Intragastric Balloons Market Size, Share, Trends and Forecast by Product, Filling Material, Implanting Procedure, Application, End-User, and Region, 2025-2033

Intragastric Balloons Market Size and Share:

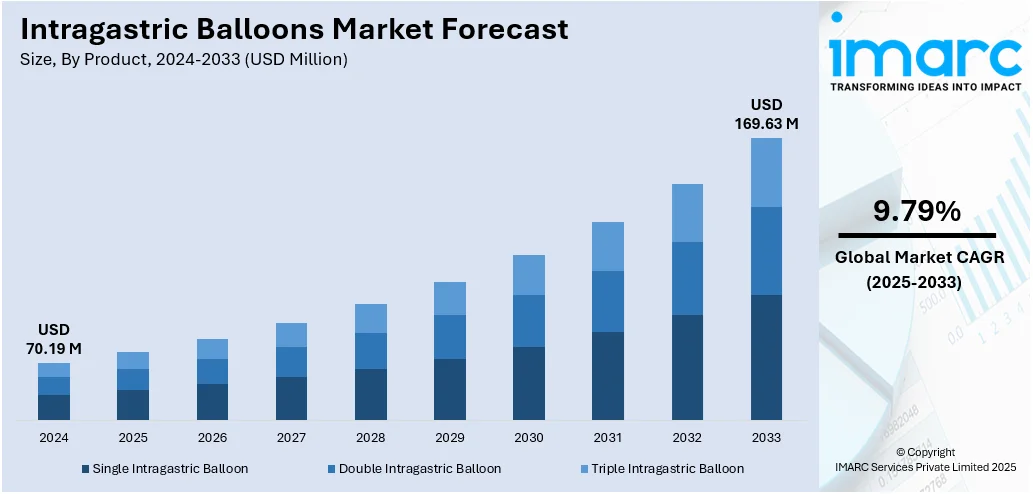

The global intragastric balloons market size was valued at USD 70.19 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 169.63 Million by 2033, exhibiting a CAGR of 9.79% during 2025-2033. North America dominated the market in 2024. High obesity rates, advanced healthcare, early FDA approvals, and growing demand for non-surgical weight loss are some of the factors contributing to the intragastric balloons market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 70.19 Million |

|

Market Forecast in 2033

|

USD 169.63 Million |

| Market Growth Rate 2025-2033 | 9.79% |

The market is gaining traction due to increasing global obesity rates and rising health concerns linked to excess weight. These balloons offer a non-surgical, temporary weight loss solution, appealing to patients seeking alternatives to invasive procedures. Growing awareness through digital health campaigns and recommendations by healthcare providers has further boosted demand. Technological improvements, such as swallowable, gas-filled, or adjustable balloons, enhance patient comfort and broaden eligibility. Additionally, supportive insurance policies in some countries and the growth of medical tourism, particularly in regions offering affordable endoscopic procedures, are driving adoption. Regulatory approvals across new markets are expanding accessibility, and clinical evidence supporting balloon effectiveness for short-term weight loss adds to their credibility. Combined, these factors create a favorable environment for intragastric balloons market growth, especially in urban areas with rising lifestyle-related health issues.

To get more information on this market, Request Sample

In the United States, new designs in intragastric balloon systems are advancing non-surgical weight loss methods. A swallowable capsule with timed deflation and natural excretion introduces added convenience and safety. As intellectual property protections extend into the next decade, such innovations are setting the stage for broader use and clinical acceptance. For instance, in April 2025, ReShape Lifesciences received a Notice of Allowance from the USPTO for its intragastric balloon patent (application 18/241,151). The patent covers a swallowable capsule with a self-sealing fill valve and a degradable release valve, designed to deflate after three months and be naturally excreted. This system adds innovation to non-surgical weight loss solutions. The patent, once issued, offers protection through at least January 2031.

