IoT Security Market Size, Share, Trends and Forecast by Component, Security Type, Vertical, and Region, 2025-2033

Global IoT Security Market Size and Share Analysis:

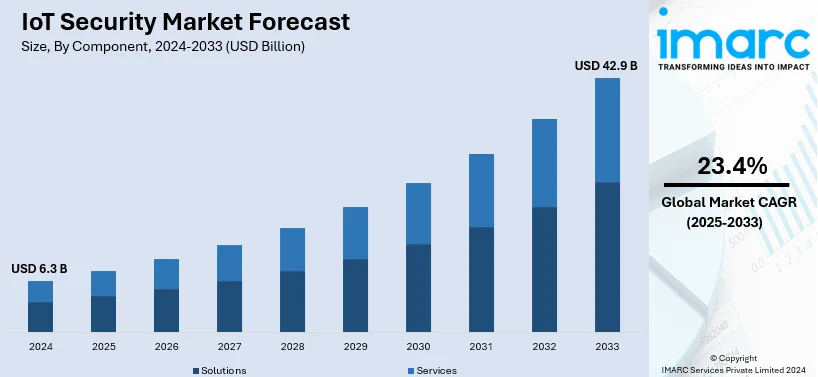

The global IoT security market size reached USD 6.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 42.9 Billion by 2033, exhibiting a growth rate (CAGR) of 23.4% during 2025-2033. North America currently dominates the market, holding a market share of over 35.0% in 2024. Because of its sophisticated technological infrastructure, widespread use of IoT devices across businesses, and high demand for cybersecurity solutions. The region's large expenditures in smart cities, digital transformation, and industrial IoT applications, as well as strict laws and heightened cybersecurity awareness is further responsible for the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.3 Billion |

| Market Forecast in 2033 | USD 42.9 Billion |

| Market Growth Rate (2025-2033) | 23.4% |

Due to the rapid advancements of IoT devices in numerous industries, such as healthcare, industrial, and smart home, strong security measures are needed to protect personal information and sensitive data. Businesses are relying on cutting edge security solutions as IoT networks are becoming more integrated and the threat of cyber-attacks is increasing, which is expanding the IoT security market growth. Increasing security measures are also followed by businesses due to regulative frameworks and compliance requirements, such as GDPR and HIPAA. Another factor that stresses the relevance of securing IoT networks is the growing number of security incidents and data breaches. In addition, there are augmentations in blockchain, AI and ML that broaden the potential of IoT security platforms, which, in turn, explains the growing patterns in the market.

The United States stands out as a key market disruptor, driven by its highly developed technological environment, early adoption of IoT devices, and robust presence of major cybersecurity businesses. There is a greater demand for strong security solutions because of the nation's numerous IoT-enabled applications in sectors like healthcare, manufacturing, transportation, and smart homes. Additionally, the adoption of secure IoT frameworks is fueled by the United States' strict cybersecurity laws, such as those set forth by the National Institute of Standards and Technology (NIST). Along with significant investments in R&D, the nation's leadership is further reinforced by the existence of large tech businesses and startups devoted to IoT security innovations. Organizations are also being forced to give IoT security a priority due to the growing concerns about data breaches and cyberthreats. As per the IMARC Group’s report, the United States IoT security market is expected to reach USD 296.1 Billion by 2033.

IoT Security Market Trends:

Increasing Cybersecurity Frauds in Finance Sector

According to an article published on the website of the International Monetary Fund (IMF) in 2024, the financial sector has suffered more than 20,000 cyberattacks, causing the loss of USD 12 Billion in past 20 years. The finance sector is a frequent target of hackers as it is high centrals of finance and data. With cyberattacks becoming more advanced, the demand for efficient security systems for IoT devices in financial institutions is rising. ATMs, payment terminals, and mobile banking apps are among the IoT equipment nowadays implemented by financial institutions to enhance customer services and their operational efficiencies. Such devices can however become weak points in the security perimeter of an organization if the proper security measures are not planned. Personal and financial information together with other sensitive data is what the financial institutions deal on a daily basis. According to the IoT security market insights, protecting this information from breaches is important to prevent regulatory penalties and more importantly to maintain customer confidence. IoT security solutions enable breach and illegal access of data which is the very reason why there is an increase in IoT security. Cyberattacks funded by criminals and other groups on financial institutions can result in substantial losses including regulatory penalties, theft, and damage to the organization’s image. Such risks are mitigated through investing in IoT security which helps sounds breaches and strengthens the financial institution’s systems.

