How Anti-Drone Technologies Are Shaping the Global Anti-Drone Market: Trends, Challenges, and Opportunities

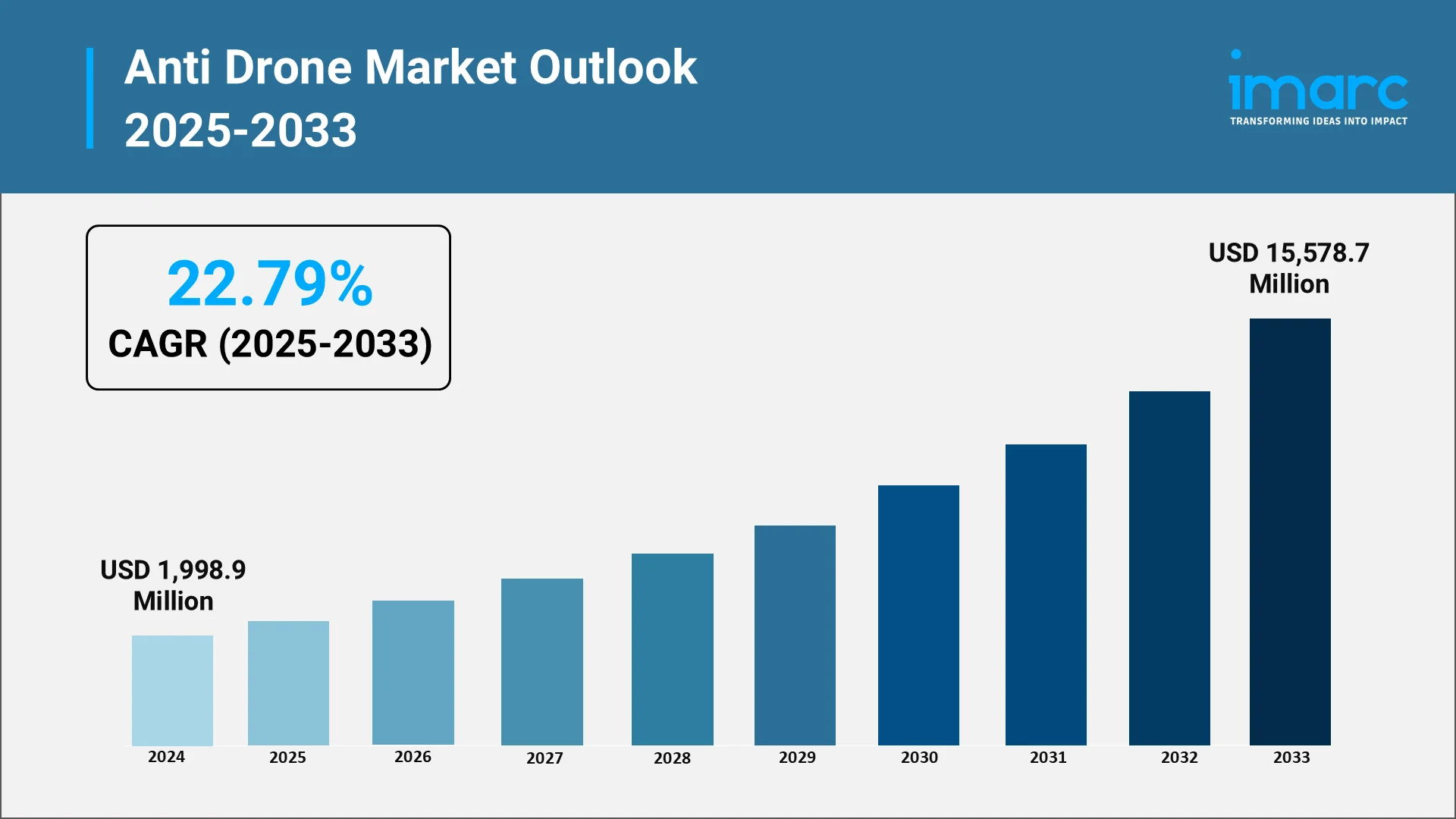

The global anti-drone market has emerged as one of the fastest-growing segments within the defense and security industry, driven by escalating concerns over unauthorized drone activities threatening critical infrastructure, military installations, and civilian safety. As unmanned aerial systems (UAS) proliferate across commercial and recreational sectors, the parallel demand for sophisticated Counter-UAS (C-UAS) solutions has intensified dramatically. The market is valued at USD 1,998.9 Million in 2024 as per IMARC Group and it is projected to experience remarkable expansion, reaching USD 15,578.7 Million by 2033, registering a compound annual growth rate (CAGR) of 22.79% during the forecast period.

