Iran Footwear Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033

Iran Footwear Market Overview:

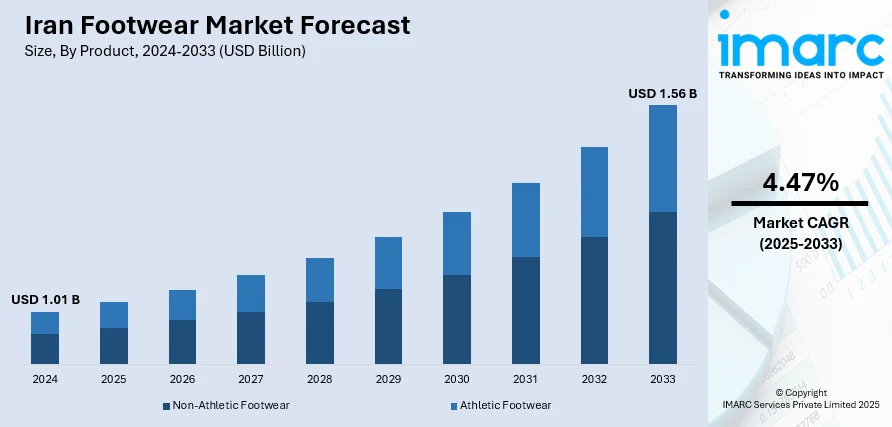

The Iran footwear market size reached USD 1.01 Billion in 2024. The market is projected to reach USD 1.56 Billion by 2033, exhibiting a growth rate (CAGR) of 4.47% during 2025-2033. The market is experiencing steady expansion, driven by rising urbanization, shifting consumer preferences, and increased demand for both casual and performance footwear. Growth is further supported by domestic manufacturing advancements and a broader retail presence across physical and digital channels. Diverse pricing strategies and material innovations are also shaping market dynamics across gender and age groups. With evolving fashion trends and regional demand variations, the sector is poised for further development, contributing to the rising Iran footwear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.01 Billion |

| Market Forecast in 2033 | USD 1.56 Billion |

| Market Growth Rate 2025-2033 | 4.47% |

Iran Footwear Market Trends:

Domestic Production Expansion Uplifts Industry Capacity

Iran’s footwear sector is witnessing a notable surge in domestic production, reinforcing its role as a regional footwear hub. According to official industry sources, Iran produces approximately 250 million pairs of shoes annually, positioning it among the top global footwear manufacturers. This sustained volume reflects investments in raw materials, such as domestically produced PU and synthetic leather, which reduce dependence on imports and lower production costs. Enhanced manufacturing capacity is enabling local producers to meet both national and export demand, particularly for PU-based footwear destined for markets in Turkey, Iraq, and Azerbaijan. Traditional footwear artisans also benefit from renewed focus on regional styles like galesh, which blend tourism and heritage craftsmanship into the modern footwear mix. Expanding production infrastructure strengthens supply chain resilience and supports Iran footwear market growth by keeping pace with domestic consumption and export opportunities. As capacity continues to deepen, the industry is increasingly equipped to capture regional demand while preserving local heritage craftsmanship in the evolving footwear landscape.

To get more information on this market, Request Sample

Surging Exports Reinforces Global Market Reach

Iran’s footwear export activity is gaining renewed momentum, as manufacturers increasingly leverage regional trade opportunities. A recent trend involves a marked uptick in shipments mainly polyurethane-based footwear heading to neighboring countries such as Turkey, Iraq, and Azerbaijan. This cross-border spike underscores Iran’s strategic export position within West Asia, where demand for competitively priced yet high-quality PU shoes is growing. Participation in global exhibitions like Iran MPEX also promotes networking with international buyers and showcases evolving craftsmanship, facilitating market entry for Iranian producers into new international segments. Export expansion not only illustrates the vitality of the Iran footwear market trends but also strengthens revenue streams outside domestic demand. Producers are investing in exportable product lines ranging from athletic to traditional styles to align with regional consumer preferences. As export volumes grow steadily, the industry is becoming more integrated into the broader West Asian supply chain, boosting economic value, supporting job creation, and improving Iran’s global footwear footprint.

