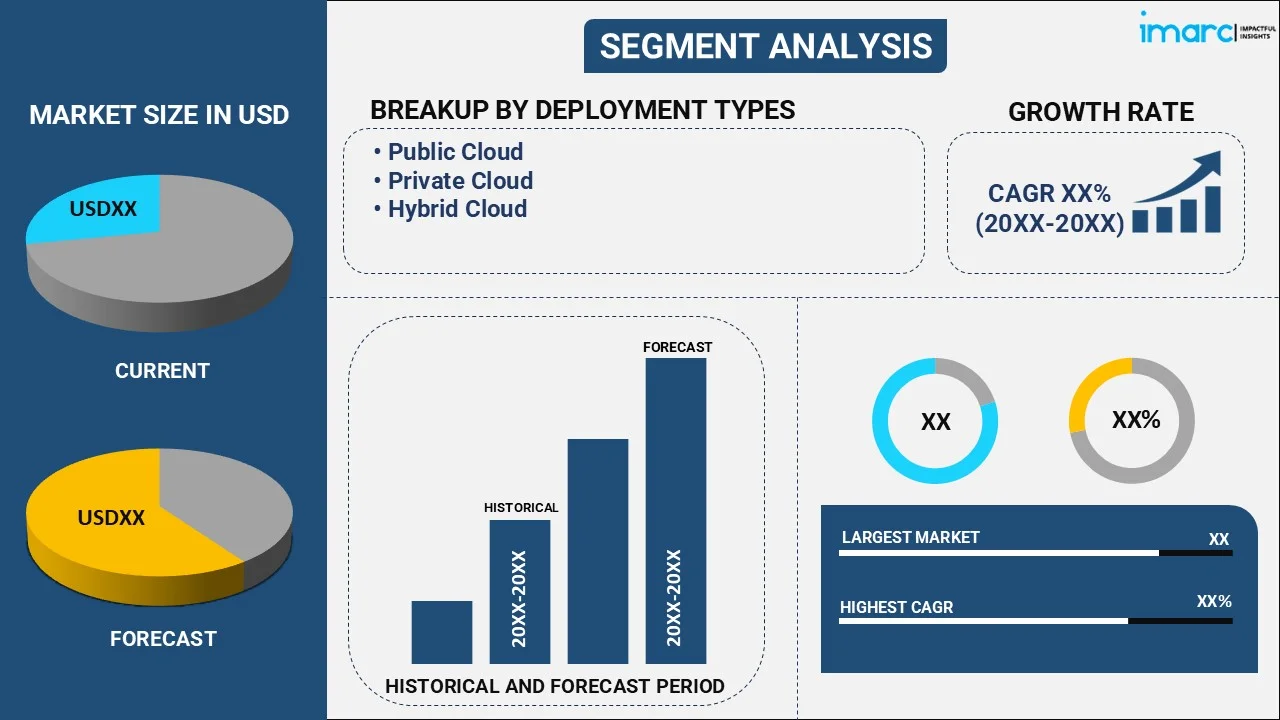

Breakup by Deployment Type:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Hybrid cloud represents the largest market segment

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes public cloud, private cloud, and hybrid cloud. According to the report, hybrid cloud represented the largest segment. A hybrid cloud is a deployment model that combines elements of both public and private cloud environments and offers a combination of on-premises and off-premises infrastructure. In this setup, critical or sensitive data and applications can be hosted on a private cloud to provide enhanced security and control, while less sensitive workloads can run on a public cloud for cost-efficiency and scalability. In addition, this deployment type addresses the need for flexibility and agility in modern enterprises. It allows businesses to leverage the advantages of both private and public clouds, optimize resource utilization, and ensure data security and compliance.

