Iran Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Province, 2025-2033

Iran Logistics Market Overview:

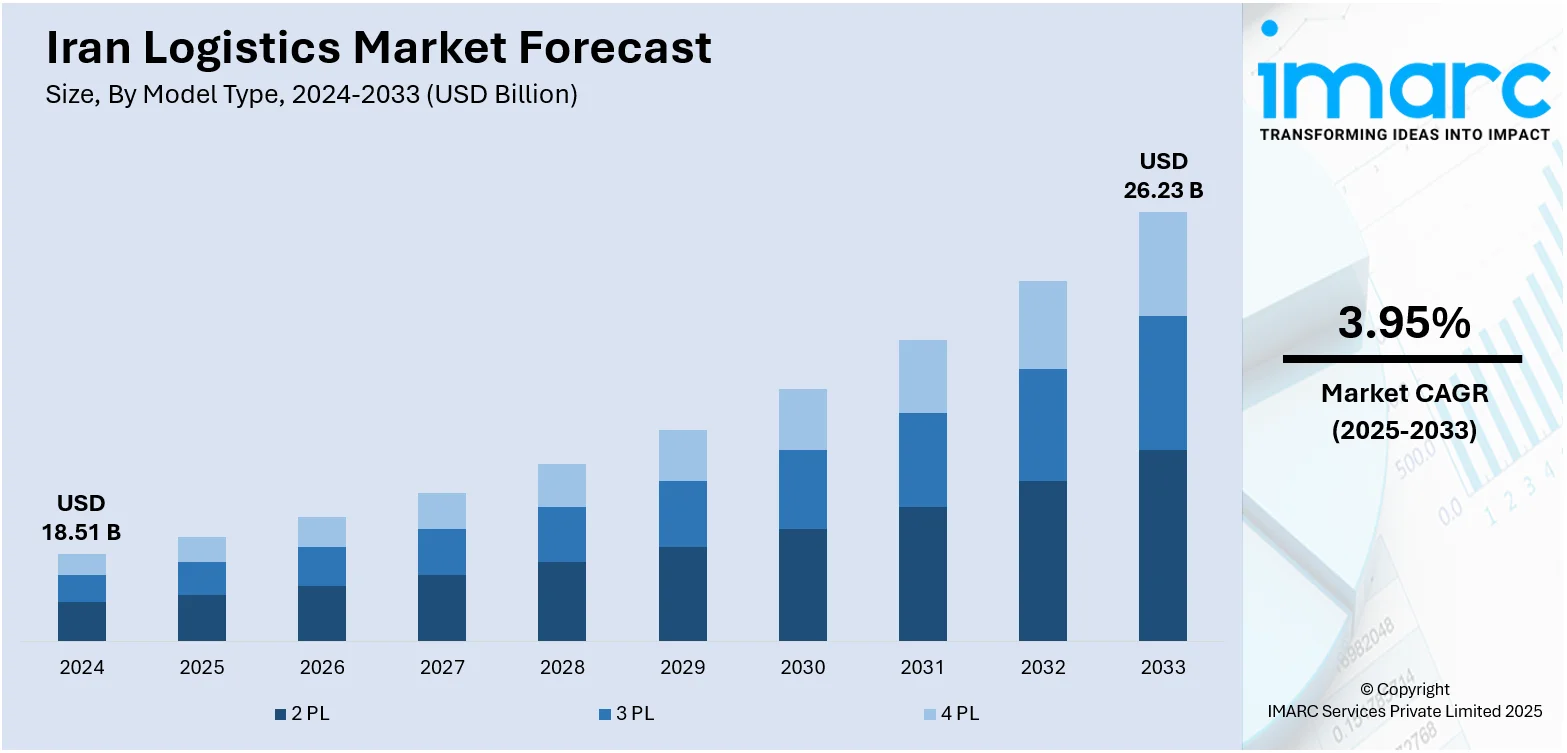

The Iran logistics market size reached USD 18.51 Billion in 2024. The market is expected to reach USD 26.23 Billion by 2033, exhibiting a growth rate (CAGR) of 3.95% during 2025-2033. The market is expanding steadily, supported by the increasing investment in transport infrastructure to improve its logistics, enhancing regional trade ties, and government-backed connectivity projects. Strategic location remains an advantage, offering potential for cross-border growth with neighboring countries. The recovery in trade volumes post-COVID has also contributed to the expansion of Iran logistics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 18.51 Billion |

| Market Forecast in 2033 | USD 26.23 Billion |

| Market Growth Rate 2025-2033 | 3.95% |

Iran Logistics Market Trends:

