Italy ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2026-2034

Italy ATM Market Summary:

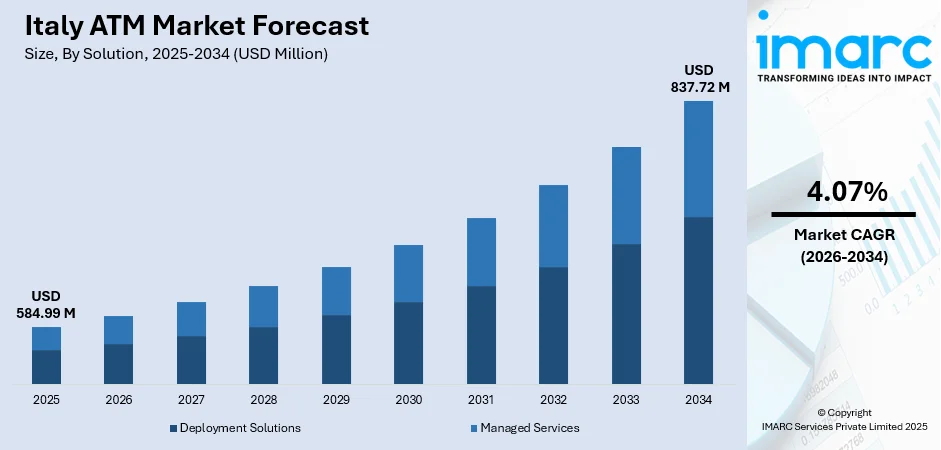

The Italy ATM market size was valued at USD 584.99 Million in 2025 and is projected to reach USD 837.72 Million by 2034, growing at a compound annual growth rate of 4.07% from 2026-2034.

The market is driven by rising demand for convenient cash access among residents and international tourists, particularly in areas where digital payment infrastructure remains limited. Private sector participation and strategic partnerships are accelerating network expansion, while regulatory support fosters modernization across financial services. The integration of ATMs with digital banking platforms enhances functionality, offering consumers hybrid banking experiences that blend physical and digital convenience. These advancements are playing a key role in redefining the Italy ATM market share.

Key Takeaways and Insights:

- By Solution: Deployment solutions dominate the market with a share of 58.06% in 2025, driven by increasing demand for onsite and offsite ATM installations across retail locations, transportation hubs, and tourist destinations, enabling financial institutions to extend cash access networks efficiently throughout Italy.

- By Screen Size: Above 15” leads the market with a share of 70.12% in 2025, owing to consumer preference for enhanced visual interfaces that improve transaction readability, accessibility for elderly users, and support for advanced multimedia banking functions.

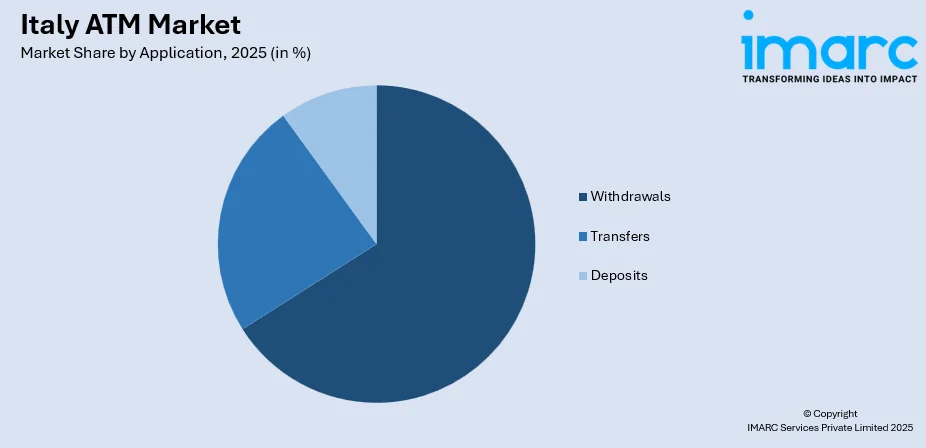

- By Application: Withdrawals represent the largest segment with a market share of 65.09% in 2025, driven by persistent consumer reliance on cash transactions for everyday purchases, particularly in small businesses, local markets, and torism-heavy regions across Italy.

