Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2025-2033

Real Estate Market Size and Share:

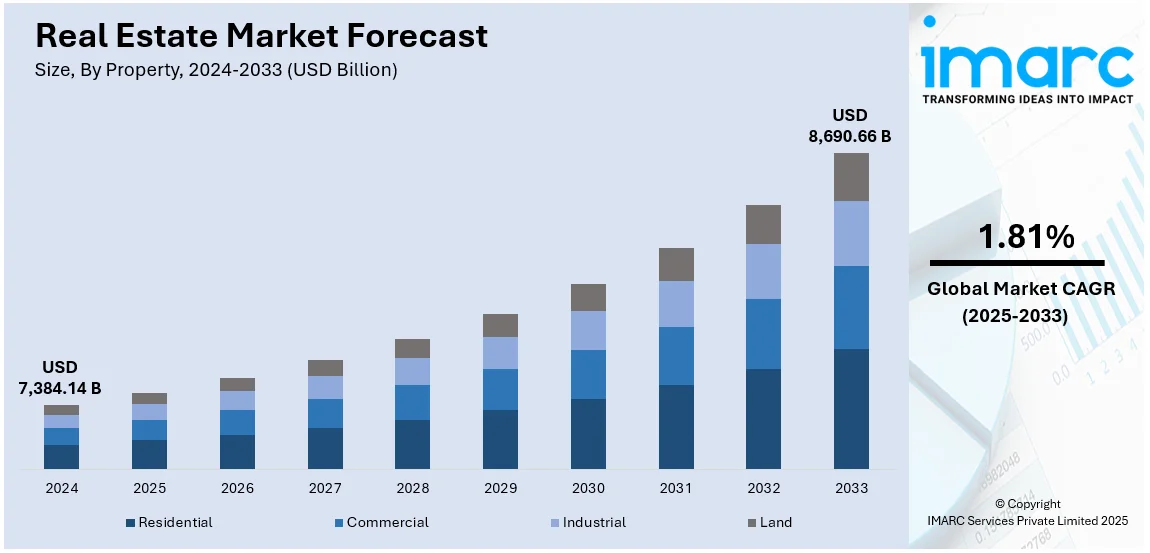

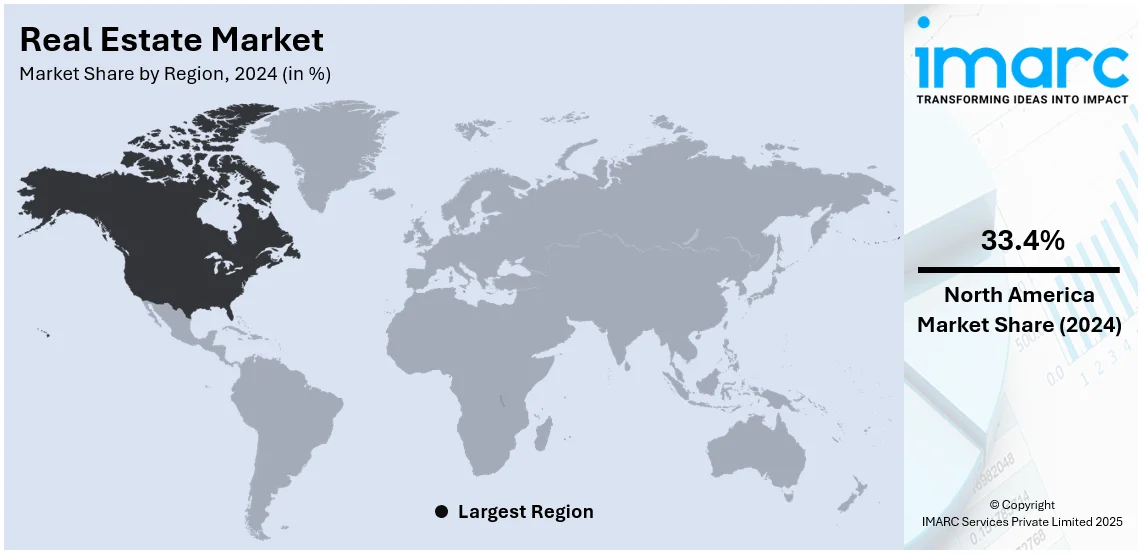

The global real estate market size was valued at USD 7,384.14 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8,690.66 Billion by 2033, exhibiting a CAGR of 1.81% from 2025-2033. North America currently dominates the market in 2024, holding a significant market share of 33.4%. The market is experiencing steady growth driven by rapid urbanization, low interest rates, changing lifestyle trends, e-commerce growth, inflating disposable incomes of individuals, infrastructure development and improvements, remote work, demographic shifts, and favorable government policies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7,384.14 Billion |

| Market Forecast in 2033 | USD 8,690.66 Billion |

| Market Growth Rate (2025-2033) | 1.81% |

The global market is primarily driven by rapid urbanization and population growth, which increases the requirement for commercial and residential spaces significantly. Moreover, the implementation of government policies, including tax incentives, affordable housing initiatives, and infrastructure investments, further stimulates market activity. Additionally, continual technological advancements, such as smart home innovations, virtual tours, and digital transaction platforms, enhance accessibility and streamline processes for buyers and investors. For instance, on December 20, 2024, Red Deer Real Estate Pros introduced cutting-edge virtual tour technology to improve the house-buying process. With this innovation, potential buyers can virtually tour properties with realistic, comprehensive images, improving accessibility and decision-making efficiency. The launch reflects a commitment to integrating cutting-edge solutions in real estate to meet changing consumer needs and preferences. Besides this, the increasing focus on energy-efficient and ecofriendly construction highlights the industry's commitment to sustainability, catering to environmentally conscious buyers and fostering long-term growth.

To get more information on this market, Request Sample

The United States stands out as a key regional market and is witnessing growth due to the country's strong job market and economic growth, creating a consistent demand for both residential and commercial properties. Moreover, demographic trends, such as the rise in millennial homebuyers and an aging population seeking retirement-friendly housing, significantly impact property preferences and development patterns. The continuous advancement in real estate investment trusts (REITs) provides opportunities for institutional and individual investors, which is fueling capital inflows into the market. Furthermore, zoning regulations and local government incentives for urban revitalization projects encourage development in underutilized areas, driving growth in emerging markets. For example, according to an industry report, in November 2024, sales of previously owned homes rose 4.8% from October and 6.1% year-over-year, reaching an annualized rate of 4.15 Million units. Tight inventory, rising prices, and higher demand for high-end properties defined the market. First-time buyers increased to 30%, while investors pulled back. Median home prices grew 4.7% annually amid fluctuating mortgage rates.

Real Estate Market Trends:

Economic Factors

Economic conditions play a pivotal role in driving the real estate market. Factors such as interest rates, employment levels, and overall economic stability significantly influence the need for both residential and commercial properties. Low interest rates stimulate homebuying by making mortgages more affordable, fostering increased demand, and driving property values higher. Economic downturns result in lower consumer confidence, which can have a detrimental impact on the market. Additionally, employment rates directly correlate with housing requirements, as job stability and income levels influence individuals' ability to purchase or invest in properties. The most recent KLEMS data from the Reserve Bank of India (RBI) shows that employment in India rose to 643.3 Million in 2023–2024 compared to 471.5 Million in 2014–2015. A strong and stable economy generally propels real estate growth, attracting investors and driving development in both residential and commercial sectors.

Demographic Trends

Demographic factors, including population growth, age distribution, and urbanization, are crucial drivers shaping the real estate market. Urbanization trends, with a shift from rural to urban areas, influence housing demand and the development of commercial spaces. The United Nations (UN) states that by 2050, 68% of the world's population is expected to reside in urban areas. Changing age demographics, such as the millennial generation entering the housing market, impact preferences for housing types and locations. The aging population drives demand for retirement communities or healthcare facilities. Understanding these demographic shifts is essential for developers, investors, and policymakers to anticipate and meet shifting real estate needs. Demographic factors significantly shape the market, encompassing aspects like population growth, age distribution, and urbanization.

