Iran IT Training Market Size, Share, Trends and Forecast by Application, End-User, and Region, 2025-2033

Iran IT Training Market Overview:

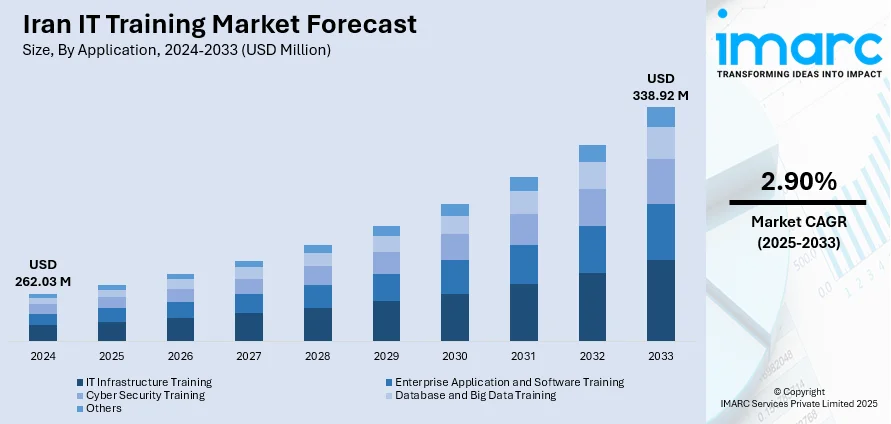

The Iran IT training market size reached USD 262.03 Million in 2024. The market is projected to reach USD 338.92 Million by 2033, exhibiting a growth rate (CAGR) of 2.90% during 2025-2033. The market is fueled by robust government support for technical education, rising youth population, and swift digitalization of companies. Emphasis by the government on vocational training through institutions, as well as collaborations with international organizations, drives the market. Increasing need for skills in fields such as cybersecurity, software development, and data analytics is also compelling public and private sectors to invest in upskilling. E-learning and microlearning platforms further increases accessibility and contributes to the Iran IT training market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 262.03 Million |

| Market Forecast in 2033 | USD 338.92 Million |

| Market Growth Rate 2025-2033 | 2.90% |

Iran IT Training Market Trends:

Government Initiatives and Infrastructure Development

The IT training scene in Iran is heavily impacted by government-run programs to improve digital literacy and build a skilled workforce. The National University of Skill (NUS), which was previously the Technical and Vocational University, is at the center of all this. With more than 170,000 students studying through over 180 branches countrywide, NUS provides a wide variety of technical and vocational courses designed to address the needs of the market. About 70% of these courses focus on practical training within well-facilitated workrooms, where students gain hands-on experience needed in the IT sector. Moreover, the Iran Technical and Vocational Training Organization (TVTO) manages more than 11,700 free technical and vocational schools with accessible training opportunities nationwide. These schools partner with global organizations such as UNESCO and the International Labour Organization to set curriculum standards in line with international standards, hence making their graduates employable in the global competitive IT job market, which further propels the Iran IT training market growth.

To get more information on this market, Request Sample

Rise of Microlearning and Digital Platforms

Following the growing educational demands and wide spread of digital technologies, there has been an increase in microlearning as well as the integration of digital learning platforms in Iran. Microlearning, which involves brief, targeted segments of content, suits the tastes of contemporary learners looking for flexible and convenient training options. The Iranian government identified the learning capacity of microlearning in improving the quality of learning, especially among rural and disadvantaged communities. To complement this, policies have been put in place to incorporate microlearning platforms in formal school curricula and vocational training. This is contained within a larger strategy for enhancing the digital infrastructure and content development efforts for the country to ensure there is fair access to high-quality education in Iran.

Technologically Inclined Workforce Growth

Iran's IT training industry is also propelled by the development of a highly educated and technologically sophisticated workforce. Iranian universities regularly graduate many science, technology, engineering, and mathematics (STEM) students, most of whom are keen to acquire more advanced IT skills. This passion for lifelong learning has fueled the emergence of local training centers, coding camps, and industry-specific certification courses focused on fields such as artificial intelligence, cloud computing, and cybersecurity. According to industry reports, Iran even intends to provide artificial intelligence (AI) training to 100,000 teachers and one million students. Moreover, a cultural focus on scholarship and innovation is creating a new generation of tech-proficient individuals who are determined to apply their expertise within the national economy. As more startups and technology incubators start popping up in cities such as Tehran, Isfahan, and Shiraz, domestic demand for high-skilled IT professionals keeps increasing. While this growing talent pool boosts internal growth, it also boosts Iran's capabilities for reaching regional markets through software exports and IT services.

Iran IT Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application and end-user.

Application Insights:

- IT Infrastructure Training

- Enterprise Application and Software Training

- Cyber Security Training

- Database and Big Data Training

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes IT infrastructure training, enterprise application and software training, cyber security training, database and big data training, and others.

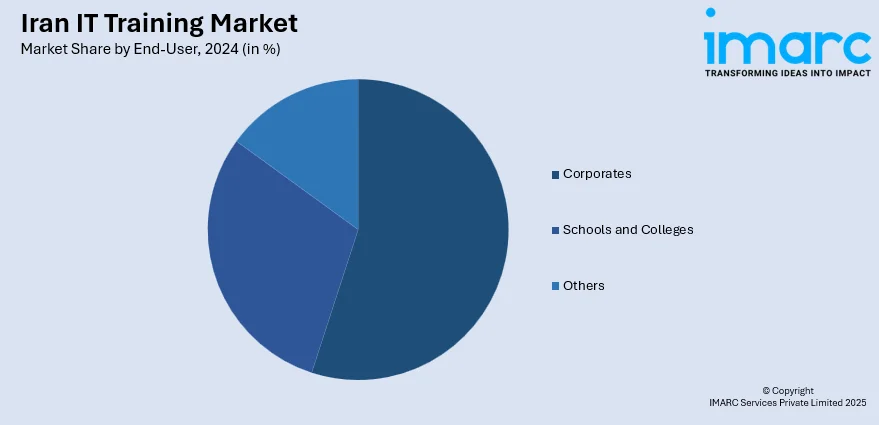

End-User Insights:

- Corporates

- Schools and Colleges

- Others

A detailed breakup and analysis of the market based on the end-user has also been provided in the report. This includes corporates, schools and colleges, and others.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major provincial markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant have been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran IT Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | IT Infrastructure Training, Enterprise Application and Software Training, Cyber Security Training, Database and Big Data Training, Others |

| End-Users Covered | Corporates, Schools and Colleges, Others |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran IT training market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran IT training market on the basis of application?

- What is the breakup of the Iran IT training market on the basis of end-user?

- What is the breakup of the Iran IT training market on the basis of region?

- What are the various stages in the value chain of the Iran IT training market?

- What are the key driving factors and challenges in the Iran IT training market?

- What is the structure of the Iran IT training market and who are the key players?

- What is the degree of competition in the Iran IT training market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran IT training market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran IT training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran IT training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)