Toys Market Size, Share, Trends and Forecast by Product Type, Age Group, Sales Channel, and Region, 2026-2034

Toys Market Size, Share, Growth, & Forecast Report:

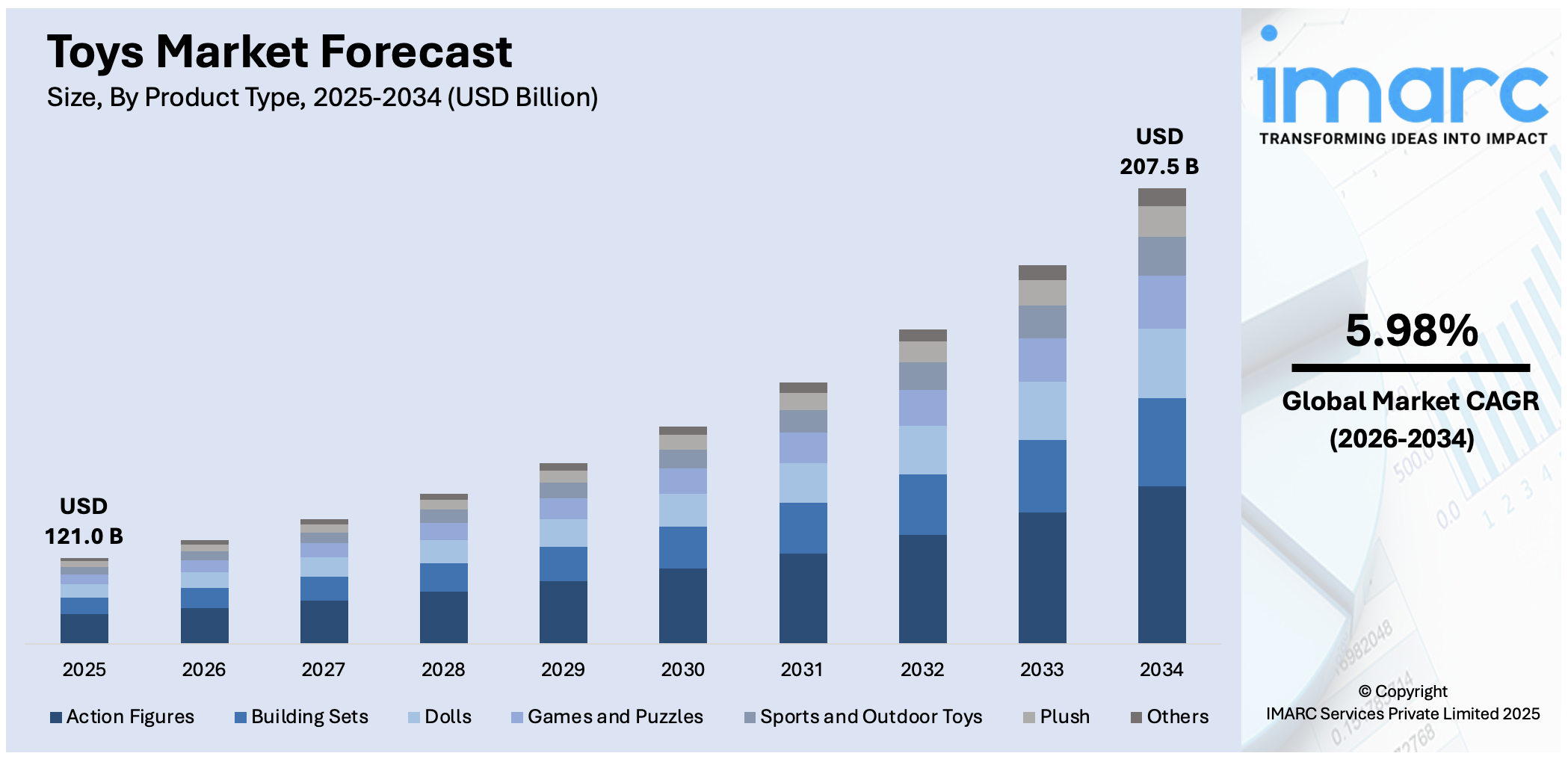

The global toys market size was valued at USD 121.0 Billion in 2025 and is projected to reach USD 207.5 Billion by 2034, growing at a CAGR of 5.98% during 2026-2034. In 2025, North America emerged as the leading region in the industry, accounting for over 39.9% of the global toys market share. The changing consumer preferences, increasing investment on quality and educational toys, and growing parental awareness about the importance of the toys industry share.

