Iran ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Province, 2025-2033

Iran ATM Market Overview:

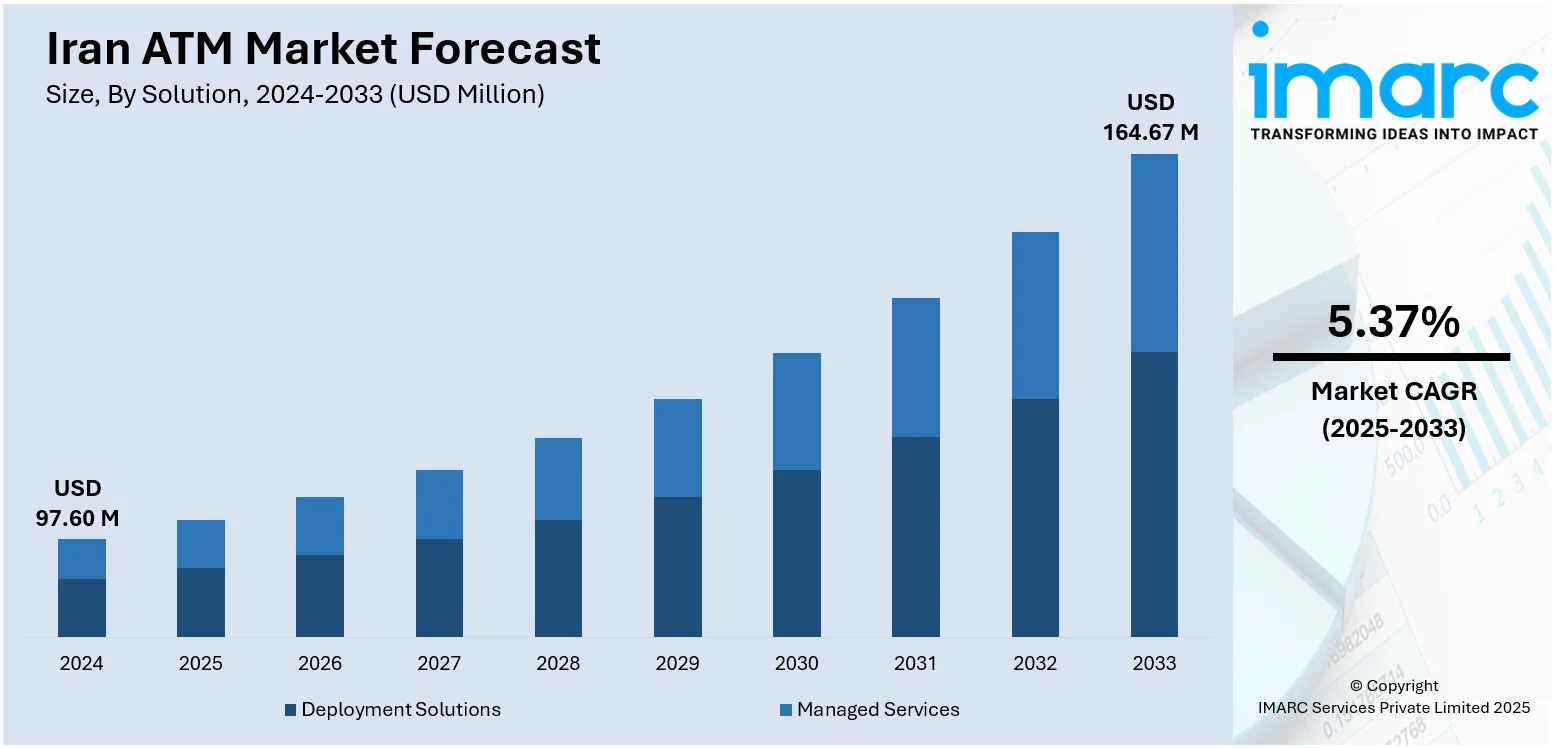

The Iran ATM market size reached USD 97.60 Million in 2024. Looking forward, the market is expected to reach USD 164.67 Million by 2033, exhibiting a growth rate (CAGR) of 5.37% during 2025-2033. Various factors are propelling the market, such as the rising need for easy cash availability, digital banking growth, and efforts by the government to boost financial inclusion. The continuous growth of ATM networks in urban and rural India is also adding to the Iran ATM market share, reflecting high market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 97.60 Million |

| Market Forecast in 2033 | USD 164.67 Million |

| Market Growth Rate 2025-2033 | 5.37% |

Iran ATM Market Trends:

Expansion of ATM Networks

The most significant factor contributing to the Iran ATM market growth is the fast development of the ATM network across Iran. The Iranian government and financial institutions have been aggressively investing in enhancing ATM density in urban and rural areas to extend wider reach of banking services. This is particularly significant in sparsely populated regions where there is limited traditional banking infrastructure. As an increasing number of ATMs are deployed, it becomes easier for people to access financial services, and more individuals are encouraged to use banking services and thus become less dependent on physical bank branches. This extensive ATM deployment has helped in significantly increasing the number of transactions facilitated by ATMs in Iran. For instance, in April 2025, Iran’s Central Bank introduced rial debit cards for foreign tourists and non-residents, facilitating financial transactions within the country. These cards, issued by licensed banks and exchange offices, are loaded with foreign currency at agreed exchange rates and can be used for purchases, transfers, ATM withdrawals, and bill payments. This initiative aims to ease payment challenges faced by tourists due to international sanctions.

