How is the Global Toys Market Evolving in the Age of Tech and Sustainability?

A Transformative Overview of the Toys Market:

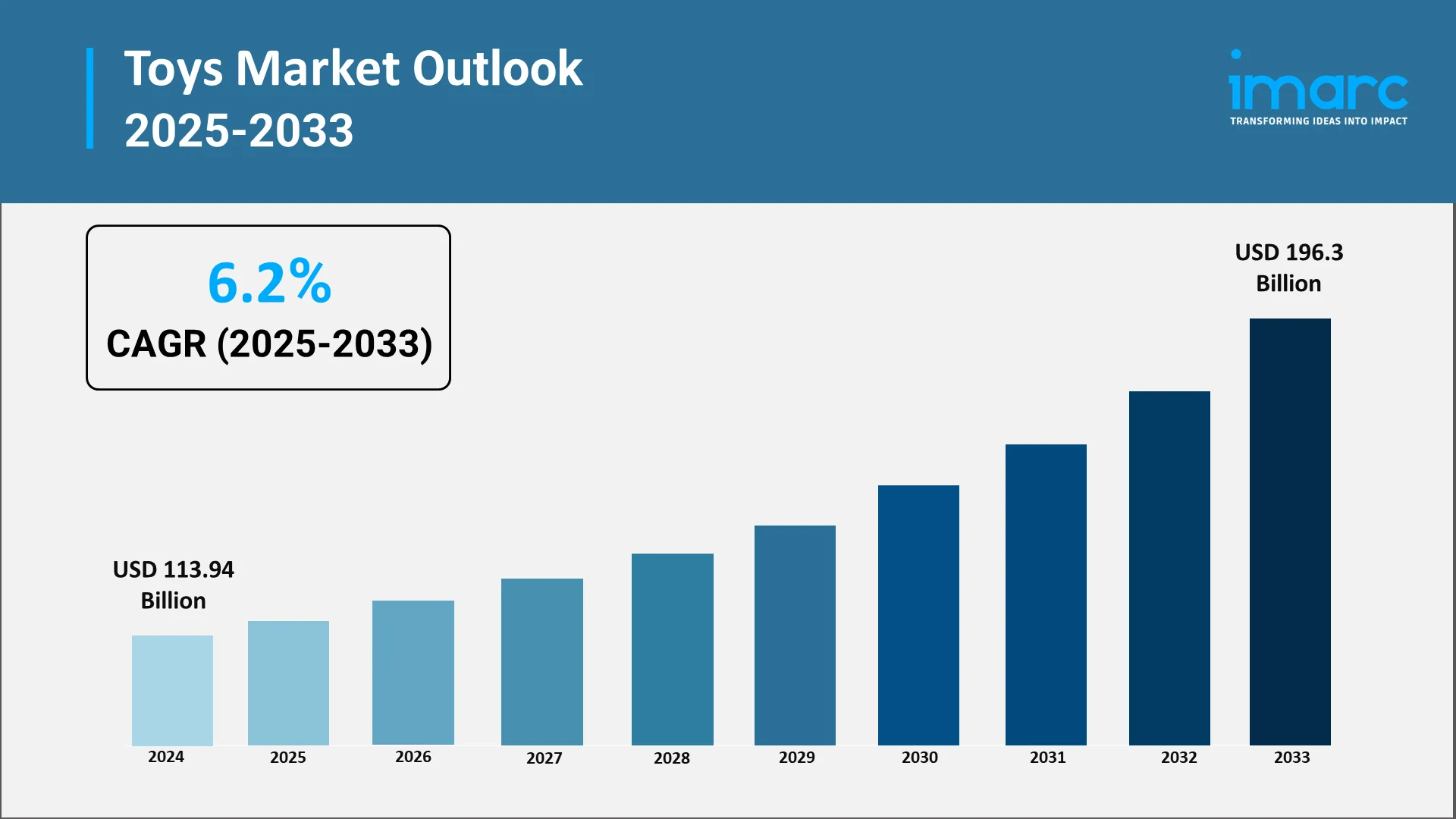

The global toys market plays a crucial role as toys fundamentally support child development by fostering creativity, cognitive skills, and social interaction. In 2024, the global toys market was valued at USD 113.94 Billion. This market is currently experiencing a profound transformation, driven by several key factors. Digital innovations like augmented reality (AR), virtual reality (VR), and app-based play are reshaping traditional play behaviors. At the same time, increasing focus on sustainability is impacting product design, material sourcing, and packaging, compelling manufacturers to become more environmentally friendly. In addition, changing educational philosophies are significantly influencing toy development, resulting in a growing need for STEM-oriented and learning-based play experiences, thus broadening the STEM toys market.

Explore in-depth findings for this market, Request Sample

Strategic Trends Shaping the Toys Industry:

- The "Kidfluencer" Effect

The "Kidfluencer" effect is a significant trend reshaping the global toy market, driven by the pervasive influence of social media, streaming content, and major movie blockbusters. This phenomenon revolves around "kidfluencers"—children who have gained massive online followings by unboxing, reviewing, and playing with toys on platforms like YouTube and TikTok. This authentic, peer-to-peer content, which resonates strongly with young audiences, directly impacts toy sales by generating buzz and creating "must-have" desires. Consequently, toy brands now partner directly with these creators, timing launches with big releases and viral moments. Furthermore, successful movie franchises and animated series often lead to a surge in licensed merchandise, as children seek to engage with their favorite characters beyond the screen. This convergence of digital entertainment and licensed products significantly shapes purchasing decisions, drives market acceleration, and keeps demand strong. While critics warn that kidfluencer content can blur the line between play and ads, raising trust questions, the impact on sales is clear, with parents also paying attention to highlighted safety and educational benefits.

- The Rise of the "Kidult"

