Italy Footwear Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End User, and Region, 2026-2034

Italy Footwear Market Summary:

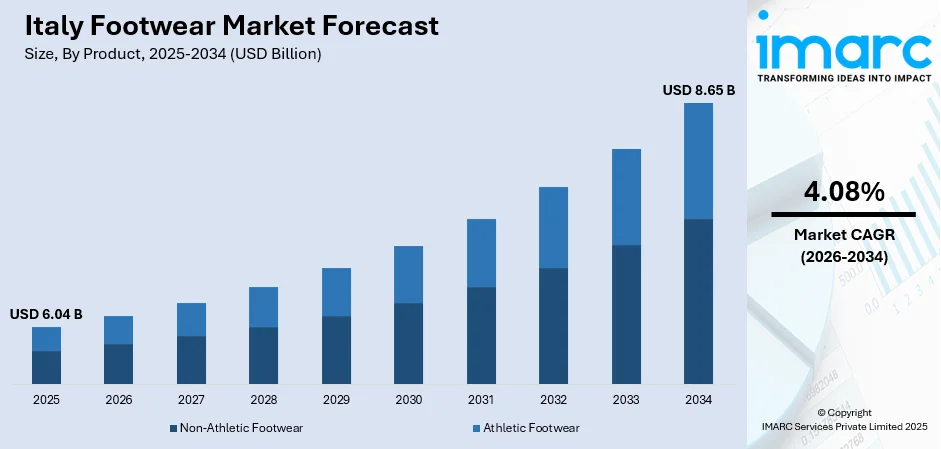

The Italy footwear market size was valued at USD 6.04 Billion in 2025 and is projected to reach USD 8.65 Billion by 2034, growing at a compound annual growth rate of 4.08% from 2026-2034.

Italy's rich heritage in footwear craftsmanship, particularly in regions such as Marche and Tuscany, sustains consistent demand for high-quality, handcrafted shoes. The country's prominent fashion industry, led by luxury brands including Gucci, Prada, and Salvatore Ferragamo, continues to set global trends. Rising consumer preference for premium leather footwear and increasing focus on sustainable production practices further enhances the Italy footwear market share.

Key Takeaways and Insights:

- By Product: Non-athletic footwear leads the market with 67.64% share in 2025, driven by Italy's specialization in luxury dress shoes, loafers, and formal footwear.

- By Material: Leather holds 45% market share in 2025, reflecting Italy's world-renowned leather tanning heritage concentrated in Tuscany.

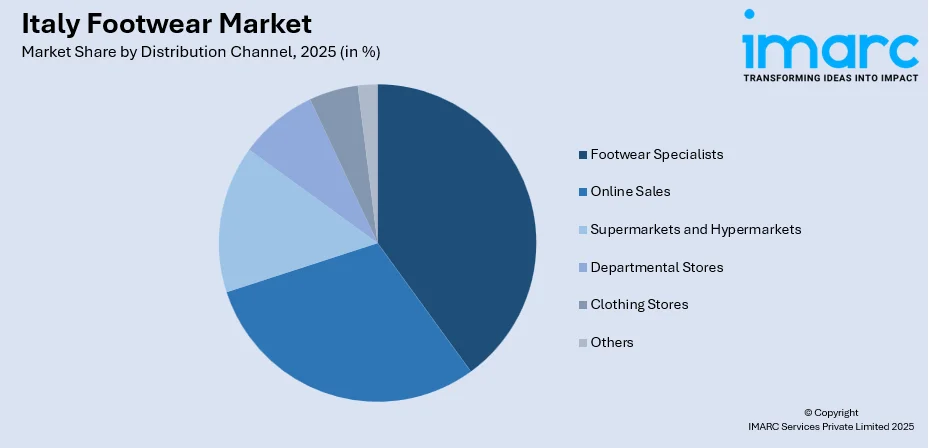

- By Distribution Channel: Footwear specialists account for 38% share in 2025, as Italian consumers prefer specialized boutiques offering expert fitting and curated selections.

- By Pricing: Premium segment dominates with 54% share in 2025, underlining Italy's position as a global leader in luxury footwear manufacturing.