Rising Development of Smart Cities

Smart cities are equipped with many interconnected devices and sensors, which are used to control and manage the urban features, such as traffic systems, energy systems, security systems, and trash collection systems. These cities too have their own key infrastructure, which include power structures, water supply systems, and transportation systems. It is vital to protect these infrastructures from cyber-attacks to prevent vulnerabilities that could threaten public safety and city operations. According to Forbes data, globally, Singapore is the current top smart city investor, followed by Tokyo, New York and London. Regionally, the US, Western Europe and China account for over 70% of the world’s total spend on smart cities, with Latin America and Japan experiencing the fastest growth in spend. Further, as part of the Smart Cities Mission, an investment of INR 2.04 lakh crore is planned for various projects in India. Planned sources of funds include central and state governments (45%), convergence of various government schemes (21%), public-private partnerships (21%), debts or loans (5%), cities’ own funds (1%) and funds from other sources (8%). Smart cities collect and interpret massive volumes of data from a variety of sources, such as surveillance cameras, environmental sensors, and citizen gadgets. Ensuring the privacy and protection of this data is critical to prevent illegal access and breaches, which is creating the need for complete IoT security solutions. With over 68% of humankind is expected to live in cities by 2050, many of them are observing the reshaping of the urban city firsthand.

Thriving Retail Industry

According to the data published on the website of the National Retail Federation, retail sales increase between USD 5.23 Trillion and USD 5.28 Trillion in 2024. The integration and use of IoT devices are evident as retailers utilize smart shelves, connected point-of-sale (POS) systems, digital signage, and RFID tags for better inventory management, customer experience, and operational efficiency. Adopting strict measures for the safety of these devices is essential for preventing data loss, fraud, and economic damages, hence the adoption of a higher measure of IoT security solutions is increasing. Large retail shops processes and collects a great deal of customers’ data including shoppers’ online activities, preferences and private details which feeds the revenues of the IoT security industry. There are great challenges of maintaining buyer confidence and legal compliance when it comes to the use and access of sensitive data as breaches are common in the current world. IoT devices are basic elements of the supply chain management enabling visibility and real-time tracking of items throughout the supply chain. The provision of IoT devices in the retail sector is increasing the overall supply chain performance by preventing the occurrences of disruptions, theft and tampering of items.

IoT Security Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on component, security type, vertical, and region.

Analysis by Component:

- Solutions

- Services

Solutions lead the market with 67.0% of market share in 2024. The strategies include a wide range of security options from hardware, software to services, specific to security concerns posed by IoT devices and networks. Considering the quick upsurge of IoT capability in healthcare, manufacturing, and transportation sectors, the demand for such integrated security solutions is going up to a great extent to protect critical information, respect individuals’ privacy, and enhance the dependability of the systems. Security solutions encompass important capabilities including encryption, authentication, firewalls, and threat detection, which are crucial in protecting against cyberattack and reducing the odds of risk. Besides this, these systems are increasingly being supported by new technologies, such as artificial Intelligence (AI), machine learning (ML), and blockchain, to improve their efficiency. According to the IoT security market overview, the growing need for 360-degree security solutions capable of tackling multifaceted IoT structural flaws and meeting compliance regulations is a major driver behind their market leadership.

