Italy Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Region, 2025-2033

Italy Gaming Market Overview:

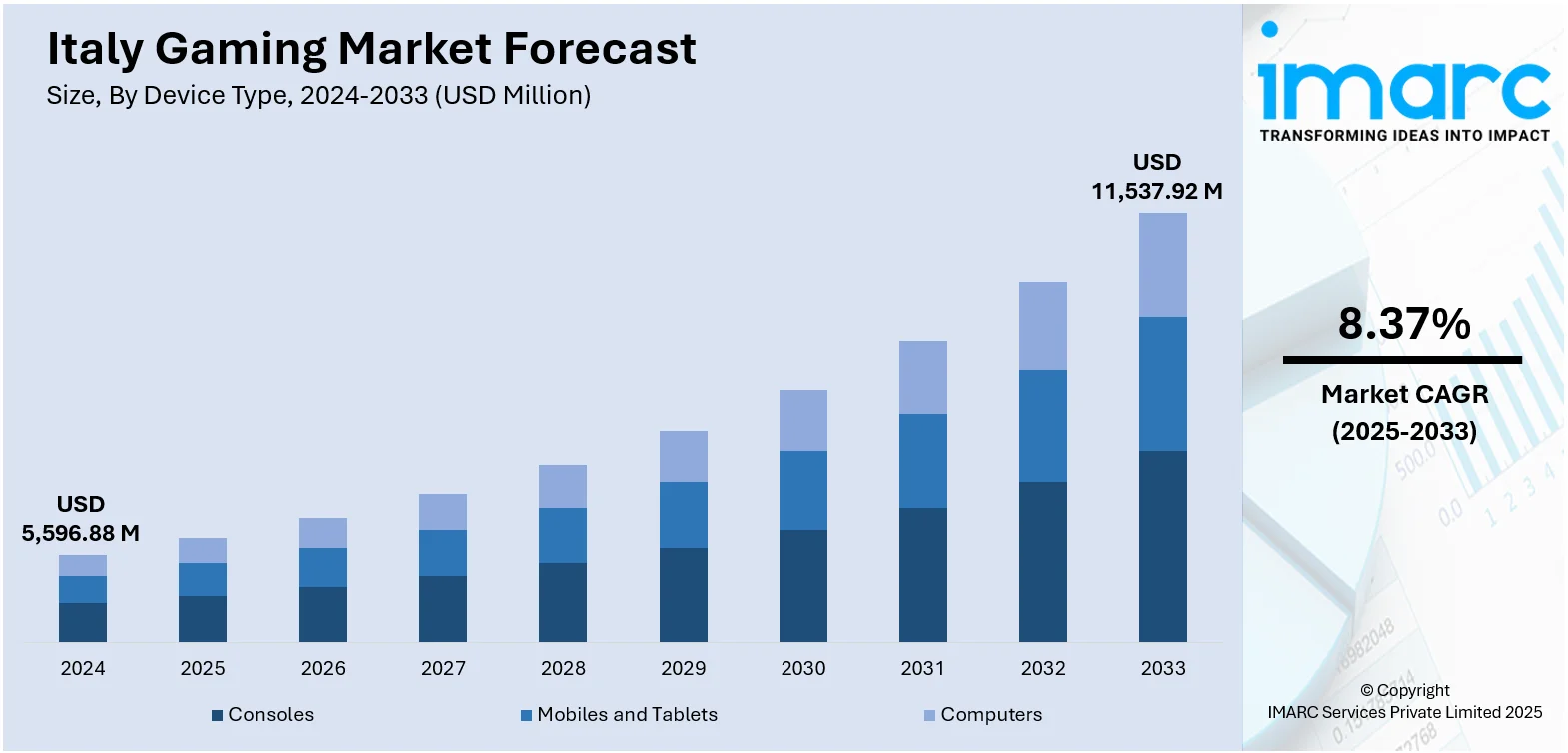

The Italy gaming market size reached USD 5,596.88 Million in 2024. Looking forward, the market is projected to reach USD 11,537.92 Million by 2033, exhibiting a growth rate (CAGR) of 8.37 % during 2025-2033. The market is driven by institutional funding and cultural policies promoting game development rooted in Italian identity and artistic heritage. Mobile gaming’s wide adoption and monetization potential reflect evolving consumer behavior across age groups. Additionally, the formalization of esports infrastructure and digital youth engagement are further augmenting the Italy gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,596.88 Million |

| Market Forecast in 2033 | USD 11,537.92 Million |

| Market Growth Rate 2025-2033 | 8.37% |

Italy Gaming Market Trends:

Cultural Investment and Government Support for Game Development

Italy’s gaming sector has gained recognition as a vital component of its creative industries, supported by increasing cultural and institutional investment. The Ministry of Culture launched a national video game fund to finance original game projects, particularly those reflecting Italian heritage, language, and storytelling. This initiative enables local studios to produce culturally rich, globally marketable content while reducing reliance on foreign funding. Organizations such as IIDEA (Italian Interactive Digital Entertainment Association) advocate for industry development, regulatory support, and international outreach. Moreover, government-funded events, such as First Playable, connect domestic developers with global publishers and investors. Italy’s games market is set to generate USD 6.40 Billion in 2025, with 22.7 million users projected by 2030 and an ARPU of USD 2,230, driven by multiplayer demand and cultural game narratives. With a CAGR of 6.34% through 2030, rising user penetration and digital innovation policies are accelerating Italy’s position in the global gaming landscape. Universities in Milan, Rome, and Turin are now offering specialized programs in game development, animation, and digital storytelling, fostering technical expertise and creative talent. Italy’s strength in visual arts and narrative traditions provides a natural foundation for game development rooted in cultural depth and aesthetic quality. By aligning gaming with national identity and creative industries, Italy has positioned itself to develop a distinct and competitive offering in the global market, directly driving Italy gaming market growth and reinforcing its relevance as both a cultural and commercial force in digital entertainment.

To get more information on this market, Request Sample

Steady Growth of Mobile and Casual Gaming Engagement

Italy has seen consistent growth in mobile and casual gaming, propelled by high smartphone penetration and widespread digital media consumption. Consumers across all age groups increasingly turn to mobile games for daily entertainment, favoring formats that offer brief, engaging gameplay experiences. In 2024, Italy’s gaming market reached 10.4M mobile users (+12.8%), 6.2M console users (+11.5%), and 4.8M PC users (+5%), with mobile leading at 74.1% share. The industry grew to ~2,800 developers (up from ~2,400 in 2022), turnover rose to €180–200M (+36%), 43% of employees are women, 80% are under 36, 56% plan hiring by 2026, 40% use generative AI, and 80+ games are in development, including 62 new IPs. Casual puzzle games, card games, and freemium RPGs have proven particularly popular among Italian players. Telecommunication providers are facilitating access through gaming-centric data packages and mobile app bundles. Local developers have adapted well to this shift, producing mobile-first content and integrating seamless monetization strategies through in-app purchases and ad-based rewards. Additionally, collaborations between game publishers and Italian influencers help promote mobile games through authentic, localized campaigns. Payment systems such as digital wallets and direct carrier billing have lowered transaction friction, enabling broader monetization. Italy’s mobile gaming trend has also intersected with wellness, education, and lifestyle applications, expanding gaming’s role beyond pure entertainment. With mobile gaming embedded in Italy’s digital culture, the segment plays a central role in shaping usage habits, developer focus, and commercial outcomes within the broader gaming market.

Italy Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, platform, revenue type, type, and age group.

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobiles and tablets, and computers.