Technological Innovation

Continual technological advancements are revolutionizing the real estate industry, impacting how properties are marketed, transacted, and managed. Proptech innovations, including virtual reality tours, artificial intelligence (AI) in property management, and blockchain for transparent and secure transactions, enhance the efficiency and accessibility of real estate processes. The rise of smart homes, equipped with internet of things (IoT) devices for automation and energy efficiency, influences property development and attracts tech-savvy buyers. The IMARC Group states that the global smart homes market is anticipated to reach USD 345.6 Billion by 2032. Technology also facilitates data-driven decision-making, enabling real estate professionals to analyze market trends, predict property values, and optimize investment strategies. As the industry continues to embrace and integrate new technologies, it shapes the overall landscape of the market, offering new opportunities and challenges for stakeholders.

Real Estate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global real estate market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on property, business, and mode.

Analysis by Property:

- Residential

- Commercial

- Industrial

- Land

Commercial property led the market, accounting for a share of 27.8% in 2024. Commercial real estate comprises office buildings, retail centers, industrial facilities, and multifamily housing, which generate income through leases and sales. The demand for commercial real estate is subject to economic conditions, urbanization, and technological advancements, which makes it a dynamic sector. Commercial properties are valuable assets for wealth accumulation and portfolio diversification for investors and corporations. In addition, commercial real estate supports job creation through businesses, retailers, and industries housed within them, thereby contributing to local and global economies. Increasing globalization also leads to cross-border investments in commercial properties, further strengthening its significance in the market. Commercial real estate is changing as the trends shift towards sustainability and digital transformation, shaping the way businesses operate, and communities evolve worldwide.

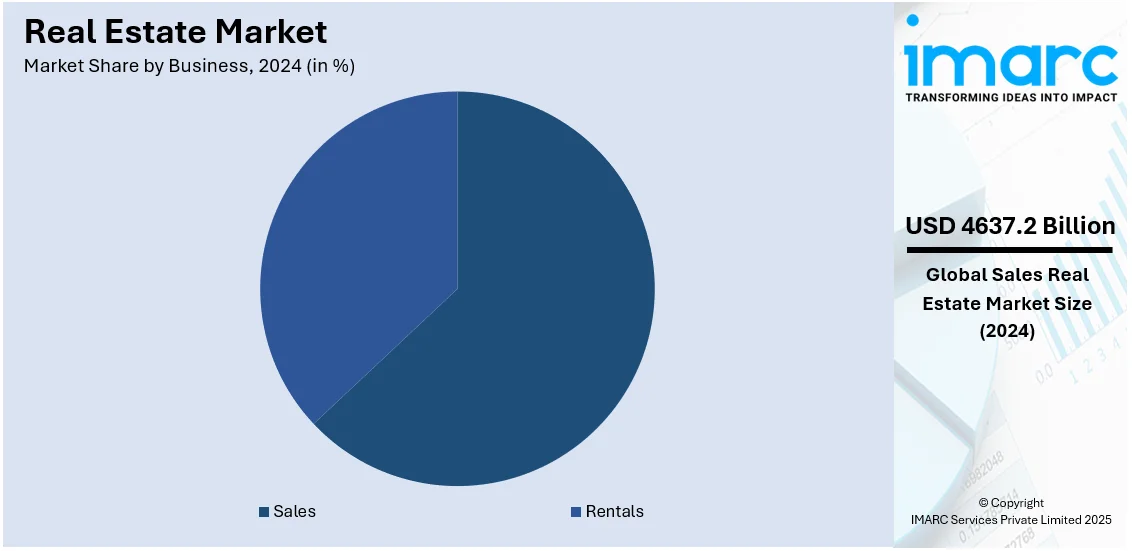

Analysis by Business:

