Top Real Estate Market Trends Shaping Residential and Commercial Sector

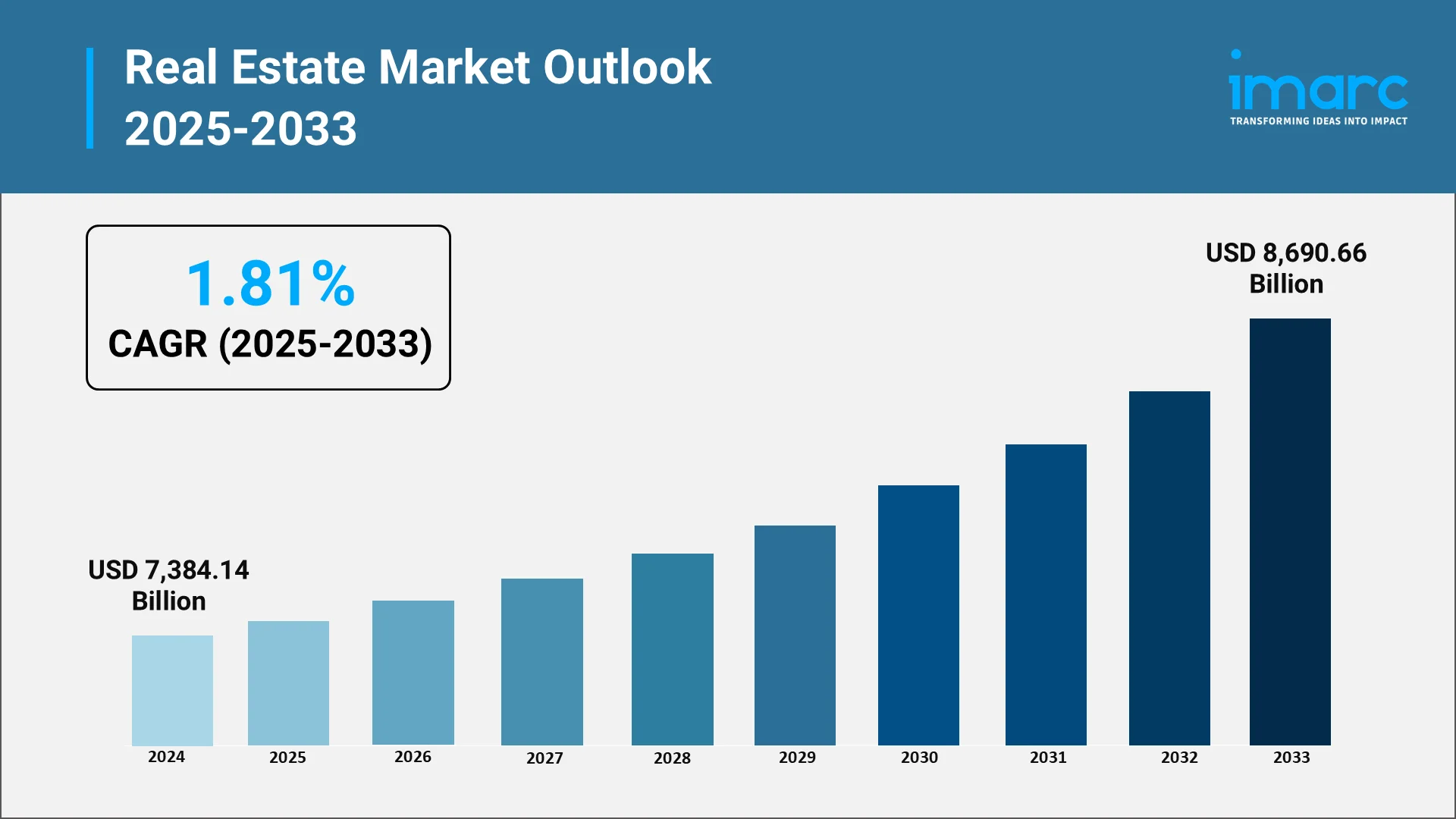

The real estate sector plays a critical role in driving economic growth and shaping communities. It significantly contributes to national economies by generating jobs, influencing investment flows, and boosting government revenues through taxes. Beyond these economic benefits, real estate development directly affects the quality of life by creating homes, enhancing infrastructure, and revitalizing urban areas. Development in real estate also attracts businesses and skilled workers, making regions economically attractive and competitive. Additionally, the industry aids in supporting financial markets, given its extensive linkages to banking, construction, and related services. Trends like digital integration, sustainable design, and suburban expansion demonstrate how dynamic the sector remains in responding to societal needs and technological advancements. Thus, a thriving real estate market is indispensable not only as a measure of economic stability, but also as a foundational element in the overall growth and resilience of modern economies. According to the IMARC Group’s research report, the global real estate market was valued at USD 7,384.14 Billion in 2024.

