Italy Lubricants Market Size, Share, Trends and Forecast by Product Type, Base Oil, End Use Industry, and Region, 2025-2033

Italy Lubricants Market Overview:

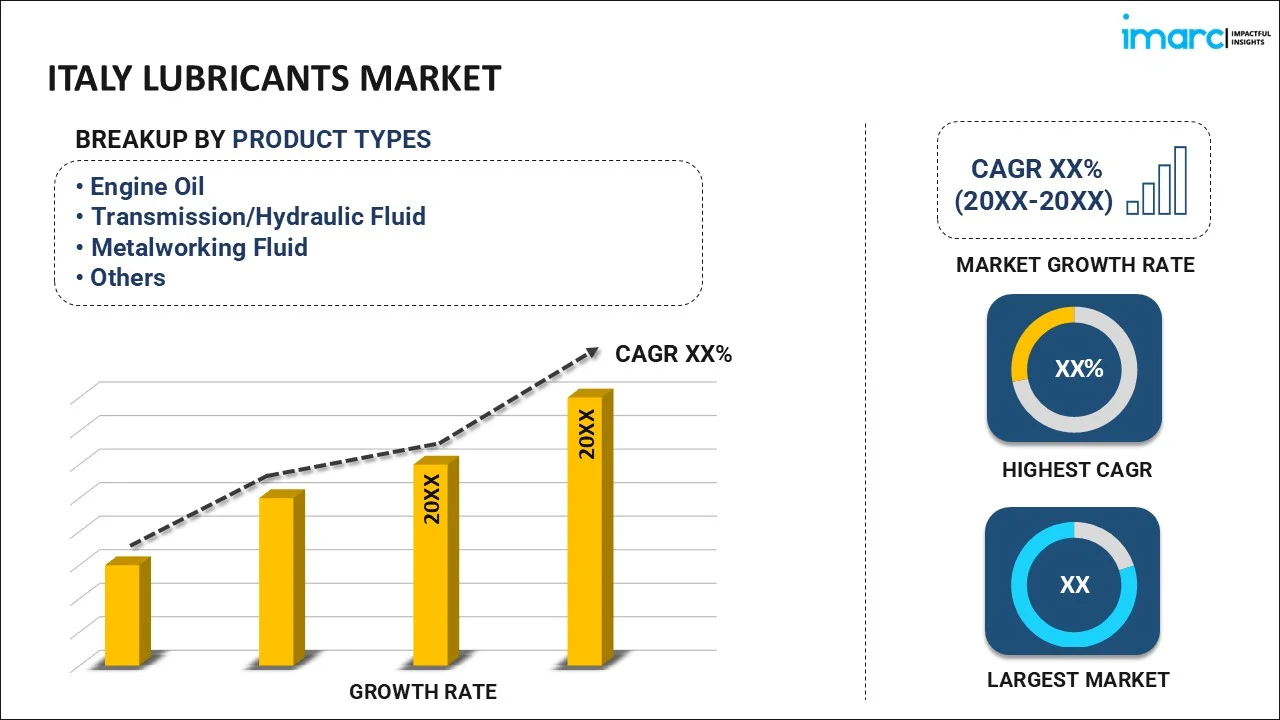

The Italy lubricants market size reached USD 3.26 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.94 Billion by 2033, exhibiting a growth rate (CAGR) of 4.37% during 2025-2033. The Italy lubricants market is driven by the growing automotive sector, increasing demand for industrial lubricants in manufacturing and steel production, and the shift toward high-performance, eco-friendly lubricants due to stringent environmental regulations, fostering innovation and sustainability in lubricant formulations to meet evolving industry needs and regulatory standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.26 Billion |

| Market Forecast in 2033 | USD 4.94 Billion |

| Market Growth Rate (2025-2033) | 4.37% |

Italy Lubricants Market Trends:

Automotive Industry Performance

The automotive industry is a major user of lubricants, such as engine oils, transmission fluids, and greases. In Italy, the well-being of this sector directly influences lubricant demand. Statistics show that during the first half of 2024, there were nearly 80,057 road accidents leading to injury or death, up by 0.9% from the first half of 2023. This rise in the number of accidents means a higher adoption of vehicles and further drives the maintenance needs and, thus, the consumption of lubricants. Additionally, the recovery of the automotive sector after the pandemic has been visible. In 2023, Italy's GDP increased by 0.7%, with domestic demand, including consumers' consumption, contributing significantly. When consumer confidence and spending were better, automobile sales and usage probably followed an upward trend and supported lubricant demand further. Furthermore, new vehicle models and improvements in automotive technology create a need for specialty lubricants. High-performance lubricants, with their specific demands of today's engines, are becoming more important to manufacturers and are driving the market growth.

Economic Growth and Industrial Output

Italy's economy plays a very impactful role in the lubricants market, particularly through industry. Its GDP surged by 0.7% in 2023, led by domestic demand. This reflects a stable economic condition, which encourages high industrial production and, by extension, the demand for more industrial lubricants. The building construction industry, an avid user of industrial lubricants, demonstrated strength with 1.5% value-added growth during the first quarter of 2023. The growth indicates increasing building activities, and hence more usage of equipment and machinery that need constant lubrication. In addition, the industrial production index, or the measure of industrial sector output, is an important indicator. Although, industrial production trends have a direct influence on the consumption of lubricants utilized in equipment and machinery maintenance. An expanding industrial sector generally translates to higher lubricant demand. In short, the Italian lubricants market largely depends on the performance of the automotive sector and the economic development of the nation. Growth in the use of vehicles and manufacturing activities stimulates demand for different types of lubricants, highlighting the dependence of the market on these sectors.