Breakup by Solution:

- Managed Hosting

- Disaster Recovery as a Service

- Storage as a Service

- Colocation

- Network Management

- Content Delivery

- High Performance Computing as a Service

- Others

Disaster recovery as a service accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the solution. This includes managed hosting, disaster recovery as a service, storage as a service, colocation, network management, content delivery, high performance computing as a service, and others. According to the report, disaster recovery as a service represented the largest segment. Disaster recovery as a service (DRaaS) is a cloud-based solution that is designed to ensure the continuity of business operations in the event of a disaster or data loss. It provides organizations with a cost-effective and reliable way to replicate and recover their critical information technology (IT) infrastructure and data in the cloud. This approach eliminates the need for traditional and resource-intensive disaster recovery methods, such as maintaining off-site backup data centers. DRaaS assists in reducing downtime by enabling rapid failover to a secondary IT environment hosted in the cloud and providing enhanced scalability.

Breakup by End-User:

- SMBs

- Large Enterprises

Large enterprises hold the biggest market share

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes SMBs and large enterprises. According to the report, large enterprises represented the largest segment. Large enterprises are typically characterized by their substantial scale, extensive operations, and complex IT infrastructure requirements. Large enterprises have unique needs and challenges that shape their demand for cloud services. For large enterprises, cloud computing, including IaaS, platform-as-a-service (PaaS), and software-as-a-service (SaaS), offers several advantages. It enables them to scale resources dynamically to support their vast workloads, improve cost management through pay-as-you-go models, and enhance agility in response to rapidly changing market conditions. Furthermore, large enterprises often seek robust security measures, compliance support, and customization options in their cloud solutions to align with their specific industry regulations.

Breakup by Vertical:

- IT and Telecom

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare

- Retail and E-commerce

- Government and Defense

- Energy and Utilities

- Manufacturing

- Others

IT and telecom dominate market share

The report has provided a detailed breakup and analysis of the market based on the vertical. This includes IT and telecom, banking, financial services, and insurance (BFSI), healthcare, retail and e-commerce, government and defense, energy and utilities, manufacturing, and others. According to the report, IT and telecom represented the largest segment. The IT and telecom vertical comprises a wide range of businesses that provide information technology services, software solutions, telecommunications infrastructure, and connectivity services. This sector plays a vital role in driving technological advancements across various industries and is a significant consumer of cloud services. Within IT and telecom, cloud services enable companies to scale their infrastructure efficiently. Moreover, IT and telecom companies leverage the cloud for enhanced connectivity and communication services, such as voice over internet protocol (VoIP) and unified communications.

Breakup by Region:

-market-regional.webp)

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America exhibits a clear dominance, accounting for the largest infrastructure-as-a-service (IaaS) market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.

North America held the biggest market share due to the increasing demand for cloud services. Additionally, the growing focus on data security and compliance among businesses of various sectors is offering a positive market outlook. Apart from this, the rising deployment of advanced cloud solutions is contributing to the growth of the market. In addition, the presence of major cloud service providers that provide a wide variety of cloud solutions is propelling the growth of the market.

Competitive Landscape:

Key players in this industry are continuously expanding their data center infrastructure globally. This expansion ensures proximity to customers, reduces latency, and enhances the performance and reliability of their services. In addition, IaaS providers are diversifying their service offerings to cater to a broader range of customer needs, such as providing specialized services like databases, machine learning (ML), and the Internet of Things (IoT) solutions. Apart from this, major manufacturers are investing heavily in security measures and compliance certifications to assure customers that their data is safe in the cloud. In line with this, they are developing hybrid and multi-cloud solutions that seamlessly integrate on-premises infrastructure with cloud resources.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Amazon Web Services, Inc

- Cisco Systems Inc.

- DXC Technology Company

- Dell Technologies, Inc.

- Fujitsu Limited

- Google LLC

- International Business Machines (IBM) Corporation

- Microsoft Corporation

- Oracle Corporation

- IONOS Cloud Inc.

- Rackspace Technology Global, Inc.

- Red Hat Inc.

- Redcentric PLC

- VMware, Inc.

