Iron Ore Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Iron Ore Price Trend, Index and Forecast

Track the latest insights on iron ore price trend and forecast with detailed analysis of regional fluctuations and market dynamics across North America, Latin America, Central Europe, Western Europe, Eastern Europe, Middle East, North Africa, West Africa, Central and Southern Africa, Central Asia, Southeast Asia, South Asia, East Asia, and Oceania.

Iron Ore Prices Outlook Q4 2025

- USA: USD 104/MT

- China: USD 97/MT

- United Kingdom: USD 107/MT

- Canada: USD 94/MT

- France: USD 96/MT

Iron Ore Price Chart

Get real-time access to monthly/quarterly/yearly prices Request Sample

During the fourth quarter of 2025, the iron ore prices in the USA reached 104 USD/MT in December. The downward pricing trend was primarily influenced by reduced procurement activity from domestic steel producers, who adjusted output levels amid softer downstream demand. Elevated inventory positions across distribution networks further limited spot market buying interest. Additionally, logistical normalization and stable freight availability reduced cost pressures that had previously supported prices.

During the fourth quarter of 2025, the iron ore prices in China reached 97 USD/MT in December. Prices declined as steelmakers operated under cautious production strategies due to muted construction sector activity. Government-led environmental compliance measures constrained blast furnace utilization, reducing raw material intake. Portside inventories remained ample, limiting urgency for fresh purchases.

During the fourth quarter of 2025, the iron ore prices in the United Kingdom reached 107 USD/MT in December. The market experienced declining prices amid restrained steel manufacturing demand linked to slower infrastructure project execution. Buyers focused on inventory optimization rather than new acquisitions, reducing transactional volumes. Supply chains operated smoothly, minimizing disruption-related cost premiums. Additionally, competitive import offers from multiple origins pressured domestic pricing benchmarks.

During the fourth quarter of 2025, the iron ore prices in Canada reached 94 USD/MT in December. Prices softened as mining output remained steady while domestic consumption showed limited growth. Steel producers adopted conservative raw material sourcing strategies, prioritizing existing stock utilization. Export demand also remained subdued, reducing upward pricing momentum. Transportation efficiencies improved, lowering delivered costs and enabling suppliers to offer more competitive pricing.

During the fourth quarter of 2025, the iron ore prices in France reached 96 USD/MT in December. The market witnessed declining prices due to reduced steel production activity and cautious procurement behavior. Industrial demand softened as manufacturing sectors operated below optimal capacity. Adequate supply availability and stable import flows minimized scarcity concerns. Buyers delayed purchases in anticipation of further price corrections, reinforcing bearish sentiment.

Iron Ore Prices Outlook Q3 2025

- USA: USD 105/MT

- China: USD 99/MT

- United Kingdom: USD 108/MT

- Canada: USD 95/MT

- France: USD 97/MT

During the third quarter of 2025, iron ore prices in the USA reached 105 USD/MT in September. The moderate increase was underpinned by sustained industrial demand from steel producers, combined with a tighter supply of high-grade ore. Domestic logistics and transport costs rose, while export pressures from major suppliers kept global pricing dynamics tight. Currency movements and higher freight rates added incremental cost burdens, prompting suppliers to adjust upward.

During the third quarter of 2025, iron ore prices in China reached 99 USD/MT in September. The upward move reflected resumed infrastructure investment and stronger steel mill restocking ahead of the winter season. Meanwhile, supply-side constraints, including port handling delays and higher shipping costs from major exporting regions, supported price gains. Regulatory oversight on mining output in key source countries also reduced the availability of lower-cost ore.

During the third quarter of 2025, iron ore prices in the United Kingdom reached 108 USD/MT in September. UK pricing benefited from strong demand in construction and offshore wind infrastructure, which increased demand for steel and thus raw iron ore. At the same time, higher import freight and rising handling costs at UK ports created upward cost pressure. Exchange-rate effects and modest supply disruptions further supported the price level. Consequently, UK prices moved higher.

During the third quarter of 2025, iron ore prices in Canada reached 95 USD/MT in September. In contrast to other markets, Canadian pricing declined as weaker export demand and competition from other sources weighed. Domestic mining output remained stable, but elevated logistic costs and lower steel-making throughput domestically reduced demand. Additionally, softer global demand dampened Canadian upward pricing momentum, causing a downward shift.