The "Kidult" phenomenon is a thriving and powerful niche in the international toy market, where adults are increasingly buying toys for themselves. The phenomenon is driven by a blend of nostalgia, the need for relaxation, and the growing appeal of collectibles tied to popular culture brands. Adults, who often have higher disposable incomes than the conventional child consumer, desire premium, limited-release, and retro-themed toys. This age group's buying power and constant year-round spending habits generate a secure and substantial revenue source for toy companies, influencing product design and marketing trends that are geared specifically to this mature, but playful, population.

- Parental Focus on STEAM

With growing emphasis on the importance of early education, parents are actively investing in toys that promote STEAM (Science, Technology, Engineering, Arts, and Math skills). These toys are designed to foster problem-solving, creativity, and analytical thinking in a fun and engaging way. From coding robots to chemistry kits and artistic building sets, the market is expanding to meet demand for both play and learning. Toy manufacturers are aligning products with educational standards and collaborating with educators to enhance credibility. This shift in consumer preference is a major driver of growth in the educational toys market.

- Economic Factors

The growth of the global toy industry is strongly influenced by rising disposable incomes and government-led economic stimulus programs. As household spending increases, consumers become more inclined toward purchasing premium and branded toys. Additionally, pandemic-era stimulus packages in several economies injected funds, indirectly stimulating consumer goods sales, including toys and games. This financial uplift has allowed more families to explore new categories, such as tech-based or educational toys, widening the consumer base. These economic tailwinds continue to support expansion across the toys and games market.

Exploring the Global Toys Market: Product, Age, and Sales Channel Segments

Major Product Categories:

- Sports and Outdoor Toys: In 2024, sports and outdoor toys led the market with a 21.9% share, reflecting growing consumer preference for active play. Products in this segment include bicycles, scooters, trampolines, and sports kits designed to promote physical activity and social interaction. Parents are increasingly opting for toys that help balance screen time with outdoor engagement. The category benefits from long product lifespans and wide appeal across age groups, often becoming central to family gatherings and group play. As wellness-focused parenting gains traction, this segment continues to drive consistent demand in the global toys market.

