Insect Protein Market Report by Source (Coleoptera, Lepidoptera, Hymenoptera, Orthoptera, Hemiptera, Diptera, and Others), Distribution Channel (Offline, Online), Application (Animal Nutrition, Food and Beverages, Pharmaceutical and Supplements, Personal Care and Cosmetics), and Region 2025-2033

Insect Protein Market Size:

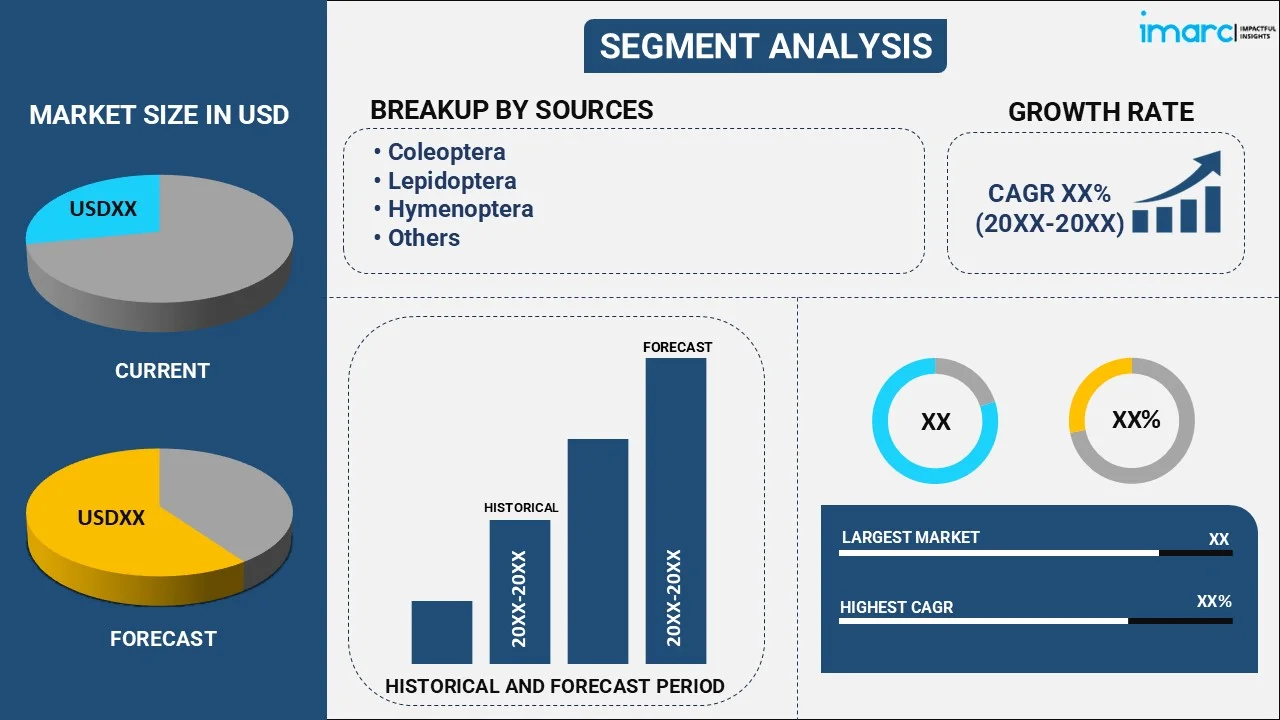

The global insect protein market size reached USD 1,171.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,528.0 Million by 2033, exhibiting a growth rate (CAGR) of 18.82% during 2025-2033. The market is rapidly growing, driven by the rising awareness of insect protein’s high nutritional value, growing demand for alternate protein sources, escalating prevalence of chronic conditions, increasing product adoption in animal feed, implementation of favorable regulatory environments, and rapid technological advancements in production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,171.4 Million |

|

Market Forecast in 2033

|

USD 5,528.0 Million |

| Market Growth Rate 2025-2033 | 18.82% |

Insect Protein Market Analysis:

- Major Market Drivers: Nutritional benefits are key drivers, as insects offer high-quality protein with a favorable amino acid profile, essential minerals, and vitamins that attract health-conscious consumers and industries who are looking for nutritious feed options. Moreover, the growing need for alternate protein sources, heightened incidences of chronic diseases, and the increasing demand for sustainable protein sources amidst rising environmental concerns is supporting the expansion of this market.

- Key Market Trends: There is a growing trend of incorporating insect protein into mainstream food products, including snacks, bars, and even beverages, to appeal to a broader consumer base. Additionally, rapid technological advancements in insect farming, processing, and genetics are leading to greater yields, reduced costs, and improved product quality, facilitating market growth and acceptance.

- Geographical Trends: Europe is leading the market for insect protein due to strong regulatory support, high consumer awareness, and advanced research and development (R&D) infrastructure. Other regional markets are also expanding, driven by traditional consumption patterns of insects as food and an increasing focus on sustainable agricultural practices.