Intragastric Balloons Market Trends:

Growing Demand for Non-Surgical Weight Loss Alternatives

The intragastric balloons market outlook remains positive as widespread weight-related health issues are pushing interest in non-invasive treatments. Intragastric balloons are becoming a preferred option for those seeking medically supervised weight loss without surgery. These devices offer a reversible and less intensive approach, which appeals to both patients and clinicians aiming to avoid long recovery periods or permanent anatomical changes. The appeal also lies in the ability to integrate these procedures with lifestyle changes under medical guidance. As healthcare systems face mounting pressure to manage obesity-related conditions, there’s a stronger emphasis on early intervention methods that are safe, effective, and cost-conscious. Awareness campaigns and broader acceptance within medical communities are further reinforcing adoption, especially in regions with limited access to advanced surgical care. The World Health Organization (WHO) reported that in 2022, 2.5 Billion adults aged 18 and above were overweight, with 890 Million of them living with obesity.

Shift toward Minimally Invasive Procedures in Weight Management

Clinical preferences are steadily moving away from traditional open surgery in favor of less invasive methods. Procedures that require smaller incisions, shorter hospital stays, and quicker recovery times are gaining favor among both practitioners and patients. Based on the intragastric balloons market forecast, this shift reflects a broader change in how weight-related interventions are approached, favoring safety, convenience, and reduced post-operative complications. Intragastric balloons fit neatly into this movement, offering a temporary, non-surgical option that aligns with patient demand for low-risk solutions. As more medical professionals adopt minimally invasive approaches, devices like these are seeing wider use in clinical settings that prioritize patient comfort and outpatient care models. A recent survey in Korea showed a shift from open surgery to minimally invasive techniques. The rate of open surgery dropped from 49.8% in 2014 to 27.6% in 2019.

Increased Validation of Non-Surgical Weight Loss Devices

Clinical studies are reinforcing confidence in non-surgical weight loss options. Intragastric balloons are drawing attention for their ability to deliver meaningful results alongside lifestyle programs. Recent trial data highlights sustained weight reduction over time with a favorable safety profile, supporting wider use in patients seeking alternatives to surgery. These findings are influencing physician decisions and could shape regulatory pathways for broader adoption. Interest continues to grow in treatments that offer measurable outcomes with minimal risk, especially when combined with structured lifestyle support. The shift toward less invasive methods is becoming more pronounced in clinical practice and patient preference alike. This reflects broader intragastric balloons market trends focused on safety, convenience, and long-term effectiveness. For example, in January 2025, Allurion Technologies reported topline results from its FDA pivotal AUDACITY trial on the Allurion Balloon. Over 550 participants joined, receiving two balloon cycles or lifestyle therapy. At 48 weeks, 58% of balloon recipients lost over 5% of body weight. Though the weight loss difference vs. controls (3.77%) missed the 3% superiority margin statistically, the margin was exceeded at 40 weeks. Serious adverse events were low at 3.1%.

Intragastric Balloons Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global intragastric balloons market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, filling material, implanting procedure, application, and end-user.

Analysis by Product:

- Single Intragastric Balloon

- Double Intragastric Balloon

- Triple Intragastric Balloon

Single intragastric balloon stood as the largest product in 2024. This type of balloon is gaining traction due to its simpler placement procedure, lower cost compared to dual or adjustable variants, and fewer associated complications. It's usually inserted endoscopically and removed after six months, offering a less invasive alternative to bariatric surgery for short-term weight loss. Patients and clinicians often prefer this option for its safety profile, faster recovery, and minimal maintenance. As obesity rates climb and demand grows for non-surgical weight loss methods, single-balloon systems are seeing wider adoption across clinics. Their convenience and growing clinical acceptance make them a leading contributor to market expansion.

Analysis by Filling Material:

- Saline Filling

- Gas Filling

Saline filling led the market in 2024. These balloons are filled with sterile saline solution after placement in the stomach, making them safer and more widely accepted. Saline allows easy visualization on imaging, which helps in monitoring and ensures prompt response to any deflation. They also come with a blue dye indicator; if leakage occurs, the dye colors the urine, acting as an early warning system. This safety feature, combined with affordability and a long track record of clinical use, makes saline-filled balloons more appealing than gas-filled options. Their predictable performance and broader physician preference are accelerating their adoption, especially in outpatient settings and emerging markets where cost and reliability are key factors.

