Investment Casting Market Size, Share, Trends and Forecast by Process Type, Material, Application, and Region, 2025-2033

Investment Casting Market Size and Share:

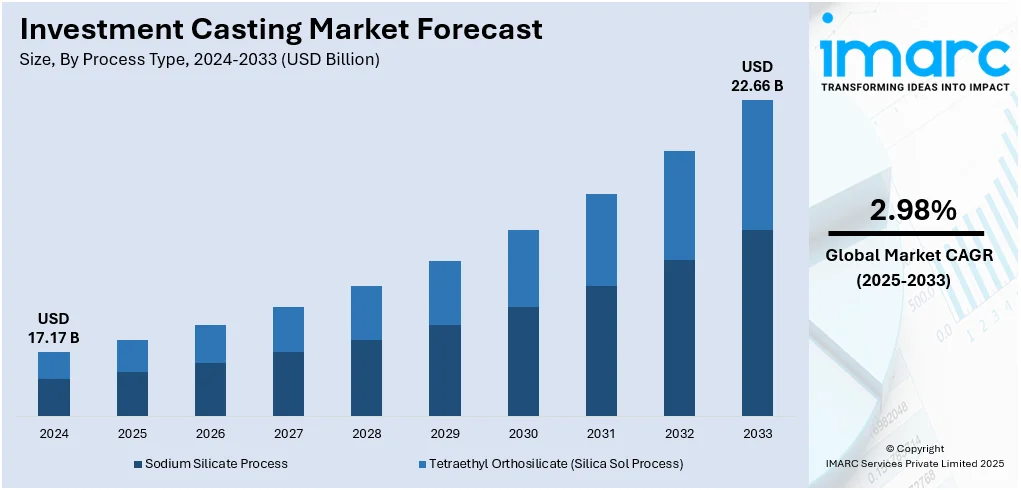

The global investment casting market size was valued at USD 17.17 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 22.66 Billion by 2033, exhibiting a CAGR of 2.98% during 2025-2033. North America currently dominates the market, holding a significant market share of 35.0% in 2024. The market is expanding due to growing demand for precise, complex metal parts in aerospace and automotive sectors. In addition, advanced automation and a shift toward sustainable production methods continue to support investment casting market share across diverse industrial applications worldwide.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.17 Billion |

|

Market Forecast in 2033

|

USD 22.66 Billion |

| Market Growth Rate 2025-2033 | 2.98% |

Modern automation is transforming the way the investment casting market advances worldwide. Companies are adopting robotics, computer-controlled machinery, and digital design tools to achieve greater precision at every stage. Automated wax pattern production, shell building, and metal pouring help deliver flawless surfaces and tight tolerances. Unlike older methods, these automated systems run with minimal interruption and fewer labor needs, which means faster turnaround and consistent output, even for complicated parts. High-value industries like aerospace, defense, and medical devices rely on these improvements to meet strict performance demands and reduce waste. Automation also makes it easier to adapt quickly when customers need design tweaks or small production runs.

To get more information on this market, Request Sample

In the United States, the investment casting industry is seeing new growth thanks to a stronger push for sustainable solutions. Instead of just cutting emissions, many manufacturers are now working to design processes that conserve raw materials from the start. Some have switched to closed-loop systems that recover leftover wax and ceramic material for reuse, lowering costs and landfill waste. Others invest in modern furnaces and energy management tools that keep energy use efficient across multiple shifts. There’s also more collaboration with suppliers to source recycled metals and certified low-carbon alloys, supporting broader climate targets. Unlike older practices, today’s operations increasingly combine advanced monitoring with cleaner equipment to track environmental impact in real time.

Investment Casting Market Trends:

Rising Use of Novel Technologies

The increasing use of advanced technologies is pushing the investment casting market forward, especially as more manufacturers adopt automation and digital tools to stay competitive. Automation enables faster, more precise creation of molds and wax patterns, unlocking new design possibilities for parts that demand intricate geometries and tight tolerances. What was once difficult or impossible to mold by hand can now be shaped accurately through automated systems and cutting-edge pattern-making equipment. Robotic arms, computer-controlled casting lines, and specialized software programs are handling tasks that would traditionally require significant manual labor, which reduces human error and boosts overall efficiency. This means fewer defects, shorter lead times, and more consistent product quality. Companies that invest in such technology gain a production advantage, meeting tighter delivery deadlines without sacrificing quality. An example is GF Casting Solutions AG’s major investment of over USD 184 Million in a new facility in Augusta, Georgia, announced in May 2024. This facility will focus on producing lightweight aluminum parts for the energy and mobility sectors, demonstrating how automation supports large-scale, high-quality production while responding to global demand for innovative manufacturing. Such developments highlight key investment casting market trends, showing how modern methods meet industry needs for precision and efficiency.

