General Aviation Market: Business Jets and Air Mobility Technologies Drive Market Growth

Introduction:

The general aviation sector is undergoing a transformative phase shaped by technological advancements, evolving travel preferences, and new mobility solutions that bridge gaps in regional connectivity. Across business travel, emergency services, leisure flying, cargo movement, and emerging electrified aircraft applications, the industry is expanding its influence and redefining how people and goods move across short and mid-range distances. In 2024, Archer Aviation struck a deal with Soracle (a JV between Japan Airlines and Sumitomo) giving Soracle the right to order up to 100 of Archer’s “Midnight” eVTOL aircraft (~US$ 500 million), signaling serious commitment to electric air mobility in Japan. As stakeholders continue to evaluate new opportunities, many are closely monitoring the general aviation market size, the expanding opportunities influencing modern flight operations, and the evolving general aviation market trends that are shaping the next decade.

A growing number of enterprises, high-net-worth individuals, logistics operators, and mobility innovators are seeking flexible, safe, and reliable flight options that bypass congestion and limitations seen in large commercial aviation systems. This shift has strengthened the relevance of advanced aviation ecosystems that can support diverse operational needs ranging from short-hop air taxis to long-range business aircraft. As these developments unfold, companies and analysts alike increasingly rely on refined insights delivered through specialized assessments such as general aviation marketing, enabling them to gauge customer preferences and investment areas with greater precision.

The current landscape reflects rising demand for efficiency, convenience, and enhanced travel autonomy. General aviation plays a direct role in supporting business mobility, private travel, emergency access, remote connectivity, and point-to-point transport flexibility. This connectivity is essential for national economies, disaster response, border monitoring, critical cargo movement, remote tourism, and executive travel operations. As expected, these drivers continue to influence the general aviation market forecast, underscoring the sector’s critical role in transforming regional and urban mobility.

A pivotal contributor to this momentum is the rapid pace of innovation occurring within aircraft systems. Advancements in powertrains, automation, lightweight structures, energy efficiency, and digital cockpit technologies support safer and more accessible flying experiences. For instance, in 2025, ZeroAvia reached a major milestone by receiving the FAA’s G-1 Issue Paper for its 600 kW hydrogen-electric propulsion system, providing a clear regulatory pathway toward certifying its full powertrain. Emerging electric, hybrid, and hydrogen-based aircraft solutions further enhance the industry’s alignment with sustainability commitments. These innovations improve fleet performance, reduce emissions, reduce pilot workload, and boost aircraft utilization rates—all core objectives driving investments across the general aviation marketing landscape.

Overall, general aviation remains essential for global accessibility, offering unmatched flexibility that complements the limitations of scheduled commercial aviation. With innovation shaping every layer—from aircraft design to air mobility platforms and operational ecosystems—the sector is poised for continued expansion, driven largely by optimized fleet economics, evolving traveler expectations, and new models of aviation engagement.

Explore in-depth findings for this market, Request Sample

Key Industry Trends:

- Surging Demand for Business Jets and Fractional Ownership Models

Business aviation continues to stand out as one of the most dynamic components of the general aviation ecosystem. Companies, entrepreneurs, and private clients increasingly value flexibility, privacy, and time optimization—factors that influence aircraft procurement and charter activity. While traditional full ownership remains strong, new business models such as fractional ownership, leasing, subscription-based flying, and on-demand charter platforms are gaining attention. For example, in 2025, GlobeAir launched a “30 by 30” fractional ownership programme, allowing clients to invest in a share of a Cessna Citation M2 with a three- or five-year contract that includes maintained operational costs. These models reduce cost barriers and expand access to modern fleets, supporting wider participation across various client segments.

The desire for fast, point-to-point travel that avoids commercial airport congestion has strengthened business jet demand. Operators are investing in cabin comforts, connectivity systems, and enhanced performance capabilities to attract new clients. These developments directly support the expansion of the general aviation market size, while reinforcing the importance of predictive insights derived through general aviation marketing strategies.

