Italy Apparel Market Size, Share, Trends and Forecast by Type, Distribution Channel, End User, and Region, 2026-2034

Italy Apparel Market Size and Share:

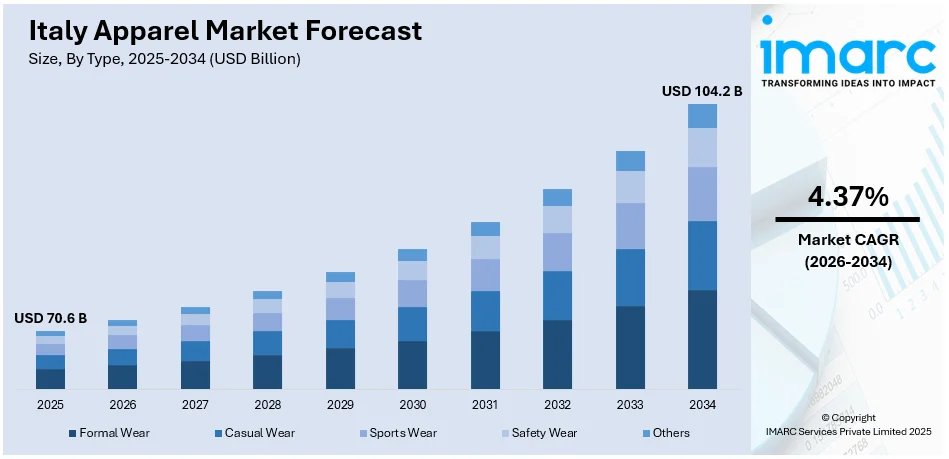

The Italy apparel market size was valued at USD 70.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 104.2 Billion by 2034, exhibiting a CAGR of 4.37% from 2026-2034. The market is fueled by a combination of factors including fast digitalization, growing e-commerce platforms, and rising per capita income. Strong sustainability efforts and technological advancements are transforming production and consumer behavior. Demographic changes, cultural fashion trends, and growing celebrity endorsements have also contributed to further boosting consumer participation, establishing growth opportunities in various apparel segments in the changing Italian fashion industry, strengthening Italy apparel market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 70.6 Billion |

| Market Forecast in 2034 | USD 104.2 Billion |

| Market Growth Rate 2026-2034 | 4.37% |

Italy’s long-standing reputation for craftsmanship and luxury fashion is a primary driver of its apparel market. Iconic brands like Gucci, Prada, and Armani not only dominate globally but also reinforce the country’s identity as a fashion capital. This legacy fosters a strong domestic and international demand for Italian-made clothing, often associated with quality, style, and prestige. Additionally, high-value exports and fashion tourism especially in cities like Milan and Florence further bolster the sector. Alongside this, Milan’s Via Monte Napoleone, now the world’s maximum pricey shopping street with retail rents of €20,000 per square meter annually, exemplifies Italy’s global prestige in luxury fashion. Attracting 11 million visitors annually with average spending of €2,500 per shopper, it underscores the country’s legacy of craftsmanship and style. The luxury segment's resilience, even during economic downturns, underscores the strength of Italy’s fashion heritage as a cornerstone of the apparel market.

To get more information on this market Request Sample

Sustainability is playing a transformative role in shaping consumer preferences in the Italy apparel market. Approximately 74% of Italians express interest in sustainable fashion, with 68% preferring eco-friendly clothing and 51% leaning toward vintage or second-hand options. This shift reflects heightened awareness of environmental and ethical concerns. As a result, consumers are increasingly seeking garments made from organic textiles, produced through transparent supply chains and circular fashion models. In response, Italian brands are integrating sustainable practices like upcycling and reduced water usage into their production processes. Supported by EU regulations and government incentives, this trend is driving innovation and competitiveness across the industry, encouraging both established labels and new designers to prioritize responsible and ethical fashion.

Italy Apparel Market Trends:

Technological Advancements in Manufacturing

Technological advancements are expected to drive efficiencies and bring new innovation in Italy apparel market. One way that Italian producers elevate their offering is by incorporating technology, be it from automated production processes, or use of the finest materials available, due to which they are able to keep some of the process efficient while not compromising on quality of workmanship. Italy’s commitment to the domestic fashion sector, with USD 260.8 Million allocated for the industry in 2025, signaling substantial investments in both innovation and sustainability. Additionally, advanced tools and software have auto customization, and it significantly reduces the turnaround time in the digital world of fast-pacing industry. Moreover, technologies such as three-dimensional printing (3D) and virtual prototyping make the design, and production stages even more revolutionary, which is further bolstering the Italy apparel market growth.

Fashion Trends and Preferences

The apparel market in Italy among others follows individual fashion trends and preferences. Italy is known as the most fashionable city of the world, that is why it is a leader exporter in the global fashion industry. As reported, Italians spend on average 710 euros per year on their clothes. The European average stands at 490 euros. Italian fashion houses and designers are constantly reinterpreting cultural phenomena and societal shifts into their collections. As a result, a strong focus on creativity and originality helps Italian apparel brands stand out in the eyes of fashion-savvy customers across the globe. From haute couture to ready to wear lines, the Italian fashion industry is praised for as they always have something nice to offer for every taste and lifestyle in the view. In addition, the long fashion tradition of Italy and the past experience in craftsmanship gives Italian clothing a certain dignity and recognition on the international market.