Analysis by Security Type:

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Others

Cloud security solutions lead the market with 76.8% of market share in 2024. As IoT devices generate vast amounts of data, businesses increasingly rely on the cloud to handle this data efficiently and securely. Cloud security solutions offer scalable and flexible protections, such as data encryption, access control, and secure APIs, which are crucial for safeguarding sensitive information stored or processed in the cloud. Additionally, cloud providers invest heavily in advanced security technologies and compliance with industry regulations, which further boosts the adoption of cloud based IoT security solutions. As IoT networks become more interconnected and distributed, the cloud provides a centralized platform for monitoring and securing devices across various locations. With its ability to support real-time data analytics, threat detection, and seamless integration, cloud security remains the preferred choice for businesses seeking robust IoT security.

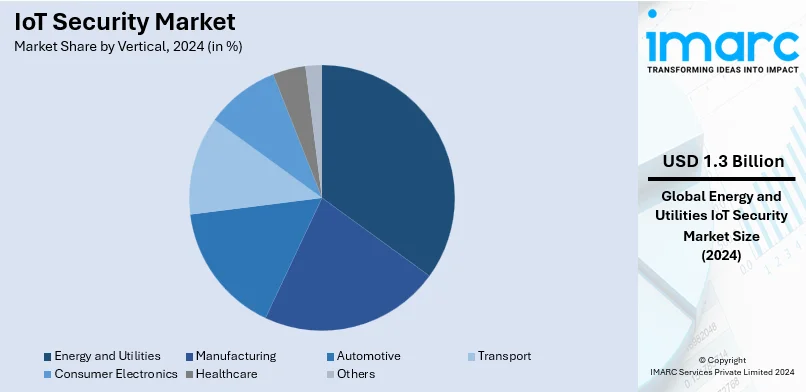

Analysis by Vertical:

- Energy and Utilities

- Manufacturing

- Automotive

- Transport

- Consumer Electronics

- Healthcare

- Others

Energy and utilities lead the market with 20.1% of market share in 2024. IoT technologies enable real-time monitoring of power grids, water supply systems, and oil and gas pipelines, which are vital for operational efficiency, safety, and sustainability. As these sectors become increasingly digitized, they face growing cybersecurity risks, making robust security measures essential to protect against potential threats that could disrupt services, cause financial loss, or compromise public safety. IoT security solutions help safeguard sensitive data, control access to critical systems, and prevent cyberattacks targeting energy infrastructure. Additionally, the global push towards smart grids and smart meters to optimize energy usage is driving the demand for IoT security in this sector. Given the high stakes in terms of public safety and regulatory compliance, energy and utilities lead the market in adopting comprehensive IoT security solutions.

Regional Analysis:

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- North America

- United States

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

In 2024, North America accounted for the largest market share of 35.0%. North America is the largest region in the IoT security market for several reasons, including the widespread adoption of IoT technology in industries, such as healthcare, manufacturing, transportation, and smart homes. The existence of significant technology businesses and modern infrastructure promotes innovations and implementation of IoT solutions, necessitating strong security measures to protect against evolving cyber threats. Furthermore, strong regulatory regulations and standards in the United States and Canada need robust cybersecurity measures, which is driving the demand for advanced IoT security solutions. Moreover, key players operating in the region are introducing new cloud solutions to strengthen the security of IoT devices and networks. with significant investments in cybersecurity, contributes to the market expansion.

Key Regional Takeaways:

United States IoT Security Market Analysis

In 2024, US accounts for 82.9% of the total North America IoT security market share. The rapid adoption of IoT devices in sectors including manufacturing, healthcare, and smart cities is propelling the IoT security industry in the US. As per an industrial report, more than 15 Billion IoT devices were connected globally as of 2023, with the United States contributing significantly because of its sophisticated technological infrastructure. Strong security solutions are more important than ever due to the increase in cyberattacks that target IoT systems. Businesses made significant investments in IoT security measures after it was discovered that majority of IoT devices in the US had vulnerabilities.

