Italy Higher Education Market Size, Share, Trends and Forecast by Component, Deployment Mode, Course Type, Learning Type, End User, and Region, 2025-2033

Italy Higher Education Market Overview:

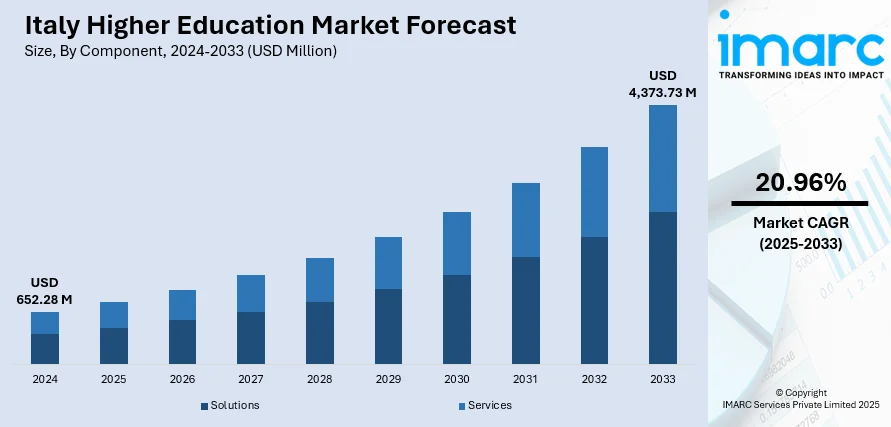

The Italy higher education market size reached USD 652.28 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,373.73 Million by 2033, exhibiting a growth rate (CAGR) of 20.96% during 2025-2033. The market is driven by targeted government reforms, increased infrastructure investments, and initiatives to modernize Italy’s university system. The expansion of English-taught programs and international collaborations is enhancing global student appeal. Additionally, industry partnerships and technological integration within academic curricula are aligning higher education with labor market demands, further augmenting the Italy higher education market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 652.28 Million |

| Market Forecast in 2033 | USD 4,373.73 Million |

| Market Growth Rate 2025-2033 | 20.96% |

Italy Higher Education Market Trends:

Government Reforms and Investment in University Infrastructure

Italy’s government is undertaking structural reforms to modernize and internationalize the country’s higher education landscape. Initiatives such as the National Recovery and Resilience Plan (PNRR), supported by EU funding, have allocated significant resources for improving university infrastructure, expanding digital tools, and enhancing research capabilities. Italian universities are investing in smart classrooms, advanced laboratories, and sustainable campus development to attract both domestic and international students. Special emphasis is being placed on digital transformation in administration and academic delivery, enabling hybrid learning options across leading universities. In December 2024, the Italian government introduced a decree mandating new standards for online degrees, including a requirement that at least 20% of classes be delivered live and that exams must be conducted in person. The decree also set staff-to-student ratios for online universities, aiming to raise academic quality amid considerable rise in online enrollments over the past decade. These regulations mark a pivotal shift for Italy’s higher education sector. Additionally, scholarship programs and student mobility incentives are fostering increased participation in tertiary education, particularly from underrepresented regions. Italian universities are collaborating with European peers on joint research projects, curriculum development, and academic exchanges. These investments aim to elevate Italian universities’ standing in international rankings while addressing local skill gaps in science, technology, and engineering fields. This combination of government funding, institutional modernization, and international collaboration is a central contributor to Italy higher education market growth, creating a competitive and globally relevant academic environment.

To get more information on this market, Request Sample

Integration of Technology and Industry Partnerships

The integration of advanced technology into curricula and the strengthening of industry-academic partnerships are reshaping higher education in Italy. Universities are increasingly embedding digital skills, data science, and artificial intelligence into degree programs to prepare students for the demands of a technology-driven global economy. Collaboration between higher education institutions and leading companies in sectors such as automotive, fashion, and renewable energy is enhancing the practical relevance of academic offerings. These partnerships provide students with internship opportunities, mentorship programs, and exposure to real-world challenges, improving employability and fostering innovation. Italy’s polytechnic universities, in particular, have established strong connections with regional industrial clusters, ensuring that academic research aligns with the innovation needs of local economies. Moreover, national initiatives supporting digital literacy and innovation are encouraging universities to adopt new pedagogical models, including flipped classrooms and experiential learning projects. Enrolments at online-only private universities in Italy rose from just over 40,000 in 2012 to more than 220,000 in 2022, marking a 410% increase, while in-person private university enrolments rose by 20% over the same period. By aligning educational outcomes with market needs, Italian universities are positioning graduates to contribute meaningfully to Italy’s economic modernization.

