Iran Higher Education Market Size, Share, Trends and Forecast by Component, Deployment Mode, Course Type, Learning Type, End-User, and Province, 2025-2033

Iran Higher Education Market Overview:

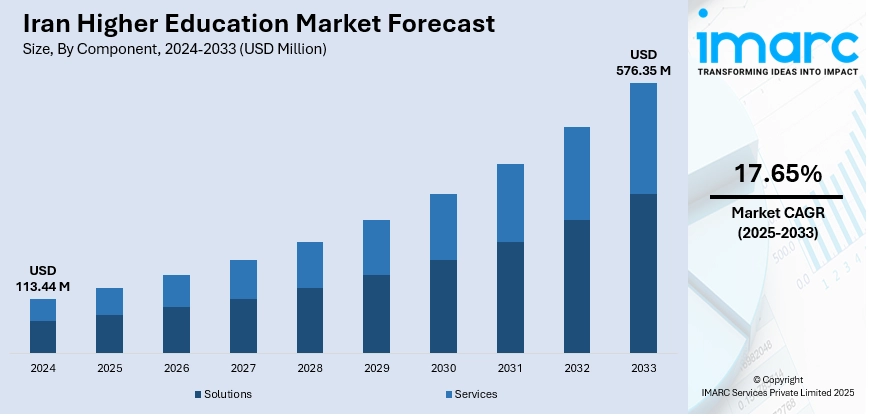

The Iran higher education market size reached USD 113.44 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 576.35 Million by 2033, exhibiting a growth rate (CAGR) of 17.65% during 2025-2033. The market is driven by Iran’s national strategies to strengthen research capabilities and foster technological self-reliance. Expansion of private universities complements public institutions, improving access for the growing student population across regions. Furthermore, the growing emphasis on technical and vocational programs is equipping students with practical skills for workforce participation, further augmenting the Iran higher education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 113.44 Million |

| Market Forecast in 2033 | USD 576.35 Million |

| Market Growth Rate 2025-2033 | 17.65% |

Iran Higher Education Market Trends:

Government Initiatives to Enhance Academic Capacity and Research Output

Iran’s higher education sector is being actively supported through national policies that prioritize academic self-sufficiency, technological advancement, and regional academic leadership. The government emphasizes strengthening research infrastructure by expanding funding for scientific institutions and promoting university-affiliated research centers. Iranian universities are increasingly integrated into national science and technology strategies, fostering advancements in fields such as biotechnology, engineering, and medicine. Furthermore, state programs promote the localization of scientific knowledge and reduce dependency on foreign academic resources. Universities are encouraged to increase research output to improve global academic rankings, while postgraduate enrollment rates continue rising. Academic cooperation with allied nations in the region bolsters international visibility, despite geopolitical limitations. Iran’s ambitious Vision 2025 Plan places academic excellence at the core of national development, supporting institutional modernization. These combined efforts are positioning the country to advance its higher education standards significantly, driving Iran higher education market growth.

To get more information on this market, Request Sample

Expansion of Private Universities and Non-Governmental Academic Institutions

The growth of private universities and non-governmental educational organizations is reshaping Iran’s academic landscape. Private sector participation complements state-run universities, expanding higher education access for Iran’s large youth population. Institutions such as Islamic Azad University and Payame Noor University represent large-scale private initiatives providing degree programs across multiple disciplines and regions. These universities often focus on professional and technical programs that address local labor market needs. Many private institutions maintain flexible admission standards, making them more accessible to students from diverse socioeconomic backgrounds. Moreover, these institutions play a crucial role in alleviating enrollment pressures faced by public universities. Academic partnerships with local industries are increasingly facilitated by private universities, contributing to workforce development in specialized sectors. The diversification of funding sources through tuition fees, industry collaborations, and endowments allows private universities greater operational flexibility. As private and semi-private universities grow in prominence, they expand both the scale and specialization of Iran’s higher education offerings.