Italy Lubricants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, base oil, and end use industry.

Product Type Insights:

- Engine Oil

- Transmission/Hydraulic Fluid

- Metalworking Fluid

- General Industry Oil

- Gear Oil

- Grease

- Process Oil

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes engine oil, transmission/hydraulic fluid, metalworking fluid, general industry oil, gear oil, grease, process oil, and others.

Base Oil Insights:

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

A detailed breakup and analysis of the market based on the base oil have also been provided in the report. This includes mineral oil, synthetic oil, and bio-based oil.

End Use Industry Insights:

- Power Generation

- Automotive and Other Transportation

- Heavy Equipment

- Food and Beverages

- Metallurgy and Metalworking

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes power generation, automotive and other transportation, heavy equipment, food and beverages, metallurgy and metalworking, and others.

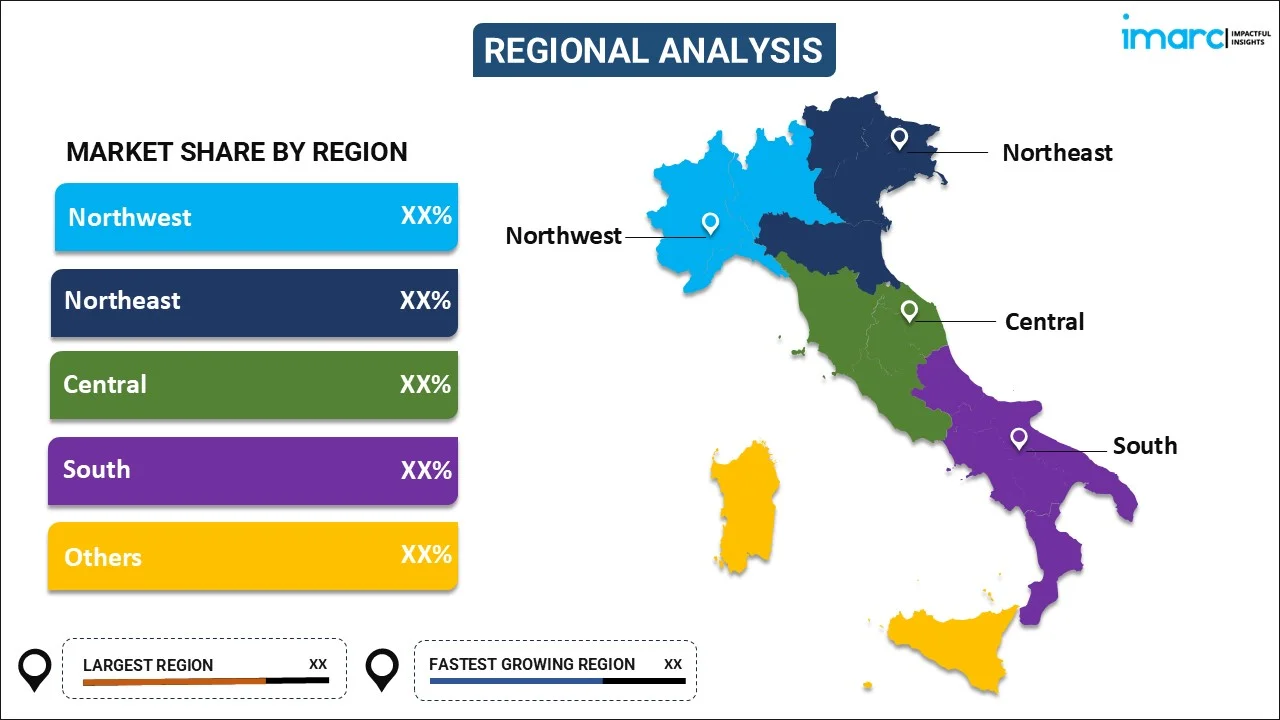

Regional Insights:

- Northwest

- Northeast

- Central

- South

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northwest, Northeast, Central, South, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Italy Lubricants Market News:

- November 2024: The Italian Ministry of Business and Metinvest Group signed a €2.5 billion agreement to construct a green steel plant in Piombino, aiming to produce 2.7 million tons of hot-rolled coils annually. This development is poised to significantly impact Italy's lubricants market.

- February 2024: Uzbekistan's top private oil and gas firm, Saneg, purchased CGC Lubricants Italy S.p.A., an Italian manufacturer of high-quality greases and oils for the automotive and industrial markets. The strategic acquisition, which resulted in the rebranding of the acquired company to SANEG OIL ITALY S.P.A., substantially increased Saneg's footprint in the European market and enhanced its technological leadership in the lubricants sector.

Italy Lubricants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Engine Oil, Transmission/Hydraulic Fluid, Metalworking Fluids, General Industry Oil. Gear Oil, Grease. Process Oil, Others |

| Base Oils Covered | Mineral Oil, Synthetic Oil, Bio-Based Oil |

| End Use Industries Covered | Power Generation, Automotive and Other Transportation, Heavy Equipment, Food and Beverages, Metallurgy and Metalworking, Others |

| Regions Covered | Northwest, Northeast, Central, South, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Italy lubricants market performed so far and how will it perform in the coming years?

- What is the breakup of the Italy lubricants market on the basis of product type?

- What is the breakup of the Italy lubricants market on the basis of base oil?

- What is the breakup of the Italy lubricants market on the basis of end use industry?

- What are the various stages in the value chain of the Italy lubricants market?

- What are the key driving factors and challenges in the Italy lubricants?

- What is the structure of the Italy lubricants market and who are the key players?

- What is the degree of competition in the Italy lubricants market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Italy lubricants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Italy lubricants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Italy lubricants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)