Iran Online Travel Market Size, Share, Trends and Forecast by Service Type, Platform, Mode of Booking, Age Group, and Region, 2025-2033

Iran Online Travel Market Overview:

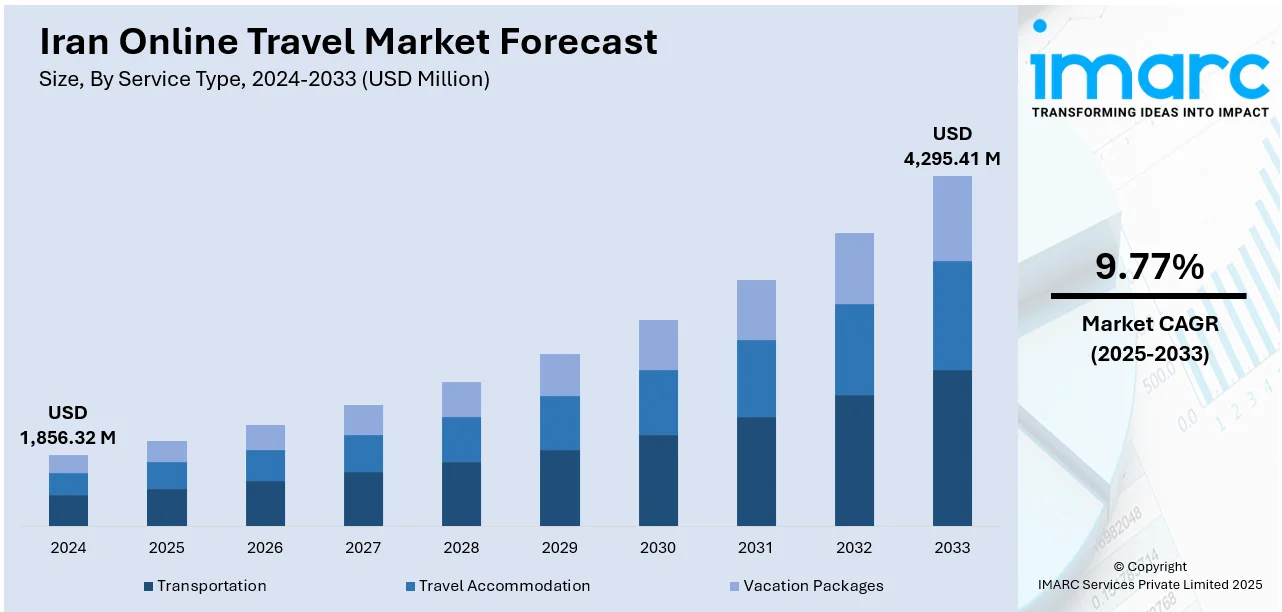

The Iran online travel market size reached USD 1,856.32 Million in 2024. The market is projected to reach USD 4,295.41 Million by 2033, exhibiting a growth rate (CAGR) of 9.77% during 2025-2033. The market is expanding steadily, driven by rising internet usage, a digitally aware population, and the growing demand for convenient holiday planning. Online bookings for flights, accommodations, and travel packages are becoming more common, with mobile apps seeing widespread adoption across age groups. Regional and domestic tourism also play a key role in market growth. As digital infrastructure improves and consumer preferences shift toward personalized travel experiences, these factors will significantly influence the future of the Iran online travel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,856.32 Million |

| Market Forecast in 2033 | USD 4,295.41 Million |

| Market Growth Rate 2025-2033 | 9.77% |

Iran Online Travel Market Trends:

Mobile‑Centric Booking with AI‑Powered Support

Rapid growth in mobile usage is fundamentally reshaping Iran’s travel booking landscape. High mobile subscription rates combined with improvements in broadband connectivity are enabling users nationwide to access seamless booking platforms. Platforms now integrate AI-driven chatbots and voice‑activated assistants to personalize itineraries, provide price‑drop alerts, and confirm bookings instantly. In tandem, one‑click payment systems offer friction‑free transactions, while proactive notifications keep travelers informed of itinerary changes. These features minimize anxiety associated with online travel planning particularly valuable given the complexity of regional travel dynamics and regulatory hurdles. Augmented reality previews of accommodations and destinations enhance decision-making, fostering confidence in digital bookings. Authorities have further promoted this shift by endorsing digital tourism initiatives and supporting infrastructure upgrades targeting mobile users. As a result, mobile interfaces serve not just as booking tools, but as comprehensive travel companions guiding users through the entire journey. This reflects a broader shift in consumer expectations from static websites to intelligent, responsive mobile applications. Ultimately, this mobile-first transformation is central to Iran online travel market growth.

To get more information on this market, Request Sample

Regional Sustainable Travel via Digital Platforms

Iran’s online travel platforms are increasingly showcasing sustainable, culturally immersive experiences to attract both domestic and international tourists. Between March 2024 and March 2025, millions of tourists visited the country, a clear indicator of growing global interest. In response, digital channels now highlight eco‑lodges, guided heritage tours, and rural boundary‑crossing excursions. To promote responsible tourism, platforms offer filter options for low-impact travel and facilitate direct bookings with local artisans and community‑run guesthouses. Virtual previews using AR and video content help users assess listings before clicking “book,” reinforcing trust in off‑grid or lesser‑known destinations. Campaigns driven by data analytics optimize the promotion of seasonal and underutilized locales, helping to distribute visitor flow beyond traditional cities. These digital tools play a dual role: they empower travelers to make sustainable choices and support local economies by channeling revenue into rural communities. By aligning consumer demand with environmental stewardship, Iran online travel market trends.