- Sales

- Rentals

Sales led the market in 2024, accounting for a share of 62.8%. The sales segment in the real estate sector drive transactions, profitability, and market liquidity. It includes residential, commercial, and industrial properties, which facilitate economic growth and wealth creation. The effectiveness of sales strategies has a direct impact on market performance, affecting property values, investment returns, and overall market stability. With globalization and digital transformation, real estate sales have spread beyond local markets to attract international investors and buyers. Online platforms and data-driven marketing revolutionize property sales, making transactions more transparent and efficient. Moreover, strong sales performance reflects market confidence and economic health, encouraging further development and investment. In competitive real estate markets, skilled sales professionals, effective negotiation, and market analysis are essential for maximizing property value. As demand shifts due to urbanization, technology, and sustainability, business sales in real estate continue to shape global investment trends and industry dynamics.

Analysis by Mode:

- Online

- Offline

Offline mode led the market, accounting for a share of 82.8% in 2024. The offline mode offers personalized experiences and fosters trust through direct interactions. Physical site visits, open houses, and face-to-face consultations enable buyers to assess properties firsthand, addressing concerns and building confidence. Offline channels also facilitate negotiations, allowing agents to leverage personal expertise to meet the specific needs of buyers and sellers. This mode is especially important in areas with low digital penetration or where more traditional practices dominate. The offline method often works in tandem with online tools to provide a haptic and social dimension to the transaction process. In addition to this, existing real estate firms and local networks are better placed in offline spaces, ensuring the market's proximity and stronger connections to the community. Offline mode ensures strong personal communications, and the real estate sector continues to grow and prosper in a relationship between the world of technology and old traditions.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America held the largest market share of 33.4% driven by its strong economy, diversified property sectors, and high investment appeal. The region, which includes the United States and Canada, offers a dynamic mix of residential, commercial, and industrial properties that attract both domestic and international investors. The United States is a key market-setting region for international trends in financing, investment methods, and real estate development. Canada's strong economy and high rates of urbanization make the region best suited for real estate development. Factors such as expanding industrial and tourism industries result in growth in the purchase of commercial properties and houses. Influenced by economic policies, interest rates, and technological advancement, North America's real estate market drastically changes the value of properties and molds global investment decisions. As sustainability and smart city developments gain importance, North America continues to lead in innovation, making it a key player in shaping global real estate market trends.

Key Regional Takeaways:

United States Real Estate Market Analysis

The United States holds a substantial share of the North American real estate market at 87.60% The real estate market in the United States is driven by a combination of economic, demographic, and societal factors. Economic growth is one of the key drivers, as robust economic conditions create employment and provide higher disposable incomes, which can be spent on purchasing homes as well as commercial property. Demographics are also a major factor since the current population trends keep shifting due to various reasons. Urbanization and walkable neighborhood preferences with amenities continue to drive housing demand within metropolitan areas. Other aspects that influence the growth of the market in the region include the changing consumer behavior due to technological advancements such as digitalized property transaction platforms, virtual tours, and smart home technologies. Also, remote work is resulting in a need for properties in suburban locations and second-tier cities. Moreover, the rising concern of individuals about environmental issues in the country is strengthening market demand due to the growing focus on eco-friendly building solutions. Apart from this, the favorable policies and incentives implemented by the governing agencies in the country are facilitating market expansion. Tax benefits, subsidies, or programs supporting first-time homebuyers can stimulate market appeal. Climate considerations are becoming increasingly significant, with buyers favoring properties resilient to natural disasters. According to the National Centers for Environmental Information, there were 17 severe storm incidences and four tropical cyclones in the US during 2024.