Analysis by Implanting Procedure:

- Surgical

- Non-Surgical

Non-surgical led the market in 2024 as more patients seek weight loss solutions that avoid the risks, recovery time, and cost of surgery. Intragastric balloons offer a minimally invasive approach, typically placed and removed via endoscopy or swallowed in capsule form, making them accessible to a wider population, including those who are not candidates for bariatric surgery. This appeals to individuals looking for a temporary, reversible option with fewer complications. Clinics and providers are also expanding their offerings to include non-surgical procedures to meet rising demand. The growing interest in outpatient and office-based treatments further supports this trend. Convenience, safety, and faster return to daily activities are making the non-surgical segment a key growth driver in this market.

Analysis by Application:

- Obesity

- Diabetes

- Diet Control

- Weight-Loss

- Pre-Operative Weight Reduction

- Others

Obesity led the market in 2024. With global obesity rates climbing steadily, more individuals are seeking effective weight management options beyond diet and exercise. Intragastric balloons offer a non-permanent, non-surgical intervention that supports initial weight loss and motivates lifestyle change. They are especially useful for patients with moderate obesity who may not qualify for bariatric surgery but still need medical intervention. As obesity is linked to conditions like diabetes, hypertension, and heart disease, healthcare providers are recommending earlier weight management strategies, including balloons. Rising awareness, insurance coverage improvements, and government health initiatives targeting obesity are also contributing to increased adoption, making the obesity segment a strong driver of market growth.

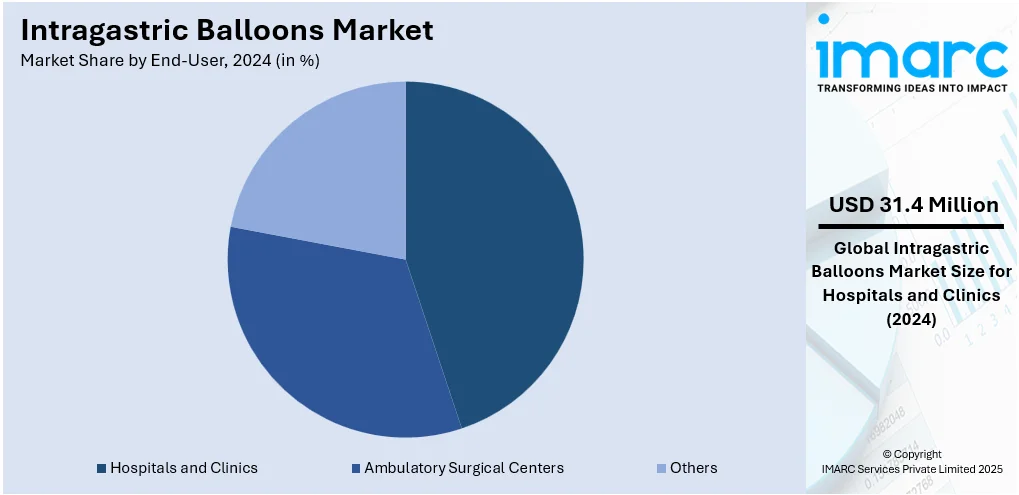

Analysis by End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

Hospitals and clinics led the market in 2024, owing to their access to trained gastroenterologists, advanced endoscopic equipment, and post-procedure care. These settings are preferred for balloon placement and removal because they offer higher safety standards, patient monitoring, and comprehensive weight management programs. As awareness grows, more patients are turning to hospitals and specialty clinics for non-surgical obesity treatments. The rise in outpatient services and day-care procedures has made balloon insertion more convenient and cost-effective in these environments. Additionally, hospitals often partner with wellness programs and dieticians, offering patients a full treatment path. Their credibility, infrastructure, and capacity to handle complications make hospitals and clinics the go-to centers, boosting the segment’s impact on market expansion.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share. The region has one of the highest obesity rates globally, creating strong demand for effective, non-surgical weight-loss solutions. The presence of advanced healthcare infrastructure and well-established medical facilities enables widespread adoption of intragastric balloon procedures. Additionally, North America benefits from early regulatory approvals by agencies like the FDA, allowing quicker market access for innovative devices. High awareness levels among patients and healthcare professionals, along with strong marketing efforts by key manufacturers, also contribute to regional growth. Insurance coverage and reimbursement options in some areas further support patient access. Moreover, a growing preference for outpatient and minimally invasive procedures aligns well with balloon treatments. These combined factors continue to strengthen North America’s leading position in the global intragastric balloons market.

