Iran Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2025-2033

Iran Medical Tourism Market Overview:

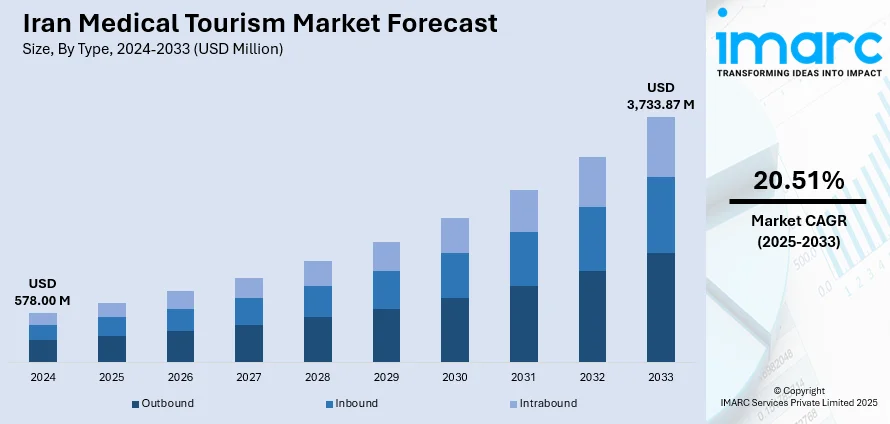

The Iran medical tourism market size reached USD 578.00 Million in 2024. Looking forward, the market is projected to reach USD 3,733.87 Million by 2033, exhibiting a growth rate (CAGR) of 20.51% during 2025-2033. The market is driven by Iran’s global reputation in cosmetic and fertility procedures, supported by a highly skilled and certified medical workforce. Its expertise in oncology and diagnostics offers advanced care at competitive pricing. Geopolitical proximity, cultural affinity, and supportive government policies are further augmenting the Iran medical tourism market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 578.00 Million |

| Market Forecast in 2033 | USD 3,733.87 Million |

| Market Growth Rate 2025-2033 | 20.51% |

Iran Medical Tourism Market Trends:

Global Reputation in Cosmetic and Reconstructive Surgery

Iran has emerged as a global destination for cosmetic and reconstructive surgery, particularly rhinoplasty, hair transplants, facelifts, and liposuction. With some of the highest rates of rhinoplasty per capita in the world, Iranian surgeons have gained extensive practical expertise and international recognition in aesthetic procedures. Major clinics in Tehran, Mashhad, and Shiraz offer affordable surgery packages often 60–80% cheaper than those in Europe or the Gulf, without compromising clinical safety or outcomes. These centers are staffed by board-certified specialists, many of whom have trained in North America or Europe. Moreover, Iranian medical schools are highly competitive, producing a large cohort of skilled physicians annually. Clinics provide services in multiple languages, including Arabic, English, and Kurdish, attracting patients from Iraq, Oman, Azerbaijan, and other regional countries. Medical tourists receive end-to-end services, visa facilitation, accommodation, airport pickup, post-op recovery planning, streamlining the treatment journey. With social acceptance of cosmetic enhancement rising in the Middle East and Central Asia, Iran’s technical proficiency and low treatment costs continue to attract a steady inflow of patients. These factors play a key role in sustaining Iran medical tourism market growth, particularly within niche surgical disciplines.

To get more information on this market, Request Sample

Fertility, Oncology, and Advanced Diagnostics Capabilities

Beyond aesthetics, Iran’s medical sector is well developed in fertility treatments, oncology, and advanced diagnostics, supported by robust research institutions and university hospitals. IVF centers across Isfahan and Tehran provide egg donation, ICSI, and preimplantation genetic testing, with costs significantly lower than in Western countries. Iran’s fertility law permits both donor and third-party reproduction, making it a legal haven for couples facing restrictions elsewhere. In oncology, facilities such as the Cancer Institute of Iran deliver chemotherapy, radiotherapy, and nuclear medicine supported by experienced oncologists and advanced diagnostic imaging. Public-private hospitals maintain partnerships with academic research centers that invest in biotechnology and treatment innovation. Diagnostic labs in Iran are among the most advanced in the region, offering genetic panels, MRI, PET-CT, and advanced pathology services. Patients from neighboring countries often arrive for second opinions, treatment of rare diseases, and advanced imaging procedures unavailable locally. The high doctor-to-patient ratio and low treatment costs allow for personalized care and extended hospital stays when needed. These strengths in high-demand, high-complexity medical services are expanding Iran’s appeal beyond elective care and positioning it as a provider of specialized, mid-to-high acuity treatments.