Sustainability and Ethical Production

In recent years, sustainability and ethical production have become significant drivers shaping the Italy apparel market outlook. Consumers are increasingly conscious of the environmental and social impacts of their purchasing decisions, prompting Italian fashion brands to adopt more sustainable practices throughout their supply chains. From sourcing eco-friendly materials to implementing fair labor practices, sustainability is integrated into every aspect of production. The European Environmental Agency has set a target for Italy to achieve a 30% circular material use rate by 2030, pushing the apparel sector to innovate and prioritize circular production models. Italy's tradition of craftsmanship aligns well with the values of sustainability, as artisans prioritize quality over quantity, resulting in durable and timeless pieces that withstand trends and seasons. Moreover, Italian fashion houses leverage their heritage and reputation to promote sustainable initiatives, resonating with environmentally conscious consumers who seek ethically produced clothing. As sustainability continues to gain momentum as a key consideration in purchasing decisions, Italian apparel companies are embracing this shift, driving innovation and transparency in the industry.

Italy Apparel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Italy apparel market, along with forecast at the country and regional levels from 2026-2034. The market has been categorized based on type, distribution channel, and end user.

Analysis by Type:

- Formal Wear

- Casual Wear

- Sports Wear

- Safety Wear

- Others

Based on the Italy apparel market forecast, the formal wear in Italy reflects the country’s deep-rooted sartorial tradition, with tailored suits and elegant attire holding strong appeal. Demand is driven by business, ceremonial, and luxury fashion needs. Although impacted by casualization trends, formal wear remains relevant due to quality craftsmanship and enduring cultural appreciation for stylish dressing.

Additionally, the casual wear dominates daily clothing preferences, driven by comfort, versatility, and lifestyle shifts toward relaxed fashion. It appeals to a broad demographic and is frequently influenced by streetwear and global trends. Italian brands increasingly blend style with sustainability, catering to fashion-conscious consumers seeking both aesthetics and ethical choices.

Moreover, the sportswear sees growing demand in Italy, influenced by active lifestyles and athleisure trends. Consumers favor functionality combined with style, pushing brands to innovate in fabric technology and design. This segment is expanding beyond athletics into everyday wear, blurring lines between performance gear and fashionable casual apparel.

Besides this, the safety wear is essential in industrial, construction, and healthcare sectors, with increasing demand for high-performance, durable, and compliant garments. Italian manufacturers focus on technical innovation and adherence to EU safety standards. Growth is supported by stricter workplace regulations and rising awareness around employee protection and risk reduction.

Furthermore, the "Others" category includes maternity, ethnic, adaptive, and seasonal wear. These niche segments are gaining traction due to inclusivity, cultural diversity, and demographic changes. Consumer interest in specialized apparel reflects broader societal shifts and opens opportunities for innovation in design, comfort, and functionality across non-traditional garment types.

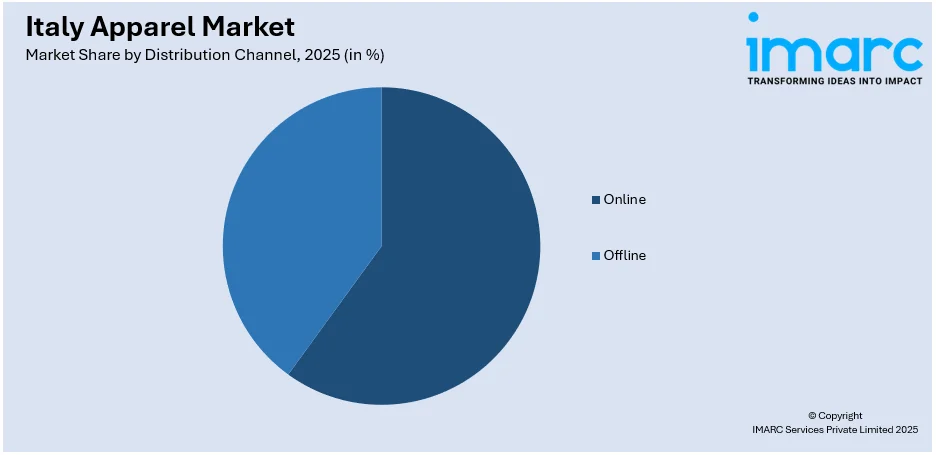

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Online retail is rapidly expanding in Italy, driven by convenience, mobile shopping, and digital-savvy consumers. E-commerce platforms offer a wide variety, competitive pricing, and personalization. Social media and influencer marketing further boost online engagement. Brands increasingly invest in omnichannel strategies to merge digital ease with brand experience.

Along with this, the offline retail remains strong due to Italy’s emphasis on in-store experience, especially for luxury and high-end fashion. Physical stores allow customers to assess quality and fit, maintaining their appeal. Flagship stores, boutiques, and department chains still dominate, though they now often integrate digital tools for a seamless shopping journey.