This explosive growth trajectory reflects a fundamental shift in global security paradigms, where drone detection & mitigation systems have transitioned from niche perimeter security solutions to indispensable components of layered air defense strategies. The proliferation of weaponized drones in active conflict zones, coupled with rising threats to national energy grids and transportation hubs, has catalyzed unprecedented investment in electronic warfare anti-drone technologies across military, government, and commercial sectors worldwide.

Explore in-depth findings for this market, Request Sample

From Defense to Civilian Safety: The Expanding Role of Anti-Drone Solutions

Anti-drone technologies encompass a comprehensive suite of detection, tracking, identification, and neutralization systems designed to counter unauthorized or malicious drone operations. These sophisticated platforms integrate multiple sensor modalities—including radar systems, radio frequency (RF) detectors, electro-optical/infrared (EO/IR) cameras, and acoustic sensors—to provide layered defense capabilities against diverse aerial threats. The drone neutralization market leverages both kinetic and non-kinetic countermeasures, ranging from directed energy weapons and projectile interceptors to electronic warfare jamming systems and cyber-based defeat mechanisms. In military applications, anti-drone systems serve critical force protection functions, safeguarding personnel, equipment, and installations from reconnaissance drones, explosive-laden UAVs, and coordinated swarm attacks.

Beyond defense applications, civilian sectors increasingly rely on counter-drone solutions to protect critical infrastructure, public events, and commercial operations. Airports worldwide have experienced significant disruptions from unauthorized drone incursions. Major sporting venues, government buildings, correctional facilities, and energy installations now deploy integrated C-UAS systems as standard security measures, reflecting the technology's evolution from specialized military capability to essential civilian protection tool.

The benefits extend to preserving privacy, protecting intellectual property, and maintaining operational continuity across diverse sectors. Manufacturing facilities utilize anti-drone systems to prevent industrial espionage, while logistics companies protect autonomous delivery operations from malicious interference. The integration of artificial intelligence (AI) and machine learning (ML) algorithms has dramatically enhanced threat classification accuracy, reducing false alarm rates while enabling automated response protocols that minimize human intervention requirements.

Key Growth Drivers in Global Anti-Drone Market:

Several converging factors propel the anti-drone market's remarkable expansion trajectory. The increasing frequency of security breaches involving unidentified drones near critical infrastructure represents the primary growth catalyst. Technological advancement in drone capabilities paradoxically also fuels anti-drone market growth, as increasingly sophisticated, autonomous, and affordable UAVs become accessible to potential threat actors. Modern commercial drones feature enhanced flight endurance, payload capacity, obstacle avoidance systems, and encrypted communication protocols that challenge legacy detection methodologies. This technological arms race compels continuous innovation in counter-drone solutions, with vendors investing heavily in next-generation sensors, AI-driven analytics, and adaptive defeat mechanisms.

Government investment constitutes another critical growth driver, with defense budgets worldwide allocating substantial resources to counter-UAS programs. In March 2025, the U.S. Marine Corps awarded Anduril Industries a USD 642 Million contract for the Installation-Counter Small UAS (I-CsUAS) program, providing fixed-site counter-drone capabilities to Marine Corps installations globally.

The integration of AI and ML technologies represents a transformative growth enabler, with AI-powered systems delivering superior threat discrimination, automated tracking, and predictive analytics capabilities. Detection systems now process data from multiple sensors simultaneously, enabling three-dimensional airspace tracking and distinguishing between authorized commercial drones and potential threats. Software-based solutions witnessed the fastest CAGR projections in recent market analyses, enabling real-time threat assessment and coordinated multi-sensor fusion that dramatically enhances response effectiveness.

Regulatory Framework and Policy Landscape in the Anti-Drone Industry:

The regulatory environment surrounding counter-drone technologies remains complex and rapidly evolving, presenting both challenges and opportunities for market participants. In the United States, the Federal Aviation Administration (FAA) Reauthorization Act of 2024 enacted critical provisions extending FAA authorities to conduct counter-UAS testing around airports through September 2028, while establishing mechanisms for temporary flight restrictions around large public gatherings.