- Competitive Landscape: Some of the major market players in the insect protein industry include Aspire Food Group, Chapul LLC, Entomo Farms, EnviroFlight LLC (Darling Ingredients), Goterra, Hexafly, InnovaFeed SAS, Jimini's, nextProtein, Protenga, and Protix B.V., among many others.

- Challenges and Opportunities: Regulatory hurdles and consumer acceptance remain significant challenges. The idea of consuming insects is still unappealing to many potential customers, requiring ongoing public education and marketing efforts. However, the market presents substantial opportunities for innovation in product development and international expansion. As acceptance grows and technologies advance, there is potential for a significant shift in how protein is sourced, opening new avenues for investment and development in the insect protein industry.

Insect Protein Market Trends:

Growing Awareness About the Nutritional Benefits of Insect Protein

Insects provide more high-quality protein, essential amino acids, vitamins, and minerals like iron, magnesium, selenium, and zinc than traditional meats. For example, the protein content in dry-weight insects like crickets can range between 60 and 75%, which is comparable to or higher than the protein content of beef or chicken. This makes the product a compelling component for diets that are heavily focused on health and nutrition. Additionally, insects contain high levels of healthy fats, like omega-3 and omega-6 fatty acids, which are vital for cardiovascular health, brain function, and overall cellular health. The rich nutritional profile of insect protein has made it a suitable option for various consumers, including athletes, bodybuilders, and those following ketogenic or paleo diets. This nutritional appeal significantly boosts the demand as health-conscious consumers look for diverse protein sources that align with their needs.

Rising Demand for Alternative Proteins

The surge in population across the globe is boosting the need for protein sources. By 2050, there will be a total of 10 billion people on this planet, which will increase the demand for proteins among individuals. Also, traditional sources are becoming more challenging to sustain due to overfishing, land degradation, and the high environmental cost of livestock farming. This has created interest in alternative protein sources. Insect protein has become more appealing in recent years due to the ongoing innovation in food technology. This has enabled the incorporation of insect-based ingredients into food products like burgers, protein bars, and snacks. As per a survey by the Food Standards Agency in the United Kingdom, 37% of people were willing to try edible insects that are ground into food, like bread, burgers, and falafel balls.

Increasing Prevalence of Chronic Conditions

The heightened incidence of chronic diseases, such as diabetes, obesity, and cardiovascular conditions, is a significant driver for the insect protein market. As per the Centre for Disease Control and Prevention (CDC), 6 in 10 adults in the U.S. are suffering from chronic diseases. And 4 out of 10 people have more than two chronic conditions. Also, about 21% of the geriatric adults in India have at least one chronic disease. 17% of geriatric people in rural areas and 29% in urban areas suffer from at least one chronic disease. These health issues can be curbed by taking care of one’s health and including protein and nutrient diets in daily routine. Insects are a brilliant source of protein, with many species containing between 50% and 80% protein by dry weight. The inclusion of insect protein can significantly help in controlling the incidence of chronic conditions in the long run.

Insect Protein Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on source, distribution channel, and application.

Breakup by Source:

- Coleoptera

- Lepidoptera

- Hymenoptera

- Orthoptera

- Hemiptera

- Diptera

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes coleoptera, lepidoptera, hymenoptera, orthoptera, hemiptera, diptera, and others.

As per the insect protein market analysis and outlook, coleoptera involves various species of beetles, which are utilized for their high protein content. Beetles, such as the mealworm beetle, are utilized in human nutrition and animal feed, especially in aquaculture and poultry. The hardiness and ease of cultivation make beetles an attractive option for large-scale production. Moreover, they are capable of thriving on a range of organic waste materials, which facilitates sustainable production practices and supports waste-to-value initiatives.

Lepidoptera includes butterflies and moths that serve as another significant source of protein through species like the silkworm. They are valued for their ability to convert inedible plant parts into high-quality protein. Moreover, the cultivation of silkworms aligns with the silk industry, offering a dual-purpose production process that enhances economic viability for producers.

According to the insect protein market trends and overview, the hymenoptera segment includes insects, such as bees, wasps, and ants. In addition, they are harvested owing to their unique nutritional properties. In line with this, edible ant species are utilized due to their rich mineral content and are popular in certain local diets.

Orthoptera includes grasshoppers, crickets, and locusts. Crickets are extensively farmed due to their high protein content, rapid growth rates, and the relative ease of processing them into powders and flours. They are mostly favored in cricket-based protein bars, snacks, and other food products among health-conscious consumers who are looking to include nutrient-rich products in their daily lifestyle.

Hemiptera, or true bugs, includes insects like cicadas and aphids. The unique flavors and textures of hemiptera make them appealing to gourmet food products and exotic cuisines. Moreover, the cultivation of this source is complex due to their specific dietary and environmental needs. However, successful integration into local food cultures has been elevating their status in the market.