- Action Figures: Popular among children who enjoy imaginative storytelling, action figures remain a staple in the market. Often linked with popular media franchises, these toys encourage narrative play and collectability. Licensing partnerships with entertainment companies fuel recurring demand and seasonal sales peaks, especially around movie or series releases.

- Building Sets: Designed to stimulate logic, creativity, and problem-solving, building sets appeal to both individual and collaborative play. With a strong foothold in educational and STEM-focused households, these toys cater to parents seeking both fun and cognitive value. Iconic brands in this category frequently release themed editions to sustain engagement.

- Dolls: Dolls continue to hold cultural and developmental significance across global markets. Beyond traditional play, modern dolls now represent diversity, inclusivity, and career aspirations. Their popularity is reinforced through multimedia campaigns and related accessories, promoting both imaginative and social play.

- Games and Puzzles: This segment targets both recreational and educational needs, ranging from board games and card games to logic-based puzzles. Designed for multiple players, these toys foster family bonding and critical thinking. Their popularity surged post-pandemic and remains high due to their social and educational appeal.

- Plush Toys: Known for emotional comfort and collectability, plush toys are favored by younger children and collectors alike. Often themed around licensed characters or trending aesthetics, these toys continue to perform well in gifting scenarios and early childhood markets.

Age Group Analysis:

- Up to 5 Years: This segment includes toys designed to support early sensory development, motor skills, and language acquisition. Items such as soft toys, stacking blocks, and sound-generating devices dominate. Safety, educational value, and durability are key purchase criteria for parents in this age bracket.

- 5 to 10 Years: Capturing the largest market share of 42.7% in 2024, this group represents the most dynamic segment in the industry. Children at this stage show advanced creativity, curiosity, and skill development, making them ideal consumers for building kits, role-play sets, puzzles, and STEM-based toys. Their preferences are shaped by school activities, peer interactions, and digital media, prompting brands to offer engaging, educational, and multimedia-integrated products.

- Above 10 Years: Toys for this age group cater to advanced interests such as strategy games, robotics, coding kits, and hobby-based collections. This segment is increasingly influenced by trends in technology, social media, and educational enrichment. Products targeting this group often blend entertainment with practical learning outcomes and tech-savvy interfaces.

Sales Channel Overview:

- Specialty Stores: Leading the market with a 30.5% share in 2024, specialty stores provide a curated shopping experience with knowledgeable staff, educational offerings, and exclusive collections. These outlets emphasize quality, safety, and interactive displays, making them a go-to choice for parents seeking value beyond price. Themed store environments and tailored recommendations enhance shopper engagement, driving repeat visits.

- Supermarkets and Hypermarkets: These large retail formats offer a wide range of toys at accessible price points, often appealing to value-driven consumers. Their broad product visibility, combined with high foot traffic and seasonal promotions, supports strong impulse buying behavior.

- Department Stores: Department stores continue to hold relevance through curated toy sections, loyalty programs, and bundled gift options. Their integrated retail approach appeals to families making multiple purchases across categories, especially during holiday seasons.

- Online Stores: With increasing internet penetration and mobile adoption, online platforms offer unmatched convenience, product variety, and competitive pricing. Personalized recommendations, quick delivery, and exclusive online discounts are driving higher engagement. E-commerce also empowers smaller brands and global players to reach new audiences, reshaping the retail landscape.

- Others: This includes local toy shops, temporary pop-up stores, educational institutions, and mail-order catalogs. While their individual reach may be limited, they serve specific markets and niche segments effectively.

Key Regional Markets and Growth Trajectories:

North America:

In 2024, North America accounted for the largest share of the global toys market at 39.9%, supported by high consumer spending, strong brand loyalty, and a well-established retail ecosystem. High disposable incomes, strong e-commerce infrastructure, and a deep-rooted gifting culture fuel steady demand. Parents in this region prioritize educational value, product safety, and brand credibility. Additionally, North America is an early adopter of digital and connected toys, with companies introducing voice-enabled, AR-integrated, and app-connected offerings. Seasonal trends, such as holiday gifting and back-to-school campaigns, continue to drive volume and innovation.