- Product Type: Sports and outdoor toys dominate due to growing interest in physical activity and active play.

- Age Group: Children aged 5 to 10 years represent the largest consumer group.

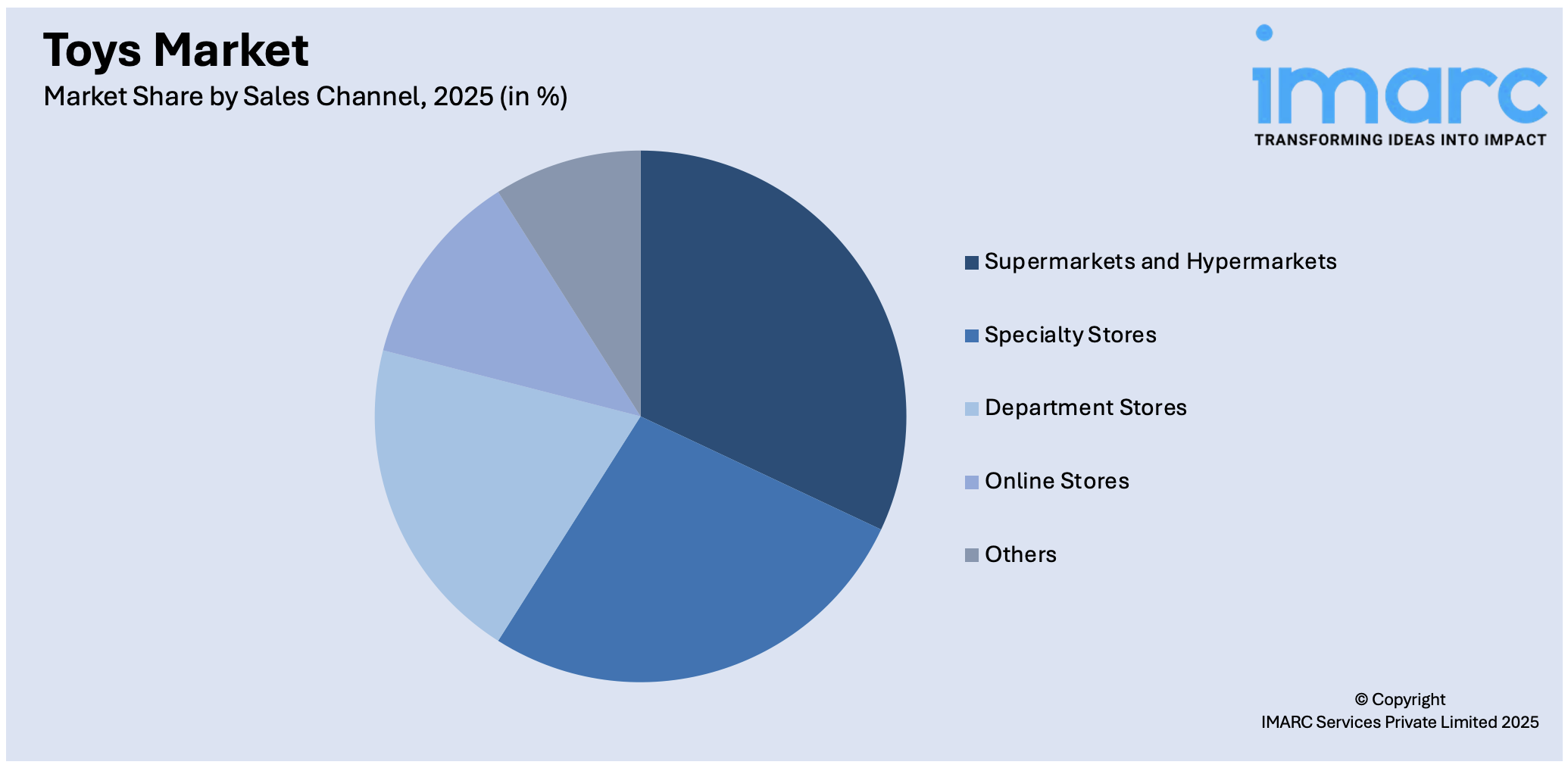

- Sales Channel: Specialty stores are the leading distribution channel, offering a wide and curated range of toys.