Congressional efforts to expand counter-UAS authorities gained momentum throughout 2024 and 2025, with multiple legislative initiatives seeking to address jurisdictional limitations and extend mitigation capabilities beyond federal agencies. The Counter-UAS Authority Security, Safety, and Reauthorization Act of 2024 (H.R. 8610), introduced by bipartisan House leadership, proposes extending existing Department of Homeland Security (DHS) and Department of Justice (DOJ) counter-UAS authorities through October 2028, while establishing pilot programs enabling select state and local law enforcement agencies to operate approved counter-UAS mitigation systems.

Current legal frameworks create significant operational constraints, as federal statutes prohibit destroying or disabling aircraft in flight and intercepting communications without explicit authorization. These restrictions limit non-federal entities from deploying most effective counter-drone technologies, creating demand for congressional action to carefully expand authorities while preserving civil liberties and privacy protections. The legislation under consideration includes robust privacy safeguards, mandated disposal of communications information, and comprehensive agency reporting requirements designed to balance security imperatives against constitutional protections.

International regulatory landscapes vary considerably, with European Union (EU) member states implementing diverse national approaches while seeking greater coordination through NATO frameworks. Countries including the United Kingdom, France, and Germany have established more permissive regulatory environments for government and military C-UAS deployment, though civilian sector adoption remains constrained by spectrum management concerns and liability considerations. Emerging markets in Asia-Pacific and Middle East regions demonstrate increasing regulatory maturity, with governments establishing clearer frameworks for counter-drone technology deployment as drone adoption accelerates.

Government Investment: Fueling the Growth of Counter-Drone Capabilities

Government agencies worldwide have launched comprehensive initiatives supporting counter-drone capability development and deployment. The U.S. Department of Defense unveiled a classified strategy in December 2024 aimed at countering unmanned systems across multiple domains, establishing unified enterprise-wide approaches to mitigate evolving threats. This strategy incorporates the Replicator 2 initiative, specifically focused on countering small drone threats to critical installations and force concentrations, with the Pentagon seeking funding in the fiscal 2026 budget request.

The Joint Counter-small UAS Office (JCO), established by the Department of Defense, coordinates counter-drone efforts across military services, conducting regular industry demonstrations and capability assessments. In fiscal year 2024, the JCO hosted demonstrations at U.S. Army Yuma Proving Ground focusing on systems capable of detecting and defeating drone swarms, while planning additional exercises emphasizing electronic warfare countermeasures for Group 3 UAS.

Top Anti-Drone Solution Providers Worldwide:

The global anti-drone market features a competitive landscape dominated by established defense conglomerates alongside specialized technology firms delivering innovative counter-UAS solutions. Some of the leading market participants include:

- RTX Corporation (formerly Raytheon Technologies) maintains significant market share through comprehensive portfolio offerings, including the Coyote kinetic interceptor system that has achieved 170 successful interceptions during operational deployments in Middle East, Africa, and European theaters. The company's advanced detection and tracking systems integrate seamlessly with broader air defense architectures, supporting both fixed-site and mobile counter-drone requirements.

- Leonardo S.p.A. has secured multiple contracts for counter-drone systems, including task orders supporting the U.S. Army's M-LIDS program. The Italian defense giant provides kinetic defeat vehicles and electronic warfare solutions, demonstrating capabilities across both detection and neutralization domains.

- Rafael Advanced Defense Systems co-develops Israel's Iron Beam laser air defense system. Iron Beam employs 100-kilowatt-class fiber lasers designed to intercept aerial threats including rockets, mortars, and drones at dramatically reduced cost-per-engagement compared to conventional interceptors.

- Dedrone Holdings, Inc. specializes in RF-based detection systems and AI-enhanced analytics platforms, protecting critical infrastructure and public events worldwide. The company introduced DedroneOnTheMove (DedroneOTM) in June 2024, a mobile counter-drone solution tailored for military and defense applications providing on-demand detection and mitigation capabilities.

Guarding the Skies: Exploring Trends, Challenges, and Opportunities in the Anti-Drone Market

Key Opportunities:

The anti-drone market presents substantial opportunities alongside formidable challenges that will shape industry evolution throughout the forecast period. Emerging market expansion represents a significant growth vector, particularly across Asia-Pacific, Middle East, and Latin American regions where drone adoption accelerates while regulatory frameworks mature.