- By ATM Type: Conventional/bank ATMs dominate the market with a share of 50.16% in 2025, owing to established trust in traditional banking infrastructure, widespread branch-affiliated networks, and consumer familiarity with bank-operated machines for secure transactions.

- Key Players: The market exhibits moderate competitive dynamics, with established financial institutions competing alongside independent deployers and international operators. Strategic partnerships between domestic banks and global service providers continue reshaping network coverage and service delivery.

To get more information on this market Request Sample

The Italy ATM market continues to experience sustained growth driven by multiple interconnected factors that reinforce the relevance of automated teller machines within the broader financial services ecosystem. Consumer demand for accessible and convenient cash services remains robust, particularly among populations that prefer physical currency for daily transactions. Italy's vibrant tourism sector generates substantial ATM usage as international visitors require convenient cash access for purchases across retail establishments, hospitality venues, and transportation services. Furthermore, the ongoing transformation of banking infrastructure sees financial institutions investing in ATM network modernization to compensate for reduced branch presence while maintaining customer service accessibility. Private sector participation and strategic collaborations between domestic operators and global service providers accelerate deployment capabilities and technological enhancements across urban and rural locations.

Italy ATM Market Trends:

Integration of Multifunctional Digital Services

Modern ATMs across Italy are evolving beyond traditional cash dispensing to incorporate comprehensive digital financial services that address diverse consumer needs. These enhanced machines now support bill payments, mobile phone top-ups, QR code scanning capabilities, and contactless transaction processing. Financial institutions are upgrading infrastructure to include biometric authentication features, advanced user interfaces, and real-time banking connectivity that streamline customer interactions. As per sources, in September 2025, Mastercard, NCR Atleos, and ITCARD introduced CDCVM-enabled ATMs in Italy, allowing secure, contactless, PIN-less cash withdrawals via mobile devices, enhancing speed, convenience, and digital-first banking experiences. Moreover, this transformation positions ATMs as versatile self-service banking hubs capable of handling multiple transaction types simultaneously. The multifunctionality aligns with consumer expectations for seamless integration between physical and digital banking channels, extending machine relevance within increasingly digitalized financial ecosystems while maintaining essential cash access services.

Expansion of Independent Deployer Networks

The Italian ATM landscape is witnessing significant expansion through independent deployers and fintech-driven operators who bring innovation beyond traditional bank-owned networks. In 2025, Euronet Worldwide launched its Independent ATM Deployer (IAD) network in Italy, placing ATMs at high-traffic, off-bank locations, expanding access, and operating without a sponsor bank. Furthermore, these market entrants focus on strategic placement across high-traffic locations including shopping centers, tourist destinations, transportation terminals, and underserved communities. Independent operators introduce competitive pricing structures and enhanced service offerings that improve consumer accessibility. Strategic partnerships between international ATM operators and local financial institutions enable efficient network scaling while maintaining regulatory compliance. This diversification of ownership models promotes healthy market competition, drives technological advancement, and ensures broader geographic coverage across regions where traditional banking infrastructure may be limited or consolidated.

Enhanced User Experience Through Technological Innovation

Italian ATM operators are prioritizing user experience enhancements through advanced technological implementations that address evolving consumer expectations. Multilingual display interfaces accommodate international tourists and diverse resident populations, improving accessibility across user demographics. Larger screen formats with intuitive navigation designs simplify transaction processes for elderly users and individuals with accessibility requirements. Contactless transaction capabilities reduce physical interaction requirements while accelerating service delivery speeds. In November 2024, Travelex partnered with NCR Atleos to upgrade over 600 ATMs across eight countries, including Italy, adding touchscreens, contactless cash withdrawals, barcode readers, and enhanced self-service features. Moreover, real-time connectivity enables instant account updates and seamless integration with mobile banking applications. These technological refinements position ATMs as modern financial service touchpoints capable of delivering convenient, secure, and efficient banking experiences that complement digital alternatives.