- Rise of eVTOLs and Urban Air Mobility Transforming General Aviation

Electric Vertical Takeoff and Landing (eVTOL) aircraft represent one of the most disruptive forces shaping the future of flight. These aircraft support short-distance mobility and are designed to function as air taxis, cargo vehicles, medical evacuation units, or urban shuttle systems. In 2025, Vertical Aerospace expanded its partnership with Bristow Group: Bristow committed to purchase up to 50 of Vertical’s VX4 eVTOLs (with an option for 50 more), accelerating plans to launch commercial air-taxi services. Urban Air Mobility (UAM) solutions aim to decongest road networks, reduce travel time, and increase accessibility between key urban zones.

With quieter propulsion systems, reduced emissions, and digital piloting interfaces, these aircraft challenge traditional assumptions about regional mobility solutions. Multiple industries—including tourism, medical services, logistics, and commuting platforms—are evaluating eVTOL applications. This new ecosystem significantly influences the general aviation market trends, especially as infrastructure development, airspace management frameworks, and customer acceptance evolve.

- Fleet Modernization and Lightweight Avionics Adoption Accelerating

Aircraft operators are prioritizing new-generation avionics, flight control systems, and cockpit automation technologies to improve safety, operational efficiency, and flight precision. Digital displays, integrated flight management systems, real-time data analytics, autopilot enhancements, and satellite connectivity modules are now central to modernization programs. For example, in 2024, Collins Aerospace announced a comprehensive Pro Line Fusion and Pro Line 21 avionics upgrade program for Beechcraft King Air and Hawker aircraft, which includes touchscreen displays, synthetic vision, and enhanced navigation to reduce pilot workload and improve situational awareness.

Lightweight composite materials and optimized aerostructures support reduced fuel consumption and enhanced durability. These advancements also benefit electric and hybrid aircraft by increasing energy efficiency and extending operational range. As operators upgrade fleets for safety and performance, modernization influences the direction of the general aviation market forecast, strengthening long-term growth potential.

- Growth of Regional Airfields and Infrastructure Supporting Private Aviation Expansion

General aviation requires infrastructure that includes regional airports, airstrips, helipads, maintenance hubs, and hangar facilities. Countries and regional authorities are investing in smaller aviation facilities to encourage economic development, promote tourism, and improve emergency accessibility.

These facilities boost connectivity for regions underserved by commercial routes. They also support business jets, air taxis, eVTOL operations, training aircraft, and small cargo planes. Infrastructure modernization—paired with digital air traffic management systems—strengthens accessibility and enhances the overall resilience of aviation networks, contributing to the broadening general aviation market trends observed across expanding markets.

- Increasing Focus on Sustainable Propulsion and Carbon-Neutral Technologies

Environmental performance is no longer a secondary consideration; it is a defining pillar shaping fleet investments and aircraft development strategies. Aircraft manufacturers, technology developers, and energy innovators are advancing electric propulsion systems, hybrid engines, hydrogen technologies, and sustainable aviation fuel (SAF) compatibility.

The ambition is to reduce emissions, minimize operational noise, and implement circular manufacturing practices. Sustainability also influences customer preferences, with companies prioritizing eco-friendly travel options. As a result, decarbonization initiatives increasingly influence the market, fleet planning decisions, and stakeholder engagement within the expanding general aviation marketing landscape.

Market Segmentation & Regional Insights:

General aviation encompasses a diverse fleet, serving commercial and non-commercial needs across global regions. Each product segment contributes uniquely to operational efficiency, accessibility, and mission diversity.

Helicopters remain essential for emergency services, offshore transport, corporate mobility, and tourism. Their ability to operate in confined or remote areas makes them indispensable across both public and private missions. Modern upgrades in avionics, safety systems, and lightweight structures continue strengthening their role.

Piston Fixed-Wing Aircraft serve as foundational platforms for training, recreational flying, and personal mobility. Their affordability and ease of operation support pilot development and short-distance travel. Advancements in cockpit digitalization, fuel efficiency, and airframe materials enhance safety and performance.

Turboprop Aircraft bridge the gap between pistons and business jets, offering strong reliability, short-runway capability, and efficient regional travel. Their suitability for commercial routes, cargo operations, and corporate transport ensures stable demand across diverse geographies.

Business Jets represent the premium segment, supporting private executives, corporate teams, government missions, and luxury travelers. Their long-range capabilities, connectivity upgrades, and cabin comfort continue attracting both individual owners and fractional fleet users.