- By End User: Women represent 54.36% of the market in 2025, with strong demand for high-heeled shoes, elegant sandals, and fashion-forward designs.

- Key Players: The Italian footwear market features a mix of globally recognized luxury brands and family-owned artisanal manufacturers, particularly in traditional crafting hubs. These players emphasize high-quality materials, meticulous craftsmanship, and innovative designs, sustaining Italy’s reputation as a leader in premium footwear.

To get more information on this market Request Sample

Italy remains the leading footwear producer in the European Union, supported by a well-established industry of thousands of companies and a skilled workforce. The Assocalzaturifici, the national footwear manufacturers’ association of Italy, recently reported that in the first five months of 2025, Italian footwear exports rose by 3.2 % in volume. The Marche region stands out as a key hub, hosting numerous manufacturers renowned for high-quality craftsmanship and specialized production. Globally, Italy ranks among the top footwear exporters, with a strong reputation for premium products. The country continues to dominate the luxury and high-fashion footwear segment, blending traditional artisanal techniques with modern design and innovation, reinforcing its position as a global benchmark in style, quality, and prestige.

Italy Footwear Market Trends:

Embracing Sustainability in Footwear Production

Italy’s footwear sector is increasingly adopting sustainable practices, integrating eco-friendly energy sources and environmentally conscious manufacturing methods. For example, the ECO‑FOOTWEAR 5.0 project, launched in mid‑2024, involves companies from the Marche region to develop circular‑economy tools, eco‑design software, and new biodegradable materials, aiming to reduce waste and environmental impact while preserving artisanal craftsmanship. Companies are also investing in initiatives that preserve traditional craftsmanship while exploring innovative, sustainable materials. Collaborative projects with international partners further support the development of eco-conscious footwear solutions. This shift not only strengthens the industry’s reputation but also aligns with growing consumer demand for ethical and environmentally responsible products.

Digital Transformation and Personalized Consumer Experiences

Italian footwear brands are embracing digital transformation to offer personalized consumer experiences. For instance, Salvatore Ferragamo, in collaboration with Microsoft and tech partner Hevolus, launched its “Tramezza Made‑to‑Order” service, enabling customers to visualise a digital twin of the shoe in 3‑D, customize materials, colors, finishes, and even soles, and preview their custom design in augmented reality. Advanced technologies allow customers to customize designs according to individual tastes, creating a unique shopping journey. Brands are also exploring AI, augmented reality, and virtual reality to deliver immersive experiences that go beyond traditional online catalogs. This integration of digital tools enhances engagement, strengthens brand loyalty, and positions the industry at the forefront of innovative, tech-driven retail experiences.

Revival of Artisanal Craftsmanship and Local Production

There is a renewed focus on artisanal craftsmanship and locally produced footwear in Italy. Entrepreneurs and consumers increasingly value quality, heritage, and authenticity, driving demand for shoes made with traditional techniques. A significant recent development is that, starting 1 December 2025, the Protected Geographical Indication (PGI) scheme, hitherto used mainly for food, will be extended to non-food products, including footwear. Historic shoemaking regions are experiencing growth as they combine time-honored methods with contemporary designs. Initiatives that certify genuine Italian production further reinforce market trust, highlighting the importance of heritage, skill, and cultural authenticity in modern footwear.

Market Outlook 2026-2034:

The Italy footwear market is set to grow, driven by rising demand for premium and luxury products. The industry is embracing sustainable manufacturing practices and digital innovations across distribution channels, enhancing consumer engagement and personalization. Italian manufacturing districts continue to lead globally in high-quality footwear while adapting to evolving preferences for ethical production and customized designs. This combination of tradition, innovation, and sustainability reinforces Italy’s position as a benchmark for craftsmanship, style, and responsible manufacturing in the global footwear market. The market generated a revenue of USD 6.04 Billion in 2025 and is projected to reach a revenue of USD 8.65 Billion by 2034, growing at a compound annual growth rate of 4.08% from 2026-2034.

