Italy Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End-User, and Region, 2025-2033

Italy Air Freight Market Overview:

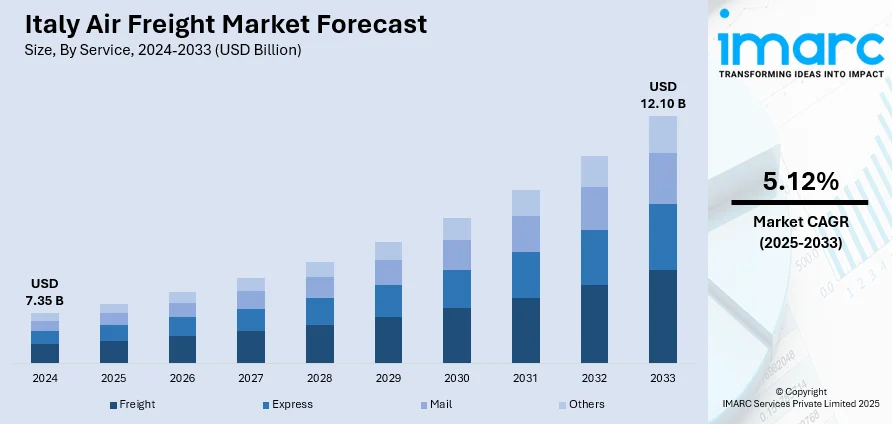

The Italy air freight market size reached USD 7.35 Billion in 2024. The market is projected to reach USD 12.10 Billion by 2033, exhibiting a growth rate (CAGR) of 5.12% during 2025-2033. The market is witnessing steady development, supported by advancements in logistics infrastructure and a growing emphasis on international trade. Government initiatives aimed at improving customs clearance processes and reducing administrative bottlenecks are streamlining cross-border movement of goods. Enhanced airport connectivity and increased investment in digital cargo solutions are also contributing to operational efficiency. Moreover, the rising demand for temperature-controlled air freight, driven by pharmaceuticals and high-value perishables, is prompting carriers to upgrade their cold chain capabilities. The adoption of AI-driven tracking and route optimization technologies is further improving delivery timelines and reducing operational costs. As businesses prioritize faster delivery and supply chain resilience, this is expected to positively influence the Italy air freight market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.35 Billion |

| Market Forecast in 2033 | USD 12.10 Billion |

| Market Growth Rate 2025-2033 | 5.12% |

Italy Air Freight Market Trends:

Cargo Volume Surge Strengthens Capacity

Italy’s air cargo sector has experienced a significant volume increase, reflecting its strategic adaptability. In the first eight months of 2024, Italian airports handled approximately 825,000 tonnes of air cargo—an 18% increase compared to the same period in 2023 driven largely by growth in pharmaceutical and express shipments. Milan Malpensa remains the country’s primary center for air freight, with Rome Fiumicino and secondary airports like Venice and Bologna contributing to the increasing capacity. To support this surge, airports are expanding apron space and reinforcing freight terminals with improved warehouse access and streamlined customs zones. Enhanced operational readiness is supporting Italy’s recovery from recent supply-chain disruptions and reinforcing its logistic integration with Europe, Asia, and North America. These capacity upgrades, centered on modular handling and enhanced ground support, are supporting Italy air freight market growth by enabling higher throughput while maintaining service reliability in rapidly evolving global trade dynamics. Furthermore, collaborative efforts with logistics firms and local authorities are streamlining intermodal connections, increasing efficiency. These investments not only address current demands but also strategically prepare Italy to meet future international freight trends and expectations.

To get more information on this market, Request Sample

Digital and Smart Logistics Elevate Efficiency

Italy is embracing digital technologies to enhance air cargo efficiency through smart logistics solutions. Airports across the country are increasingly adopting AI-driven tracking systems, automated customs pre-clearance, and Internet of Things (IoT) sensors for container and pallet monitoring. These technologies improve visibility across the supply chain, enabling predictive route planning and optimizing ground handling workflows. Real-time data sharing between freight forwarders, customs, and airport operators enables faster clearances and more reliable delivery schedules. The digitized logistics infrastructure supports smooth intermodal connectivity, especially between air and rail routes managed under national freight modernization plans. This shift marks a significant move in Italy air freight market trends, reflecting the sector’s transition toward data-driven, agile operations that reduce turnaround times and boost competitiveness in international markets. Further integration of cloud-based platforms, electronic air waybills, and AI-enhanced demand forecasting tools is reinforcing this trend. Together, these innovations are helping stakeholders align with international compliance standards and enhance real-time decision-making. With digital systems playing a key role, Italy’s air cargo sector is well-positioned to navigate future disruptions and ensure stable performance across time-sensitive shipments.