E-Commerce Growth

The swift growth of Iran's e-commerce, driven by the growing penetration of the internet and mobile phones, is transforming logistics. According to industry reports, in early 2024, Iran reported 73.14 million internet users, reflecting an 81.7% penetration rate. The nation had 48 million social media users, comprising 53.6% of its population. Additionally, there were 146.5 million active cellular mobile connections, equating to 163.7% of the total population. Consumers increasingly demand quicker delivery times and real-time tracking, which has led logistics companies to enhance last-mile delivery. Conventional courier operations are being modified to carry greater volumes of parcels, while startups are arriving in the market with app-based delivery models. Congestion in urban areas and aging infrastructure create difficulties, but there is a definite trend toward more effective, technology-driven solutions such as route optimization and micro-fulfillment centers. There is also investment in own delivery networks by retailers to address increasing customer needs. The need for fast, reliable, and inexpensive last-mile delivery became pivotal to success in online retailing in Iran. This shift is prompting greater collaboration between e-commerce platforms and logistics providers, serving as a strong driver of Iran logistics market growth.

To get more information on this market, Request Sample

Rapid Infrastructure Investment

Iran has been steadily increasing investment in transport infrastructure to enhance its logistics capabilities. Strategic projects include the development and modernization of highways, expansion of the national rail network, and upgrades at key ports like Chabahar and Bandar Abbas. For instance, in April 2025, Iran's private sector secured agreements with the government to invest over 640 trillion rials in railroad infrastructure, including 2,000 passenger cars and cargo wagons. An additional 30 trillion rials will fund the purchase of 650 freight wagons for transporting agricultural products. Long-term plans aim to increase freight volume to 40 Million Tons. Chabahar, in particular, is gaining attention due to its position outside the Strait of Hormuz and its potential to handle Indian and Central Asian trade. Bandar Abbas remains Iran’s busiest port, and improvements here aim to reduce congestion and boost container throughput. Rail connectivity is also improving, with efforts to link major industrial and trade hubs across the country. These upgrades aim to reduce transit times, lower freight costs, and support regional trade corridors. The overall effect is a more efficient supply chain system, which continues to attract domestic and regional business, contributing to market growth.

Iran Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on model type, transportation mode, and end use.

Model Type Insights:

- 2PL

- 3PL

- 4PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2PL, 3PL, and 4PL.

Transportation Mode Insights:

- Roadways

- Seaways

- Railways

- Airways

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes roadways, seaways, railways, and airways.