Heritage Footwear Revival Through Eco-Craftsmanship

Iran’s footwear market is experiencing a sustainable revival through the production of heritage styles like galesh and giveh, crafted using eco-friendly methods that blend tradition with modern ethics. These handwoven shoes, originating from provinces such as Gilan, Zanjan, and Kermanshah, are made from natural materials including cotton, wool, and leather, with rubber or leather soles. Artisans maintain ancient nalbinding techniques passed down through generations, ensuring each pair is uniquely crafted and culturally significant. As rising numbers of consumers seek environmentally friendly products and meaningful cultural forms, demand for these artisanal styles is growing particularly in heritage and boutique marketplaces. This eco-conscious craftsmanship not only conserves local traditions but also supports rural economies through cottage-industry production. By aligning artisanal value with sustainable sourcing, the trend strengthens Iran footwear market, offering a distinctive alternative in contemporary footwear. The intersection of ecological responsibility and cultural authenticity positions Iran’s heritage styles as a relevant and competitive option, contributing to evolving Iran footwear market, where handcrafted, sustainable products are increasingly appreciated.

Iran Footwear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, material, distribution channel, pricing, and end-user.

Product Insights:

- Non-Athletic Footwear

- Athletic Footwear

The report has provided a detailed breakup and analysis of the market based on the product. This includes non-athletic footwear and athletic footwear.

Material Insights:

- Rubber

- Leather

- Plastic

- Fabric

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes rubber, leather, plastic, fabric, and others.

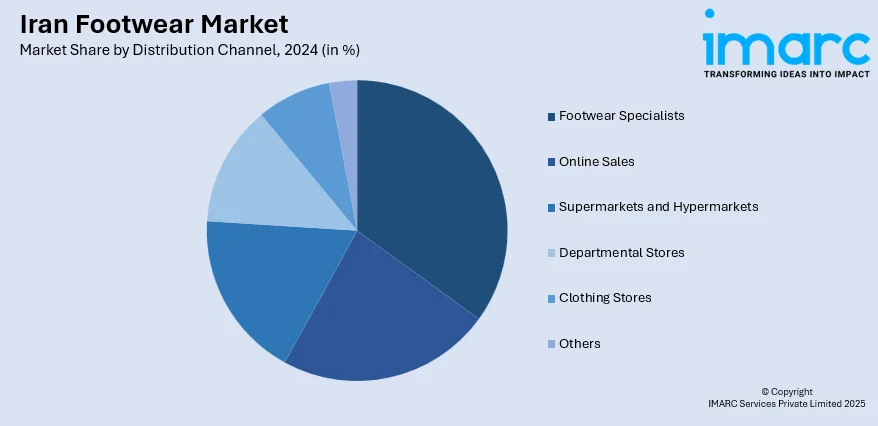

Distribution Channel Insights:

- Footwear Specialists

- Online Sales

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes footwear specialists, online sales, supermarkets and hypermarkets, departmental stores, clothing stores, and others.

Pricing Insights:

- Premium

- Mass

A detailed breakup and analysis of the market based on the pricing have also been provided in the report. This includes premium and mass.

End-User Insights:

- Men

- Women

- Kids

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes men, women, and kids.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Footwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non-Athletic Footwear, Athletic Footwear |

| Materials Covered | Rubber, Leather, Plastic, Fabric, Others |

| Distribution Channels Covered | Footwear Specialists, Online Sales, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Others |

| Pricings Covered | Premium, Mass |

| End-Users Covered | Men, Women, Kids |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran footwear market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran footwear market on the basis of product?

- What is the breakup of the Iran footwear market on the basis of material?

- What is the breakup of the Iran footwear market on the basis of distribution channel?

- What is the breakup of the Iran footwear market on the basis of pricing?

- What is the breakup of the Iran footwear market on the basis of end-user?

- What is the breakup of the Iran footwear market on the basis of region?

- What are the various stages in the value chain of the Iran footwear market?

- What are the key driving factors and challenges in the Iran footwear?

- What is the structure of the Iran footwear market and who are the key players?

- What is the degree of competition in the Iran footwear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran footwear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran footwear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)