To get more information on this market, Request Sample

Integration of Contactless and Digital Features

The growing inclusion of contactless and digital banking attributes in Iran's ATM market has brought new levels of payment ease and security. With consumers insisting on quicker, more secure banking services, ATMs are being enhanced with innovations such as contactless card readers, mobile wallet support, and biometric authentication. These developments meet the rising trend for smooth, cardless transactions. However, the recent cyberattack on Bank Sepah in June 2025, reportedly linked to hackers from Israel, underscores the risks associated with digital banking. This breach disrupted ATM services and impacted gas station transactions. While Iran's central bank assured that banking operations remained intact, it highlights the growing need for robust cybersecurity measures in ATMs to support the ongoing digital transformation, further fueling the demand for secure and efficient financial access in Iran, driving market growth.

Iran ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/province levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes 15" and below and above 15".

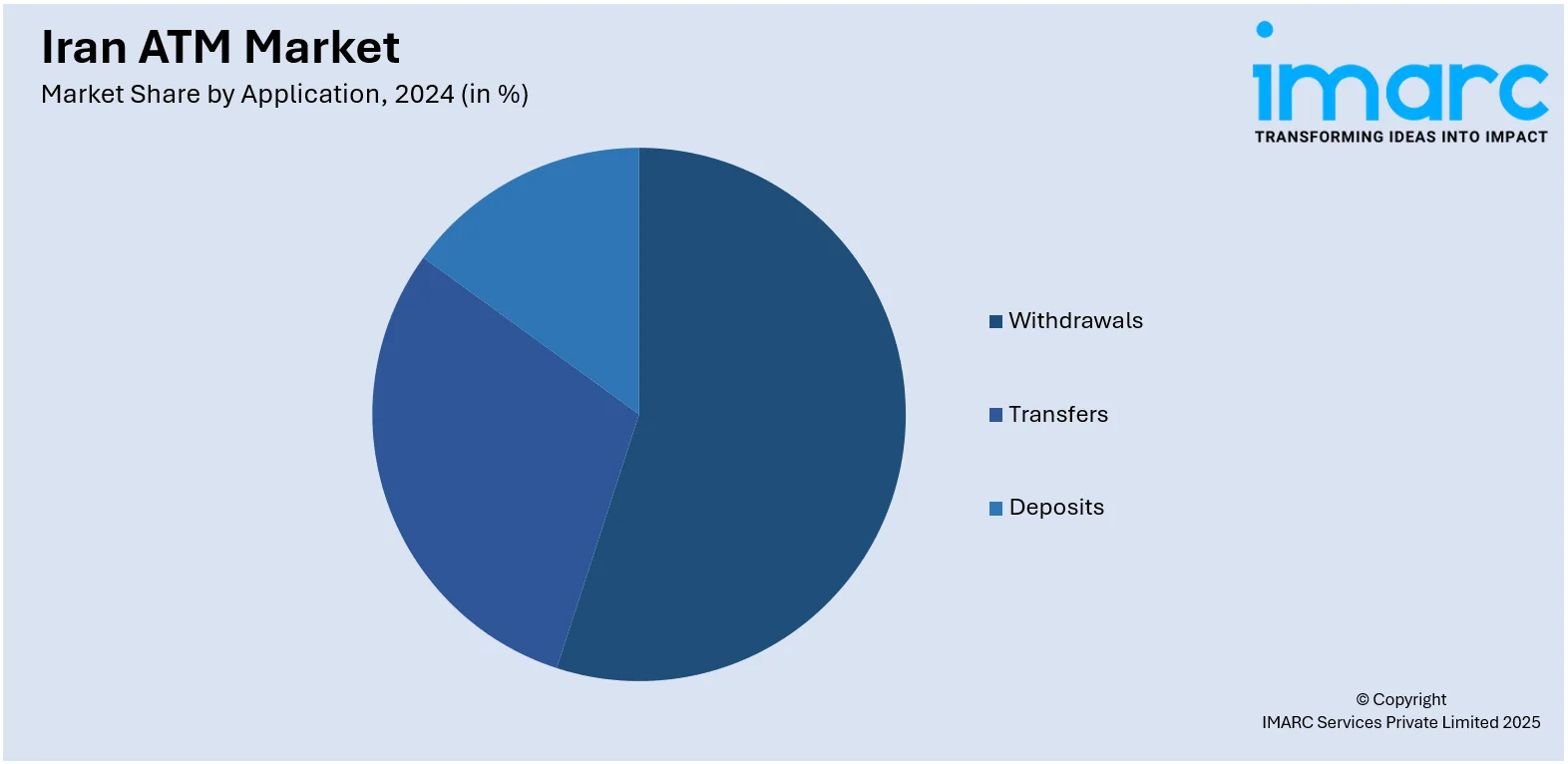

Application Insights:

- Withdrawals

- Transfers

- Deposits

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Provincial Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major provincial markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran ATM Market News:

- In November 2024, Russia's Mir payment system officially integrated with Iran's Shetab at a ceremony in Tehran. The first phase allows Shetab cardholders to use their cards at Russian ATMs. In subsequent phases, Russian tourists can use Mir cards in Iran, and Iranians will be able to use Shetab cards in Russia for payments.

Iran ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran ATM market on the basis of solution?

- What is the breakup of the Iran ATM market on the basis of screen size?

- What is the breakup of the Iran ATM market on the basis of application?

- What is the breakup of the Iran ATM market on the basis of ATM type?

- What is the breakup of the Iran ATM market on the basis of province?

- What are the various stages in the value chain of the Iran ATM market?

- What are the key driving factors and challenges in the Iran ATM market?

- What is the structure of the Iran ATM market and who are the key players?

- What is the degree of competition in the Iran ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)