Iran Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Province, 2025-2033

Iran Vegetable Oil Market Overview:

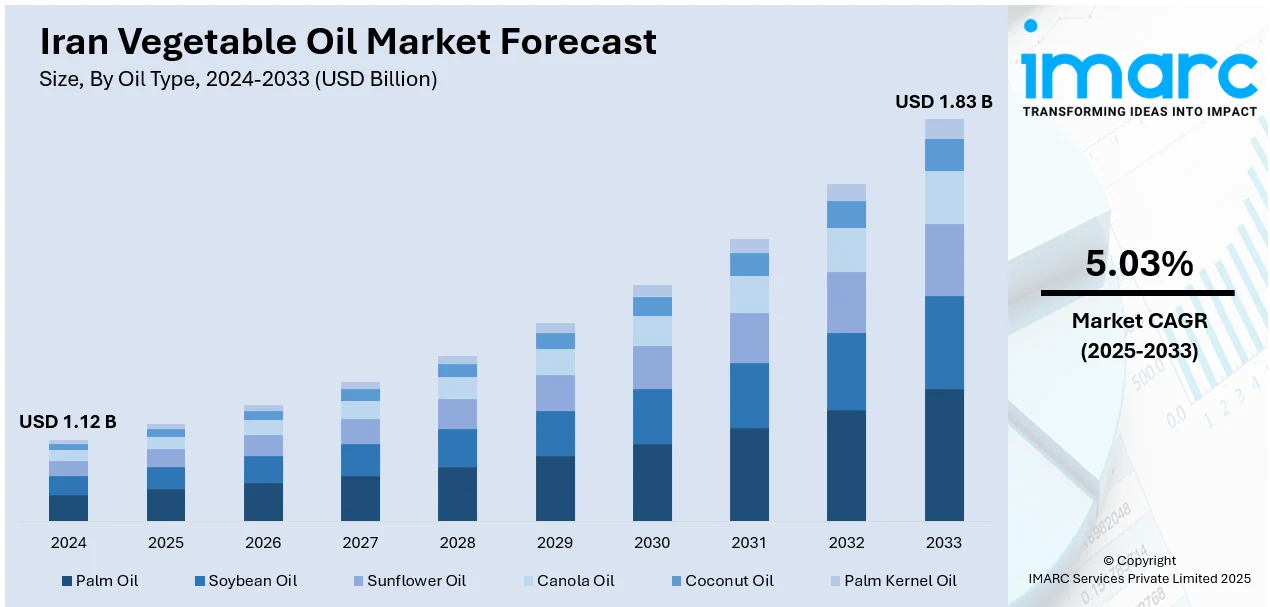

The Iran vegetable oil market size reached USD 1.12 Billion in 2024. Looking forward, the market is projected to reach USD 1.83 Billion by 2033, exhibiting a growth rate (CAGR) of 5.03% during 2025-2033. The market is driven by Iran’s push for oilseed self-sufficiency, supported by agro-policy reforms and vertical integration in refining. Regulatory crackdowns on trans fats and increased demand for healthier alternatives are reshaping consumer behavior and product formulation. Diversified import sourcing and enhanced refining capacities are further augmenting the Iran vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.12 Billion |

| Market Forecast in 2033 | USD 1.83 Billion |

| Market Growth Rate 2025-2033 | 5.03% |

Iran Vegetable Oil Market Trends:

National Self-Sufficiency Efforts in Edible Oils

Iran has made vegetable oil security a national priority, pushing for reduced reliance on imported crude and refined oils. With a traditionally high dependence on imports—especially sunflower, soybean, and palm oil—the government has introduced policies to promote domestic cultivation of oilseed crops such as canola, safflower, and soybean. Agricultural subsidies, access to improved seed varieties, and water-efficient irrigation systems are being provided to farmers to incentivize production. The Ministry of Agriculture has also emphasized contract farming schemes and research on high-yield, drought-resistant varieties suited to local conditions. Major food companies are vertically integrating by investing in local oilseed crushing and refining facilities, reducing foreign currency exposure and logistics costs. This drive aligns with Iran’s broader economic strategy of import substitution under international sanctions. Though domestic production still falls short of demand, rising investment in infrastructure and technology is helping close the gap. These supply-side initiatives are not only improving food security but are also generating rural employment and modernizing agro-processing capabilities. Iran vegetable oil market growth is increasingly shaped by these national self-reliance goals and upstream capacity-building initiatives that aim to stabilize domestic supply chains.