Across applications, the Commercial segment includes charter services, regional commuter flights, air taxis, cargo operations, and aerial work activities. These missions require dependable aircraft performance and operational flexibility. The Non-Commercial segment encompasses personal flying, pilot training, hobby aviation, and recreational travel—activities that support broader aviation culture and global pilot supply.

Regionally, Asia Pacific is expanding rapidly due to infrastructure investments and rising private aviation interest. Europe maintains a mature ecosystem shaped by sustainability policies and advanced training networks. North America leads with its large fleet base, widespread airfields, and strong business aviation activity. Latin America depends on general aviation for connectivity across remote terrains, while the Middle East and Africa rely on helicopters, business jets, and turboprops for essential transport, tourism growth, and regional development.

Forecast (2026–2034):

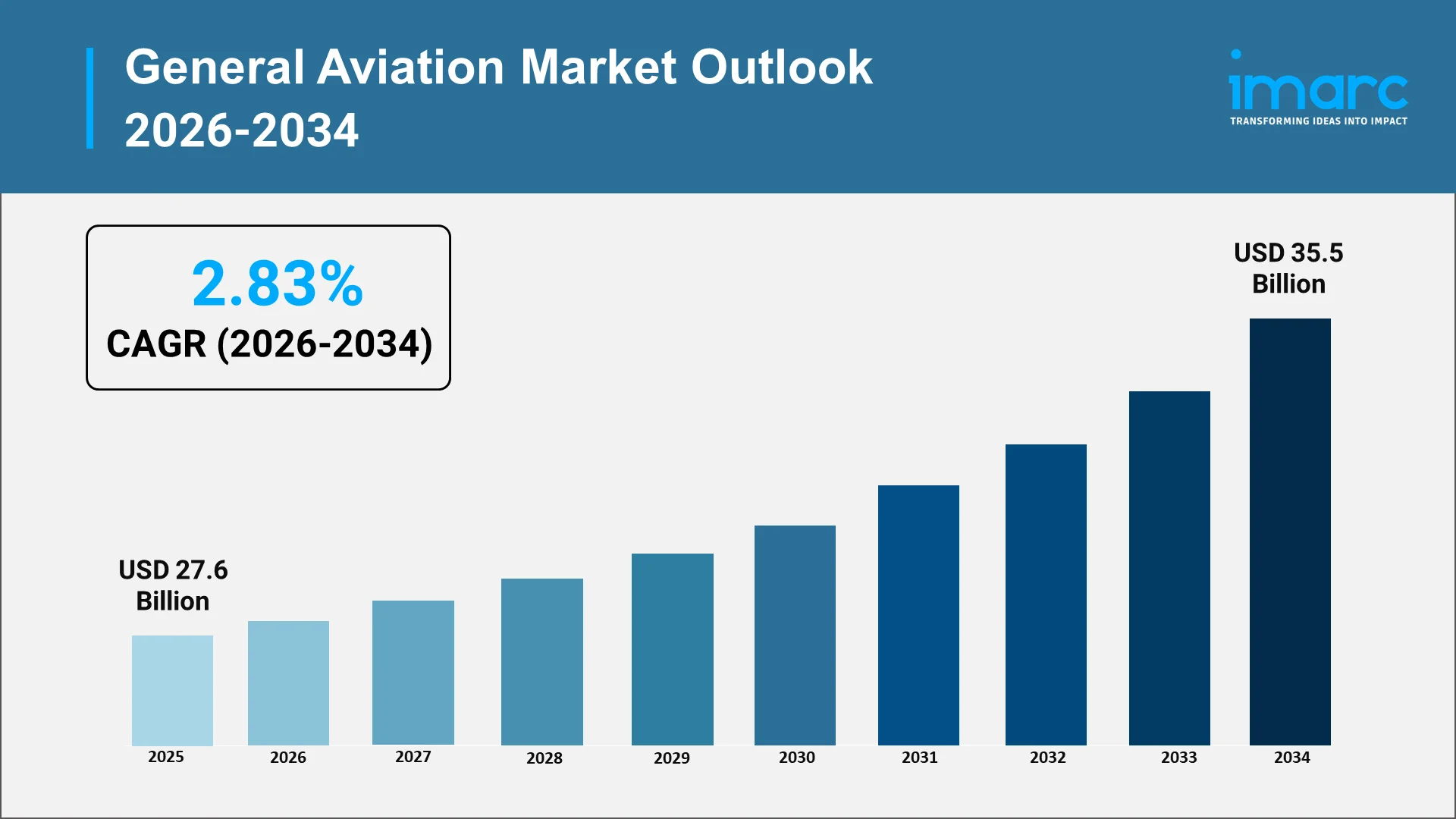

Future projections indicate a continued shift toward flexible, efficient, and technology-driven aviation solutions. The global general aviation market size was valued at USD 27.6 Billion in 2025, and looking forward, the market is expected to reach USD 35.5 Billion by 2034, exhibiting a CAGR of 2.83% from 2026-2034. As global transportation needs evolve, analysts anticipate steady momentum within the sector, shaped by a combination of demand-driven and innovation-led factors. Stakeholders analyzing the long-term general aviation market forecast anticipate a sustained focus on improved aircraft capabilities, diversified aviation applications, and new categories of mobility platforms.

Demand drivers shaping growth trajectories include:

- Rising demand for private and business air travel: Executives, entrepreneurs, and luxury travelers continue to adopt flexible flying solutions, valuing privacy, speed, and direct route access. This trend reinforces demand across charter, subscription, and fractional ownership models.

- Growth of urban air mobility and eVTOL adoption: Electrified mobility platforms will redefine commuting landscapes, reshaping the future of short-distance travel. As eVTOL ecosystems evolve, these platforms will increasingly become central to general aviation market trends.

- Advancements in aircraft technologies improving performance and costs: Innovations in lightweight materials, avionics automation, connectivity, and propulsion efficiency will continue to improve aircraft economics. Enhanced performance metrics expand accessibility for more operators, influencing the global general aviation market size.

- Expansion of regional airports and air-taxi infrastructure: Smaller airports, vertiports, and support facilities will shape future mobility networks, creating new aviation corridors and supporting the development of point-to-point services. Strengthening infrastructure also enhances stakeholder awareness supported through optimized general aviation marketing.