Another important factor is government regulations, which sets security requirements for IoT devices that are used in federal networks. A major area of growth is the healthcare industry, where IoT-enabled medical devices need to be extremely secure to safeguard private patient information. Advancements in machine learning (ML) and artificial intelligence (AI) are further strengthening the market by making predictive threat identification possible. In 2024, the industrial IoT security market in the United States is expected to be worth USD 135.6 Billion. The market would increase at a compound annual growth rate (CAGR) of 17.1% from 2025 to 2033, reaching USD 568.9 Billion.

Europe IoT Security Market Analysis

The IoT security market in Europe is being driven by strict data protection regulations like the General Data Protection Regulation (GDPR) and the increasing use of IoT in industries like retail, energy, and automobile. Because connected cars depend on secure communication systems, the automobile industry makes a significant contribution. The significant risk of cybersecurity in certain European countries also supports the IoT security market outlook. For instance, Russia is most vulnerable to cybercrimes, according to the World Cybercrime Index. Furthermore, Poland is the target of the most attacks, even though Russia may be at the most risk. In 2024, Poland experienced more than 1,000 cyberattacks every week, according to the nation's Cyberspace Defence Forces. Since the Russian invasion of Ukraine in 2022, the nation has experienced a dramatic increase in cyberattacks, much of which the Polish government has blamed on the Kremlin. However, the best and most secure cybersecurity systems and the finest readiness for an attack are also found in European nations like Finland, Norway, and Denmark.

Asia Pacific IoT Security Market Analysis

IoT usage is expanding quickly in the Asia-Pacific region due to the widespread use of smart devices and industrial automation. China, India, Japan, and South Korea are among the nations making significant investments in IoT adoption in its digital infrastructure, which also leads to the high risk of cybersecurity attacks in the region. APAC had 1,835 new cyberattacks per company on average each week, which is significantly higher than the 1,248 global averages. Because of this, there is a great deal of potential for cybercrime in APAC, with an estimated cost of USD 3.3 Trillion by 2025 if one includes the region's 31% share in global cyberattacks. The need for safe IoT ecosystems is being driven by government efforts such as South Korea's IoT Master Plan and India's Digital India. IoT security solutions are being implemented in the manufacturing and healthcare sectors, which are important growth areas, to protect sensitive data and avoid interruptions. Due to developments in edge computing and AI, cloud-based IoT security solutions are becoming more popular.

Latin America IoT Security Market Analysis

The growing use of IoT systems in smart city initiatives and agriculture applications is propelling the IoT security market in Latin America. IoT networks are susceptible to cyberattacks due to a lack of strong security measures, which forces businesses to spend money on cutting-edge security solutions. The need for IoT security is increasing because of smart city projects like Brazil's smart agricultural initiatives and Mexico City's urban IoT deployment. Another driver is the rollout of 5G technology, which makes IoT connectivity quicker and safer. The market is also supported by regional government initiatives and rising corporate investments. Despite being at the vanguard of IoT adoption, nations like Brazil, Mexico, and Argentina are predicted to have USD 1.3 Billion IoT connections by 2025.

Middle East and Africa IoT Security Market Analysis

The growing use of IoT systems in smart cities, industrial automation, and oil and gas applications is propelling the Middle East and Africa (MEA) IoT security market. With initiatives like Saudi Vision 2030 and the UAE's Smart Dubai initiative concentrating on safe IoT ecosystems, nations like Saudi Arabia, the United Arab Emirates, and South Africa are spearheading the adoption of IoT. An important part of the MEA economy, the oil and gas sector depend on IoT for operational effectiveness and needs strong security measures to safeguard vital infrastructure. Business investments in cutting-edge security technologies are spurred by the growing threat of cyberattacks. The increasing awareness about cybersecurity and technical improvements is also supporting the IoT security market growth in the region.