Recent Developments:

- In February 2023, Oracle and Uber Technologies, Inc., announced a seven-year strategic cloud partnership to accelerate Uber’s innovation that help deliver new products to market and increase the profitability. In addition, Uber will migrate some of its business-critical workloads to the Oracle Cloud Infrastructure (OCI) to modernize its infrastructure.

- In December 2022, Amazon Web Services (AWS), an Amazon.com, Inc. company announced that Yahoo has selected AWS as its preferred public cloud provider for its advertising technology business Yahoo Ad Tech.

- In July 2021, Microsoft acquired CloudKnox Security, a leader in cloud infrastructure entitlement management (CIEM), to offer unified privileged access and cloud entitlement management in its Microsoft 365 cloud service offerings, more specifically Microsoft Azure Active Directory.

Infrastructure-as-a-Service (IaaS) Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Deployment Types Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| Solutions Covered | Managed Hosting, Disaster Recovery as a Service, Storage as a Service, Colocation, Network Management, Content Delivery, High Performance Computing as a Service, Others |

| End-Users Covered | SMBs, Large Enterprises |

| Verticals Covered | IT and Telecom, Banking, Financial Services, and Insurance (BFSI), Healthcare, Retail and E-commerce, Government and Defense, Energy and Utilities, Manufacturing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon Web Services, Inc, Cisco Systems Inc., DXC Technology Company, Dell Technologies, Inc., Fujitsu Limited, Google LLC, International Business Machines (IBM) Corporation, Microsoft Corporation, Oracle Corporation, IONOS Cloud Inc., Rackspace Technology Global, Inc., Red Hat Inc., Redcentric PLC, VMware, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the infrastructure-as-a-service (IaaS) market from 2019-2033.

- The research report study provides the latest information on the market drivers, challenges, and opportunities in the global infrastructure-as-a-service (IaaS) market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the infrastructure-as-a-service (IaaS) industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global infrastructure-as-a-service (IaaS) market was valued at USD 127.9 billion in 2024.

We expect the global infrastructure-as-a-service (IaaS) market to exhibit a CAGR of 20.64% during 2025-2033.

The sudden outbreak of the COVID-19 pandemic has led to the growing deployment of IaaS-based cloud computing service to protect organization’s sensitive data, during remote working and Bring-Your-Own-Device (BYOD) models.

The rising demand for IaaS for test and development of web-based applications, website hosting, storage, backup and recovery, etc., owing to their various benefits, such as minimal costs of operation, rapid innovation and enhanced stability, reliability and supportability, etc., is primarily driving the global infrastructure-as-a-service (IaaS) market.

Based on the deployment type, the global infrastructure-as-a-service (IaaS) market has been segmented into public cloud, private cloud, and hybrid cloud, where hybrid cloud currently holds the majority of the total market share.

Based on the solution, the global infrastructure-as-a-service (IaaS) market can be bifurcated into managed hosting, disaster recovery as a service, storage as a service, colocation, network management, content delivery, high performance computing as a service, and others. Among these, disaster recovery as a service currently exhibits a clear dominance in the market.

Based on the end-user, the global infrastructure-as-a-service (IaaS) market has been divided into SMBs and large enterprises. Currently, large enterprises hold the majority of the global market share.

Based on the vertical, the global infrastructure-as-a-service (IaaS) market can be categorized into IT and telecom, Banking, Financial Services, and Insurance (BFSI), healthcare, retail and e-commerce, government and defense, energy and utilities, manufacturing, and others. Among these, the IT and telecom sector accounts for the largest market share.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, where North America currently dominates the global market.

Some of the major players in the global infrastructure-as-a-service (IaaS) market include Amazon Web Services, Inc, Cisco Systems Inc., DXC Technology Company, Dell Technologies, Inc., Fujitsu Limited, Google LLC, International Business Machines (IBM) Corporation, Microsoft Corporation, Oracle Corporation, IONOS Cloud Inc., Rackspace Technology Global, Inc., Red Hat, Inc., Redcentric plc, and VMware, Inc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)