Market Outlook 2026-2034:

The Italy ATM market is projected to experience steady revenue growth throughout the forecast period, driven by sustained consumer demand for cash access services and continued infrastructure modernization initiatives. Financial institutions will maintain strategic investments in network expansion and technological upgrades to compensate for reduced branch presence while enhancing service accessibility. Private sector participation and international operator involvement will accelerate deployment capabilities across urban centers and underserved regions. Integration with digital banking platforms will extend ATM functionality, positioning these machines as versatile financial service hubs within hybrid banking models that balance physical and digital convenience for consumers. The market generated a revenue of USD 584.99 Million in 2025 and is projected to reach a revenue of USD 837.72 Million by 2034, growing at a compound annual growth rate of 4.07% from 2026-2034.

Italy ATM Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Solution | Deployment Solutions | 58.06% |

| Screen Size | Above 15” | 70.12% |

| Application | Withdrawals | 65.09% |

| ATM Type | Conventional/Bank ATMs | 50.16% |

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The deployment solutions dominate with a market share of 58.06% of the total Italy ATM market in 2025.

Deployment solutions encompass the comprehensive installation, configuration, and maintenance of ATM infrastructure across diverse locations throughout Italy. This segment includes onsite ATMs positioned within bank branches, offsite machines located in retail establishments and public spaces, worksite units serving corporate environments, and mobile ATMs deployed for events and temporary requirements. Financial institutions prioritize deployment solutions to extend cash access networks while optimizing operational efficiency and customer convenience.

The dominance of deployment solutions reflects strategic priorities among Italian banks and independent operators to establish extensive ATM coverage across geographic regions. As financial institutions reduce physical branch presence to optimize operational costs, expanded ATM deployment becomes essential for maintaining customer service accessibility. Operators invest substantially in site selection analysis, installation infrastructure, network connectivity establishment, and ongoing maintenance protocols that ensure reliable machine performance across diverse environmental conditions and usage patterns.

Screen Size Insights:

- 15" and Below

- Above 15"

The above 15” leads with a share of 70.12% of the total Italy ATM market in 2025.

Larger screen formats dominate the Italian ATM market as operators prioritize enhanced visual interfaces that improve transaction clarity and user accessibility. Above fifteen-inch displays accommodate comprehensive information presentation, enabling users to navigate complex transaction options efficiently while reducing input errors. These expanded interfaces support multimedia content delivery, promotional messaging, and detailed transaction confirmations that enhance overall customer engagement.

The preference for larger screens reflects demographic considerations within Italy, where aging populations benefit from improved readability and simplified navigation designs. As per sources, in March 2024, UniCredit extended ATM withdrawal functions for blind and visually impaired users to over 4,000 machines nationwide, featuring large yellow-on-black screens and audio guidance for all card types. Moreover, enhanced display capabilities also support advanced functionality including video banking features, biometric authentication interfaces, and interactive service menus that extend machine capabilities beyond basic cash dispensing. Financial institutions recognize that superior screen quality contributes to positive customer experiences, encouraging continued ATM usage despite expanding digital alternatives.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Withdrawals

- Transfers

- Deposits

Withdrawals exhibit a clear dominance with a 65.09% share of the total Italy ATM market in 2025.

Withdrawals represent the primary application driving ATM usage across Italy, reflecting persistent consumer preference for physical currency in daily transactions. According to sources, Unimpresa reported that Italians withdrew €1 billion daily from ATMs in 2023, totaling €360 billion, €10 billion more than 2022 and €18 billion more than 2021. Furthermore, residents and tourists alike rely on convenient withdrawal access for purchases at small businesses, local markets, and establishments where digital payment acceptance remains limited. The withdrawal segment benefits from strategic machine placement across high-traffic locations including commercial centers, transportation hubs, and tourist destinations.

The continued dominance of withdrawal applications underscores the enduring role of cash within Italian commerce despite expanding digital payment options. Many consumers prefer physical currency for budget management, privacy considerations, and transactions with vendors who favor cash payments. Seasonal tourism fluctuations generate substantial withdrawal activity as international visitors access local currency for discretionary spending across hospitality, retail, and entertainment sectors throughout the country.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

The conventional/bank ATMs dominate with a market share of 50.16% of the total Italy ATM market in 2025.

Conventional/bank ATMs maintain leading market position through established consumer trust, extensive branch-affiliated networks, and seamless integration with existing banking relationships. As per sources, in 2024, Poste Italiane’s ATM network will exceed 8,500, adding over 350 new machines to address banking desertification and ensure secure, accessible services across inland areas and small towns. Moreover, conventional machines benefit from brand recognition and perceived security advantages associated with financial institution ownership. These ATMs typically offer comprehensive functionality including deposits, transfers, and account inquiries alongside standard withdrawal services.