Strategic Location, Cultural Affinity, and Government Support

Iran benefits from its strategic location at the intersection of Central Asia, the Middle East, and the Caucasus, enabling it to serve patients from countries such as Afghanistan, Iraq, Turkmenistan, and Lebanon. Cultural and linguistic familiarity, shared religious values, and visa facilitation for many regional countries simplify travel for medical purposes. Major hospitals have established international patient departments that coordinate interpreters, cross-border follow-up, and family accommodations. The Iranian government has prioritized medical tourism in national economic policy, granting licenses to medical tourism facilitators and incentivizing public-private hospital upgrades. The Ministry of Health also introduced regulatory protocols for international patients, enhancing accountability, documentation, and service delivery. Tehran, Mashhad, and Shiraz serve as national medical hubs, offering a high density of specialty hospitals and tertiary care institutions. While geopolitical issues have slowed broader inbound tourism, the medical sector remains resilient and increasingly specialized. Regional medical travelers continue to rely on Iran for both price competitiveness and familiarity. These advantages collectively create a stable pipeline of patients seeking comprehensive, culturally resonant healthcare in a professionally regulated setting.

Iran Medical Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and treatment type.

Type Insights:

- Outbound

- Inbound

- Intrabound

The report has provided a detailed breakup and analysis of the market based on the type. This includes outbound, inbound, and intrabound.

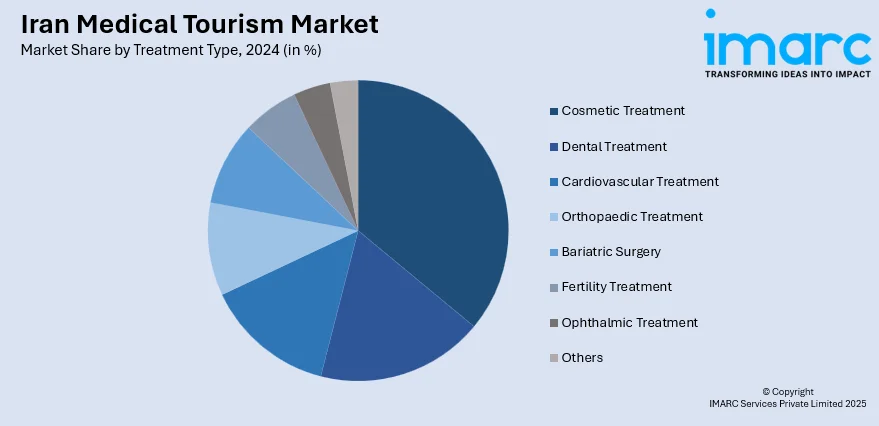

Treatment Type Insights:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

The report has provided a detailed breakup and analysis of the market based on the treatment type. This includes cosmetic treatment, dental treatment, cardiovascular treatment, orthopaedic treatment, bariatric surgery, fertility treatment, ophthalmic treatment, and others.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all major provincial markets. This includes Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Medical Tourism Market News:

- On March 8, 2025, Iran confirmed the nationwide rollout of a comprehensive medical tourism management system, following a successful pilot in Khorasan Razavi province. Launching with the new Iranian year on March 21, the system aims to streamline coordination among ministries and enhance healthcare services for international patients. Officials emphasized plans to improve holiday-period care continuity, expand private sector roles, and promote Iran’s medical and religious tourism hubs.

Iran Medical Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Outbound, Inbound, Intrabound |

| Treatment Types Covered | Cosmetic Treatment, Dental Treatment, Cardiovascular Treatment, Orthopaedic Treatment, Bariatric Surgery, Fertility Treatment, Ophthalmic Treatment, Others |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran medical tourism market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran medical tourism market on the basis of type?

- What is the breakup of the Iran medical tourism market on the basis of treatment type?

- What is the breakup of the Iran medical tourism market on the basis of region?

- What are the various stages in the value chain of the Iran medical tourism market?

- What are the key driving factors and challenges in the Iran medical tourism market?

- What is the structure of the Iran medical tourism market and who are the key players?

- What is the degree of competition in the Iran medical tourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran medical tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran medical tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran medical tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)