- Region: North America holds the largest market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 121.0 Billion |

|

Market Forecast in 2034

|

USD 207.5 Billion |

| Market Growth Rate 2026-2034 | 5.98% |

Innovation and technology play a major role, with smart toys, AR/VR features, and STEM-based learning products gaining popularity. Pop culture influences, such as movies, TV shows, and social media, fuel the demand for licensed merchandise and character-based toys. Growing disposable incomes allow consumers to purchase more varied and high-quality toys, particularly in emerging nations. Parents are also prioritizing educational and developmental value, seeking toys that enhance creativity, motor skills, and cognitive growth. Additionally, the rapid growth of e-commerce has expanded market access, allowing easy comparison, broader choices, and convenient delivery. Sustainability trends and safety concerns are also shaping buying preferences, encouraging manufacturers to innovate with eco-friendly and safe materials.

To get more information on this market Request Sample

In the United States, the toys market is driven by strong consumer spending, driven by high disposable income and a culture of gift-giving. Popular media and entertainment franchises play a major role, with licensed toys based on movies, TV shows, and games in high demand. Parents increasingly value educational and STEM-based toys that support child development. E-commerce growth and omnichannel retailing have also made toy shopping more convenient and accessible. Additionally, trends toward sustainability and safety influence purchasing decisions, prompting brands to offer eco-friendly and non-toxic options. Social media and influencer marketing further fuel interest and drive purchasing behavior. For instance, in September 2024, Macy’s and Toys“R”Us® started the holiday season by revealing Geoffrey’s Hot Toy List for 2024, showcased the trendiest toys for all ages and preferences. This year's compilation features 150 of the most desired toys for the 'Toys R Us' enthusiast in each of us, showcasing beloved brands such as Barbie®, Hot Wheels, Pokémon, LEGO®, Bluey, and others. Notable features consist of a Toys“R”Us® exclusive Geoffrey accompanied by a Christmas Tree FUNKO, in addition to beloved brands made by Toys“R”Us, such as Fast Lane, You & Me, Animal Zone, and others. Customers will additionally discover unique toys from leading brands such as Transformers, Teenage Mutant Ninja Turtles, Littlest Pet Shop, and others, available solely at Toys“R”Us within Macy’s.

Toys Market Trends:

Rising “Kidult” Demand

The emergence of “kidults,” consumers aged 15 and above, is transforming the toys market and reshaping toys industry trends. This segment is driven by nostalgia, stress relief, and collectible culture. From action figures and LEGO sets to board games and pop culture merchandise, manufacturers are catering to adult buyers seeking both entertainment and display-worthy items. In the U.S. alone, adult toy sales reached USD 1.5 Billion in Q1 2024, while European kidult toys purchases exceeded USD 4.8 Billion in 2023, highlighting the segment’s growing commercial importance. Brands are increasingly collaborating with franchises, artists, and designers to release limited-edition toys that appeal to this demographic. As fandom culture gains mainstream appeal, retailers are expanding offerings for this lucrative audience.

Growth of Educational and STEM Toys

Educational and STEM toys are witnessing accelerated growth as parents and educators prioritize hands-on learning alongside sustainability. Increasing demand for eco friendly toys made from sustainable and non-toxic materials is also influencing purchasing decisions, reflecting growing environmental awareness among consumers. These toys help build critical thinking, problem-solving, and coding skills in a fun and engaging way. Robotics kits, science experiments, and math-based puzzles are gaining popularity across age groups, especially amid the rising adoption of homeschooling and digital learning tools. The trend aligns with a broader shift toward future-ready skill development, making STEM toys attractive to both consumers and institutions. Brands are integrating gamification, augmented reality (AR), and app connectivity to enhance interactivity. This segment is increasingly supported by government and school initiatives aimed at improving early STEM education, contributing to consistent market demand.