Mobile‑First Engagement with AI‑Powered Personalisation

Iranian travel platforms are evolving rapidly through intelligent mobile-centric solutions. In 2024, developers expanded app functionalities to include AI-assisted chatbots, dynamic itinerary creation, and predictive pricing alerts. A key metric underscores that millions of tourists visited Iran between March 2024 and March 2025, reflecting heightened interest supported by smarter digital tools. Leveraging high mobile penetration and improved broadband coverage, these apps enable in-app transactions, real-time updates for travel disruptions, and AR-enhanced exploration tools ranging from interactive maps to virtual concierge services. AI-driven recommendation engines personalize suggestions based on seasonal context, location patterns, and user history, encompassing everything from heritage tours to eco-friendly stays. Multilingual support and local cultural guidance are embedded to improve usability for international visitors. This drive for tailored, seamless experiences reduces booking abandonment and fosters loyalty. National tourism bodies have endorsed this innovation by promoting mobile‑optimized platforms and collaborating with SMEs to integrate smart functionalities. As travelers increasingly seek personalization, efficiency, and immersion, Iran’s AI-enhanced mobile travel apps are setting new standards reinforcing their pivotal role in shaping Iran online travel market.

Iran Online Travel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service type, platform, mode of booking, and age group.

Service Type Insights:

- Transportation

- Travel Accommodation

- Vacation Packages

The report has provided a detailed breakup and analysis of the market based on the service type. This includes transportation, travel accommodation, and vacation packages.

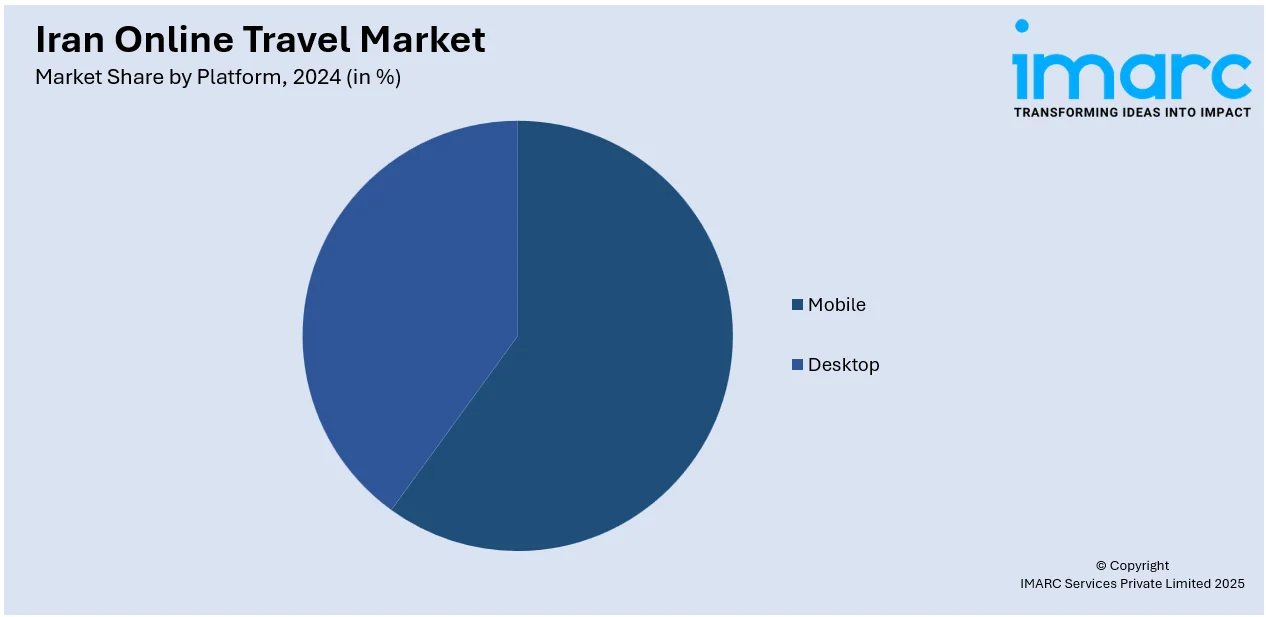

Platform Insights:

- Mobile

- Desktop

A detailed breakup and analysis of the market based on the platform have also been provided in the report. This includes mobile and desktop.

Mode of Booking Insights:

- Online Travel Agencies (OTAs)

- Direct Travel Suppliers

The report has provided a detailed breakup and analysis of the market based on the mode of booking. This includes online travel agencies (OTAs) and direct travel suppliers.

Age Group Insights:

- 22-31 Years

- 32-43 Years

- 44-56 Years

- Above 56 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 22-31 years, 32-43 years, 44-56 years, and above 56 years.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Online Travel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation, Travel Accommodation, Vacation Packages |

| Platforms Covered | Mobile, Desktop |

| Mode of Bookings Covered | Online Travel Agencies (OTAs), Direct Travel Suppliers |

| Age Groups Covered | 22-31 Years, 32-43 Years, 44-56 Years, Above 56 Years |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran online travel market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran online travel market on the basis of service type?

- What is the breakup of the Iran online travel market on the basis of platform?

- What is the breakup of the Iran online travel market on the basis of the mode of booking?

- What is the breakup of the Iran online travel market on the basis of age group?

- What is the breakup of the Iran online travel market on the basis of the region?

- What are the various stages in the value chain of the Iran online travel market?

- What are the key driving factors and challenges in the Iran online travel market?

- What is the structure of the Iran online travel market and who are the key players?

- What is the degree of competition in the Iran online travel market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran online travel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran online travel market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran online travel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)