Iran Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2025-2033

Iran Real Estate Market Overview:

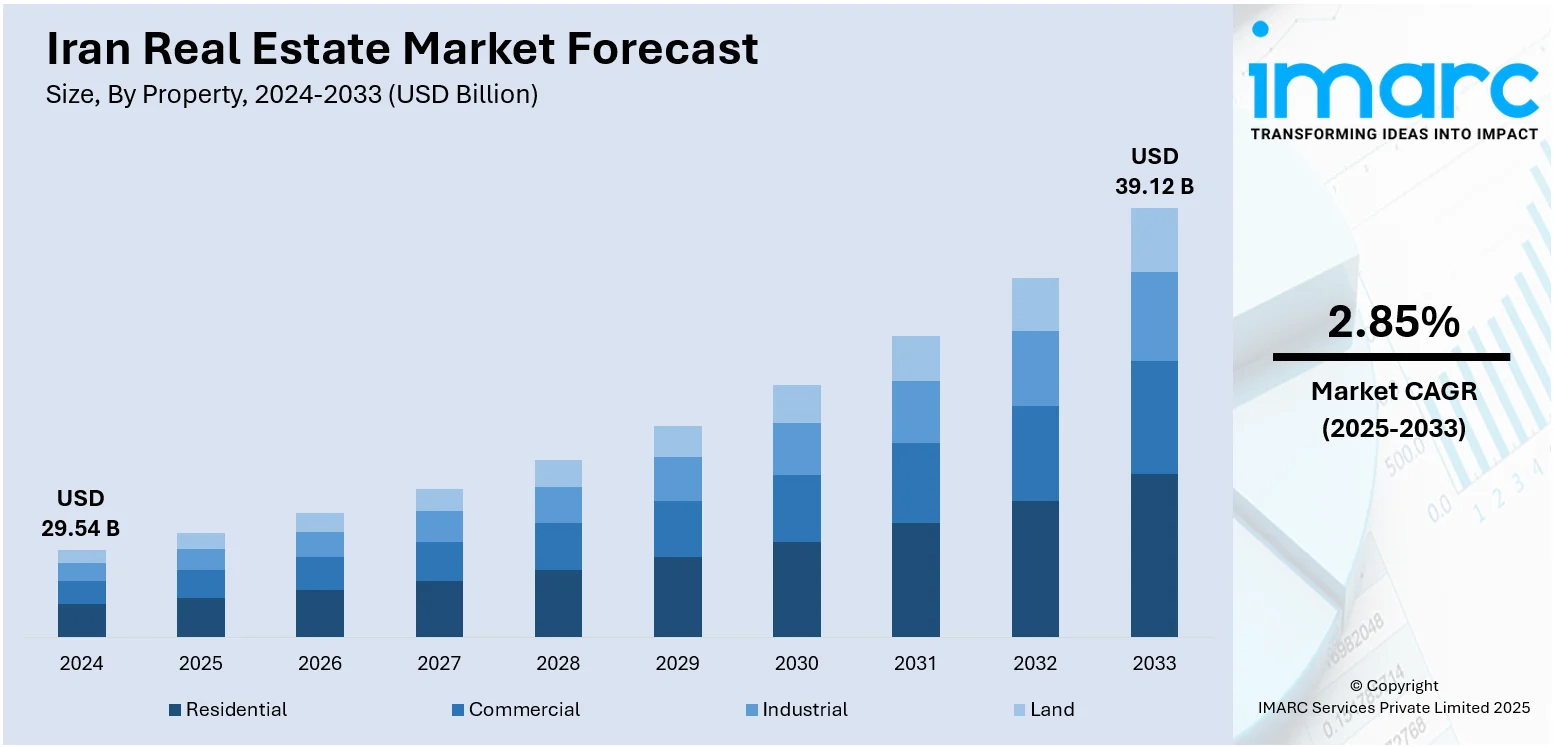

The Iran real estate market size reached USD 29.54 Billion in 2024. The market is projected to reach USD 39.12 Billion by 2033, exhibiting a growth rate (CAGR) of 2.85% during 2025-2033. The market is driven by the high inflation and Rial devaluation, pushing people to invest in property as a hedge against currency risk; rapid urbanization and a young population creating constant demand for housing, especially in major cities; and government policies such as housing programs, construction regulations, and taxation that influence supply, affordability, and investment behavior. These drivers interact to create price volatility, speculative activity, and uneven development across urban and suburban areas thus strengthening the Iran real estate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 29.54 Billion |