Influence of Pop Culture and Media Franchises

Pop culture continues to exert a powerful influence on toy trends. Toys based on blockbuster films, popular streaming series, video games, and viral social media characters consistently dominate retail sales. From Marvel and Star Wars to Minecraft and Stranger Things, licensed merchandise fuels fan engagement and cross-generational appeal. Media franchises offer ready-made narratives and characters that deepen the emotional connection with consumers, particularly children and kidults. Toy makers increasingly time releases with movie premieres and TV show launches to maximize visibility. This convergence of entertainment and play not only boosts sales but also creates collectible opportunities that expand the toy’s lifecycle beyond traditional playtime.

Toys Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global toys market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, age group, and sales channel.

Analysis by Product Type:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

Sports and Outdoor Toys stand as the largest product type in 2025, holding around 21.9% of the market. According to the toys market outlook, the emphasis on physical activity and a healthy lifestyle among parents and caregivers drives the demand for outdoor and sports-related toys. These toys encourage children to engage in active play, fostering physical development and well-being. Additionally, the allure of outdoor and sports toys lies in their ability to provide a diverse range of experiences. From traditional sports equipment, like bicycles, soccer balls, and basketball hoops, to innovative products, such as water play sets and adventure gear, this segment caters to a broad spectrum of preferences and age groups. Moreover, the enduring appeal of outdoor play transcends generational shifts, making these toys timeless investments for families.

Analysis by Age Group:

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

5 to 10 years leads the market with around 42.7% of market share in 2025. According to the toys industry overview, this age range is characterized by a crucial phase of cognitive and physical development, during which children are highly receptive to learning through play. As children transition from early childhood to pre-adolescence, they actively engage in exploring their surroundings, honing their motor skills, and developing their social abilities. Within this age bracket, children are more capable of comprehending complex concepts and engaging in imaginative play scenarios, making them a prime audience for a wide variety of toys. Educational toys that stimulate creativity, critical thinking, and problem-solving are particularly sought after by parents aiming to enhance their child's cognitive growth. Furthermore, children aged 5 to 10 are typically at school age, and the toys designed for this group often complement educational curricula, aligning playtime with learning objectives. This makes the 5 to 10 years segment a pivotal target for educational and skill-enhancing toys, propelling its status as the largest category in the market breakup by age group.

Analysis by Sales Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

Specialty stores lead the market with around 30.5% of market share in 2025. Specialty stores are dedicated to offering a curated selection of toys, often focusing on specific categories or niches that cater to diverse customer demands. This specialization allows them to provide in-depth product knowledge, personalized recommendations, and an immersive shopping experience. Customers seeking a wide variety of toys, from educational and innovative options to niche collectibles, are drawn to specialty stores for their comprehensive offerings. The hands-on interaction with products and the expertise of store staff contribute to informed purchasing decisions, fostering customer loyalty. Moreover, specialty stores often foster a sense of community among enthusiasts and collectors, enhancing the overall shopping experience. This personalized approach and ability to cater to unique interests set specialty stores apart from other sales channels, making them a preferred destination for discerning consumers seeking quality, variety, and expertise in their toy purchases.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 39.9%. According to the toys market statistics, North America’s relatively high disposable income levels and consumer spending power enable parents to invest significantly in toys that cater to their children's entertainment and educational needs. For instance, according to Statista, in 2019, the average amount spent on toys per child in North America was USD 300. Furthermore, North American parents prioritize quality, safety, and innovation when selecting toys for their children, driving demand for a diverse range of products. The region's cultural emphasis on early childhood development and education has led to a strong demand for educational and STEM-focused toys, which align with modern learning trends. Additionally, the presence of established toy manufacturers, licensing agreements with popular media franchises, and a robust retail infrastructure contribute to the market's growth. Furthermore, North America's multicultural population contributes to a diverse range of preferences, driving the demand for various types of toys that cater to different tastes and backgrounds. These factors collectively establish North America as a thriving market for toys, attracting manufacturers and retailers aiming to tap into the region's economic stability and consumer-driven demand.