Key Regional Takeaways:

United States Intragastric Balloons Market Analysis

The United States intragastric balloons market is primarily driven by the rising prevalence of obesity and related health complications. According to the new 2023 CDC population data, over one in three adults (35%) in 23 states are affected by obesity. Also, at least one in five adults (20%) in every U.S. state is currently living with obesity. In line with this, continual advances in balloon technology have significantly improved the safety and efficacy of procedures, attracting more patients to the market. The increasing awareness of non-surgical weight loss options is further driving market growth as individuals seek alternatives to traditional surgical procedures. Similarly, the growing preference for minimally invasive procedures, offering faster recovery times, is also fueling market demand. Furthermore, the heightened emphasis on preventive healthcare, motivating people to manage their weight actively, is fostering market expansion. Additionally, the rising trend of medical tourism is contributing to the market appeal as patients seek cost-effective solutions abroad. Moreover, favorable government initiatives and policies focused on obesity management are creating a supportive environment for market development, accelerating the adoption of intragastric balloon treatments.

Europe Intragastric Balloons Market Analysis

The market for intragastric balloons in Europe is experiencing growth due to the increasing prevalence of obesity and related chronic conditions. In accordance with this, the growing awareness of non-surgical weight loss options is encouraging patients to opt for minimally invasive treatments. Furthermore, ongoing advancements in intragastric balloon technology, which offers improved safety and effectiveness, are enhancing market appeal. The rise of medical tourism in Europe, where patients seek cost-effective solutions, is also contributing to market expansion. Additionally, supportive healthcare policies and reimbursement schemes across European countries are improving access to these treatments. The aging population in Europe, more prone to obesity, is another key market driver. The 2022 Health Survey for England found that individuals aged 55 to 74 were more likely to be overweight or obese compared to other age groups, with over 70% of people in these age ranges having excess weight. Additionally, preventive healthcare initiatives and a growing focus on wellness are fueling demand for weight management solutions. Apart from this, numerous collaborations between healthcare providers and research institutions are fostering innovation, further impacting market trends.

Asia Pacific Intragastric Balloons Market Analysis

The Asia Pacific market is predominantly driven by rapid urbanization and changing dietary habits, resulting in a larger patient base. In addition to this, growing awareness of minimally invasive procedures is prompting more individuals to opt for intragastric balloons as a non-surgical option. Furthermore, supportive government initiatives focusing on obesity management and preventive healthcare are fostering market growth. The region's increasing access to advanced medical technologies, which enhance the safety and effectiveness of treatments, is strengthening the market demand. Moreover, the expanding middle class, with higher disposable incomes, is fueling demand for weight loss treatments, providing further market potential. According to the People Research on India's Consumer Economy (PRICE), India's middle class is the fastest-growing segment, expanding at a rate of 6.3% annually, with an increase of 338 Million people from 1995 to 2021. It now constitutes 31% of the population and is projected to reach 38% by 2031 and 60% by 2047.

Latin America Intragastric Balloons Market Analysis

In Latin America, the market for intragastric balloons is expanding, predominantly driven by rising disposable income, which enables more individuals to afford weight loss treatments. Similarly, increasing awareness of minimally invasive procedures is encouraging individuals to opt for non-surgical options. The growing availability of advanced medical technologies, enhancing the safety and efficacy of treatments, is further fueling market expansion. Moreover, favorable government initiatives focused on addressing obesity through public health campaigns and improving healthcare access are making these treatments more accessible, strengthening the market's presence. As such, Novo Nordisk planned to invest USD 1.09 Billion in Brazil to expand production of Ozempic, Wegovy, and other injectable drugs. The investment will enhance manufacturing capacity at its Minas Gerais facility, with operations set to begin in 2028.

Middle East and Africa Intragastric Balloons Market Analysis

The market in the Middle East and Africa is significantly influenced by the growing awareness of obesity-related health risks and the need for effective weight loss solutions. The 2023 update from the World Obesity Federation's Global Observatory revealed that the UAE has a childhood obesity prevalence rate of 15% among girls (ranked 24th globally) and 18.5% among boys (ranked 21st globally). Furthermore, increasing access to modern medical treatments in the region, bolstered by investments in healthcare infrastructure, is accelerating market demand. Additionally, the region's growing health-conscious population, particularly among younger generations, is driving the need for minimally invasive weight loss options, thereby impelling the market. Moreover, various collaborative partnerships between local healthcare providers and global medical device companies are enhancing the availability and affordability of these treatments, providing an impetus to the market.