The diptera segment, through the use of black soldier fly larvae, is particularly valued for its ability to convert organic waste into high-quality protein efficiently. It is mostly used in human consumption and as a premium protein source in animal feeds, like aquaculture and pet foods. Besides this, the sustainability of black soldier fly farming, coupled with the high yield and nutritional profile of their larvae, is favoring the insect protein market growth.

Breakup by Distribution Channel:

- Offline

- Online

Offline holds the largest share of the industry

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes offline and online. According to the report, offline accounted for the largest market share.

According to the insect protein market forecast and report, the offline distribution channel represented the largest segment, as it consists of a wide range of retail formats like supermarkets, health food stores, and specialty stores. Moreover, the increasing consumer preference for physically inspecting food products before purchase is favoring the market growth. Additionally, physical stores offer consumers the chance to engage directly with products, assess packaging information, and receive immediate assistance and recommendations from store staff, thereby promoting the insect protein market growth. Furthermore, offline channels are essential for reaching demographics that are less inclined to shop online or those who value the immediate availability of products.

Breakup by Application:

- Animal Nutrition

- Aqua Feed

- Poultry Feed

- Others

- Food and Beverages

- Pharmaceutical and Supplements

- Personal Care and Cosmetics

Animal nutrition represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes animal nutrition (aqua feed, poultry feed, and others), food and beverages, pharmaceutical and supplements, and personal care and cosmetics. According to the report, animal nutrition represented the largest segment.

The animal nutrition segment represented the largest share of the market, driven by the rising demand for sustainable and high-quality feed in the aquaculture and poultry industries. Insect protein from species like the black soldier fly and mealworm is used as a key component in feed due to its high protein content and excellent amino acid profile. Moreover, the rising ability of insects to efficiently convert low-quality biomass into nutrient-rich protein, providing an eco-friendly alternative to traditional feed sources such as fishmeal and soybean meal, is enhancing the insect protein market revenue.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe leads the market, accounting for the largest insect protein market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe represents the largest regional market for insect protein.

Europe accounted for the largest regional segment in the market, supported by robust regulatory frameworks, high consumer awareness of environmental issues, and significant investments in sustainable technologies. The European Union (EU) has been at the forefront of regulating and promoting the use of insects as food and feed, thereby fueling the market growth. Along with this, the proliferation of startups and established companies venturing into insect farming, driven by consumer willingness to adopt alternative proteins, is bolstering the market growth. Besides this, the extensive research and development (R&D) activities that are focused on improving insect protein extraction methods and integrating them into popular food products are favoring the market share.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the insect protein industry include Aspire Food Group, Chapul LLC, Entomo Farms, EnviroFlight LLC (Darling Ingredients), Goterra, Hexafly, InnovaFeed SAS, Jimini's, nextProtein, Protenga, Protix B.V., etc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

- The top insect protein companies are engaging in various strategic activities to expand their market presence and enhance their competitive edge. They are investing in research and development (R&D) to improve breeding, harvesting, and processing technologies to increase yield, efficiency, and product quality. Moreover, they are focusing on collaborations and partnerships with food and feed companies to create new applications for insect protein, such as snack foods, protein supplements, and animal feed, thereby expanding the insect protein market’s recent developments and opportunities. Moreover, market leaders are focusing on scaling up production to meet the rising demand while ensuring sustainability in their operations. They are also navigating the regulatory landscape to secure approvals for new products and expand into new geographic markets.

Insect Protein Market News:

- In February 2021, Aspire Food Group and its collaborators, Telus Agriculture, DarwinAI, Swift Labs and A&L Laboratories, were awarded approximately USD 13.2 million from next generation manufacturing (NGen) to help construct a cricket protein plant in Canada.

- In February 2022, Innovafeed announced a collaboration with the ADM. In this collaboration, Innovafeed will offer its black soldier fly protein to ADM’s pet food division to create high-quality and nutritious products that have a much smaller carbon footprint and land need than conventional animal protein.

Insect Protein Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Coleoptera, Lepidoptera, Hymenoptera, Orthoptera, Hemiptera, Diptera, Others |

| Distribution Channels Covered | Offline, Online |

| Applications Covered |

|

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aspire Food Group, Chapul LLC, Entomo Farms, EnviroFlight LLC (Darling Ingredients), Goterra, Hexafly, InnovaFeed SAS, Jimini's, nextProtein, Protenga, Protix B.V., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global insect protein market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global insect protein market?

- What is the impact of each driver, restraint, and opportunity on the global insect protein market?

- What are the key regional markets?

- Which countries represent the most attractive insect protein market?

- What is the breakup of the market based on the source?

- Which is the most attractive source in the insect protein market?

- What is the breakup of the market based on the distribution channel?

- Which is the most attractive distribution channel in the insect protein market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the insect protein market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global insect protein market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the insect protein market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global insect protein market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the insect protein industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)