Iran E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Province, 2025-2033

Iran E-Invoicing Market Overview:

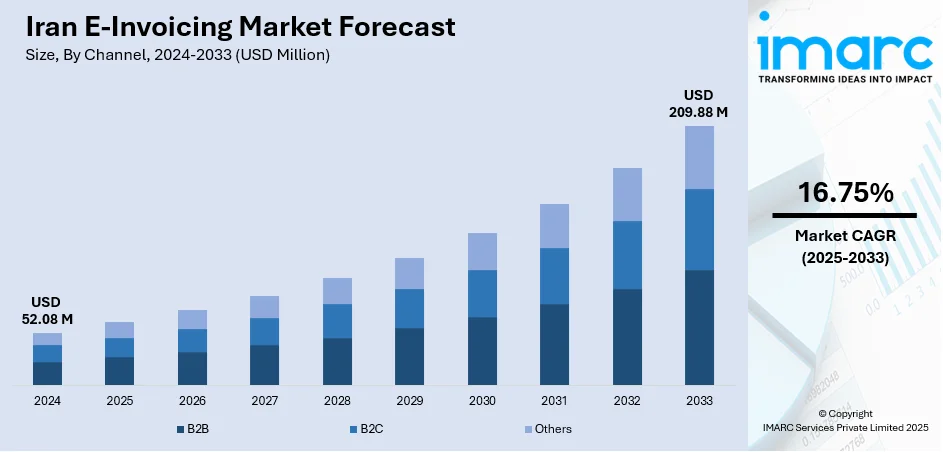

The Iran e-invoicing market size reached USD 52.08 Million in 2024. The market is projected to reach USD 209.88 Million by 2033, exhibiting a growth rate (CAGR) of 16.75% during 2025-2033. The market is growing steadily due to increasing digital adoption and government initiatives promoting electronic billing. Both small and large businesses across various industries are shifting towards efficient, real-time invoicing systems to improve accuracy and reduce paperwork. Cloud-based solutions and regulatory support play key roles in accelerating this trend. The growing focus on digital transformation in the region is expected to further enhance the Iran e-invoicing market share in the coming years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 52.08 Million |

| Market Forecast in 2033 | USD 209.88 Million |

| Market Growth Rate 2025-2033 | 16.75% |

Iran E-Invoicing Market Trends:

Broad Mandates Extend E‑Invoicing Coverage

Iran is actively broadening its e‑invoicing regulations to encompass additional sectors, responding to the demand for transparency and efficiency in tax administration. As part of a regional trend, the Ministry of Economic Affairs and Finance has been encouraging businesses especially large-scale and high-turnover entities to adopt digital invoicing formats and move away from traditional paper invoicing systems. In recent surveys, approximately 65% of major corporations report having implemented compliant e‑invoice systems, reflecting substantial migration toward nationwide digital invoicing. The expansion reduces paperwork for government audits and helps curb invoice-related fraud. New mandates specify uniform e‑invoice templates, secure digital signatures, and mandatory archiving. These regulations also drive system upgrades in small and medium-sized enterprises. Integrating invoicing with existing financial software is becoming essential, as it facilitates automated compliance and reduces administrative burdens. These advancements are a clear signal of Iran e-invoicing market growth, enabling smoother tax operations and setting the stage for a more robust digital financial ecosystem.

To get more information on this market, Request Sample

Real‑Time Invoice Processing Strengthens Controls

In 2025, Iran’s tax authority launched a pilot program for a real-time e‑invoice validation system designed to enhance tax compliance and reduce fraud. This advanced system cross-references digital invoice data with national payment records through the Shetab interbank network, enabling near-instant verification of transactions. Currently, around 70% of invoices from sectors like manufacturing and wholesale are processed digitally, minimizing the potential for hidden revenue and boosting transparency. Mandatory digital signatures and encrypted QR codes ensure document authenticity and facilitate efficient audit processes. The system integrates with enterprise resource planning (ERP) platforms, allowing seamless flow of invoice data from generation to tax authority submission without manual interference. These initiatives align with Iran’s broader strategy to modernize treasury and tax functions through centralized digital gateways, reducing administrative burdens for compliant businesses while improving regulatory oversight. The introduction of these real-time processes represents a significant advancement in Iran e-invoicing market trends, promoting trust between businesses and authorities and streamlining financial reporting nationwide.

Interoperability and Regional Alignment Accelerate Adoption

Iran is progressing towards e‑invoicing interoperability by adopting internationally recognized structured invoice formats like UBL and XML, facilitating regional trade integration. In early 2025, Iran initiated pilot programs with neighboring countries to test cross-border electronic tax documentation. These pilots focus on utilizing standardized digital invoice templates to streamline customs clearance and regulatory compliance in international trade. Reports indicate that over 50% of export-related invoices are already formatted to be compatible with such regional systems. This harmonization strategy reduces the cost and complexity of system upgrades for businesses, easing their transition toward compliant invoicing practices. Moreover, regional alignment supports increased export transparency, fostering smoother trade flows and better regulatory cooperation. These developments underscore key market trends, positioning the country to integrate more fully with larger regional economies and support efficient commercial infrastructure. This interoperability initiative is a forward-looking step that prepares Iran for future digital economy participation and regulatory evolution.

Iran E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on channel, deployment type, and application.

Channel Insights:

- B2B

- B2C

- Others

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others.

Deployment Type Insights:

- Cloud-based

- On-premises

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes cloud-based and on-premises.

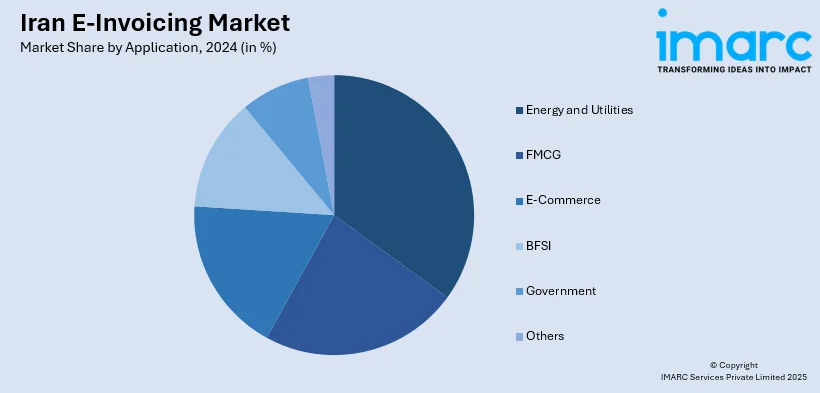

Application Insights:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes energy and utilities, FMCG, e-commerce, BFSI, government, and others.

Provincial Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Provinces Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran e-invoicing market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran e-invoicing market on the basis of channel?

- What is the breakup of the Iran e-invoicing market on the basis of deployment type?

- What is the breakup of the Iran e-invoicing market on the basis of application?

- What is the breakup of the Iran e-invoicing market on the basis of region?

- What are the various stages in the value chain of the Iran e-invoicing market?

- What are the key driving factors and challenges in the Iran e-invoicing?

- What is the structure of the Iran e-invoicing market and who are the key players?

- What is the degree of competition in the Iran e-invoicing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran e-invoicing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)