These networks leverage existing infrastructure investments and customer relationship frameworks that encourage usage among account holders seeking convenient service access. Financial institutions position conventional ATMs strategically within branch locations, commercial districts, and residential areas to maximize accessibility for existing customers while attracting potential new account holders. The established regulatory compliance frameworks and security protocols associated with bank-operated machines reinforce consumer confidence in transaction safety and service reliability.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The Northwest region represents a significant contributor to Italy's ATM market, anchored by economic powerhouses including Milan and Turin that generate substantial financial services activity. Dense commercial development, international business presence, and robust tourism flows create consistent demand for cash access infrastructure across metropolitan areas. Major transportation hubs serving domestic and international travelers require extensive ATM networks accommodating high transaction volumes and multilingual service requirements.

The Northeast region demonstrates strong ATM market participation driven by prosperous industrial corridors, tourist destinations including Venice and the Dolomites, and well-developed commercial infrastructure. Manufacturing districts generate consistent business activity supporting ATM deployment across commercial zones. Tourism-intensive cities experience seasonal demand fluctuations requiring network capacity flexibility while smaller municipalities maintain steady usage patterns supporting regional network viability.

Central Italy encompasses Rome and surrounding regions representing critical ATM market territory due to governmental functions, international tourism volumes, and substantial residential populations. The capital city's role as a global tourism destination generates extraordinary cash access demand across historical districts, hospitality zones, and transportation terminals. Regional commercial centers and university cities contribute additional usage patterns supporting comprehensive network deployment.

Southern Italy presents growth opportunities for ATM market expansion as financial inclusion initiatives target underserved communities and developing commercial regions. Tourism destinations along coastal areas and cultural heritage sites generate seasonal demand requiring strategic machine placement. Economic development programs supporting regional growth create expanding commercial activity that reinforces ATM infrastructure investment rationales across municipalities previously lacking adequate coverage.

Other Italian territories including island regions contribute to overall market dynamics through tourism-driven demand and local commercial requirements. Geographic isolation may limit traditional banking presence, enhancing ATM importance for resident populations and seasonal visitors. Smaller market scale requires careful deployment planning balancing accessibility objectives with operational viability considerations across dispersed communities.

Market Dynamics:

Growth Drivers:

Why is the Italy ATM Market Growing?

Tourism Sector Driving Sustained Cash Demand

Italy's position as a premier global tourism destination generates substantial and consistent demand for ATM services throughout the country. As per sources, in 2024, Italy recorded 458,4 million tourist presences, a +2,5 percent increase from 2023, with foreign visitors exceeding 250 Million, ranking the country second in the EU behind Spain. Furthermore, international visitors require convenient access to local currency for purchases across diverse establishments including restaurants, boutiques, transportation services, and cultural attractions. Tourist-heavy regions experience elevated ATM usage as visitors prefer cash transactions for small purchases, tipping customs, and payments at venues with limited digital acceptance. ATM operators strategically position machines near airports, train stations, historical sites, and hospitality districts to capture tourism-driven demand. Seasonal visitor fluctuations create predictable usage patterns that operators accommodate through enhanced network capacity and multilingual interface capabilities. The tourism sector's economic significance ensures continued investment in accessible cash infrastructure.

Financial Inclusion and Rural Access Expansion

The Italian ATM market benefits from ongoing initiatives to extend financial services access across underserved communities and rural regions. As traditional bank branches consolidate operations toward urban centers, ATMs provide essential cash access for populations distant from physical banking locations. In 2024, Poste Italiane’s “Polis Project” involved nearly 7,000 Post Offices, installing 7,000 evolved ATMs to enhance digital access, financial inclusion, and public service delivery nationwide. Independent deployers and financial institutions collaborate to establish machine networks serving smaller municipalities and agricultural communities where digital banking adoption may lag. Elderly populations and individuals preferring physical currency transactions rely upon accessible ATM infrastructure for routine financial activities. Government support for financial inclusion objectives encourages network expansion beyond commercially optimal locations, ensuring equitable service distribution across diverse geographic and demographic segments throughout the country.

