Iran Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Province, 2025-2033

Iran Diaper Market Overview:

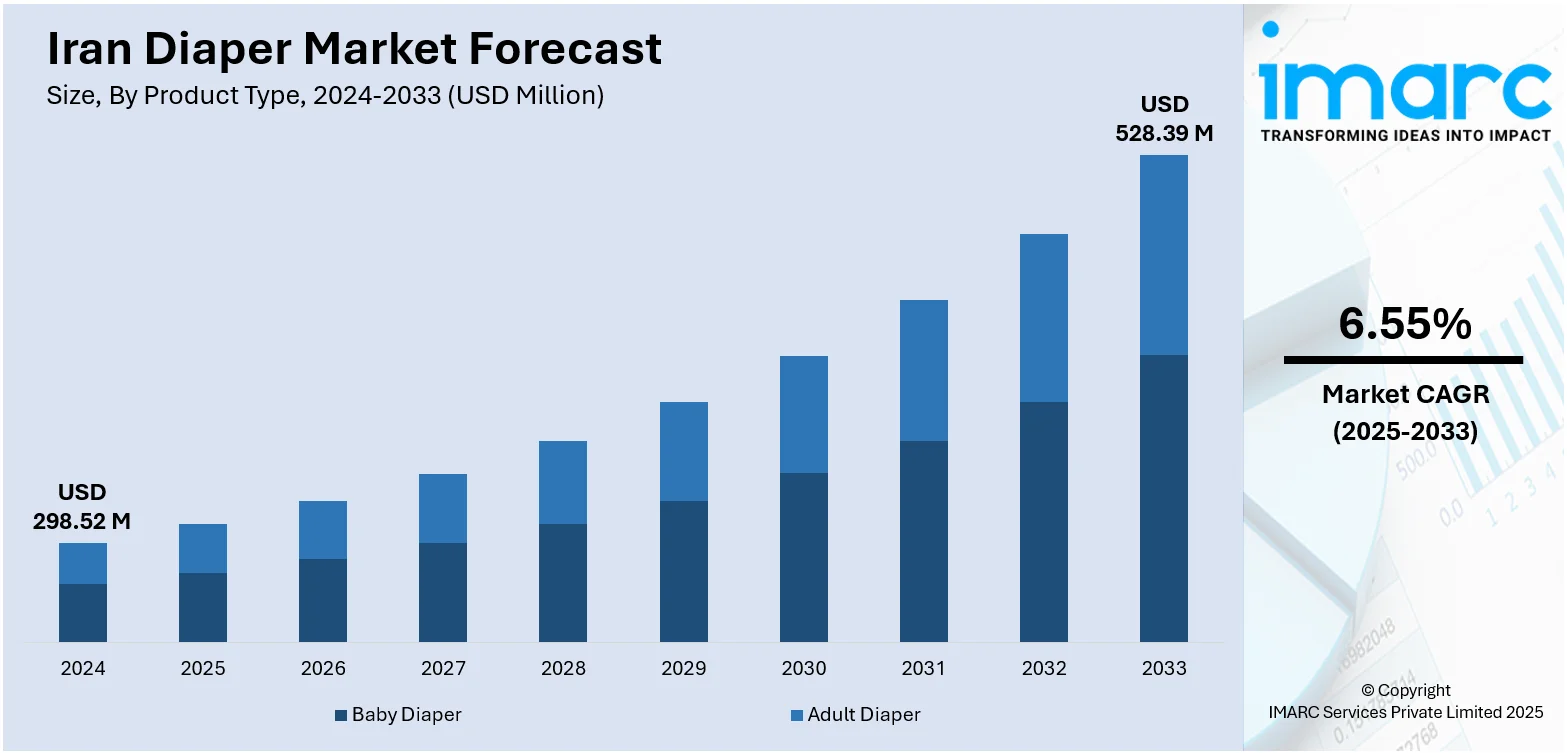

The Iran diaper market size reached USD 298.52 Million in 2024. The market is projected to reach USD 528.39 Million by 2033, exhibiting a growth rate (CAGR) of 6.55% during 2025-2033. The market is fueled by growing birth rates, enhanced hygiene awareness, urbanization, and greater retail and e-commerce channel access. Furthermore, evolving lifestyles of consumers and heightened demand for high-quality, environmentally friendly products are driving Iran diaper market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 298.52 Million |

| Market Forecast in 2033 | USD 528.39 Million |

| Market Growth Rate 2025-2033 | 6.55% |

Iran Diaper Market Trends:

