Iran Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033

Iran Cement Market Overview:

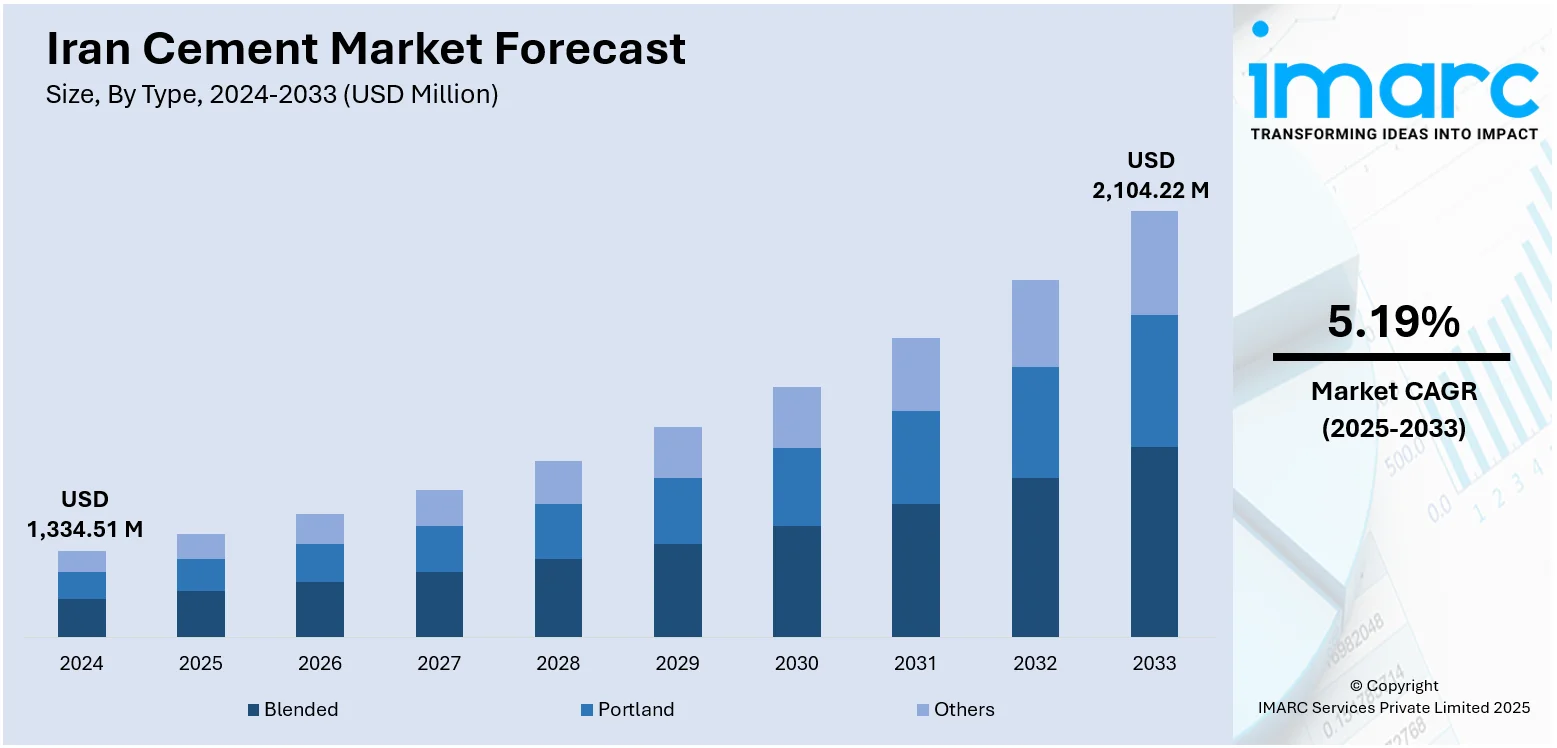

The Iran cement market size reached USD 1,334.51 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,104.22 Million by 2033, exhibiting a growth rate (CAGR) of 5.19% during 2025-2033. Iran is presently developing extensive infrastructure, which is driving the construction material demand in the country. Moreover, government policies are providing support to the export trend by streamlining export procedures and lowering tariffs to promote foreign trade. This, along with the rise in focus on improving manufacturing processes to increase efficiency, lower emissions, and meet environmental standards, is expanding the Iran cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,334.51 Million |

| Market Forecast in 2033 | USD 2,104.22 Million |

| Market Growth Rate 2025-2033 | 5.19% |

Iran Cement Market Trends:

Expanding Infrastructure Development Projects

Iran is presently developing extensive infrastructure, which is driving the cement demand in the country. The government is launching a number of big urban development initiatives involving transportation networks, water management systems, and housing construction. The 2025-2026 infrastructure budget comprises 350 trillion tomans. These initiatives are a part of larger national agendas that focus on self-reliance and economic diversification. With the construction or remodeling of new roads, bridges, airports, and dwelling units, cement is still a basic material. Public and semipublic capital is being spent to expand housing supply, especially in rural and lower-income urban communities. Domestic cement makers are also ramping up production to satisfy the expanding demand created by these efforts. This continuous growth in infrastructure is not only rising the demand but also inducing modernization in Iran's cement sector, motivating improvements in the level of production capacity and technology towards greater efficiency and environmental sustainability.