Analysis by End User:

- Men

- Women

- Kids

The men’s apparel segment in Italy benefits from a strong tradition in tailoring and classic style. Demand is steady across formal, casual, and sportswear categories. Increasing interest in fashion-forward and sustainable clothing, along with growing self-expression among male consumers, is driving diversification and innovation in design and marketing.

Concurrently, the Women’s apparel dominates the market, driven by high fashion engagement, trend responsiveness, and diverse style preferences. From luxury to fast fashion, women are key consumers of seasonal collections. Sustainability, personalization, and digital engagement are increasingly influential, making this segment highly competitive and central to brand strategy and innovation.

Furthermore, the kids’ apparel segment is growing steadily, fueled by parental focus on quality, comfort, and safety. Fashion-conscious parents seek stylish yet functional clothing, often from trusted brands. Seasonal and school-related demand, along with rising interest in organic and sustainable materials, shapes purchasing behaviour in this family-oriented segment.

Regional Analysis:

- Northwest

- Northeast

- Central

- South

- Others

The Northwest, including Milan, is Italy’s fashion and business hub, driving the highest apparel consumption and production. It hosts major fashion houses, trade fairs, and retail innovation. With affluent consumers and international influence, this region sets national trends and leads in luxury, designer wear, and e-commerce development.

Also, the Northeast is a key manufacturing zone, especially for textiles and footwear. Cities like Venice and Verona contribute to both production and retail. The region balances tradition with industrial innovation, supporting both local and export markets. SMEs and craftsmanship are strong, with growing focus on sustainable and high-quality apparel.

Moreover, the Central Italy, including Florence and Rome, blends heritage and modern fashion. Known for artisanal expertise and luxury craftsmanship, it plays a major role in premium apparel production. Tourism boosts retail in historic cities, while local demand is driven by a mix of cultural pride, style consciousness, and quality preferences.

Besides this, the Southern Italy has lower consumption levels but is growing due to rising urbanization and improved retail infrastructure. The region emphasizes affordability and functional fashion. Traditional textile crafts and emerging fashion initiatives are gaining attention, though challenges remain in logistics, investment, and retail access compared to the North and Central.

However, the others Island regions like Sicily and Sardinia have smaller apparel markets, focused on local preferences, tourism, and artisanal fashion. Limited access to large retail chains creates opportunities for niche and e-commerce players. While less industrialized, these areas contribute unique cultural designs and seasonal demand from both locals and tourists.

Competitive Landscape:

The competitive landscape of the Italy apparel market is dynamic and multifaceted, characterized by a blend of traditional craftsmanship and modern innovation. Competition is intense across segments, from luxury to fast fashion, with players vying for consumer attention through quality, design, sustainability, and digital presence. Domestic and international brands coexist, targeting both local demand and global consumers drawn to "Made in Italy" appeal. E-commerce and omnichannel strategies are increasingly crucial, reshaping how brands engage with shoppers. Consumer preferences are shifting toward ethical production, personalization, and experiential retail, prompting companies to adapt quickly. Innovation, agility, and brand authenticity are key differentiators in this competitive, trend-sensitive market.

The report provides a comprehensive analysis of the competitive landscape in the Italy apparel market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Prada acquired Versace for USD 1.375 Billion, bringing the iconic Italian brand back under Italian control after its 2018 sale to Capri Holdings. This move aimed to create a major Italian luxury group, addressing Italy's lack of rivals to French giants like LVMH and Kering. Prada's CEO Andrea Guerra led the shift.

- April 2025: L.B.M. 1911 launched its first women's suit collection after 20 years of success in menswear. Style director Giovanni Bianchi responded to demand from women and retail partners. The collection featured tailored blazers, suits, and trousers in premium fabrics, offering versatile, timeless pieces with contemporary details like decorative buttons and lapel pins.

- August 2024: Bloomingdale's initiated "From Italy, With Love," a two-month celebration of Italian fashion, design, and food. Starting September 5, it included more than 300 products, including collaborations with brands such as Max Mara, Ferragamo, and Valentino. The event also included installations, pop-ups, and tastings, celebrating Italian culture in New York.

- April 2024: Uniqlo opened its second flagship store in Italy on Rome's Via del Corso, covering more than 1,300 square meters over three floors. The store included unique services such as RE.UNIQLO Studio and the UTme! Machine. Inspired by Roman architecture, it marked a significant step in Uniqlo's expansion in Italy.

Italy Apparel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Formal Wear, Casual Wear, Sports Wear, Safety Wear, Others |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy apparel market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Italy apparel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Italy apparel market was valued at USD 70.6 Billion in 2025.

The Italy apparel market is projected to exhibit a CAGR of 4.37% during 2026-2034, reaching a value of USD 104.2 Billion by 2034.

Key factors driving the Italy apparel market include its strong fashion heritage, high demand for luxury goods, increasing focus on sustainability, and digital transformation through e-commerce. Consumer preference for quality, craftsmanship, and ethical production also shapes market dynamics, alongside global recognition of the “Made in Italy” brand appeal.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)