Digital Transformation in Retail and Consumer Engagement

Digital platforms are becoming increasingly influential in shaping purchasing behavior within the Iran diaper market. For instance, as of January 2024, Iran had approximately 73.14 million internet users, representing 81.7% of the country’s total population. Moreover, the number of internet users grew by 537,000, a 0.7% increase, compared to January 2023. As internet penetration increases, consumers increasingly utilize online shopping platforms for their diapers due to convenience and competitive prices. AI-based recommendation systems and subscription services are also being adopted by e-commerce sellers to keep customers. Social media promotions and influencer marketing are also becoming key drivers for brand building and product testing. This online movement not only provides new opportunities for smaller brands but also enables targeted consumer interactions, enhancing customer loyalty. Consequently, digital transformation is a key driver of Iran diaper market growth that both established and new brands are able to scale efficiently.

To get more information on this market, Request Sample

Technological Advancements in Diaper Design

Technological innovations in diaper design are playing a pivotal role in transforming the Iran diaper market. Driven by increasing consumer demand for convenience, comfort, and hygiene, manufacturers are integrating advanced features such as wetness indicators, breathable materials, and antibacterial layers. Notably, local innovators have introduced smart diapers equipped with moisture sensors and RFID technology, enabling real-time alerts via mobile applications—a feature particularly beneficial for infant and elderly care. For instance, recently, a bioelectronics student at Iran’s Islamic Azad University developed a smart diaper equipped with a moisture sensor that notifies caregivers through a mobile application. Tailored for infants, the elderly, and individuals with dementia, the diaper incorporates RFID technology beneath an absorbent layer to detect wetness. This innovation has received international acclaim, including approval from the World Intellectual Property Organization (WIPO) and multiple medals in global invention contests. These innovations are also aligned with global sustainability trends, incorporating biodegradable materials and more efficient absorbent cores. As Iran continues to invest in its domestic manufacturing and research capabilities, such advancements are enhancing product quality and user satisfaction. This trend significantly contributes to Iran diaper market growth by addressing evolving health, environmental, and caregiving needs.

Iran Diaper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/province levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Baby Diaper

- Disposable Diaper

- Training Diaper

- Cloth Diaper

- Swim Pants

- Biodegradable Diaper

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby diaper (disposable diapers, training diapers, cloth diapers, swim pants, and biodegradable diapers) and adult diaper (pad type, flat type, and pant type).