Top Leading IoT Security Companies:

Key players in the market are creating and improving comprehensive security solutions to combat emerging threats to IoT ecosystems. These firms use modern technologies like artificial intelligence (AI), machine learning (ML), and blockchain to deliver effective threat detection, prevention, and response capabilities. They are also working to integrate their solutions with cloud platforms and other IT infrastructure while providing smooth and scalable security measures. To remain ahead of growing threats, these major organizations are spending in research and development (R&D), forging strategic alliances, and purchasing smaller companies with specific expertise. Furthermore, they are collaborating closely with regulatory organizations to ensure that their solutions help clients achieve severe compliance criteria. In addition, major players are focusing on mergers and partnerships to expand their customer base and keep them competitive in the market. For instance, in 2023, Allot Ltd. has extended its partnership with PPF Telecom Group to launch consumer cybersecurity services.

The global IoT security market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Allot Ltd.,

- Armis Inc.

- CENTRI Technology

- Cisco Systems, Inc.

- ForgeRock Inc.

- Fortinet, Inc.

- Gemalto NV

- International Business Machines (IBM) Corporation

- Infineon Technologies AG

- Intel Corporation

- Mocana Corporation

- Newsky Internet Limited

- SecuriThings

- NortonLifeLock Inc. (Symantec Corporation)

- ZingBox Inc.

Latest News and Recent Developments:

- October 2024: The European Telecommunications Standards Institute (ETSI) has released new security guidelines aimed at enhancing the security of consumer Internet of Things (IoT) devices, addressing its vulnerabilities. These guidelines emphasize the importance of implementing security measures throughout the lifecycle of IoT products, particularly as the number of connected devices is expected to rise.

- September 2024: Chinese cybercriminals have been implicated in the discovery of a new IoT botnet called "Raptor Train," which may target more than 1.5 million devices and perhaps perform massive Distributed Denial of Service (DDoS) attacks. As the number of connected devices keeps growing, this botnet takes advantage of flaws in consumer IoT devices, such as routers and webcams, underscoring the urgent need for enhanced security measures in the IoT ecosystem.

- August 2024: LORIOT and LORATECH have joined forces in an exciting partnership set to transform the Internet of Things (IoT) landscape in Latin America. This collaboration leverages the strengths of two industry leaders to offer advanced solutions for managing and operating sensor networks, representing a significant stride toward a more connected and intelligent future.

IoT Security Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solutions, Services |

| Security Types Covered | Network Security, Endpoint Security, Application Security, Cloud Security, Others |

| Verticals Covered | Energy and Utilities, Manufacturing, Automotive, Transport, Consumer Electronics, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Others, Turkey, Saudi Arabia, Iran, United Arab Emirates, Others |

| Companies Covered | Allot Ltd., Armis Inc., CENTRI Technology, Cisco Systems, Inc. ForgeRock Inc., Fortinet, Inc., Gemalto NV, International Business Machines (IBM) Corporation, Infineon Technologies AG, Intel Corporation, Mocana Corporation, Newsky Internet Limited, SecuriThings, NortonLifeLock Inc. (Symantec Corporation), ZingBox Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, IoT security market forecast, and dynamics of the market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global IoT security market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the IoT security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The IoT security market was valued at USD 6.3 Billion in 2024.

The IoT security market is projected to exhibit a CAGR of 23.4% during 2025-2033, reaching a value of USD 42.9 Billion by 2033.

The market is primarily driven by the growing adoption of IoT devices, increasing cyber threats, and the need for data privacy, stricter regulations and compliance requirements, such as GDPR, are encouraging businesses to improve security measures, ongoing technological advancements in AI and machine learning (ML), and the rising frequency of cyberattacks.

North America currently dominates the IoT Security market, accounting for a share of over 35.0%, driven by the widespread adoption of IoT technologies, robust regulatory frameworks, advanced cybersecurity infrastructure, and significant investments in R&D by key market players.

Some of the major players in the IoT security market include Allot Ltd., Armis Inc., CENTRI Technology, Cisco Systems, Inc. ForgeRock Inc., Fortinet, Inc., Gemalto NV, International Business Machines (IBM) Corporation, Infineon Technologies AG, Intel Corporation, Mocana Corporation, Newsky Internet Limited, SecuriThings, NortonLifeLock Inc. (Symantec Corporation), and ZingBox Inc. among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)