During the third quarter of 2025, iron ore prices in France reached 97 USD/MT in September. The French pricing trend moved downward due to reduced manufacturing and slower restocking by steel mills in the region. While supply costs (shipping, port fees) increased modestly, the weaker demand side dominated. Imported ore costs and regulatory compliance added cost burdens, but these could not offset the decline in demand. Hence, the net effect was a moderate price reduction.

Iron Ore Prices Outlook Q2 2025

- Singapore: USD 102.91/MT

- China: USD 96.24/MT

- UK: USD 104.70/MT

- Canada: USD 98.67/MT

- France: USD 99.56/MT

During the second quarter of 2025, the iron ore prices in Singapore reached 102.91 USD/MT in June. As per the iron ore price chart, prices in Singapore edged higher, lifted by steady demand from regional steel producers and a seasonal uptick in construction activity. Persistent supply worries from key exporting countries added pressure, as weather disruptions and shipping constraints tightened availability.

During the second quarter of 2025, iron ore prices in China reached 96.24 USD/MT in June. The availability of domestic iron ore in China impacted prices. In May 2025, China's iron ore imports fell, with steel manufacturers opting for domestic sourcing due to more competitive pricing, which impacted the overall pricing trends. Freight costs changed slightly toward late June, but market sentiment remained cautious amid global economic uncertainty, keeping prices in a stable but watchful range.

During the second quarter of 2025, the iron ore prices in the UK reached 104.70 USD/MT in June. Shifting trade patterns, geopolitical tensions, and environmental regulations played a role, influencing production and consumption trends and prices. Traders also kept an eye on policy changes in major exporting countries, which added mild uncertainty.

During the second quarter of 2025, the iron ore prices in Canada reached 98.67 USD/MT in June. Fluctuations in the US dollar and local currencies impacted the cost of production for iron ore, adding a layer of complexity to pricing. Besides, speculative buying, particularly for high-grade concentrates, led to price changes in certain segments of the market.

During the second quarter of 2025, the iron ore prices in France reached 99.56 USD/MT in June. Existing and potential trade tariffs and other geopolitical uncertainties created instability in the market, impacting price fluctuations. Besides, the growing demand for high-grade iron ore and direct reduction pellets also influenced prices.