Asia Pacific Real Estate Market Analysis

The Asia Pacific real estate market is shaped by economic, demographic, and policy-driven factors. The key drivers of the market are the growth of the economy in emerging countries such as China, India, and Southeast Asia due to rapid urbanization and industrial expansion. This growth further supports the demand for residential, commercial, and industrial properties as populations migrate to urban centers, and businesses expand their operations. Furthermore, the increasing demand for better quality housing and lifestyle-based developments is creating a positive market outlook. Luxury property sales in India have doubled their market share in 2023 and risen by 75%, according to IBEF. Large-scale investments by the government in transportation networks, smart cities, and economic zones increase connectivity and improve the appeal of emerging real estate markets. These developments add additional requirements for retail, office, and residential space in newly connected areas. Also, foreign investments greatly influence growth, with global investors seeking opportunities in high-growth markets, especially in commercial and industrial real estate sectors. Apart from this, governing agencies in the region are undertaking various initiatives like India's Real Estate Regulatory Authority (RERA) and tax reforms to improve transparency and attract institutional investments. Climate resilience and sustainability are also becoming critical, with green buildings and eco-friendly practices gaining popularity across the region.

Europe Real Estate Market Analysis

Economic stability, demographic trends, technological progress, and policy measures influence the real estate market in Europe. The economic recovery in most of the key countries, such as Germany, France, and the UK, along with its growth, is generating a boost for both residential and commercial properties. The low interest rates in recent years have prompted borrowing and thus inducing investment in real estate. In addition to this, urbanization and the growing preference for city living are leading to increased demand in cities like Paris, London, and Berlin. Older populations in countries like Italy and Spain create opportunities in senior housing, healthcare facilities, and retirement communities. Younger professionals looking for affordable housing drive the co-living space. The implementation of green and sustainable initiatives is an important factor in the growth of the European real estate market. The market is experiencing growing demand for green buildings and energy-efficient homes, driven by regulatory initiatives like the EU Green Deal and increasing consumer preference for eco-friendly properties. . According to IMARC Group, the UK's green building market is estimated to be at about 6.6 billion U.S. dollars for 2024. These trends also include retrofitting older buildings to meet energy efficiency standards. Additionally, technological changes in the sector have created an overwhelming development of prop-tech platforms that smooth out the nexus between property transactions and management. All these drivers highlight the emerging real estate market in Europe.

Latin America Real Estate Market Analysis

The market in Latin America is primarily driven by urbanization, economic growth, and increasing middle-class income. The rapid urbanization of countries like Brazil, Mexico, and Colombia tends to increase demands for residential properties. Growing urban centers provide possibilities for commercial and industrial development. According to the CIA reports, the urban population of Cuba was 77.5% of the total in 2023. Also, the transportation network, energy projects, and smart cities are sectors that agencies in the region mainly focus on investing and heightening property values in associated places. Foreign investments, specifically from commercial real estate, in addition to tourism-oriented developments, boost market growth, particularly in nations that are stable in economics and have favorable government policies.

Middle East and Africa Real Estate Market Analysis

Economic diversification, urbanization, population dynamics, and government initiatives have primarily influenced the market in the region. Also, Saudi Vision 2030 and UAE's Centennial Plan have become significant stimulants to colossal investment in the real estate area. These projects are aimed at reducing oil-revenue reliance and promoting growth in sectors such as tourism and retail, which would increase the need for residential and commercial or mixed-use space. Construction awards in the Middle East and North Africa have touched the peak, as around 101 billion USD have been awarded in the first half of this year. Dubai and Riyadh are among notable cities in the Middle East due to high populations. Lagos and Nairobi have witnessed huge growth in Africa. Governments have also created infrastructures that have contributed to defining the marketplace.

Competitive Landscape:

The competitive landscape for real estate comprises established and newer companies that are steered by innovation, regional needs, and market dynamics. Companies compete at property location, pricing approach, green building, smart integration of technology, Economic trends, government policies, and shifting preferences of consumers toward eco-friendly and more urbanized developments further influence the market. The firms try to differentiate through unique portfolios, operational efficiencies, and customer focus. Additionally, strategic partnerships with finance companies and technology houses become inevitable for the competition factor, as digital platforms allow smoother transactions and market accessibility. The competitive market reflects dynamic regional expertise and global trends.

The report provides a comprehensive analysis of the competitive landscape in the real estate market with detailed profiles of all major companies, including:

- Anywhere Real Estate Inc.