Growing Demand for Sustainable Practices

Sustainability has become a central focus in the investment casting industry as global regulations tighten and more customers expect responsible production practices. More foundries and casting companies are taking active steps to reduce their environmental footprint by shifting toward greener operations. Many firms now use biodegradable waxes, low-impact binders, and recycled metals to lower waste and cut carbon emissions throughout production. Companies are also adopting more energy-efficient equipment and cleaner melting processes to lessen their dependence on fossil fuels. According to recent reports, around 85% of firms in the sector boosted their sustainability spending during 2023 and 2024, showing that environmental responsibility is no longer optional but an industry standard. Norsk Hydro’s USD 85 Million investment in a new casting line at its Henderson, Kentucky site in May 2024 is an example of this commitment. The facility, designed to produce recycled-content aluminum parts for the automotive market, highlights how sustainability goals can align with strong commercial demand, enhancing both environmental impact and revenue growth for the sector.

Increasing Applications in the Aerospace Industry

Demand for advanced components in the aerospace sector continues to fuel steady expansion of the investment casting market growth. Aircraft engines and critical structural parts require precision manufacturing to withstand intense pressure, high temperatures, and demanding mechanical loads. Investment casting remains the go-to process for producing these mission-critical components because it consistently delivers the tight tolerances, fine surface finishes, and design freedom needed for aerospace applications. Lightweight yet strong turbine blades, casings, and support structures benefit greatly from this casting method’s ability to create complex internal shapes that would be costly or impractical with other techniques. As the aerospace industry pushes toward fuel efficiency and next-generation aircraft, the importance of producing lighter, high-performance parts grows each year. Innovation in this field continues as universities and industry groups work together to test new techniques. For instance, in January 2024, Alfred University and the Investment Casting Institute (ICI) began a federally backed research project to explore the use of 3D printing alongside traditional casting and forging. This type of collaboration opens the door to faster prototyping, more flexible design, and new ways to integrate cutting-edge materials into flight-critical parts.

Investment Casting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global investment casting market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on process type, material, and application.

Analysis by Process Type:

- Sodium Silicate Process

- Tetraethyl Orthosilicate (Silica Sol Process)

As per the investment casting market outlook, in 2024, sodium silicate process segment led the market, driven by its affordability and flexibility for shaping detailed, large cast components. Industries like automotive, farm equipment, and general machinery continue to favor this method because it balances cost control with reliable surface quality. The process works well for a wide range of metals and allows producers to deliver consistent, repeatable results for complex shapes. Many foundries stick with the sodium silicate process because raw materials are accessible, and the steps can be scaled for high-volume output. New binder systems and coating improvements have helped manufacturers tighten tolerances and cut down on excess finishing. This keeps the method competitive against more expensive alternatives, especially in markets where balancing cost with performance is crucial. As companies push for dependable, high-detail castings without raising costs too much, this segment remains central to the global investment casting industry.

Analysis by Material:

- Superalloys

- Steel

- Aluminum

- Titanium

- Others

In 2024, the steel led the market, driven by steel’s combination of strength, durability, and natural resistance to wear and corrosion makes it a top choice for crafting detailed, high-performance parts used in sectors like automotive, aerospace, construction, and energy. The versatility to blend steel with other alloying elements allows engineers to fine-tune its properties for demanding applications, solving complex design challenges. This adaptability, combined with the worldwide need for strong and dependable metal parts, has kept steel in high demand for investment casting. Its continued use supports steady pricing trends in the market, as manufacturers rely on steel’s proven performance to deliver parts that stand up to tough working conditions and precise technical requirements. For example, in May 2023, JSW Steel USA Ohio, Inc., a subsidiary of JSW Steel, invested USD 145 Million in numerous projects to upgrade its manufacturing operations in Mingo Junction, Ohio.