Italy Footwear Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Non-Athletic Footwear | 67.64% |

| Material | Leather | 45% |

| Distribution Channel | Footwear Specialists | 38% |

| Pricing | Premium | 54% |

| End User | Women | 54.36% |

Product Insights:

- Non-Athletic Footwear

- Athletic Footwear

The non-athletic footwear dominates with a market share of 67.64% of the total Italy footwear market in 2025.

Italy’s non-athletic footwear segment thrives on a long-standing tradition of craftsmanship, focusing on luxury dress shoes, elegant loafers, and refined formal footwear. Artisans across regions like Marche and Tuscany blend classic techniques with modern design, creating pieces that combine durability, style, and sophistication, appealing to discerning domestic and international consumers. Such craftsmanship is embodied by brands like Pakerson, based in Tuscany, which produces hand‑dyed, hand‑sewn shoes through a meticulous process involving about 200 separate stages.

The market benefits from Italy’s dedication to quality materials, particularly premium leathers, and meticulous attention to detail. Italian shoemakers emphasize comfort, fit, and aesthetic appeal, ensuring each pair reflects heritage and innovation. Boutique stores and specialized retailers further enhance the customer experience, reinforcing Italy’s global reputation as a leader in premium non-athletic footwear.

Material Insights:

- Rubber

- Leather

- Plastic

- Fabric

- Others

The leather leads with a share of 45% of the total Italy footwear market in 2025.

Italy’s footwear industry is strongly supported by its renowned leather tanning traditions, particularly in Tuscany. Skilled artisans transform high-quality hides into supple, durable leathers, ensuring exceptional texture and finish. This heritage of craftsmanship underpins the production of premium shoes, combining timeless elegance with lasting quality, and sustaining Italy’s global reputation. For example, Prada Group acquired a 43.65% stake in the Tuscan tannery Superior (located in Santa Croce sull’Arno), a move that reflects growing industry focus on vertical integration, traceability, and maintaining strict control over leather sourcing and finishing.

The focus on leather allows Italian shoemakers to create versatile designs that balance style and functionality. Attention to detail in tanning, dyeing, and finishing processes ensures each product meets exacting standards. This commitment to excellence reinforces consumer trust and positions Italy as a leader in luxury footwear, where quality materials remain central to the brand’s identity.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Footwear Specialists

- Online Sales

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Others

The footwear specialists dominate with a market share of 38% of the total Italy footwear market in 2025.

Italian consumers show a strong preference for specialized footwear boutiques that offer personalized service and expert fitting. These stores provide curated selections of premium shoes, ensuring a tailored shopping experience that emphasizes quality, style, and comfort. The focus on individualized attention enhances customer satisfaction and loyalty.

Boutiques also serve as hubs for craftsmanship and heritage, showcasing Italy’s finest footwear designs. By combining knowledgeable staff with carefully selected collections, these specialists create an immersive shopping environment. This approach reinforces the value of expert guidance in purchasing decisions and strengthens the connection between consumers and Italy’s luxury footwear tradition.

Pricing Insights:

- Premium

- Mass

The premium leads with a share of 54% of the total Italy footwear market in 2025.

Italy’s footwear market is strongly defined by its premium segment, which emphasizes luxury, craftsmanship, and exclusivity. Italian shoemakers focus on high-quality materials, meticulous detailing, and innovative designs, ensuring that each product reflects sophistication and enduring style. For example, the acquisition of Versace by Prada highlights how top Italian houses are doubling down on luxury heritage and status, a move that reinforces the industry’s emphasis on craftsmanship, exclusivity, and global prestige.

Consumers are drawn to the prestige and heritage associated with premium Italian footwear. The segment thrives on personalized experiences, limited editions, and artisanal techniques, appealing to those seeking both elegance and status. This focus on luxury reinforces Italy’s position as a leader in designing, producing, and consuming high-end footwear worldwide.

End User Insights:

- Men

- Women

- Kids

The women dominate with a market share of 54.36% of the total Italy footwear market in 2025.