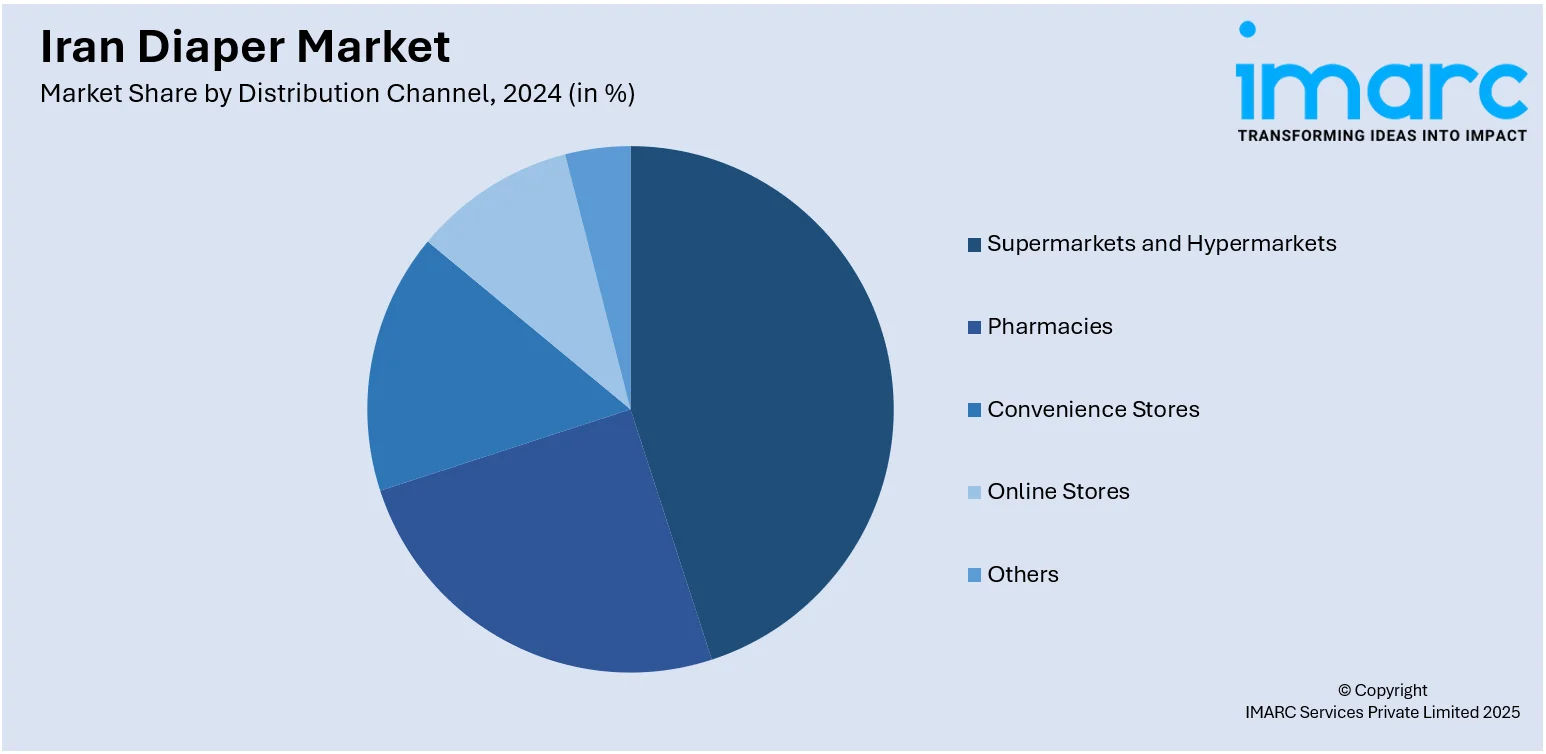

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, pharmacies, convenience stores, online stores, and others.

Provincial Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major provincial markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Diaper Market News:

- In January 2025, Henkel introduced its patented Easyflow® Auto-Fed Micro Chubs in Iran’s hygiene product manufacturing industry. This hot melt adhesive innovation automates adhesive feeding using non-sticky micro chubs, boosting production efficiency and sustainability. The system cuts adhesive waste, lowers maintenance costs by 50%, and reduces production rejects by over 10%. Widely used in diaper and incontinence product manufacturing, Easyflow® also enhances workplace safety and supports Henkel’s broader goals for high-quality, eco-conscious hygiene solutions.

Iran Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Provinces Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran diaper market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran diaper market on the basis of product type?

- What is the breakup of the Iran diaper market on the basis of distribution channel?

- What is the breakup of the Iran diaper market on the basis of province?

- What are the various stages in the value chain of the Iran diaper market?

- What are the key driving factors and challenges in the Iran diaper market?

- What is the structure of the Iran diaper market and who are the key players?

- What is the degree of competition in the Iran diaper market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran diaper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran diaper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)