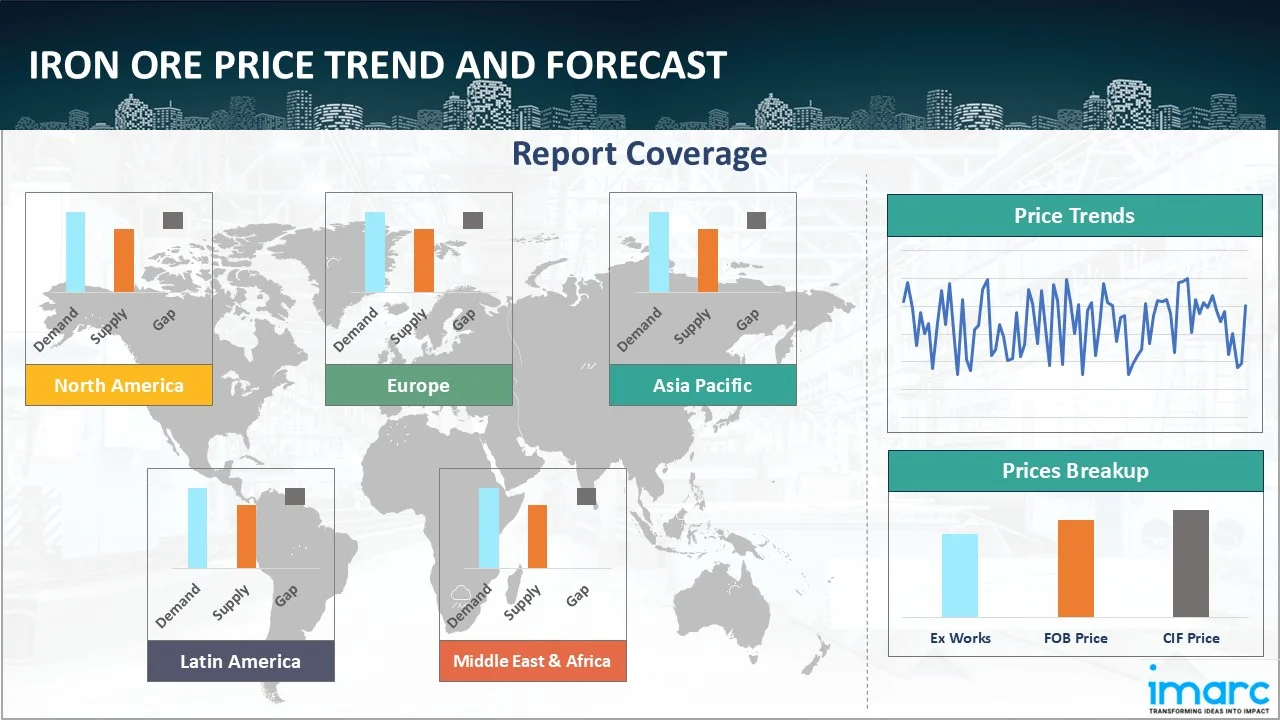

Regional Coverage

The report provides a detailed analysis of the market across different regions, each with unique pricing dynamics influenced by localized market conditions, supply chain intricacies, and geopolitical factors. This includes price trends, price forecast and supply and demand trends for each region, along with spot prices by major ports. The report also provides coverage of FOB and CIF prices, as well as the key factors influencing iron ore prices.

Europe Iron Ore Price Trend

Q4 2025:

The iron ore price index in Europe reflected a declining trend as demand-side fundamentals remained weak across major consuming economies. Regional steelmakers operated cautiously in response to subdued construction activity and slower manufacturing output, particularly within infrastructure-linked segments. This cautious operating environment reduced raw material intake, limiting spot market participation. Inventory optimization remained a key strategy, with buyers prioritizing stock drawdowns over fresh procurement.

Q3 2025:

In the third quarter of 2025, the iron ore price index in Europe saw moderate variance across markets. Demand remained resilient as regional infrastructure projects and the manufacturing sector supported steel consumption, but logistical bottlenecks and higher port‐handling charges increased the ore landed cost. Regulatory compliance costs (environmental and safety) also added to the supply base. Meanwhile, import competition and currency volatility suppressed sharper price gains, resulting in only moderate upward pressure overall.

Q2 2025:

As per the iron ore price index, prices in Europe moved within a narrow range during the second quarter of 2025. Higher freight charges and elevated energy costs, especially for electricity and fuel, pushed production expenses up for European steelmakers. Sluggish construction activity and modest automotive demand kept buying interest subdued. Some support came from restocking by mills ahead of summer maintenance shutdowns, but not enough to drive significant price spikes. Overall, sentiment held steady with market players cautious about weaker downstream demand and potential policy changes on emissions targets.

This analysis can be extended to include detailed iron ore price information for a comprehensive list of countries.

| Region | Countries Covered |

|---|---|

| Europe | Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal, and Greece, among other European countries. |

North America Iron Ore Price Trend

Q4 2025:

The iron ore price index in North America weakened due to a combination of softer demand conditions and comfortable supply availability. Steel producers adjusted output levels downward as end-use demand from construction and manufacturing sectors showed limited momentum. This adjustment directly reduced raw material procurement requirements, dampening price support. At the same time, adequate domestic production and steady import arrivals ensured balanced supply conditions. Transportation efficiencies improved across rail and port networks, lowering delivered costs and removing logistical cost pressures from the market.

Q3 2025:

In the third quarter of 2025, the iron ore price index in North America moved erratically, with some markets showing gains and others declines. Elevated transportation and freight costs, combined with domestic raw material scarcity, raised prices in certain areas. However, weaker export demand and slower steel restocking in other zones weighed on pricing. Overall, supply‐chain cost inflation was present, but mixed demand trends resulted in uneven regional price performance.

Q2 2025:

The reinstatement of US steel import tariffs and broader trade tensions created uncertainty and impacted the flow of iron ore, affecting prices. Besides, environmental regulations on mining operations raised production expenses slightly. Softening Chinese demand capped any major rally, but North American buyers kept inventories balanced, preventing sharp dips. Market sentiment stayed firm but watchful of global trade tensions and logistics costs, which continued to shape price movements through the quarter.

Specific iron ore prices and historical data within the United States and Canada can also be provided.

| Region | Countries Covered |

|---|---|

| North America | United States and Canada |

Middle East and Africa Iron Ore Price Trend

Q4 2025:

As per the iron ore price chart, the prices in the Middle East and Africa fluctuated due to a complex interplay of factors, primarily driven by supply chain disruptions, seasonal demand shifts, and geopolitical influences.

Q3 2025:

The report explores the iron ore trends and iron ore price chart in the Middle East and Africa, considering factors like regional industrial growth, the availability of natural resources, and geopolitical tensions that uniquely influence market prices.