Competitive Landscape:

The intragastric balloon market is seeing steady activity with ongoing product launches, regulatory approvals, and research-driven innovation. Companies are introducing adjustable and non-invasive balloon systems to improve safety and patient comfort. Partnerships, mergers, and funding rounds are being used to expand product portfolios and global reach. Research institutions are contributing to the development of next-generation capsules with automated inflation features. While government initiatives mainly support obesity awareness and prevention, they indirectly benefit market growth. Among these, research and development, along with commercial partnerships, remain the most common practices, helping companies differentiate their offerings and meet regulatory requirements in new markets.

The report provides a comprehensive analysis of the competitive landscape in the intragastric balloons market with detailed profiles of all major companies, including:

- Apollo Endosurgery

- Obalon Therapeutics Inc.

- ReShape Medical Inc.

- Medicone

- Medsil

- Allurion Technologies Inc.

- Helioscopie

- Spatz Fgia Inc.

- PlenSat

- Districlass Medical SA

- Endalis

- Lexel SRL

- Silimed Inc.

- Shandong Institute of Medical Instruments

Latest News and Developments:

- February 2025: Allurion relaunched its balloon in France after receiving clearance from the French regulatory authority, ANSM. The company is also exploring clinical trials combining the Allurion Balloon with GLP-1 therapies to prevent muscle loss during weight loss, aiming to develop an advanced obesity treatment.

- January 2025: ReShape Lifesciences announced an update on its merger with Vyome Therapeutics and asset purchase agreement with Biorad Medisys. The merger, involving an all-stock transaction, aims to advance Vyome's immuno-inflammatory assets. ReShape will be renamed Vyome Holdings and focus on U.S.-India innovation.

- December 2024: MIT engineers developed a dynamic inflatable gastric balloon that can be inflated before meals to reduce food intake by 60%, offering a temporary solution for weight loss. This innovative design aims to provide an alternative to surgery or weight-loss drugs for patients with limited treatment options.

- December 2024: Boston Scientific launched the Apollo ESG System and Orbera365 Intragastric Balloon System in India, expanding into endobariatrics. These minimally invasive solutions aim to address obesity, offering alternatives to traditional surgery. With rising obesity rates in India, these systems provide effective weight-loss options for patients.

Intragastric Balloons Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Single Intragastric Balloon, Double Intragastric Balloon, Triple Intragastric Balloon |

| Filling Materials Covered | Saline Filling, Gas Filling |

| Implanting Procedures Covered | Surgical, Non-Surgical |

| Applications Covered | Obesity, Diabetes, Diet Control, Weight-Loss, Pre-Operative Weight Reduction, Others |

| End-Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apollo Endosurgery, Obalon Therapeutics Inc., ReShape Medical Inc., Medicone, Medsil, Allurion Technologies Inc., Helioscopie, Spatz Fgia Inc., PlenSat, Districlass Medical SA, Endalis, Lexel SRL, Silimed Inc. and Shandong Institute of Medical Instruments, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the intragastric balloons market from 2019-2033.

- The intragastric balloons market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the intragastric balloons industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The intragastric balloons market was valued at USD 70.19 Million in 2024.

The intragastric balloons market is projected to exhibit a CAGR of 9.79% during 2025-2033, reaching a value of USD 169.63 Million by 2033.

The intragastric balloons market is driven by rising obesity rates, growing demand for minimally invasive weight-loss options, short recovery times, supportive medical tourism, and increasing awareness. Advances in balloon technology and expanding approvals across regions are also helping adoption, especially among patients avoiding bariatric surgery.

North America dominated the intragastric balloons market in 2024 due to high obesity prevalence, strong healthcare infrastructure, early adoption of advanced technologies, and favorable regulatory approvals supporting non-surgical weight-loss treatments.

Some of the major players in the intragastric balloons market include Apollo Endosurgery, Obalon Therapeutics Inc., ReShape Medical Inc., Medicone, Medsil, Allurion Technologies Inc., Helioscopie, Spatz Fgia Inc., PlenSat, Districlass Medical SA, Endalis, Lexel SRL, Silimed Inc., and Shandong Institute of Medical Instruments, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)