| Market Forecast in 2033 | USD 39.12 Billion |

| Market Growth Rate 2025-2033 | 2.85% |

Iran Real Estate Market Trends:

Inflation and Currency Devaluation

One of the main forces shaping Iran’s real estate market is the severe devaluation of the Iranian Rial (IRR) and persistently high inflation. In 2024 alone, the Rial lost nearly 35% of its value, sharply increasing construction costs and pushing property prices higher across the country. As inflation remains in double digits year after year, real estate continues to serve as a reliable hedge against currency depreciation. Iranians frequently shift their savings into property land, apartments, or commercial units to protect their wealth from monetary erosion. This defensive investment behavior fuels demand and drives prices up, regardless of actual supply-demand balance or economic fundamentals. Meanwhile, stagnant real income prompts speculative buying, as property ownership offers perceived security amid financial uncertainty. As a result, real estate prices climb artificially even as affordability declines, solidifying the sector’s role as both an asset refuge and inflation shield thereby bolstering the Iran real estate market growth.

To get more information on this market, Request Sample

Government Policy and Regulatory Influence

The Iranian government remains a key force in real estate market dynamics through its policies, subsidies, and housing programs. Initiatives like the “Mehr Housing Project” and the "National Housing Action Plan" aim to expand affordable housing supply, though outcomes vary. As of February 2024, over 230,000 housing units had been delivered, with 435,000 under construction and a total of 2.6 million homes planned nationwide. Despite these efforts, issues like project delays, affordability gaps, and uneven execution persist. Moreover, strict property ownership laws for foreigners, taxation measures, and zoning regulations shape market behavior and investor confidence. State-controlled banks influence housing credit availability, further affecting affordability. Recent policies like vacancy taxes seek to reduce speculation but face weak enforcement. Overall, government action remains the most decisive factor influencing supply, pricing, and investor strategies in Iran’s housing sector.

Population Growth and Urbanization

Another significant Iran real estate market trends is the Iran’s young, expanding population and rapid urbanization for housing, particularly in key cities like Tehran, Mashhad, and Isfahan. A large segment of the population is reaching working and marriageable age, seeking independent homes and fueling residential demand. At the same time, high rural-to-urban migration for jobs, education, and improved living standards further amplifies housing needs. However, urban land scarcity and rising costs have led to vertical construction and suburban growth to meet demand. Government housing projects attempt to ease this pressure but often fail in affordability and timely delivery. As a result, housing expenses consume around 37% of urban household budgets—and more than 55% in Tehran—making Iranian cities some of the least affordable globally. These demographic and urbanization trends continue to exert upward pressure on property prices and construction activity.

Iran Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on property, business, and mode.

Property Insights:

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

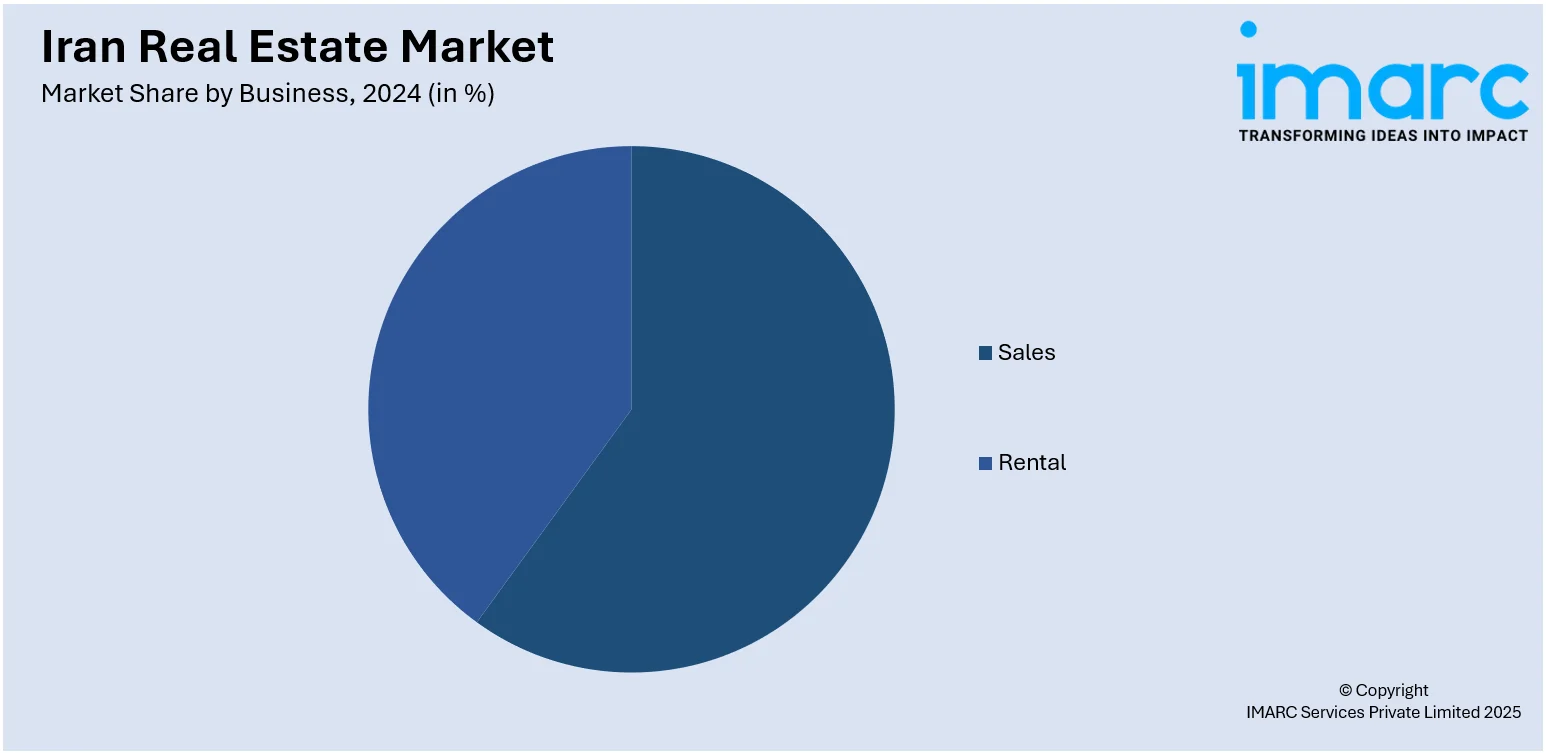

Business Insights:

- Sales

- Rental

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes sales and rental.

Mode Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the mode. This includes online and offline.

Regional Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Real Estate Market News:

- In October 2024, Iran launched a housing project on Bu Musa island in the Persian Gulf, announcing plans to build 110 residential units. The move follows renewed claims by the UAE over Bu Musa and two other islands, which Iran strongly rejects. Officials stated that construction will begin soon, with homes offered to local residents and applicants nationwide. Iran insists Bu Musa is an inseparable part of its territory, with development fully aligned with national laws.

Iran Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran real estate market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran real estate market on the basis of property?

- What is the breakup of the Iran real estate market on the basis of business?

- What is the breakup of the Iran real estate market on the basis of mode?

- What is the breakup of the Iran real estate market on the basis of region?

- What are the various stages in the value chain of the Iran real estate market?

- What are the key driving factors and challenges in the Iran real estate market?

- What is the structure of the Iran real estate market and who are the key players?

- What is the degree of competition in the Iran real estate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)