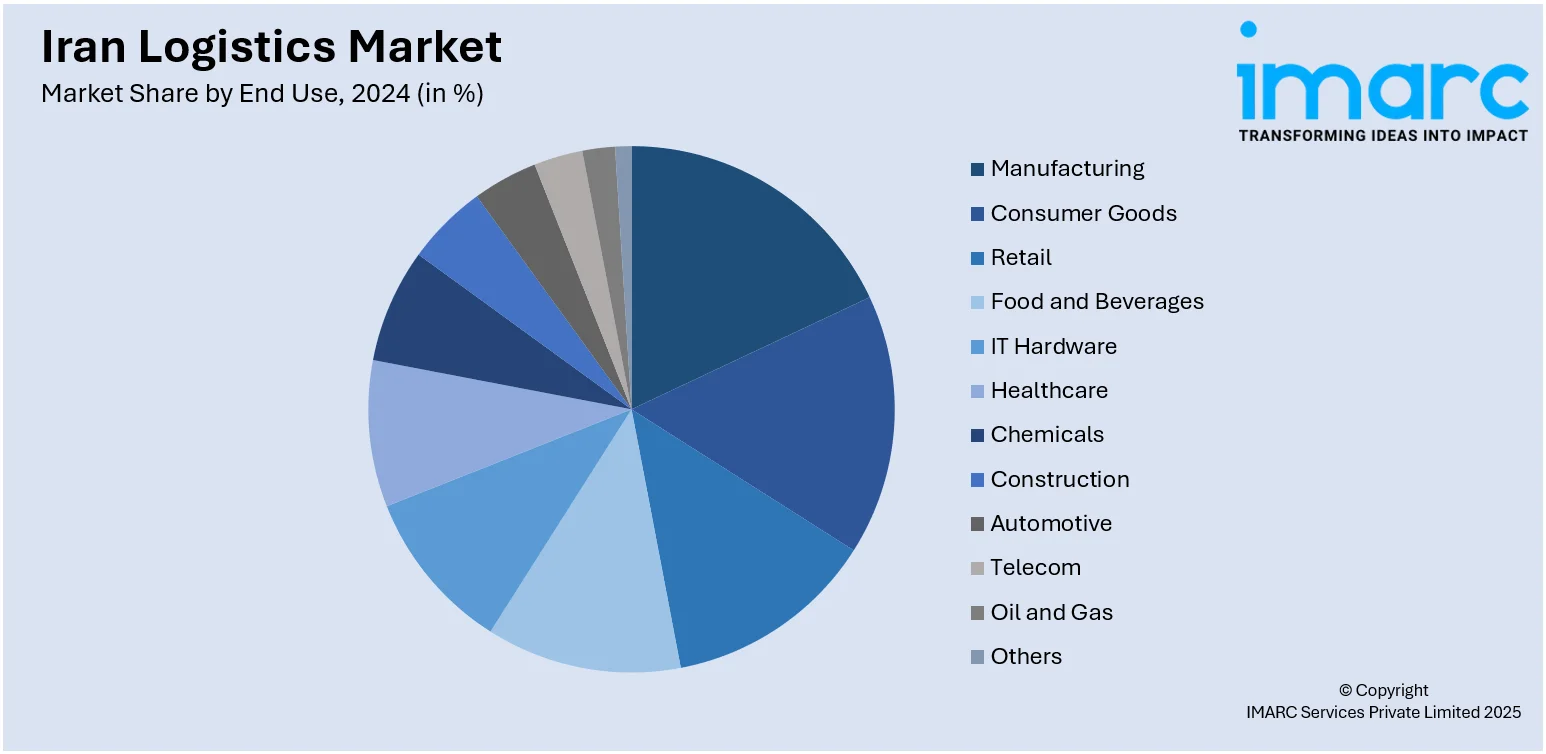

End Use Insights:

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Province Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Logistics Market News:

- In June 2025, Iran and Kazakhstan strengthened their economic partnership at the 20th Joint Economic Committee meeting in Astana, focusing on trade, investment, and logistics. Key agreements included forming a joint health task force and enhancing agricultural collaboration, with bilateral agricultural trade rising by 33% in 2024, underscoring their commitment to sustainable development.

- In May 2025, IranAir signed a USD 300 Million public-private partnership with Imam Khomeini Airport City to develop a multimodal cargo terminal and logistics center at Tehran's airport. This project aims to enhance freight capacity and transit capabilities, positioning the airport as a regional logistics hub amid ongoing expansion efforts.

- In December 2024, Iran and Russia launched two major logistics projects, the Ulyanovsk-Astara rail corridor and the Volga-Caspian Sea river route, aiming to enhance trade and reduce cargo transport times from 21 days to seven. These initiatives mark a significant boost in bilateral trade, increasing trade volume by 76% in 2024.

Iran Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Provinces Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran logistics market on the basis of model type?

- What is the breakup of the Iran logistics market on the basis of transportation mode?

- What is the breakup of the Iran logistics market on the basis of end use?

- What is the breakup of the Iran logistics market on the basis of region?

- What are the various stages in the value chain of the Iran logistics market?

- What are the key driving factors and challenges in the Iran logistics market?

- What is the structure of the Iran logistics market and who are the key players?

- What is the degree of competition in the Iran logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)