Explore in-depth findings for this market, Request Sample

Key Trends Transforming the Real Estate Industry:

High-End Residential Demand Stays Strong

Demand for mid- and high-end residences remains robust on account of inflating incomes, urban migration, and evolving lifestyles. According to the United Nations Economic and Social Council, the global population is becoming increasingly urbanized, with nearly 58% living in urban regions in 2024. Moreover, numerous buyers favor more spacious homes, improved amenities, and safe gated neighborhoods, encouraging developers to concentrate on high-quality projects in top areas. Aspirational purchasers are also more inclined to spend on high-end amenities and eco-friendly designs, viewing homes as both essential and a lasting investment. This sustained demand helps maintain consistent sales volumes and keeps developers launching new projects in desirable locations. A detailed real estate market analysis helps stakeholders understand these shifting buyer preferences, assess emerging demand patterns, and plan projects that align with evolving urban housing needs.

Sustainability Takes Center Stage

Developers are focusing more on sustainable and green buildings as people are becoming increasingly aware about energy efficiency and environment-friendly living. Contemporary projects now incorporate elements, such as rainwater collection, solar energy systems, effective waste disposal, and ecological public areas. Sustainable practices aid in decreasing long-term expenses for residents and minimizing the environmental impact of sizable housing developments. Many buyers prefer properties certified by green building councils, seeing them as future ready. In 2025, the Canadian Real Estate Association (CREA) launched the Canadian Certified Green Representative (CCGR) certification to help REALTORS® lead in sustainability. The program includes four e-learning modules on climate change, energy efficiency, renewable energy, and eco-friendly practices. Completing the certification enables members to showcase environmental commitment to clients and communities. This growing demand encourages builders to adopt better materials and construction practices, setting higher standards for responsible development in the real estate market.

The PropTech Revolution

Technology is transforming the construction, sales, and management of properties, with PropTech emerging as an essential component of the real estate industry. Technology enhances property transactions and daily living by facilitating virtual tours, digitizing paperwork, integrating smart home systems, and enabling app-based facility management. Constructors utilize data analytics and artificial intelligence (AI) to organize projects and forecast market trends. Residents gain advantages from intelligent security, energy-efficient gadgets, and digital upkeep services. In 2025, Matterport unveiled new features that let real estate agents make better-quality virtual tours using just a smartphone. The Winter Release includes tools like Property Intelligence, Minimap, and Compass, making tours easier to create and navigate. According to a recent real estate market report, these technological advancements are expected to further streamline operations, enhance client experiences, and drive innovation across the sector.

Rise of Tier-II and Tier-III Cities as Investment Hubs

Investors and developers are focusing on Tier-II and Tier-III cities as they seek opportunities outside the bustling metros. Enhanced infrastructure, increased job prospects, and superior connectivity make these cities attractive to homebuyers seeking affordable and contemporary living options. In 2025, Ashwinder R. Singh, Chairman of the CII Real Estate Committee (North), released the report BHARAT 2030, highlighting how Tier-II and Tier-III cities will drive India's INR 10 lakh crore real estate future. Cities like Raipur, Ayodhya, and Tirunelveli are emerging as hubs due to better infrastructure, affordability, and policy support. The expansion of smart city projects, industrial corridors, and improved civic amenities are further contributing to this shift, making these regions key growth engines for housing and commercial development.

Strong Investor Confidence and Increased FDI

Robust investor confidence and increased FDI is influencing the real estate market trends positively. Enhanced regulations, increased transparency, and more efficient project execution are encouraging both global and local investors to invest additional funds in residential, commercial, and industrial projects. In 2025, Juwai IQI projected that Malaysia’s ASEAN Summit chairmanship could generate RM15 billion in real estate activity through increased FDI. Such consistent influx of funds helps developers finish projects more quickly and initiate new ones in potential growth areas. This assurance also fosters innovation and enhances quality throughout the entire real estate industry. Recent real estate market research indicates that these capital inflows and policy improvements will continue to attract diverse investors and sustain long-term sector expansion.

Rise of Integrated Townships

Integrated townships are gaining popularity among homebuyers who seek well-designed areas that offer more than just residences. These projects combine housing with educational facilities, medical services, retail, and leisure within a single community. Numerous families opt for residing in self-sufficient neighborhoods that minimize daily commuting and offer a more secure, interconnected way of life. In 2024, Edinburgh approved the £2 billion West Town project, set to deliver 7,000 homes, two schools, and a 300-bed hotel. The 205-acre site near Ingliston Park and Ride would also feature shops, offices, and leisure facilities. This transition towards community-oriented living is influencing how developers design and execute contemporary real estate projects throughout urban areas.