Women play a central role in Italy’s footwear market, with strong demand for high-heeled shoes, elegant sandals, and stylish seasonal collections. Italian brands cater to evolving tastes, blending contemporary fashion trends with classic craftsmanship to create footwear that combines elegance, comfort, and sophistication for discerning female consumers.

The female segment drives innovation in design and material use, encouraging brands to experiment with textures, colors, and embellishments. Seasonal collections are curated to reflect both global fashion trends and Italy’s rich heritage in shoemaking, ensuring that women have access to footwear that is both fashionable and enduringly stylish.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The Northwest of Italy, including Lombardy and Piedmont, serves as a key hub for luxury footwear design and retail. Milan, the nation’s fashion capital, hosts flagship stores, boutiques, and designer studios. The region emphasizes high-end, trend-driven collections, catering to both domestic and international premium consumers seeking style and innovation.

The Northeast, especially Veneto and Friuli-Venezia Giulia, is renowned for its artisanal craftsmanship and precision manufacturing. Towns along the Riviera del Brenta are globally recognized for luxury women’s shoes. The region balances traditional handcrafting techniques with modern production methods, sustaining Italy’s reputation for elegance, durability, and high-quality footwear.

Central Italy, including Tuscany, Marche, and Umbria, combines leather expertise with creative design. The area is famous for tanneries producing high-quality leather used in shoes across Italy. Footwear brands leverage this heritage to craft premium dress shoes, boots, and elegant casual styles, blending artisanal skill with contemporary aesthetics for discerning consumers.

Southern Italy focuses on vibrant, innovative, and fashion-forward footwear. Regions like Campania and Apulia combine local craftsmanship with bold designs, producing stylish and comfortable shoes that reflect cultural flair. Small workshops drive niche, high-quality production, contributing to regional identity while supporting both domestic markets and selective international distribution.

Other Italian regions contribute through specialized, small-scale footwear production and supporting industries. These areas focus on niche markets, bespoke designs, and complementary products such as leather goods or footwear components. Their work strengthens Italy’s overall footwear ecosystem, emphasizing craftsmanship, heritage techniques, and regional diversity that enrich the national market.

Market Dynamics:

Growth Drivers:

Why is the Italy Footwear Market Growing?

Heritage Craftsmanship and Manufacturing Excellence

Italy’s footwear sector is defined by centuries of heritage craftsmanship and exceptional manufacturing expertise concentrated in specialized districts. These regions have evolved into comprehensive ecosystems where raw materials, leather tanneries, component suppliers, machinery producers, and skilled artisans collaborate seamlessly. For example, the Riviera del Brenta footwear district (in Veneto) was formally highlighted by a conference emphasising “tradition + innovation”: dozens of small and mid‑sized luxury shoemaking firms there are investing in digitalisation, advanced training, and Industry 4.0 processes to modernize production while preserving artisanal know‑how. This territorial concentration allows for efficient production, rapid innovation, and meticulous quality control. Artisans combine traditional techniques with modern technologies to create footwear that reflects both style and durability. The strong network of designers, workshops, and suppliers ensures consistency in high-quality output. Italy’s structured manufacturing landscape continues to underpin its global reputation for excellence in luxury and premium footwear.

Premium Brand Positioning and Luxury Demand

Italian footwear is synonymous with luxury, style, and prestige, supported by globally recognized brands renowned for design excellence. Consumers value craftsmanship, brand heritage, and attention to detail, seeking products that combine timeless aesthetics with modern trends. Areas such as Riviera del Brenta exemplify this model, with the district comprising over 507 companies producing around 20 million pairs annually and generating an estimated annual turnover of about €2 billion. The Riviera del Brenta and other manufacturing hubs focus on producing high-end footwear for designer labels, reinforcing Italy’s status as a leader in luxury shoes. Italian brands emphasize creativity, exclusivity, and superior material quality, catering to discerning clientele worldwide. Strong brand identity and reputation for elegance drive sustained demand, positioning Italian footwear as an aspirational choice for premium consumers seeking style, comfort, and distinction.