To get more information on this market, Request Sample

Shifting Health Regulations and Reformulation in Food Industry

Iran’s Ministry of Health has launched multiple nutrition campaigns to reduce trans fat, saturated fat, and excessive oil consumption in the general population. These initiatives are in response to rising incidences of cardiovascular disease and obesity, which are partially attributed to the excessive use of hydrogenated vegetable oils. The government has banned the use of certain trans fats in food processing and encourages reformulation across edible oil categories. Food manufacturers and refiners are responding by introducing low-saturated fat products, non-hydrogenated alternatives, and fortified oils containing vitamins A and D. Urban consumers, particularly in Tehran and Mashhad, are showing preference for sunflower, corn, and canola oils marketed as heart-healthy and suitable for everyday cooking. Packaged foods, from snacks to pastries, are now required to display clear labeling of oil type and nutritional content, driving consumer awareness. This regulatory and consumer shift is creating demand for technologically advanced refining processes, better quality control, and transparent supply chains. As the market aligns with stricter health norms, both domestic and international players are innovating within compliance frameworks. These health-driven reforms are reshaping the oil category’s product mix and competitive dynamics.

Import Dependency and Diversification of Trade Partners

Despite efforts toward domestic oilseed production, Iran continues to rely heavily on imports to meet its edible oil requirements—particularly for palm oil from Southeast Asia and sunflower oil from Black Sea countries. However, shifting geopolitical alliances and sanctions have led Iran to diversify its trade relationships, increasingly sourcing from alternative suppliers in Russia, Kazakhstan, and Malaysia. Strategic stockpiling and long-term supply contracts help mitigate price volatility and supply chain disruptions caused by global conflict, currency instability, or trade restrictions. Local refiners, supported by government-owned trading agencies, import crude oil and process it domestically to retain value and support the national workforce. Tariff adjustments, port development projects, and preferential trade agreements further streamline import channels and reduce procurement costs. While consumer prices remain sensitive to currency fluctuations, the expansion of regional trade corridors, such as the International North-South Transport Corridor (INSTC), offers long-term benefits in logistics and sourcing efficiency. These evolving trade strategies ensure oil availability while gradually reducing economic vulnerability. The interplay between trade dependency and regional diversification plays a pivotal role in shaping the operational structure and resilience of Iran’s vegetable oil sector.

Iran Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

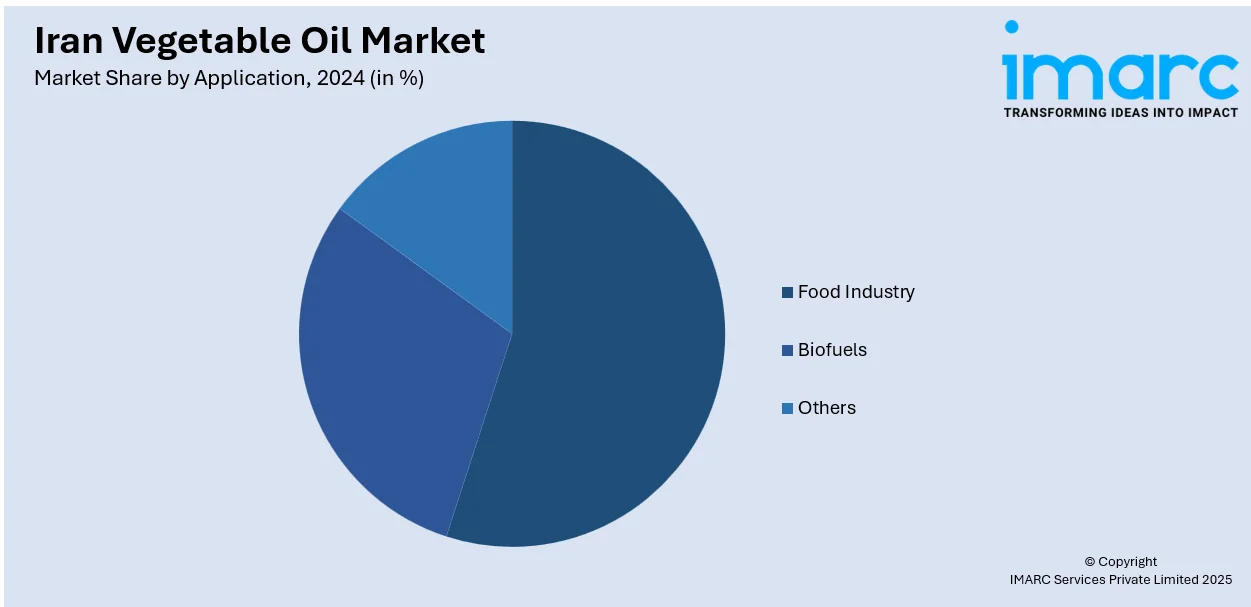

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Province Insights:

- Tehran

- Khuzestan

- Bushehr

- Esfahan

- Khorasan

- Others

The report has also provided a comprehensive analysis of all major provincial markets. This includes Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Iran Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Provinces Covered | Tehran, Khuzestan, Bushehr, Esfahan, Khorasan, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Iran vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Iran vegetable oil market on the basis of oil type?

- What is the breakup of the Iran vegetable oil market on the basis of application?

- What is the breakup of the Iran vegetable oil market on the basis of province?

- What are the various stages in the value chain of the Iran vegetable oil market?

- What are the key driving factors and challenges in the Iran vegetable oil market?

- What is the structure of the Iran vegetable oil market and who are the key players?

- What is the degree of competition in the Iran vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Iran vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Iran vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Iran vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)