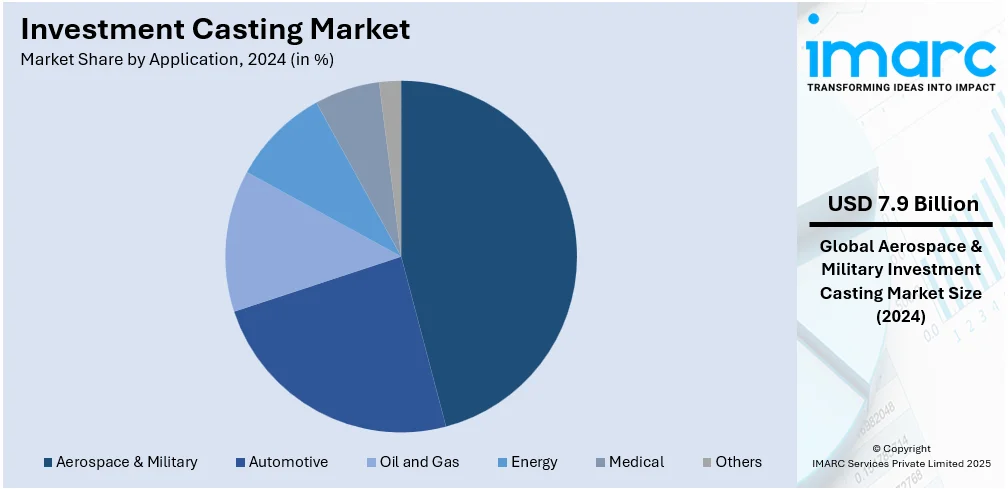

Analysis by Application:

- Automotive

- Aerospace & Military

- Oil and Gas

- Energy

- Medical

- Others

Based on the investment casting market forecast, in 2024, the aerospace & military segment led the market, accounted for the largest market share of over 45.8%. Investment casting plays an essential role in aerospace and defense manufacturing because it delivers highly accurate, intricate parts that must perform flawlessly under extreme conditions. This method allows for producing parts with tight tolerances, complex shapes, and detailed features, which are vital for critical components like engine blades, turbine parts, and structural fittings. These parts face intense heat, pressure, and mechanical stress, so they must be made from advanced alloys that offer maximum strength and resilience. Investment casting makes it possible to work with these specialized materials while maintaining precision and consistency. Its ability to meet strict safety and performance requirements means the process remains a trusted choice for building reliable parts that protect crews and ensure mission success in both aerospace and military fields.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, the North America led the market, accounted for the largest market share of over 35.0%, driven by its robust aerospace, defense, and industrial manufacturing sectors. Aircraft makers and defense contractors count on investment casting for critical parts like turbine blades and lightweight structural pieces that must meet strict standards. Local demand stays strong as budgets for defense and commercial aviation keep orders flowing to foundries. Automakers and energy firms also rely on precision cast parts for engines, turbines, and high-performance equipment. North America’s competitive edge comes from steady adoption of new casting methods, digital tools, and modern equipment that raise output quality and speed. Skilled labor and experienced suppliers help keep production smooth and standards high. This mix of technical leadership, solid domestic demand, and constant upgrades in process capabilities ensures the region continues to anchor the global investment casting market in the years ahead.

Key Regional Takeaways:

United States Investment Casting Market Analysis

The United States investment casting sector is largely supported by rising requirements for precise parts in aerospace, automotive, and medical device manufacturing. According to ASA, U.S. aerospace and defense exports totaled USD 138.7 Billion between 2023 and 2024. The process’s ability to deliver complex shapes with exact specifications makes it a top choice where high strength and accuracy are essential. The ongoing shift toward lightweight and advanced materials like titanium in aerospace and auto fields drives this further, as investment casting handles these efficiently. Rapid progress in 3D printing and additive manufacturing is reshaping mold production, shortening lead times and boosting adoption. IMARC Group reports that the United States 3D printing market hit USD 5.8 Billion in 2024 and should grow at a CAGR of 21.70% during 2025-2033. Cost efficiency is another key factor, as the method reduces waste and machining expenses. Strong infrastructure development also fuels demand for durable, high-grade parts for heavy equipment and energy systems. Supportive government measures for manufacturing innovation and stronger local supply chains are adding to this industry’s steady rise across the region.