Rising Demand for Technical and Vocational Education Aligned with Labor Market Needs

Technical and vocational education programs are witnessing heightened demand in Iran, aligning with the country’s goals for industrial diversification and workforce modernization. Universities of applied sciences, technical colleges, and vocational institutions are expanding programs in engineering, ICT, healthcare, and industrial maintenance to fill critical skill gaps. Employers are increasingly engaged in curriculum development to ensure alignment between academic training and job market requirements. Iran’s focus on developing its domestic manufacturing and technological sectors reinforces the need for skilled technical graduates. National development programs actively promote competency-based learning and practical skill acquisition as integral components of the country’s industrial strategy. Additionally, specialized technical programs appeal to students seeking direct entry into the workforce rather than pursuing purely academic careers. Cooperative education models that integrate on-the-job training with formal education are being implemented more frequently across both public and private institutions. This focus on employability strengthens Iran’s efforts to modernize its human capital and improve economic resilience.

Iran Higher Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, course type, learning type, and end user.

Component Insights:

- Solutions

- Student Information Management System

- Content Collaboration

- Data Security and Compliance

- Campus Management

- Others

- Services

- Managed Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (student information management system, content collaboration, data security and compliance, campus management, and others) and services (managed services and professional services).

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Course Type Insights:

- Arts

- Economics

- Engineering

- Law

- Science

- Others

The report has provided a detailed breakup and analysis of the market based on the course type. This includes arts, economics, engineering, law, science, and others.

Learning Type Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the learning type. This includes online and offline.

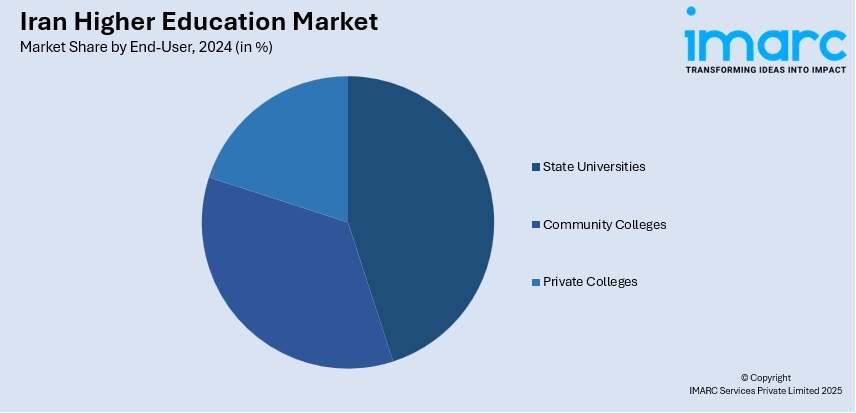

End-User Insights:

- State Universities

- Community Colleges

- Private Colleges

The report has provided a detailed breakup and analysis of the market based on the end user. This includes state universities, community colleges, and private colleges.

Province Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Higher Education Market News:

- On 26 May 2025, At the World Conference on Digital Education 2025, Iran’s Deputy Minister of Science, Research and Technology, Abolfazl Vahedi, proposed the establishment of an international center for digital education, emphasizing global collaboration in digital learning frameworks. Presenting Iran’s higher education achievements and challenges, Vahedi highlighted the integration of artificial intelligence in lesson preparation and student assessment. The proposal also included a unified international system for quality assessment of digital education, positioning Iran as a proactive contributor to global digital academic cooperation.

- On December 2024, Iran’s Ministry of Science, Research and Technology confirmed that approximately 90,000 foreign students are currently enrolled in its higher education institutions, including public universities, Islamic Azad University, and medical schools. These students are primarily from regional peers such as Iraq, Afghanistan, Pakistan, India, and Lebanon.

Iran Higher Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Course Types Covered | Arts, Economics, Engineering, Law, Science, Others |

| Learning Types Covered | Online, Offline |

| End-Users Covered | State Universities, Community Colleges, Private Colleges |

| Provinces Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran higher education market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran higher education market on the basis of component?

- What is the breakup of the Iran higher education market on the basis of deployment mode?

- What is the breakup of the Iran higher education market on the basis of course type?

- What is the breakup of the Iran higher education market on the basis of learning type?

- What is the breakup of the Iran higher education market on the basis of end user?

- What is the breakup of the Iran higher education market on the basis of province?

- What are the various stages in the value chain of the Iran higher education market?

- What are the key driving factors and challenges in the Iran higher education market?

- What is the structure of the Iran higher education market and who are the key players?

- What is the degree of competition in the Iran higher education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran higher education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran higher education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran higher education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)