Conclusion:

The general aviation sector is entering a period of significant renewal as technological progress, shifting mobility expectations, and the rise of new aircraft categories reshape the movement of people and goods. Expanding applications across private travel, business operations, emergency response, regional connectivity, and emerging electric flight ecosystems highlight the sector’s increasing relevance in modern transportation networks. Continued advancements in propulsion systems, digital avionics, automation, and lightweight structures are elevating safety, efficiency, and operational flexibility, strengthening the foundation for broader adoption. Parallel improvements in infrastructure, including regional airports, vertiports, and maintenance hubs, support wider accessibility and reinforce aviation’s role in connecting remote and underserved regions. Growing interest in sustainable propulsion technologies further aligns general aviation with long-term environmental objectives. As innovation accelerates and new mobility models gain momentum, the sector is positioned for sustained progress, driven by rising demand for convenience, autonomy, and mission-specific aviation solutions across global markets.

Choose IMARC Group as We Offer Unmatched Expertise and Core Services:

IMARC Group stands as a trusted partner for organizations seeking clarity, accuracy, and strategic direction in the rapidly evolving general aviation ecosystem. Our research approach combines industry intelligence, future-ready forecasts, and actionable insights that enable businesses to navigate complexities with confidence. Whether assessing fleet expansion opportunities, emerging air mobility technologies, regional aviation strategies, or competitive landscapes, IMARC provides unparalleled support tailored to your goals.

- Data-Driven Market Research: Comprehensive and rigorously validated studies that empower stakeholders with clarity on industry dynamics, customer preferences, and operational opportunities.

- Strategic Growth Forecasting: Scenario-based aviation forecasting designed to help organizations anticipate future developments, evaluate investment potential, and plan long-term strategies.

- Competitive Benchmarking: Deep competitor analyses that allow companies to identify leadership gaps, evaluate strengths, and position themselves effectively in the market.

- Policy and Infrastructure Advisory: Guidance on regulatory shifts, airport infrastructure development, aviation safety frameworks, and air mobility integration.

- Custom Reports and Consulting: Tailored aviation research solutions developed to support business expansion, investment decisions, and customized strategic objectives.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)