Digital Banking Integration Enhancing Functionality

Modern ATM infrastructure increasingly integrates with broader digital banking ecosystems, extending machine relevance beyond traditional cash dispensing functions. Italian financial institutions invest in technological upgrades enabling ATMs to support bill payments, mobile account top-ups, QR code transactions, and contactless operations that align with evolving consumer expectations. This multifunctionality transforms ATMs into comprehensive self-service banking hubs capable of accommodating diverse transaction requirements. Integration with mobile banking applications enables seamless service experiences across physical and digital channels. Real-time connectivity supports instant transaction processing and account updates that enhance customer convenience. These technological enhancements position ATMs as complementary infrastructure within hybrid banking models rather than legacy systems facing obsolescence.

Market Restraints:

What Challenges the Italy ATM Market is Facing?

Digital Payment Adoption Reducing Cash Reliance

The accelerating adoption of digital payment solutions across Italy presents competitive pressure for ATM services as consumers increasingly embrace cashless transaction alternatives. Mobile payment applications, contactless cards, and digital wallets offer convenience advantages that reduce cash withdrawal frequency among tech-savvy demographics. Younger generations particularly demonstrate preference for digital payment methods, suggesting potential long-term shifts in cash usage patterns. Merchant acceptance of electronic payments continues expanding, diminishing scenarios where cash represents the only viable transaction option.

Infrastructure Maintenance and Operational Costs

ATM operators face substantial ongoing expenses associated with machine maintenance, security requirements, cash replenishment logistics, and technological upgrades necessary for competitive service delivery. Network expansion requires significant capital investment in equipment procurement, installation infrastructure, and connectivity establishment. Security vulnerabilities including fraud attempts and physical attacks necessitate continuous monitoring and protective measure investments. Regulatory compliance requirements add operational complexity and associated costs that impact profitability calculations for potential deployment locations.

Branch Consolidation Affecting Strategic Positioning

Banking sector rationalization involving branch closures and operational consolidation creates uncertainty regarding optimal ATM placement strategies and network configurations. Reduced physical banking presence in certain regions may diminish foot traffic near existing machine locations. Financial institutions must balance cost optimization objectives with service accessibility commitments when evaluating network adjustments. Independent deployers navigating partnership arrangements with consolidating banks face potential relationship disruptions affecting deployment agreements and service continuity.

Competitive Landscape:

The Italy ATM market demonstrates moderate competitive intensity characterized by diverse participant categories including established financial institutions, independent deployers, and international operators pursuing market expansion. Traditional banks maintain significant network presence through branch-affiliated machines while seeking operational efficiencies through managed service arrangements and technology partnerships. Independent deployers contribute competitive dynamism by focusing on strategic placement across high-traffic commercial locations and tourist destinations underserved by conventional banking networks. International operators bring technological innovation and operational expertise while navigating regulatory requirements and partnership frameworks necessary for market entry. Competition drives continuous improvement in service quality, technological capabilities, and geographic coverage as participants seek differentiation through enhanced functionality and customer experience optimization. Strategic collaborations between domestic institutions and global service providers accelerate modernization initiatives.

Recent Developments:

- In February 2025, NCR Atleos has expanded its Cashzone ATM network into Italy, marking the company’s thirteenth country of operation. The rollout provides residents and tourists with convenient cash access at key retail locations, boosts merchant foot traffic, and allows banks to serve customers efficiently without new branch investments.

Italy ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Italy ATM market size was valued at USD 584.99 Million in 2025.

The Italy ATM market is expected to grow at a compound annual growth rate of 4.07% from 2026-2034 to reach USD 837.72 Million by 2034.

Deployment solutions held the largest market share in the Italy ATM market, driven by financial institution investments in expanding network coverage across urban centers, tourist destinations, and underserved regions while compensating for reduced physical branch presence.

Key factors driving the Italy ATM market include strong tourism sector demand for cash access, financial inclusion initiatives extending coverage to underserved communities, digital banking integration enhancing machine functionality, and private sector partnerships accelerating network modernization.

Major challenges include accelerating digital payment adoption reducing cash transaction frequency, substantial infrastructure maintenance and operational costs, branch consolidation affecting strategic positioning, security vulnerability management requirements, and evolving regulatory compliance demands.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)