Italy Craft Beer Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2025-2033

Italy Craft Beer Market Overview:

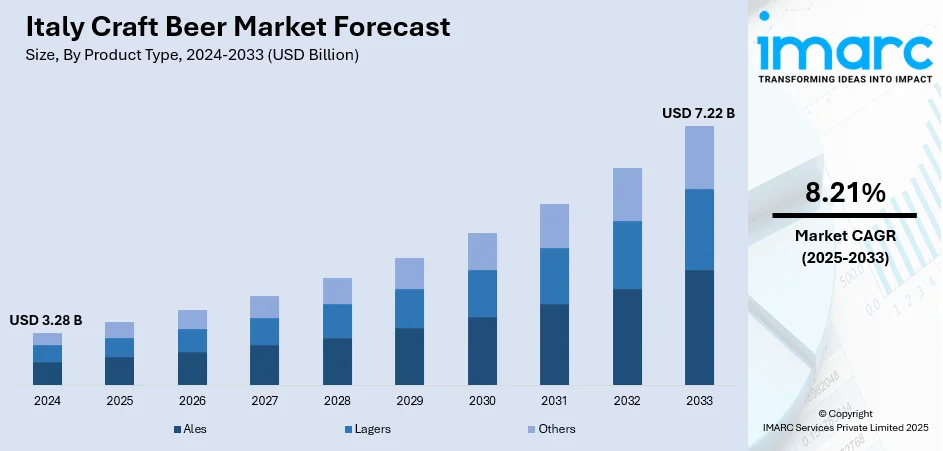

The Italy craft beer market size reached USD 3.28 Billion in 2024. Looking forward, the market is expected to reach USD 7.22 Billion by 2033, exhibiting a growth rate (CAGR) of 8.21% during 2025-2033. The market is vibrant and diverse, driven by a growing network of independent breweries, consumer interest in artisanal flavors, and a strong on-premise culture centered around craft consumption. Despite dominance by large brewers, unique local styles and tourism enhance visibility and growth, reinforcing the expanding Italy craft beer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.28 Billion |

| Market Forecast in 2033 | USD 7.22 Billion |

| Market Growth Rate 2025-2033 | 8.21% |

Italy Craft Beer Market Trends:

Emphasis on Local Sourcing and Regional Identity

A defining strength of the Italian craft beer market is its deep connection to local identity and regional pride. Several microbreweries are emphasizing traditional ingredients, such as the Tuscan chestnuts and the Sicilian citro, and even the Piedmontese honey, which feature focused reminiscences of the geographical beginnings. This also helps to sustain local farming in terms of sustainability and has a historical appeal to consumers who want to experience an authentic place. Local milk attracts emotional connections and promotes brand loyalty, where consumers are becoming more interested in provenance and craft. The stories associated with heritage, family recipes, or terroir are frequently injected into the breweries, which makes every product exclusive. Consequently, storytelling about a region, as well as sourcing products locally, has been used as a major differentiator in a competitive market positioning and makes the Italian craft beer something bigger than its drinkable form, something more of an Italian cultural benchmark and as a reflector of a diverse landscape.

To get more information on this market, Request Sample

Rising Demand for Distinctive Flavors and Premium Quality

Italian consumers are increasingly drawn to the rich, diverse flavor profiles offered by craft beers, fueling the Italy craft beer market growth. Unlike mass-produced lagers, craft brews emphasize taste complexity, aroma, texture, and authenticity. Breweries experiment with fermentation techniques, unique hops, and specialty malts to develop signature styles that appeal to discerning drinkers. This shift reflects growing consumer interest in quality over quantity, with many seeking beverages that align with artisanal values and slower consumption. As taste sophistication rises, so does the demand for IPAs, stouts, and seasonal styles that offer something beyond the ordinary. The association of craft beer with innovation and superior craftsmanship positions it as a premium alternative, helping brands attract loyal followers and enabling them to command higher pricing within an evolving beverage landscape.

Expansion of Microbreweries and Experiential Craft Culture

The rapid rise of microbreweries across Italy has created a dynamic and diverse craft beer landscape. These small-scale producers are not only innovating with bold flavors and brewing methods but also enhancing community engagement through taprooms, brewery tours, and events. Experiential spaces, such as craft pubs and beer festivals, offer consumers an immersive way to explore new brews and connect with local makers. These environments foster brand discovery and social connection, turning beer consumption into a cultural and lifestyle experience. Cities like Rome, Milan, and Bologna are seeing a surge in craft-focused venues, further boosting public interest. This hands-on, grassroots approach helps craft brewers stand out in a market long dominated by large commercial players, driving continued momentum and visibility.

Italy Craft Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and distribution channel.

Product Type Insights:

- Ales

- Lagers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ales, lagers, and others.

Age Group Insights:

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 21–35 years old, 40–54 years old, and 55 years and above.

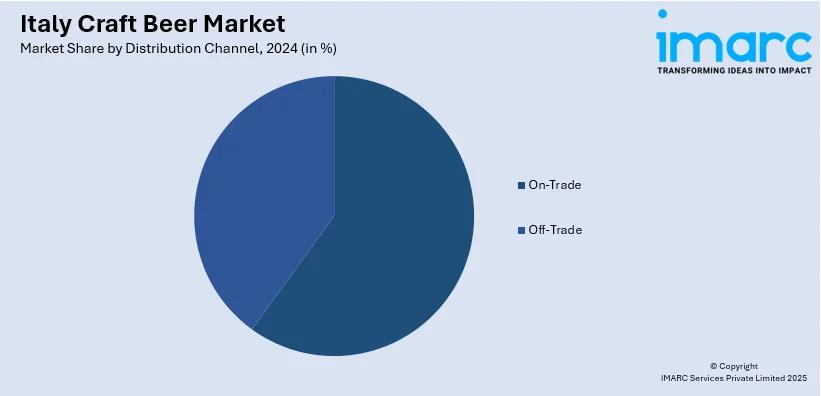

Distribution Channel Insights:

- On-Trade

- Off-Trade

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes on-trade and off-trade.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Craft Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21–35 Years Old, 40–54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy craft beer market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy craft beer market on the basis of product type?

- What is the breakup of the Italy craft beer market on the basis of age group?

- What is the breakup of the Italy craft beer market on the basis of distribution channel?

- What is the breakup of the Italy craft beer market on the basis of region?

- What are the various stages in the value chain of the Italy craft beer market?

- What are the key driving factors and challenges in the Italy craft beer market?

- What is the structure of the Italy craft beer market and who are the key players?

- What is the degree of competition in the Italy craft beer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy craft beer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy craft beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy craft beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)