To get more information on this market, Request Sample

Rising Cement Exports to Adjacent Markets

Iran is strategically increasing its cement exports, which is propelling the market growth. The nation possesses one of the Middle East's biggest cement production capacities, and it is utilizing this to boost export amounts to neighboring nations with limited production capacities, like Iraq, Afghanistan, and Central Asian nations. Regional rebuilding initiatives, especially in war-torn regions, are putting great demand on low-cost building materials, making Iranian cement a credible option. Iran is further leveraging its geographical location and cost benefits, such as the availability of cheaper labor and energy, to keep prices competitive in foreign markets. Government policy is providing support to this trend by streamlining export procedures and lowering tariffs to promote foreign trade. In addition, even with sanctions, numerous Iranian manufacturers are discovering alternative market avenues and customers, for example, through barter agreements or third-party brokers, which guarantee stable demand and maintain foreign currency inflows necessary for the financial stability of the industry. According to International Cement Review, total cement exports reached 1.393Mt in the first quarter of 2025, reflecting a 17.1 percent increase compared to 1.19Mt in 1Q24.

Modernization and Technological Progress in Production

Iranian cement producers are busily upgrading their manufacturing processes to increase efficiency, lower emissions, and meet environmental standards, thereby supporting the Iran cement market growth. This upgrade is driven by domestic policy demands as well as international sustainability currents. Numerous plants are now investing in sophisticated equipment like vertical roller mills, waste heat recovery, and automated quality control technology. These renovations are allowing firms to cut their carbon footprint and lower costs of production through enhanced energy efficiency. The move toward green practices is also placing Iranian cement on a stronger footing for acceptance in world markets, where sustainability requirements are tightening. At the same time, digitalization is enhancing supply chain management and preventive maintenance along the production line. Through the adoption of automation and innovation, the industry is positioning itself according to international best practices, which is likely to enhance operational productivity as well as ensure long-term economic resilience to volatility and supply chain disruption.

Iran Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others.

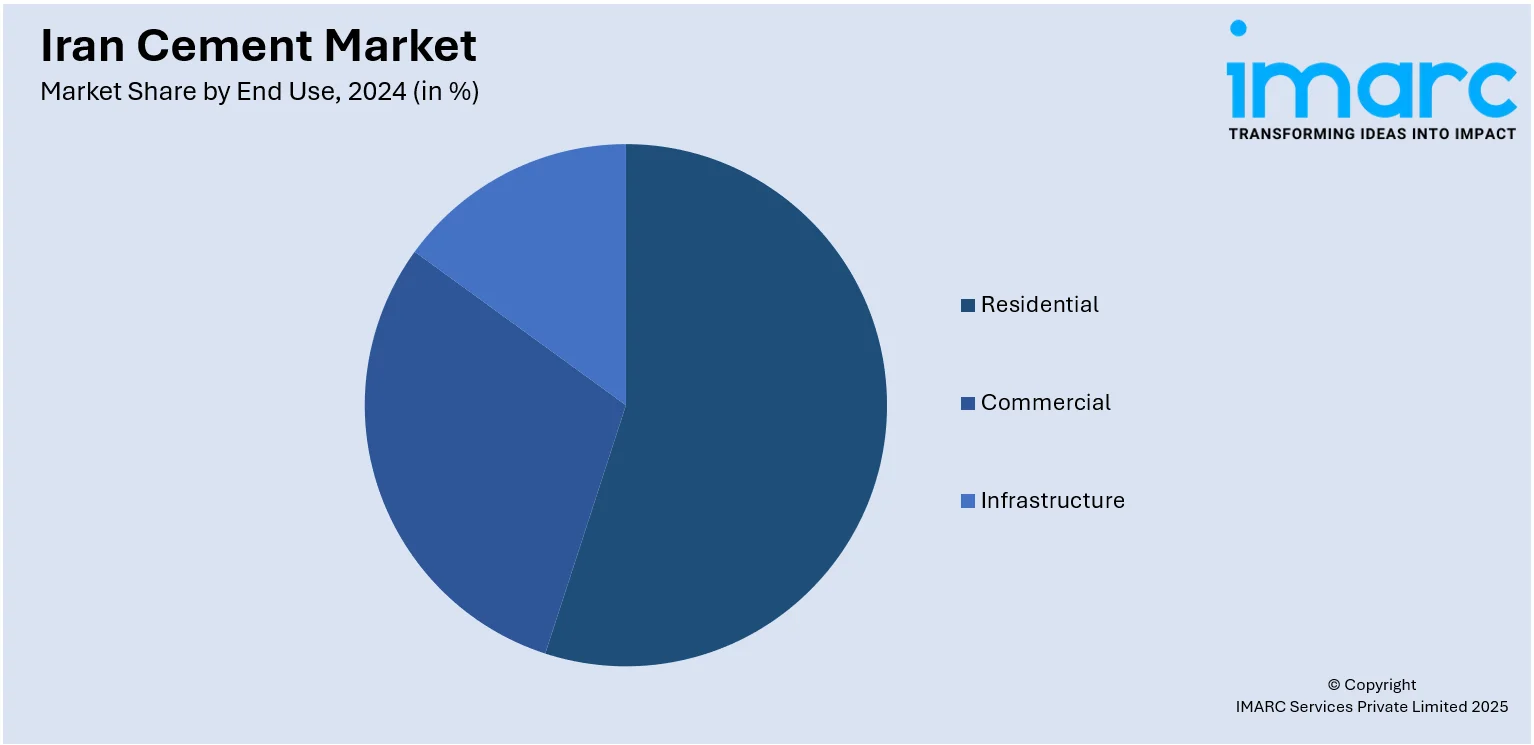

End-Use Insights:

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes residential, commercial, and infrastructure.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran cement market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran cement market on the basis of type?

- What is the breakup of the Iran cement market on the basis of end-use?

- What is the breakup of the Iran cement market on the basis of region?

- What are the various stages in the value chain of the Iran cement market?

- What are the key driving factors and challenges in the Iran cement market?

- What is the structure of the Iran cement market and who are the key players?

- What is the degree of competition in the Iran cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)