Asia-Pacific:

The fastest-growing region in the global toys market, Asia-Pacific is powered by a large youth population, increasing urbanization, and rising middle-class income levels. Markets like China, India, and Indonesia are at the forefront of demand for licensed character toys, affordable electronics, and educational products. For instance, in April 2025, Infinity Toy Tronics launched Cricket Icons, India’s first officially licensed IPL collectibles, featuring highly accurate miniature figurines of players from Mumbai Indians, Kolkata Knight Riders, Rajasthan Royals, and Gujarat Titans. Government programs encouraging early childhood development and digital learning also play a role. The rapid shift toward mobile-first commerce, combined with flexible payment methods and localized content, is transforming how families discover and purchase toys in the region.

Europe:

Europe is a mature, innovation-driven market where sustainability, safety, and educational impact are top priorities. Consumers are increasingly drawn to eco-friendly materials, STEM-oriented products, and culturally inclusive toys. For instance, in May 2024, Liledu, a Lithuanian eco-friendly toy subscription service, announced its plans to expand into the UK with a €500,000 investment. The company, which provides Montessori-based wooden toys, aims to reduce the environmental impact of the toy industry. Liledu has already proven successful in Lithuania, delivering 60,000 toys to date. Premium European brands benefit from strong regulatory standards and consumer trust. Holiday seasons such as Christmas and school breaks remain high-sales periods, while growing interest in experiential toys and interactive tech has led to category reinvention. Cross-border online retail further expands access to niche and premium offerings.

Latin America:

Latin America demonstrates steady growth, supported by improving economic conditions, urban migration, and expanding retail infrastructure. Brazil and Mexico dominate regional demand, particularly in educational and affordable toy segments. While traditional toys remain popular, there is growing interest in digital integration and media-licensed products among urban youth. Online retail is expanding reach, but price sensitivity continues to influence purchasing behavior, prompting brands to balance innovation with affordability.

Middle East and Africa:

With a young and growing population, the Middle East and Africa represent emerging opportunities in the global toys market. Rising demand for baby toys, educational kits, and development-focused products reflects greater parental involvement in early learning. Countries like the UAE and South Africa are witnessing increased sales of premium brands, while broader regions remain focused on accessible pricing. Retail expansion, increased smartphone penetration, and global brand entry are reshaping consumer expectations and driving more structured growth across the region.

Global Toy Market Forecast 2025-2033: Powered by Tech Innovation

The global toys market is projected to reach an estimated size of USD 196.3 Billion by 2033, with a compound annual growth rate (CAGR) of 6.2% during the forecast period (2025-2033), driven significantly by ongoing technological advancements. Artificial intelligence (AI) and machine learning (ML) are poised to revolutionize play by enabling highly personalized and adaptive experiences. For manufacturers, this necessitates significant investment in data analytics capabilities, advanced software development, and specialized talent to design and continuously refine these intelligent play experiences. Furthermore, the increasing accessibility of 3D printing will empower consumers with unprecedented customization options. This allows for the creation of unique, personalized toys on demand, fostering creativity and potentially disrupting traditional manufacturing and distribution models by enabling bespoke products. Finally, the thriving metaverse presents a new frontier for digital toys and immersive brand engagement. Virtual worlds offer expansive opportunities for digital collectibles, interactive play environments, and novel avenues for brand interaction, expanding the very definition of a "toy" and driving new revenue streams. These innovations collectively underpin the anticipated growth in global toy sales.

Conclusion:

The global toys market is experiencing a fundamental metamorphosis. Its future is characterized by smart, personalized play experiences driven by AI and machine learning, alongside a strong commitment to sustainability in production. The expanding digital frontier of the metaverse also offers novel avenues for brand engagement and digital toy development.

The industry's success will ultimately be defined by its ability to embrace these innovations while preserving the fundamental value of play in fostering creativity and development.

For a comprehensive analysis of these transformative trends and detailed market insights, explore or purchase the full report from IMARC Group. Click here to learn more: https://www.imarcgroup.com/toys-market.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)