Toys Market Regional Takeaways:

Toys Industry Analysis in the United States

In 2025, the United States accounted for over 93.00% of the toys market in North America. The U.S. toys industry is growing due to increasing demand for educational and interactive toys, evolving digital gaming trends, and licensing collaborations with entertainment franchises. In line with this, parents are prioritizing STEM and STEM-based toys, particularly coding kits and robotics, to support skill-building play experiences. The growing popularity of blockbuster movies, TV shows, and digital content creators is strengthening demand for licensed toys, with major brands launching collectibles and action figures tied to popular media. Similarly, the ongoing shift to e-commerce and direct-to-consumer (DTC) models is transforming toy retail, enabling brands to reach consumers more efficiently. According to the 2025 Digital Commerce 360 Report, U.S. ecommerce sales have grown annually, accounting for at least 20% of retail sales since 2020, with over USD 500 Billion in 2024 from North America’s two largest online retailers. Subscription-based toy services are gaining popularity, offering curated play experiences. Additionally, sustainability trends are shaping purchasing decisions, with companies focusing on eco-friendly materials, recyclable packaging, and ethically sourced products. Moreover, consumers are increasingly choosing environmentally responsible toys, reinforcing a market shift toward sustainable and educational play options.

Toys Industry Analysis in Europe

The European toys market is expanding due to rising demand for eco-conscious toys, digital gaming trends, and strict industry regulations. Similarly, parents increasingly prefer sustainable, plastic-free, and biodegradable toys, pushing brands to use recyclable and ethically sourced materials. According to industry surveys, 90% of UK parents are concerned about toxic chemicals in baby products, with 89% believing they should be banned. This awareness is prompting manufacturers to develop safer, eco-friendly toys. Meanwhile, augmented reality (AR) and AI-powered interactive toys are transforming play experiences, thereby impelling the market. A European Parliament report highlights children's AI usage in apps, toys, and games, while a 2024 UK survey found 77.1% of 13-18-year-olds use generative AI, twice as likely as adults, primarily for homework assistance and entertainment. Furthermore, educational toys remain in high demand, driven by government-backed early childhood learning initiatives. Premium craftsmanship and heritage branding continue to thrive in Germany, France, and the UK, where traditional toys hold strong appeal. Additionally, second-hand toy marketplaces and circular economy models are reshaping consumer behavior, encouraging brands to adopt reusable materials, rental models, and recycling programs, reinforcing Europe’s leadership in sustainable and innovative toy manufacturing.

Toys Industry Analysis in Asia Pacific

The Asia Pacific toys market is experiencing robust growth, driven by increasing disposable incomes, a rising middle class, and changing consumer preferences in emerging economies. According to reports, by 2033, 18 Asia Pacific megacities will see over 50% growth in disposable income, with Delhi leading India at 73%, while Bangalore remains the most affluent city. The number of developing cities with USD 50 Billion+ markets is expected to nearly double, driving demand. Countries like India, China, and Japan are major contributors to the market, with a growing demand for both traditional and electronic toys, including educational and interactive products. The increasing focus on safety standards, along with the popularity of licensed characters from films, TV shows, and video games, is further fueling market expansion. Additionally, the growing trend of online retail, particularly in e-commerce, is making toys more accessible to a broader audience, contributing to the market's growth. Innovations in technology, such as augmented reality (AR) and virtual reality (VR) toys, are also gaining traction, appealing to tech-savvy younger generations. Overall, the Asia Pacific toys industry is poised for continued expansion, supported by strong consumer demand, technological advancements, and evolving market dynamics.

Toys Industry Analysis in the Latin America

The Latin America toys market is being driven by several key factors, including the growth of the middle class and rising disposable incomes, particularly in countries like Brazil and Mexico. The middle class in Latin America grew 50%, and now represents 30% of the population. As the middle class expands, families have more purchasing power, leading to increased spending on toys, especially for educational and entertainment purposes. Additionally, rising urbanization is contributing to greater demand in cities, where both traditional toys and newer, tech-driven products, such as interactive and educational toys, are becoming more popular. The increasing influence of digital platforms and e-commerce also plays a significant role in making toys more accessible to a wider consumer base, further boosting market growth.

Toys Industry Analysis in the Middle East and Africa

The market in the Middle East and Africa is witnessing growth driven by increasing investments in entertainment infrastructure, growing demand for educational toys, and developing retail landscapes. Furthermore, countries like the UAE and Saudi Arabia are heavily investing in theme parks, family entertainment centers, and toy retail stores, augmenting toy sales. The demand for STEM-based and bilingual educational toys is rising, particularly in North Africa and the Gulf, where parents seek interactive learning tools. Additionally, expanding modern retail chains, toy stores, and online platforms are making toys more accessible. As of the fourth quarter of 2024, the Kingdom now has 40,953 registered e-commerce businesses, marking a 10 percent year-on-year increase. Besides this, international toy brands are expanding through licensing agreements, while seasonal sales linked to Eid and Christmas continue to shape purchasing behaviors, driving demand for high-quality and culturally relevant toys.