Detailed Market Segmentation

- Breakup by Property:

- Commercial: Commercial dominates the market, accounting for a share of 27.8% in 2024. It includes office buildings, retail stores, shopping centers, and co-working spaces, which are essential for business activities and client services. Increasing demand for adaptable workspaces and contemporary retail formats is driving investment in key commercial areas.

- Residential: Residential properties encompass apartments, villas, and gated communities that serve different income levels and lifestyle requirements. Increasing urban populations and a demand for safe, amenity-filled housing are fueling expansion in both premium and affordable housing sectors.

- Industrial: Industrial real estate consists of warehouses, manufacturing facilities, logistics centers, and cold storage units. A surge in e-commerce, enhancements in supply chains, and the development of industrial corridors are fostering growth in this sector.

- Land: Land encompasses areas designated for housing developments, business centers, manufacturing zones, and agricultural transformation. Increasing demand for plotted developments and integrated townships is promoting investments in land banks situated in strategic locations.

- Breakup by Business:

- Sales: Property sales represented the largest segment, holding 62.8% in 2024. It involves outright purchases for ownership, catering to end-users and investors seeking asset appreciation. Robust demand in urban growth corridors and tier-II cities is sustaining steady sales momentum.

- Rentals: The rental sector includes leased living spaces, business offices, retail shops, and industrial warehouses. Increasing urban migration and adaptable lease options are driving the growth of the rental sector in metropolitan areas and developing cities.

- Breakup by Mode:

- Offline: In 2024, offline dominated the market with 82.8%. Offline avenues encompass conventional brokers, real estate firms, and in-person property visits for transactions. Personal engagement, on-site evaluations, and knowledge of the local market ensure offline services remain significant, particularly for high-value transactions.

- Online: Online platforms simplify property search, virtual tours, digital transactions, and remote management. Rapid PropTech adoption and digital innovation are transforming how buyers, sellers, and tenants engage with the market.

Regional Insights

North America: Innovation and Mixed-Use Developments

In 2024, North America held the biggest market share of 33.4%, accredited to strong investments across residential, commercial, and industrial developments. The area's ongoing economic stability and favorable policies for investors greatly enhance this robust investment environment. A significant illustration of this trend took place in 2025 when Cawley Partners purchased the vast 5,200-acre South Creek Ranch close to Ferris, North Texas. This bold acquisition seeks to create an extensive mixed-use community, featuring about 5,000 housing units in addition to modern data centers and specialized digital commerce parks covering nearly 2,000 acres. These extensive projects demonstrate North America's ability to draw significant investment while meeting varied real estate demands. Additionally, ongoing demand for residential properties and contemporary logistics facilities keeps fueling consistent investment across major markets. The increasing use of smart buildings and the drive for green certifications further boost project appeal, aligning real estate strategies with larger sustainability goals and strengthening investor trust.

Asia-Pacific: Tech-Driven Urbanization

Real estate expansion in the Asia Pacific region is propelled by swift urbanization, government-supported smart city projects, and rising housing needs. This continuous growth encourages strategic progress in industrial corridors, cohesive townships, and contemporary commercial centers, all of which draw significant domestic and global investment. Technology, especially PropTech, is crucial as it streamlines property management, boosts market transparency, and increases transactional efficiency, thus generating attractive prospects for investors. Additionally, local governments consistently promote eco-friendly construction methods and strong infrastructure growth to effectively address both environmental goals and housing requirements. Exemplifying this technology-driven expansion, in 2025, PropTechBuzz introduced the India PropTech Portal, specifically designed to boost innovation and draw investment into India's vast $1 trillion real estate sector. The platform effectively links property developers, creative startups, prominent investors, and educational institutions, offering essential digital resources and platforms for exploration, funding, teamwork, and professional networking.

Europe: Sustainable and Adaptive Designs

The real estate market in Europe emphasizes retrofitting, communal living environments, and energy conservation. Large urban areas experience increasing demand for adaptable office spaces and last-mile delivery solutions. Sustainability, urban renewal, and carbon-neutral design criteria make European projects appealing to investors looking for future-oriented assets. In 2025, Nrep announced a €100 million hybrid living development in Helsinki, Finland, combining 425 rental apartments and 108 elderly care homes. Construction will begin in autumn 2025 and finish by 2028, with a focus on sustainability, including solar panels and geothermal heating. The project aims for LEED Platinum certification and energy class A standards.

Latin America: Affordable Housing and Infrastructure Development

The market in Latin America gains from urban development, a need for budget-friendly housing, and the expansion of logistics. Cities such as São Paulo and Mexico City attract investment in hospitality, retail, and office spaces. Enhancements in infrastructure and digital platforms transform conventional practices of purchasing, selling, and leasing throughout the area. In 2024, Ayesa announced its role in supervising construction of the 46-floor Puerta Bosques residential tower in Mexico, developed by Greystar. The €42 million project included 455 rental apartments and extensive amenities, along with an 8-story shared parking structure. Ayesa managed all aspects of project execution, emphasizing sustainability and energy efficiency.