- Technological innovation continues creating opportunities for differentiated solutions addressing evolving threat landscapes. The integration of AI and ML enables predictive analytics, behavioral pattern recognition, and automated threat classification that dramatically enhance operational effectiveness. Vendors developing modular, open-architecture platforms that support rapid sensor integration and flexible effector deployment position advantageously for government procurement programs emphasizing adaptability and cost-effectiveness.

- Commercial sector adoption presents untapped potential as enterprises recognize counter-drone systems as risk mitigation tools protecting intellectual property, ensuring operational continuity, and safeguarding personnel. Industries including energy, telecommunications, logistics, and entertainment increasingly deploy counter-drone capabilities, expanding market addressable base beyond traditional defense and government customers.

Overcoming Major Challenges in Anti-Drone Technology:

- Regulatory complexity and legal constraints create substantial barriers, with many jurisdictions imposing strict limitations on technologies that interfere with drone operations, particularly in civilian airspace. The lack of standardized international regulations generates confusion and inconsistency, complicating multinational deployments and increasing compliance costs.

- Technological limitations persist despite rapid advancement, as evolving drone capabilities outpace detection and defeat methodologies. Small, low-altitude drones operating in urban environments present detection challenges for conventional radar systems, while sophisticated jamming-resistant communication protocols complicate electronic warfare approaches. The emergence of autonomous drone swarms employing distributed coordination algorithms represents an escalating challenge requiring advanced multi-target tracking and simultaneous engagement capabilities.

- Cost considerations limit widespread adoption, particularly for smaller entities and developing markets. High-end counter-drone systems requiring advanced sensors, sophisticated signal processing, and kinetic interceptors demand substantial capital investment, ongoing maintenance expenditure, and specialized operator training. The cost-per-engagement for kinetic interceptors remains prohibitive when confronting inexpensive commercial drones converted to weapons platforms, driving demand for directed energy and electronic warfare solutions offering more favorable cost-exchange ratios.

- False positive rates in densely populated urban environments with complex RF signatures pose operational challenges, with legitimate commercial drone activities potentially triggering unnecessary responses. Striking appropriate balances between security requirements and civil liberties protections while minimizing collateral impacts demands sophisticated discrimination capabilities and carefully calibrated response protocols.

Soaring into Future: How Anti-Drone Technologies Will Shape Global Security

The global anti-drone market stands at a critical inflection point, transitioning from nascent capability development to essential security infrastructure supporting military operations, critical infrastructure protection, and civilian safety worldwide. The counter-drone industry represents one of the defense and security sector's most dynamic growth segments, driven by converging technological innovation, escalating threat environments, and expanding government investment.

Success in this rapidly evolving market demands sustained focus on technological advancement, particularly AI-driven analytics and directed energy solutions that offer cost-effective defeat mechanisms against proliferating drone threats. Regulatory advocacy remains critical, with industry stakeholders collaborating with government agencies to establish frameworks enabling responsible counter-drone technology deployment while preserving civil liberties and supporting legitimate drone operations.

As unmanned systems become increasingly integral to both commercial operations and military campaigns, the organizations and nations that successfully develop, deploy, and operationalize sophisticated counter-drone capabilities will secure decisive advantages protecting critical assets, ensuring operational continuity, and maintaining security in an increasingly contested aerial domain. The future belongs to those who can effectively balance innovation, regulation, and operational effectiveness in confronting the persistent and evolving drone challenge.

Choose IMARC Group As We Offer Unmatched Expertise and Core Services:

- Comprehensive Market Intelligence: In-depth research on anti-drone market dynamics, detection systems, electronic warfare solutions, and emerging threats across global regions.

- Strategic Forecasting and Trend Analysis: Anticipate developments in counter-UAS technologies, including AI-driven detection, directed energy weapons, and regulatory shifts, aiding proactive planning and investment.

- Competitive Benchmarking and Intelligence: Evaluate competitive positioning, product pipelines, and technological advancements in radar systems, RF detection, and kinetic/non-kinetic defeat methods.

- Regulatory and Policy Advisory Services: Navigate evolving regulatory frameworks and anticipate policy changes impacting market access and operational strategies.

- Customized Reports and Consulting Solutions: Tailored insights aligned with your goals, whether for infrastructure protection, investment opportunities, or market entry strategies.

At IMARC Group, we empower defense, security, and commercial sectors to navigate the anti-drone market and turn security challenges into strategic advantages.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)