Asia Pacific Investment Casting Market Analysis

The Asia Pacific investment casting industry continues to expand thanks to rapid industrial growth, especially in China and India, where precision parts are in demand across aerospace, automotive, and heavy industry. The Press Information Bureau notes India’s Index of Industrial Production (IIP) grew 2.9% in February 2025, highlighting strong output across sectors. The region’s cost-effective labor and robust manufacturing base make investment casting an ideal method for creating detailed parts at scale. Large-scale spending on new infrastructure also pushes the need for reliable cast parts in construction and heavy equipment manufacturing. India’s Union Budget 2025-26 raised capital spending for infrastructure to USD 128.64 Billion, equal to 3.1% of the country’s GDP, per India Brand Equity Foundation (IBEF). Alongside this, more renewable energy projects are emerging, driving use of investment cast parts in turbines and related equipment. This combined growth keeps the sector competitive and supports continued expansion across the Asia Pacific region.

Europe Investment Casting Market Analysis

Expansion in the Europe investment casting industry is driven by demand for detailed metal parts across aerospace, automotive, energy, and healthcare. A focus on precision engineering and complex shapes supports growth, as investment casting delivers fine finishes that other methods may not match. The aerospace sector is a major force, needing durable, lightweight, high-performance pieces made with advanced alloys — ideal for investment casting. The shift in the auto industry toward electric vehicles (EVs) is also increasing need for specialized parts that this method can produce well. The European Environment Agency reports EVs accounted for 22.7% of new car registrations and 7.7% of new vans in the EU in 2023. Altogether, 2.4 Million new electric cars were registered in 2023, up from 2 Million in 2022. Europe’s clear push for sustainability and lower material waste makes this casting process a good fit. Combined with a skilled production base and more automation, this keeps the industry moving ahead.

Latin America Investment Casting Market Analysis

The investment casting sector in Latin America benefits strongly from regional efforts to modernize industrial operations. Many countries continue to invest in better infrastructure, lifting demand for precise, strong parts for heavy machinery, mining, and energy generation. A growing renewable energy market, with wind and solar installations in Brazil alone making up 21% of the country’s renewable mix in 2023, up from 17% in 2022 and 5.8% in 2016, supports further use of investment casting in turbine systems. This data is backed by industry reports. Advances in casting methods, together with labor cost advantages, make investment casting a practical choice for producers wanting efficient, cost-effective production. Local firms are increasingly using improved techniques to meet customer standards and compete globally. Together, industrial upgrades, clean energy growth, and competitive manufacturing conditions position Latin America to strengthen its role in the worldwide market for high-quality cast metal parts.

Middle East and Africa Investment Casting Market Analysis

The Middle East and Africa region shows steady growth in investment casting, fueled by rising needs for highly precise parts in sectors like oil and gas, aerospace, and energy. The large oil and gas industry here demands complex, wear-resistant cast pieces for extraction and refining. For instance, IMARC Group states the UAE oil and gas market reached 3.4 BPD in 2024, with a projected increase to 4.9 BPD by 2033, growing at a CAGR of 3.7% from 2025-2033. Expanding infrastructure projects, including new construction and power facilities, add to demand for dependable cast solutions. New technologies and better manufacturing setups across the region help local producers meet high standards and serve diverse end uses. Growing local production capacity cuts reliance on imports and supports job creation. Altogether, energy needs, modernization of infrastructure, and advances in local manufacturing continue to push the market ahead, strengthening the region’s place in the global supply chain.

Competitive Landscape:

Companies in the investment casting market are advancing practical methods to address new technical demands and produce increasingly complex parts. They are using advanced design software and simulation tools to turn detailed design data into precise casting processes that improve accuracy and reduce defects. Many are refining how digital modeling and casting equipment work together, ensuring smooth coordination between design, mold-making, and production stages without errors or delays. Some companies are enhancing remote monitoring of casting lines, enabling real-time tracking and quicker adjustments to maintain quality. Others are partnering closely with manufacturers in sectors like aerospace and automotive to develop digital solutions that align with performance goals, helping minimize waste, optimize material use, and ensure reliable delivery of high-quality, intricate metal components.

The report provides a comprehensive analysis of the competitive landscape in the investment casting market with detailed profiles of all major companies, including:

- Alcoa Corporation

- CIREX bv (Signicast Corporation)

- Dongfeng Metal Products Co. Ltd.