Sustainability Drives Green Air Cargo Initiatives

Italy’s air freight network is actively implementing green logistics initiatives at major airports. In January 2025, Rome Fiumicino unveiled a 22 MW solar farm along its runways Europe’s largest on-airport photovoltaic installation designed to offset over 11,000 tonnes of CO₂ emissions annually and support future carbon-neutral operations. Similar measures are being planned at Milan Malpensa, including deployment of solar panels and electric cargo vehicles to reduce site emissions. These eco-friendly investments showcase Italy’s commitment to green air transport infrastructure and cater to freight customers with sustainability targets. The alignment with EU climate objectives enhances Italy’s role in low-carbon logistics corridors. Such environmental modernization reflects Italy air freight market, positioning the sector for regulated growth while demonstrating sustainability as a competitive advantage in evolving global supply chains. Additionally, airports are collaborating with energy providers to incorporate renewable sources and battery storage systems into cargo handling operations. As more businesses demand low-emission transport solutions, these developments are likely to influence long-term infrastructure planning and solidify Italy’s position in sustainable air cargo delivery.

Italy Air Freight Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, destination, and end-user.

Service Insights:

- Freight

- Express

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes freight, express, mail, and others.

Destination Insights:

- Domestic

- International

A detailed breakup and analysis of the market based on the destination have also been provided in the report. This includes domestic and international.

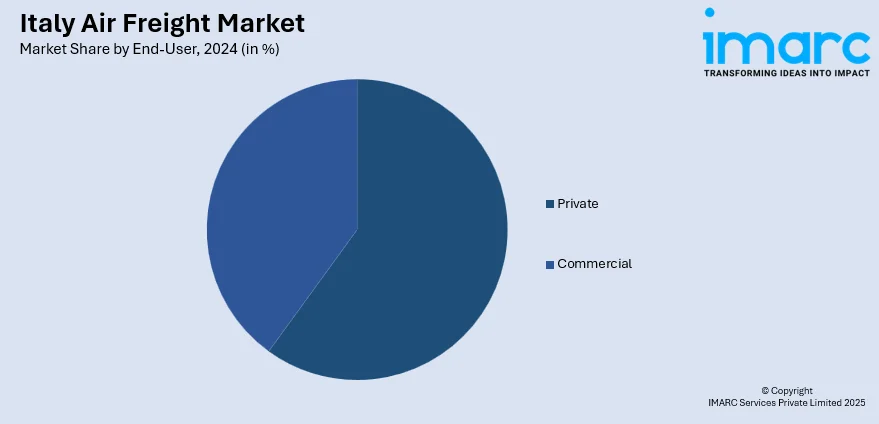

End-User Insights:

- Private

- Commercial

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes private and commercial.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Air Freight Market News:

- May 2025: Lufthansa Cargo will, from June 16, begin marketing cargo capacity on ITA Airways flights marking an expansion following Lufthansa Group’s 41% acquisition of the Italian airline. The move includes designating Rome–Fiumicino as Lufthansa Cargo’s fifth major hub in Southern Europe, boosting global belly capacity by nearly 20%. Initially, the integration targets routes from São Paulo, Rio de Janeiro, and Buenos Aires to Rome under a Lufthansa airway bill. CEO Ashwin Bhat emphasizes that this builds a denser network and offers customers enhanced flexibility and speed.

- April 2025: ITA Airways has received formal approval from the Star Alliance Chief Executive Board to begin integration into the alliance, aiming for full membership in early 2026. This milestone follows Lufthansa Group’s 41% stake acquisition in January 2025, positioning ITA as the fifth Lufthansa hub airline joining the alliance. Upon joining, Star Alliance will welcome an additional 360 daily ITA flights, significantly boosting connectivity across Italy and Europe. Joerg Eberhart, ITA’s CEO, said this marks “a significant moment” offering customers the network's full benefits

Italy Air Freight Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Freight, Express, Mail, Others |

| Destinations Covered | Domestic, International |

| End-Users Covered | Private, Commercial |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy air freight market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy air freight market on the basis of service?

- What is the breakup of the Italy air freight market on the basis of destinations?

- What is the breakup of the Italy air freight market on the basis of end-user?

- What is the breakup of the Italy air freight market on the basis of region?

- What are the various stages in the value chain of the Italy air freight market?

- What are the key driving factors and challenges in the Italy air freight?

- What is the structure of the Italy air freight market and who are the key players?

- What is the degree of competition in the Italy air freight market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy air freight market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy air freight market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy air freight market and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)