Middle East and Africa: Luxury and Smart Urban Centers

The Middle East and Africa experience swift real estate expansion via large-scale projects, contemporary residences, and industrial centers. Gulf nations are at the forefront of high-end projects and intelligent urban centers. Cost-effective housing and climate-resilient structures draw investors, as new regulations back sustainability and digital management of properties. In 2025, Betterhomes partnered exclusively with DHB Holding to launch Opula, a 192-unit residential project in Yas Bay, Abu Dhabi. The development features studios, duplexes, penthouses, and townhouses with minimalist architecture and waterfront views. Opula offers competitive pricing and a flexible payment plan, targeting both investors and homeowners.

Real Estate Market Outlook: 2025-2033

According to IMARC Group projections, the global real estate market is expected to reach USD 8,690.66 Billion by 2033, exhibiting a CAGR of 1.81% from 2025-2033. The major drivers of this growth will include:

- Urbanization and Demographic Shifts: The growth of the real estate market is largely influenced by increasing migration to cities, changing age groups, and evolving individual preferences for modern, well-located properties. According to data from the OECD, Africa's urban population is set to double in the next thirty years, rising from 700 million to 1.4 billion by 2050, creating opportunities for the real estate market.

- Economic Growth and Rising Incomes: Increasing prosperity and higher earning potential are resulting in greater purchasing power, encouraging investment in residential and commercial properties. Current real estate market forecast suggests this trend will continue to fuel demand for premium developments and diversified property portfolios.

- Government Policies and Infrastructure Development: Supportive regulations and improved infrastructure is crucial in boosting the real estate market, offering incentives for development and enhancing connectivity, which drives the demand for properties. In 2024, South Korea revealed housing supply initiatives to tackle increasing real estate costs, intending to construct more than 400,000 homes within six years. The government aimed to relax construction regulations, unlock "green belt" zones close to Seoul, and increase loan guarantees for developers. It also sought to enhance public rental housing and provide tax benefits to stabilize the market.

- Investment Appeal and Asset Class Stability: The attractiveness of property as a reliable investment option, coupled with its long-term value retention, continues to draw both local and international capital into the market.

Unlocking Tomorrow: Navigating Future of Real Estate

The real estate sector is experiencing several changes influenced by a number of important trends. The demand for mid-range and upscale residential properties keeps growing because of inflating incomes and evolving individual preferences. An increasing emphasis on sustainability is encouraging developers to prioritize environment-friendly construction methods and energy-saving solutions. Technological innovations, especially in PropTech, are transforming property dealings and administration, improving operational efficiency. Moreover, Tier-II and Tier-III cities are becoming appealing investment locations, supported by enhanced infrastructure and policy measures. Investor sentiment remains robust, bolstered by more transparent regulations and consistent foreign capital inflows. Integrated townships that provide education, healthcare, and retail in one project are increasingly favored, highlighting the demand for self-sustaining, well-connected neighborhoods. These factors are expected to shape the real estate market 2025 outlook, highlighting growth in sustainable projects, smart technologies, and expanding opportunities in emerging urban centers.

How IMARC Group Supports Growth in the Real Estate Market

IMARC Group equips stakeholders across the real estate sector with the strategic intelligence needed to navigate shifting market dynamics and capitalize on emerging opportunities. Our services help clients identify growth areas, manage risks, and advance sustainable and profitable real estate ventures through:

- Market Insights: Assess global and regional real estate trends, demand patterns for residential, commercial, and industrial properties, and growth potential in urban expansion, smart cities, and green building initiatives.

- Strategic Forecasting: Anticipate future developments in the real estate sector, including technology adoption in PropTech, evolving individual preferences, sustainability regulations, and the rise of integrated townships and mixed-use developments.

- Competitive Intelligence: Monitor competitor activities, track large-scale projects, mergers, and investments, and analyze innovations in construction methods, digital property management, and energy-efficient design that influence competitive positioning.

- Policy and Regulatory Analysis: Evaluate the influence of government policies, urban development programs, FDI rules, and sustainability standards on market access, project approvals, and long-term returns.

- Tailored Consulting Solutions: From feasibility studies and portfolio strategy to digital transformation roadmaps, we deliver customized consulting that aligns with your goals and addresses unique market challenges.

As the global real estate market continues to expand and diversify, IMARC Group remains a trusted partner, delivering actionable insights and solutions that empower stakeholders to build resilient, future-ready projects and investments.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)