- Dongying Giayoung Precision Metal Co. Ltd.

- Impro

- MetalTek

- Milwaukee Precision Casting

- Ningbo Jiwei Melt Mould Castings Co. Ltd.

- Ningbo Wanguan

- Precision Castparts Corporation

- RLM Industries

- Taizhou Xinyu Precision Casting Co. Ltd.

- Zollern

Latest News and Developments:

- May 2025: Auxo Investment Partners, a private investment company, successfully acquired Bay Cast Incorporated (BCI) and Bay Cast Technologies, a Michigan-based business that combines precise machining and steel casting. Bay Cast is an expert in manufacturing intricate, massive components for numerous sectors, including aerospace and defense, automotive, marine, chemical, energy, and power generation.

- April 2025: Wisconsin Aluminum Foundry (WAF), a manufacturer of aluminum and copper-based alloy castings, completed the acquisition of Anderson Global, a Michigan-based maker of aluminum foundry tools. The acquisition will broaden WAF's casting, tooling, and machining capabilities across numerous industrial sectors.

- January 2025: Form Technologies, Inc., a large-scale provider of various casting services, including investment casting, disclosed that the majority of its common shares were purchased by Ares Management funds. As a result, Form Technologies has added nearly USD 304 Million in additional stock funding. The new funding is anticipated to expedite the company's commercial plan and facilitate further investment in Form Technologies' superior operating skills.

- December 2024: The Saudi Aluminum Casting Foundry, Obeikan Glass Co.'s aluminum casting factory, officially commenced trial operations. The pilot phase is expected to continue until factory equipment has been thoroughly tested and operational effectiveness has been guaranteed. It is anticipated that commercial operations will begin in Q1 2025.

- December 2024: JS Auto Cast Foundry, a subsidiary of Bharat Forge, announced an investment of Rs. 67.5 Crore for the expansion of its foundry in Tamil Nadu, India. The project, which will be financed by internal accruals and loans, is expected to boost the manufacturing capacity of grey and SG iron castings by more than 60%.

- January 2024: Alfred University partnered with the Investment Casting Institute (ICI) on a federally funded project to research ways to utilize 3D printing in casting and forging manufacturing processes.

Investment Casting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Process Types Covered | Sodium Silicate Process, Tetraethyl Orthosilicate (Silica Sol Process) |

| Materials Covered | Superalloys, Steel, Aluminum, Titanium, Others |

| Applications Covered | Automotive, Aerospace & Military, Oil and Gas, Energy, Medical, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alcoa Corporation, CIREX bv (Signicast Corporation), Dongfeng Metal Products Co. Ltd., Dongying Giayoung Precision Metal Co. Ltd., Impro, MetalTek, Milwaukee Precision Casting, Ningbo Jiwei Melt Mould Castings Co. Ltd., Ningbo Wanguan, Precision Castparts Corporation, RLM Industries, Taizhou Xinyu Precision Casting Co. Ltd., Zollern, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the investment casting market from 2019-2033.

- The investment casting market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the investment casting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The investment casting market was valued at USD 17.17 Billion in 2024.

The investment casting market is projected to exhibit a CAGR of 2.98% during 2025-2033, reaching a value of USD 22.66 Billion by 2033.

The investment casting market is driven by demand for precise, complex parts in aerospace, automotive, energy, and industrial sectors. Advantages like reduced material waste, design flexibility, and ability to handle high-performance alloys make investment casting attractive for manufacturers seeking cost-effective, accurate production.

In 2024, North America dominated the investment casting market accounted for 35.0% market share, driven by a strong aerospace industry, advanced manufacturing capabilities, and steady defense spending. High demand for lightweight, complex metal components keeps the region leading global investment casting production.

Some of the major players in the global investment casting market include Alcoa Corporation, CIREX bv (Signicast Corporation), Dongfeng Metal Products Co. Ltd., Dongying Giayoung Precision Metal Co. Ltd., Impro, MetalTek, Milwaukee Precision Casting, Ningbo Jiwei Melt Mould Castings Co. Ltd., Ningbo Wanguan, Precision Castparts Corporation, RLM Industries, Taizhou Xinyu Precision Casting Co. Ltd., Zollern, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)