Fashion Industry Integration and Trend Leadership

The Italian footwear industry is deeply integrated within the nation’s broader fashion ecosystem, benefiting from close coordination with apparel, accessories, and design sectors. Major fashion houses align footwear collections with seasonal apparel lines, ensuring coherence in trends and brand messaging. According to reports, MICAM Milano, Italy’s leading international footwear trade fair, which in its 2025 edition showcased collections and functioned as a hub where footwear trends were presented alongside leather‑goods, accessories, and global fashion buyers, formally linking shoe design to the broader fashion and lifestyle market. Iconic fashion events showcase new designs, influencing international style directions and consumer preferences. Artisanal heritage is blended with contemporary aesthetics, creating products that appeal to global audiences while maintaining traditional craftsmanship. Personalized retail experiences, brand storytelling, and innovative design approaches strengthen customer engagement, allowing Italian footwear to remain a trendsetter in the global fashion market while preserving its reputation for quality and style.

Market Restraints:

What Challenges the Italy Footwear Market is Facing?

Elevated Production Costs and Labor Expenses

Italian footwear manufacturers face significantly higher labor costs compared to Asian and Eastern European competitors. Skilled artisanal labor required for premium production commands substantial wages, increasing manufacturing expenses. Rising energy costs and premium raw material prices further compress margins, challenging competitiveness in price-sensitive market segments.

Competition from Lower-Cost International Producers

Italian manufacturers compete with lower-priced imports from China, Vietnam, and other Asian producers leveraging labor cost advantages. Some Italian districts, including Barletta in Puglia, have shifted toward standardized products to compete on price, potentially diluting premium positioning. Maintaining quality differentiation while addressing price-conscious consumer segments presents ongoing strategic challenges.

Shifting Consumer Preferences and Casualization Trends

Growing consumer preference for casual and athletic footwear challenges Italy's traditional strength in formal and dress shoes. The athleisure trend elevates functional sportswear to fashion statements, redirecting demand toward sneakers and comfort-oriented styles. Italian manufacturers must adapt product portfolios while preserving heritage craftsmanship appeal.

Competitive Landscape:

Italy’s footwear market is characterized by a diverse competitive landscape that blends high-end luxury offerings with a vast network of family-run artisanal workshops. Premium segments are driven by brands recognized for craftsmanship, design excellence, and global appeal, commanding strong consumer loyalty. Mid-market players focus on innovation, comfort, and functional design to meet evolving customer preferences. The industry’s backbone consists of numerous small and medium enterprises concentrated in specialized manufacturing districts, where skilled artisans produce both private-label footwear for international clients and their own proprietary collections. This structure fosters creativity, quality, and flexibility, allowing Italian footwear to balance tradition with modern trends, maintain its global reputation, and cater to a wide spectrum of consumer tastes and expectations.

Recent Developments:

- In February 2025: Ermenegildo Zegna Group is set to open a 12,500 m² high-end footwear and leather-goods facility in Sala Baganza, Parma, designed for sustainable production, R&D, and artisan training, employing 300+ by 2027. The move aligns with Italy’s luxury footwear modernization trend. Meanwhile, Assocalzaturifici celebrates 80 years and MICAM marks its 100th edition, focusing on digitalization and talent development.

Italy Footwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non-Athletic Footwear, Athletic Footwear |

| Materials Covered | Rubber, Leather, Plastic, Fabric, Others |

| Distribution Channels Covered | Footwear Specialists, Online Sales, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Others |

| Pricings Covered | Premium, Mass |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Italy footwear market size was valued at USD 6.04 Billion in 2025.

The Italy footwear market is expected to grow at a compound annual growth rate of 4.08% from 2026-2034 to reach USD 8.65 Billion by 2034.

Non-athletic footwear dominates with 67.64% market share, reflecting Italy's specialization in luxury dress shoes, loafers, pumps, and formal footwear categories.

Key factors driving the Italy footwear market include heritage craftsmanship excellence concentrated in manufacturing districts, strong premium and luxury brand positioning, fashion industry integration, and growing sustainable production practices.

Italian footwear makers face high labor and material costs, competition from low-cost imports, and shifting consumer demand toward casual, athletic styles, requiring adaptation while maintaining premium craftsmanship and brand heritage.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)