In addition to region-wise data, information on iron ore prices for countries can also be provided.

| Region | Countries Covered |

|---|---|

| Middle East & Africa | Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco, among other Middle Eastern and African countries. |

Asia Pacific Iron Ore Price Trend

Q4 2025:

The Asia Pacific region experienced declining iron ore prices as steel production activity remained restrained across key consuming markets. Steelmakers adopted conservative operating rates amid uncertain downstream demand, particularly within construction and export-oriented manufacturing sectors. Restocking activity remained limited, with buyers relying on existing inventories rather than entering the spot market aggressively. Port inventories stayed sufficient throughout the quarter, reducing concerns over material availability and limiting price support.

Q3 2025:

In the third quarter of 2025, iron ore prices in the Asia Pacific region were shaped by strong demand from major steel-making economies, escalating freight and handling costs for imported ore, and supply constraints from key exporters. Domestic mines in the region faced cost inflation in energy and transport, which translated into higher base pricing. While some nations curbed ore exports, others grappled with inland logistics challenges, resulting in upward pressure across the region.

Q2 2025:

China's steel production cuts, motivated by factors like overcapacity reduction and environmental concerns, significantly impacted iron ore demand. This decrease in demand from China, a major consumer, exerted pressure on prices. Besides, weak construction activity and cautious sentiment in downstream sectors weighed on buying appetite. Freight rates on key routes moved within a narrow band, offering little cost relief. Overall, iron ore market participants adopted a wait-and-see approach, holding prices within a restrained range under muted demand conditions.

This iron ore price analysis can be expanded to include a comprehensive list of countries within the region.

| Region | Countries Covered |

|---|---|

| Asia Pacific | China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand, among other Asian countries. |

Latin America Iron Ore Price Trend

Q4 2025:

Latin America's iron ore market is predominantly influenced by its rich natural reserves, particularly in countries like Chile and Brazil. However, political instability and inconsistent regulatory frameworks can lead to significant volatility in iron ore prices.

Q3 2025:

Infrastructure challenges and logistical inefficiencies often impact the supply chain, affecting Latin America’s ability to meet international demand consistently. Moreover, the iron ore price index, economic fluctuations, and currency devaluation are critical factors that need to be considered when analyzing iron ore pricing trends in this region.

This comprehensive review can be extended to include specific countries within the region.

| Region | Countries Covered |

|---|---|

| Latin America | Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru, among other Latin American countries. |

Iron Ore Pricing Report, Market Analysis, and News

IMARC's latest publication, “Iron Ore Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the iron ore market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of iron ore at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed iron ore prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting iron ore pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Iron Ore Industry Analysis

The global iron ore market size reached USD 327.60 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 418.03 Billion, at a projected CAGR of 2.75% during 2026-2034. The market is primarily driven by rising infrastructure investment, growth in global steel production, increasing mining automation, reducing costs, and tightening supply from major exporters, pushing up raw-material pricing.

Latest News and Developments:

- June 2025: Roy Hill and Atlas Ore announced a merger to form Hancock Iron Ore, bringing together the firms' experience and strengths. Roy Hill is one of Australia's biggest iron ore miners, exporting over 64 million tons of iron ore to surrounding Asian steelmaking markets each year.

- June 2025: Rio Tinto launched Western Range, its newest iron ore mine in Pilbara. The Western Range holds the potential to generate up to 25 million tons of iron ore per year, which could support the present Paraburdoo mining hub for up to 20 years.

Product Description

Iron ore is a naturally occurring mineral primarily composed of iron oxides, which serve as the main raw material for steel production. Found in sedimentary rocks, iron ore is extracted through mining and then processed to separate the iron content from impurities. The most commonly mined forms include hematite (Fe₂O₃) and magnetite (Fe₃O₄), both of which contain high concentrations of iron. Once mined, the ore undergoes crushing, grinding, and beneficiation to enhance its iron content before being transported to steel mills.

Iron ore is essential for the global steel industry, which consumes the majority of iron ore produced worldwide. Steel is used in a wide array of sectors, including construction, automotive, manufacturing, energy, and infrastructure. The quality of iron ore significantly impacts steel production efficiency and environmental footprint, with high-grade ores being preferred for their lower energy requirements and reduced emissions.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Iron Ore |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Iron Ore Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of iron ore pricing, covering global and regional trends, spot prices at key ports, and a breakdown of FOB and CIF prices.

- The study examines factors affecting iron ore price trend, including input costs, supply-demand shifts, and geopolitical impacts, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The iron ore price charts ensure our clients remain at the forefront of the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)