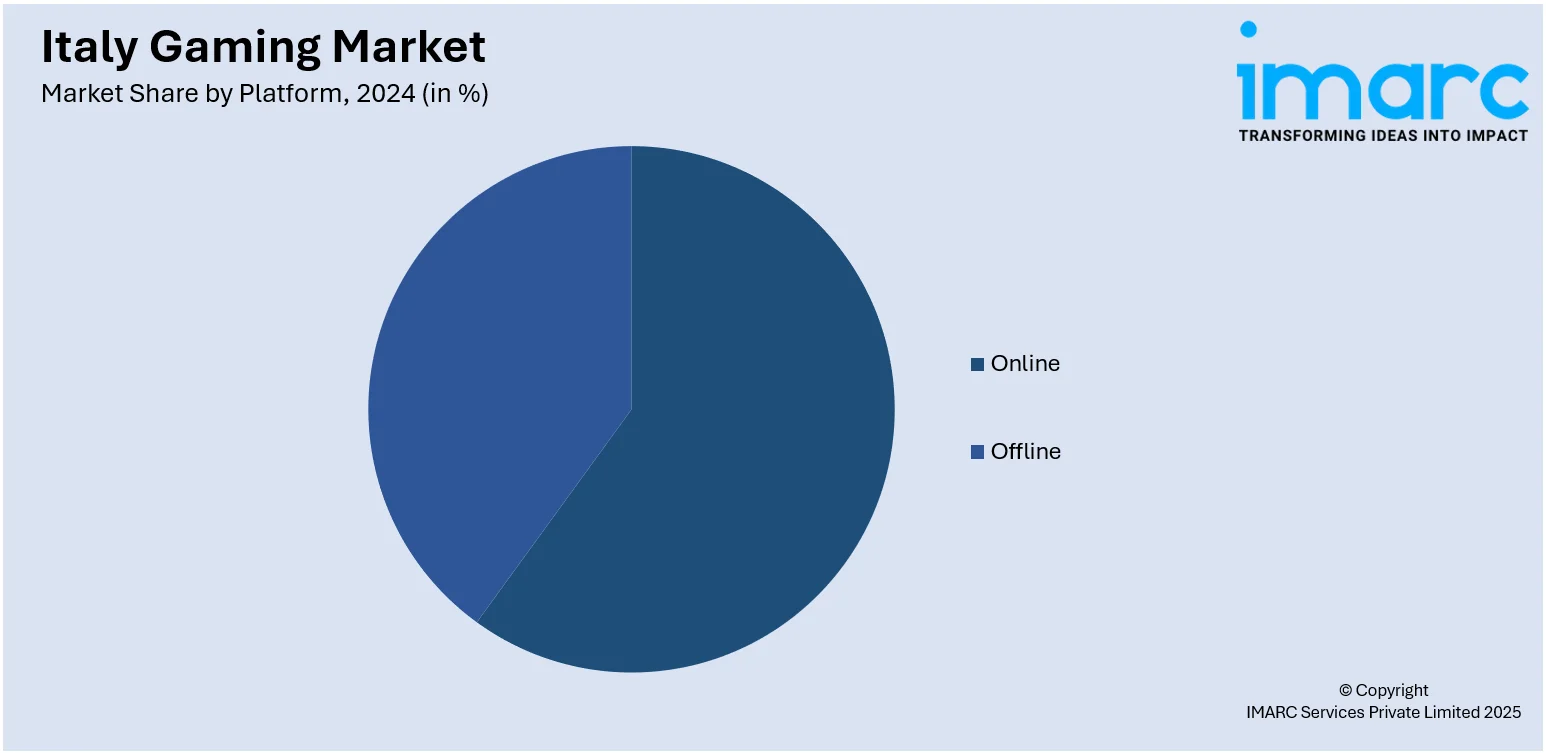

Platform Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the platform. This includes online and offline.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

The report has provided a detailed breakup and analysis of the market based on the revenue type. This includes in-game purchase, game purchase, and advertising.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Stimulation

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes adventure/role playing games, puzzles, social games, strategy, stimulation, and others.

Age Group Insights:

- Adults

- Children

The report has provided a detailed breakup and analysis of the market based on the age group. This includes adults and children.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Gaming Market News:

- On March 12, 2025, IGT’s Italian subsidiary secured its sixth consecutive European Lotteries Responsible Gaming certification and achieved Level 4 certification from the World Lottery Association, its highest recognition. The company earned a perfect score across 10 evaluation areas, reaffirming its leadership in player protection, ethical standards, and responsible gaming practices in Italy. These achievements highlight IGT’s commitment to sustainability and regulatory excellence, further solidifying Italy’s role in the global gaming ecosystem.

- On June 23, 2025, TaDa Gaming expanded its presence in Italy through a strategic partnership with Octavian Digital, integrating its certified titles like Crazy 777 and Jackpot Joker into Octavian's Hub Casino aggregator. The deal includes gamification tools such as GiftCode and WIN CARD, enhancing player retention in a youth-oriented market. This move aligns with Italy's 2025–2027 regulatory shift focused on legal compliance and player protection within the iGaming space.

Italy Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Stimulation, Others |

| Age Groups Covered | Adults, Children |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy gaming market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy gaming market on the basis of device type?

- What is the breakup of the Italy gaming market on the basis of platform?

- What is the breakup of the Italy gaming market on the basis of revenue type?

- What is the breakup of the Italy gaming market on the basis of type?

- What is the breakup of the Italy gaming market on the basis of age group?

- What is the breakup of the Italy gaming market on the basis of region?

- What are the various stages in the value chain of the Italy gaming market?

- What are the key driving factors and challenges in the Italy gaming market?

- What is the structure of the Italy gaming market and who are the key players?

- What is the degree of competition in the Italy gaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)