Top 10 Toy Industry Companies:

The toys market is highly competitive, featuring a mix of global giants, niche brands, and emerging startups. The major market players dominate with strong brand portfolios and licensed partnerships. Retail collaborations, such as Toys“R”Us at Macy’s, add strategic strength. Innovation, product differentiation, and digital integration are key competitive factors, especially in STEM and interactive toys. E-commerce platforms intensify competition by lowering entry barriers for new brands. Additionally, sustainability and safety have become vital differentiators. Companies must constantly adapt to shifting consumer preferences, media trends, and seasonal demands to maintain market share and relevance.

The report provides a comprehensive analysis of the top companies & brands in the toys market with detailed profiles of all major companies, including:

- Bandai Namco Toys & Collectibles America Inc.

- Clementoni Spa

- Funskoolindia

- Goliath

- Hasbro

- Mattel, Inc.

- Moose Toys

- Playmobil

- Ravensburger AG

- Simba Dickie Group

- Spin Master

- The LEGO Group

- TOMY Company, Ltd.

Latest News and Developments:

- January 2025 : The toy industry grew 6% in dollar sales and 3% in units sold from January to April 2025, making it the fastest-growing sector early in the year. Adult toy sales (18+) increased 12% in Q1 2025, reaching USD 1.8 Billion, driven by collectibles like Pokémon trading cards, which 19% of adults purchased recently. Growth was seen across categories such as games, puzzles, building sets, and action figures. Pricing trends show a polarized market, with consumers either trading up or choosing less expensive toys amid inflation and tariff concerns.

- January 2025: Ed-a-Mamma, expanded its portfolio by launching sustainable toys and accessories like plush toys, dolls, sling bags, and handcrafted hair accessories. Priced between INR 799 to INR 3,999, the collection is available on the brand’s website and retail stores across India.

- November 2024: Trends UK and Pat Avenue announced a strategic merger to strengthen their UK toy market position. The collaboration enhances product integration, geographic synergies, and operational efficiency. Both companies remain committed to delivering high-quality, educational toys while ensuring a smooth transition for customers and suppliers.

- September 2024: Funskool India launched a special range of toys and games for infants, preschoolers, and older children. New products include Pour & Play Octopus, Junior Chef’s Playset, Colour Clash Launchers, Country Games, Murder Mystery puzzles, and Sofdough-Colour Up, promoting holistic child development through interactive and educational play.

- August 2024: The Toy Association and People of Play (POP) announced a merger, integrating CHITAG Fair, TAGIE Awards, and innovation events into the Association’s portfolio. POP founder joins as a senior leader, enhancing industry creativity, consumer engagement, and inventor collaboration, strengthening the global toy and game community.

- August 2024: Incredible Group added three new toys to its Squishi lineup: SOUR PATCH KIDS, OREO, and SWEDISH FISH. Each Squishi product is crafted to ensure maximum squishiness and durability for stress relief or sensory play.

Toys Market Research Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others |

| Age Groups Covered | Up to 5 Years, 5 to 10 Years, Above 10 Years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bandai Namco Toys & Collectibles America Inc., Clementoni Spa, Funskoolindia, Goliath, Hasbro, Mattel, Inc., Moose Toys, Playmobil, Ravensburger AG, Simba Dickie Group, Spin Master, The LEGO Group, TOMY Company, Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the toys market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global toys market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the toys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global toys market was valued at USD 121.0 Billion in 2025.

The toys market is projected to grow at a CAGR of 5.98% during 2026-2034, reaching a value of USD 207.5 Billion by 2034.

In 2025, North America dominated the toys market, holding over 39.9% of the global market share.

Key players in the global toys market include Bandai Namco Toys & Collectibles America Inc., Clementoni Spa, Funskoolindia, Goliath, Hasbro, Mattel, Inc., Moose Toys, Playmobil, Ravensburger AG, Simba Dickie Group, Spin Master, The LEGO Group, and TOMY Company, Ltd.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)