- Aston Pearl Real Estate Broker

- Ayala Land Inc.

- CBRE

- Colliers

- Gecina

- Jones Lang LaSalle IP, Inc.

- Nomura Real Estate Holdings, Inc

- Prologis Inc.

- RE/MAX, LLC.

- SEGRO plc

- Simon Media Properties LLC

- Sotheby's International Realty Affiliates LLC

Latest News and Developments:

- October 2025: The Uttar Pradesh Real Estate Regulatory Authority (UP RERA) announced its approval of six new real estate initiatives valued at INR 176.28 Crore in six cities, facilitating the development of 501 residential and commercial units in the state. The projects WERE located in Ayodhya, Noida, Jhansi, Moradabad, Lucknow, and Prayagraj, highlighting the expansion of real estate development into new urban areas beyond the key metropolitan zones of the state.

- July 2025: Japanese real estate investment company GATES declared its plan to tokenize more than USD 200 Billion in revenue-generating properties utilizing the Oasys blockchain. The project would commence with a tokenization of USD 75 Million in properties situated in central Tokyo, seeking to enhance accessibility of Japan’s real estate market for investors.

- July 2025: eXp Realty®, the prominent independent real estate brokerage firm and a key subsidiary of eXp World Holdings, Inc., announced its expansion into Japan. To begin the launch, eXp planned to host a live welcome event in Tokyo on October 2, 2025, where company executives would share the vision and business model. eXp provided the most scalable model in real estate, enabling individual agents to operate efficient, high-performing businesses.

- July 2025: LandCo and Aedas Homes formed a strategic partnership to create a distinctive project in the Algarve region of Portugal. The first project consisted of building a 16-floor tower on property owned by LandCo, featuring a residential space of 14,000 sqm and 2,200 sqm designated for commercial purposes.

- June 2025: Square Asset Management, Portugal's largest real estate fund manager, increased its intended investment in commercial properties in Spain and Portugal to €200 Million (USD 231 Million). Square raised its investment target, as office buildings and shopping centers, which encountered major difficulties during the pandemic, were recovering.

- June 2025: Daiwa Securities, the Japanese brokerage firm, was set to partner with the Osaka-based firm Samty and the investment manager Hillhouse to gather ¥100 Billion (USD 690 Million) real estate fund targeting both domestic and international institutions. Daiwa would focus on Japanese rental properties and hotels, which typically offered more protection against inflation than other sectors.

Real Estate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Anywhere Real Estate Inc., Aston Pearl Real Estate Broker, Ayala Land Inc., CBRE, Colliers, Gecina, Jones Lang LaSalle IP, Inc., Nomura Real Estate Holdings, Inc, Prologis Inc., RE/MAX, LLC., SEGRO plc, Simon Media Properties LLC, Sotheby's International Realty Affiliates LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the real estate market from 2019-2033.

- The real estate market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global real estate market was valued at USD 7,384.14 Billion in 2024.

The global real estate market is expected to exhibit a CAGR of 1.81% from 2025-2033, reaching a value of USD 8,690.66 Billion by 2033.

The key factors driving the global market include rapid urbanization, population growth, rising disposable incomes, significant technological advancements in construction, and increased demand for sustainable properties. Additionally, government policies supporting housing and infrastructure development significantly influence market expansion.

North America currently dominates the market, holding a share of 33.4% in 2024. The market is experiencing steady growth driven by rapid urbanization, low interest rates, changing lifestyle trends, e-commerce growth, inflating disposable incomes of individuals, infrastructure development and improvements, remote work, demographic shifts, and favorable government policies.

Some of the major players in the global real estate market includes Anywhere Real Estate Inc., Aston Pearl Real Estate Broker, Ayala Land Inc., CBRE, Colliers, Gecina, Jones Lang LaSalle IP, Inc., Nomura Real Estate Holdings, Inc, Prologis Inc., RE/MAX, LLC., SEGRO plc, Simon Media Properties LLC, and Sotheby's International Realty Affiliates LLC, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)