Italy Higher Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, course type, learning type, and end user.

Component Insights:

- Solutions

- Student Information Management System

- Content Collaboration

- Data Security and Compliance

- Campus Management

- Others

- Services

- Managed Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solutions (student information management system, content collaboration, data security and compliance, campus management, and others) and services (managed services and professional services).

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Course Type Insights:

- Arts

- Economics

- Engineering

- Law

- Science

- Others

The report has provided a detailed breakup and analysis of the market based on the course type. This includes arts, economics, engineering, law, science, and others.

Learning Type Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the learning type. This includes online and offline.

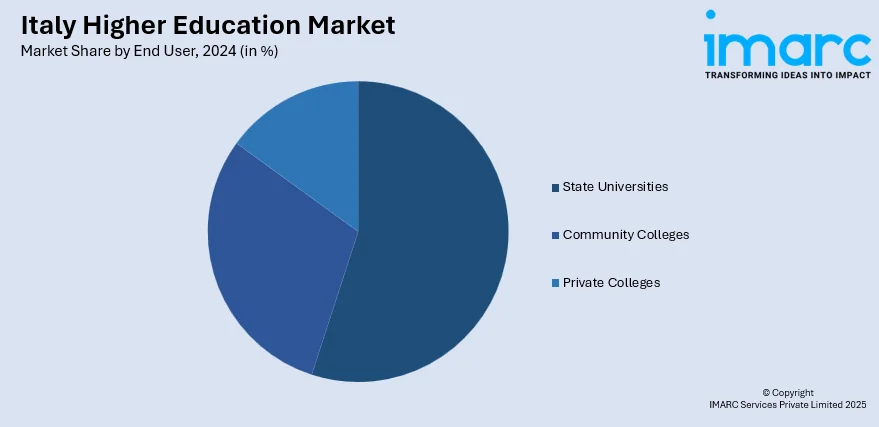

End User Insights:

- State Universities

- Community Colleges

- Private Colleges

The report has provided a detailed breakup and analysis of the market based on the end user. This includes state universities, community colleges, and private colleges.

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Higher Education Market News:

- On January 29, 2025, ABB Italy and the University of Bergamo renewed their collaboration with a four-year agreement to advance research and technological innovation. The agreement spans various areas including sustainability, artificial intelligence, and Diversity, Equity, and Inclusion (DEI), aiming to create joint research projects, training, and development programs. As part of the collaboration, two students will be selected for the ABB SACE scholarship in 2025, offering them a 6-month internship focused on sustainability while working alongside ABB experts at the Bergamo and Dalmine campuses.

- On April 21, 2025, GEMS Education signed a landmark partnership with the Italian Industry and Commerce Office in the UAE (IICUAE), facilitating exclusive access to Italy’s prestigious fashion institutes and iconic brands. The collaboration will enable GEMS students to engage in joint academic programs, internships, and creative workshops, creating new opportunities for B2B exchanges between the UAE and Italy. This partnership highlights GEMS Education’s continued commitment to enhancing global exposure and real-world industry experience for its students.

Italy Higher Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Course Types Covered | Arts, Economics, Engineering, Law, Science, Others |

| Learning Types Covered | Online, Offline |

| End Users Covered | State Universities, Community Colleges, Private Colleges |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy higher education market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy higher education market on the basis of component?

- What is the breakup of the Italy higher education market on the basis of deployment mode?

- What is the breakup of the Italy higher education market on the basis of course type?

- What is the breakup of the Italy higher education market on the basis of learning type?

- What is the breakup of the Italy higher education market on the basis of end user?

- What is the breakup of the Italy higher education market on the basis of region?

- What are the various stages in the value chain of the Italy higher education market?

- What are the key driving factors and challenges in the Italy higher education market?

- What is the structure of the Italy higher education market and who are the key players?

- What is the degree of competition in the Italy higher education market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy higher education market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy higher education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy higher education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)